Valid Ohio Deed Template

When it comes to transferring property in Ohio, understanding the Ohio Deed form is essential for both buyers and sellers. This legal document serves as a critical tool in the real estate transaction process, ensuring that ownership rights are clearly defined and legally recognized. The form typically includes vital information such as the names of the grantor (the seller) and grantee (the buyer), a description of the property being transferred, and any conditions or restrictions that may apply. Additionally, the Ohio Deed form must be signed, notarized, and filed with the appropriate county recorder’s office to be valid. Familiarity with this form can help avoid potential disputes and ensure a smooth transfer of ownership, making it an important aspect of real estate dealings in the state.

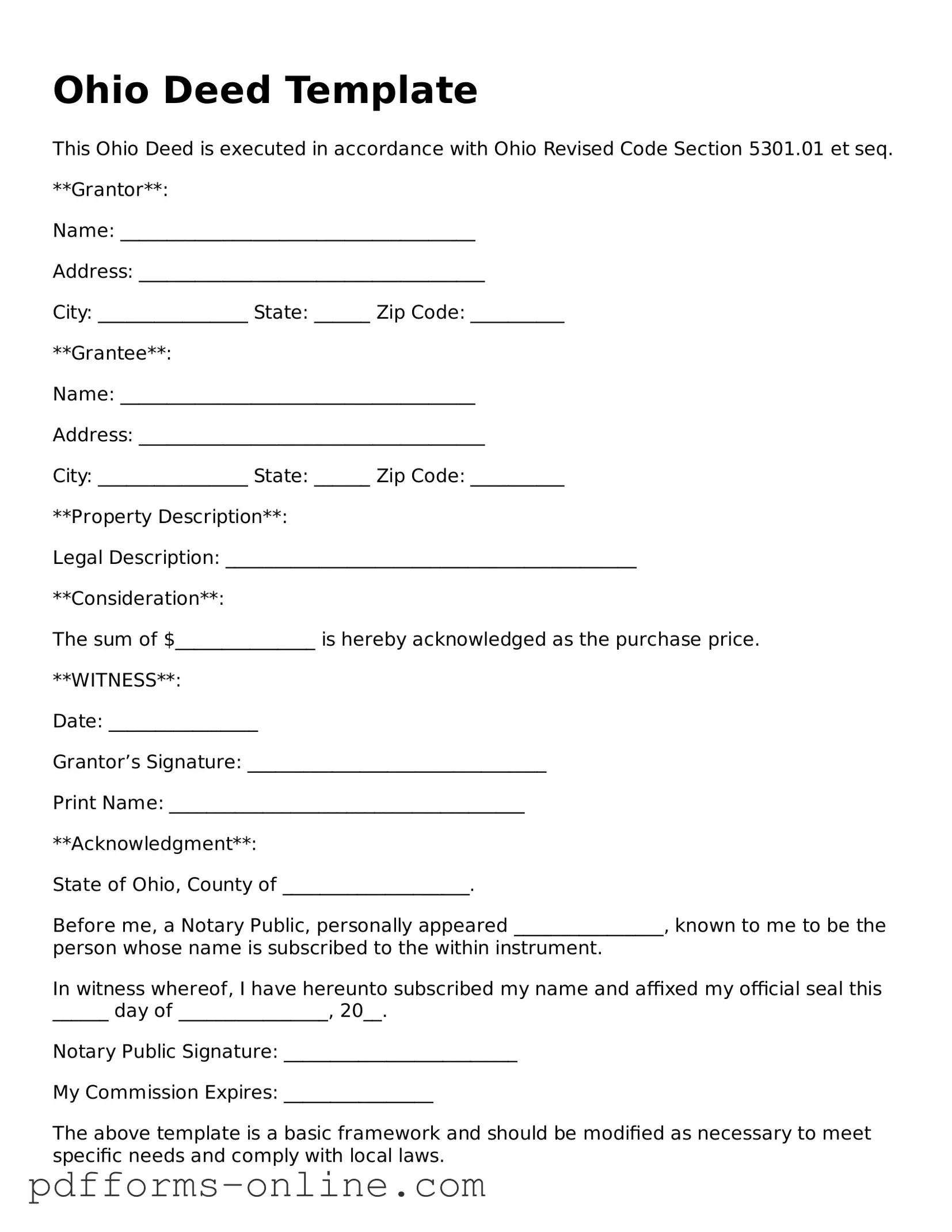

Document Example

Ohio Deed Template

This Ohio Deed is executed in accordance with Ohio Revised Code Section 5301.01 et seq.

**Grantor**:

Name: ______________________________________

Address: _____________________________________

City: ________________ State: ______ Zip Code: __________

**Grantee**:

Name: ______________________________________

Address: _____________________________________

City: ________________ State: ______ Zip Code: __________

**Property Description**:

Legal Description: ____________________________________________

**Consideration**:

The sum of $_______________ is hereby acknowledged as the purchase price.

**WITNESS**:

Date: ________________

Grantor’s Signature: ________________________________

Print Name: ______________________________________

**Acknowledgment**:

State of Ohio, County of ____________________.

Before me, a Notary Public, personally appeared ________________, known to me to be the person whose name is subscribed to the within instrument.

In witness whereof, I have hereunto subscribed my name and affixed my official seal this ______ day of ________________, 20__.

Notary Public Signature: _________________________

My Commission Expires: ________________

The above template is a basic framework and should be modified as necessary to meet specific needs and comply with local laws.

Frequently Asked Questions

-

What is an Ohio Deed form?

An Ohio Deed form is a legal document used to transfer ownership of real property in the state of Ohio. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions or restrictions related to the transfer. It serves as a record of the change in ownership and is typically filed with the county recorder's office.

-

What types of deeds are available in Ohio?

Ohio recognizes several types of deeds, including:

- Warranty Deed: This type guarantees that the seller holds clear title to the property and has the right to sell it.

- Quit Claim Deed: This deed transfers whatever interest the seller has in the property without any warranties.

- Executor's Deed: Used when property is transferred from an estate, typically after someone has passed away.

- Trustee's Deed: This is used when property is transferred by a trustee, often in accordance with a trust agreement.

-

How do I complete an Ohio Deed form?

To complete an Ohio Deed form, follow these steps:

- Identify the correct type of deed for your transaction.

- Fill in the names of the grantor (seller) and grantee (buyer).

- Provide a complete legal description of the property, which can often be found on the previous deed or property tax documents.

- Include any necessary terms or conditions related to the transfer.

- Ensure that the document is signed in front of a notary public to validate the transfer.

-

Do I need to file the deed after it is completed?

Yes, once the deed is completed and notarized, it must be filed with the county recorder's office in the county where the property is located. Filing the deed provides public notice of the transfer and protects the rights of the new owner. There may be a small fee associated with the filing process.

-

Are there any taxes associated with transferring property in Ohio?

Yes, property transfers in Ohio may be subject to conveyance fees or transfer taxes. These fees vary by county and are typically based on the sale price of the property. It's important to check with your local county auditor or recorder's office for specific rates and regulations that may apply to your situation.

Misconceptions

Understanding the Ohio Deed form can be challenging, especially with the number of misconceptions surrounding it. Here are five common misunderstandings that people often have:

-

All Deeds Are the Same: Many believe that all deeds serve the same purpose and have identical requirements. In reality, there are various types of deeds, such as warranty deeds, quitclaim deeds, and special purpose deeds. Each serves a different function and offers varying levels of protection to the grantee.

-

A Notary Is Not Required: Some people think that a deed can be valid without a notary. However, in Ohio, a deed must be notarized to be legally effective. This step is crucial as it helps to verify the identity of the parties involved and ensures that the transaction is legitimate.

-

Filing Is Optional: There is a misconception that filing the deed with the county recorder is optional. In fact, to protect ownership rights and make the transfer public, the deed must be filed. Failing to do so can lead to disputes over property ownership in the future.

-

Property Taxes Are Unaffected: Some individuals assume that transferring property via a deed does not impact property taxes. However, changes in ownership can trigger a reassessment of property taxes, which may lead to an increase in tax obligations.

-

Deeds Can Be Written by Anyone: It is a common belief that anyone can draft a deed without any legal knowledge. While it is true that the form can be filled out by a layperson, it is highly advisable to consult with a legal expert. This ensures that the deed meets all legal requirements and protects the interests of all parties involved.

By addressing these misconceptions, individuals can navigate the process of property transfer in Ohio with greater confidence and understanding.

Common mistakes

-

Incorrect Property Description: One of the most common mistakes is failing to provide a clear and accurate description of the property. This includes not specifying the correct parcel number or failing to include the legal description.

-

Missing Signatures: All necessary parties must sign the deed. If a spouse or co-owner does not sign, it can lead to complications in ownership transfer.

-

Improper Notarization: The deed must be notarized to be valid. Failing to have the document properly notarized can result in the deed being rejected by the county recorder.

-

Incorrect Grantee Information: The name of the grantee (the person receiving the property) must be accurate. Typos or incorrect names can create legal issues in the future.

-

Omitting Consideration Amount: The deed should state the consideration amount, which is the price paid for the property. Omitting this information can lead to questions about the transaction.

-

Failure to Check Local Requirements: Each county may have specific requirements for deed filings. Not checking these requirements can result in delays or rejections.

-

Not Filing the Deed Promptly: After completing the deed, it must be filed with the county recorder in a timely manner. Delays in filing can complicate property ownership records.

Find Some Other Deed Forms for Specific States

Property Deed Form - Can simplify the process of buying or selling property.

Who Has the Deed to My House - Errors in previous transactions can be corrected with new Deeds.

How Long Does It Take to Record a Deed in Florida - Understanding the implications of a Deed can benefit all parties involved.

For those looking to address their separation effectively, understanding the Florida Marital Separation Agreement form is crucial for outlining key terms related to custody and asset distribution. A thorough exploration of the Marital Separation Agreement guidelines can simplify this process significantly. For more information, visit the Florida Marital Separation Agreement resources.

New York Warranty Deed Form - May also involve relaying information about existing mortgages on the property.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An Ohio Deed form is a legal document used to transfer ownership of real property in Ohio. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Special Warranty Deed. |

| Governing Law | The Ohio Revised Code, specifically Chapter 5301, governs property transfers and deeds. |

| Required Signatures | The deed must be signed by the grantor (the seller) to be valid. |

| Notarization | A notary public must witness the signing of the deed for it to be legally binding. |

| Recording | To protect the buyer's interest, the deed should be recorded at the county recorder's office. |

| Consideration | The deed must state the consideration, or payment, involved in the property transfer. |

| Legal Description | A precise legal description of the property must be included in the deed. |

| Transfer Tax | Ohio imposes a transfer tax on real estate transactions, which must be paid at the time of recording. |

| Revocation | Once recorded, a deed cannot be revoked unilaterally; it requires a new deed to transfer ownership back. |

Similar forms

The Ohio Deed form shares similarities with a Warranty Deed. A Warranty Deed is a legal document that guarantees the property title is clear of any claims or liens. Like the Ohio Deed, it transfers ownership from one party to another. The key difference lies in the level of protection offered. A Warranty Deed provides a stronger assurance to the buyer, as the seller warrants that they hold clear title to the property and will defend against any future claims. Both documents serve the purpose of transferring property but differ in the guarantees they provide to the buyer.

When looking into the various types of deeds for property transfer, it's essential to consider the implications of each document type. For those interested in understanding a Quitclaim Deed, one useful resource is https://onlinelawdocs.com, which provides detailed information on how this form can be used when transferring property interests without warranties.

Another document similar to the Ohio Deed is the Quitclaim Deed. This type of deed transfers whatever interest the grantor has in the property without making any promises about the title's validity. While the Ohio Deed typically includes assurances about the title, a Quitclaim Deed does not. This makes it less secure for the grantee, as they assume the risk of any existing claims against the property. Both deeds facilitate the transfer of ownership but differ significantly in the level of title protection offered.

The Ohio Deed also resembles a Special Purpose Deed, which is used for specific transactions, such as transferring property into a trust or from a trust. Like the Ohio Deed, a Special Purpose Deed formalizes the transfer of property ownership. However, the Special Purpose Deed often includes unique language tailored to the specific purpose of the transfer. Both documents serve to convey property but are used in different contexts and for different legal reasons.

A similar document is the Bargain and Sale Deed. This deed implies that the grantor has title to the property but does not provide warranties against claims. Like the Ohio Deed, it facilitates the transfer of ownership. However, the Bargain and Sale Deed does not guarantee a clear title, which may expose the buyer to risks. Both documents are used in property transactions but differ in the assurances provided to the buyer.

The Ohio Deed can also be compared to a Trustee's Deed. This document is used when a property is transferred by a trustee, typically in the context of a trust or bankruptcy. Similar to the Ohio Deed, it conveys ownership from one party to another. However, a Trustee's Deed often includes specific language that reflects the fiduciary duties of the trustee. While both documents accomplish the transfer of property, the context and responsibilities involved differ significantly.

Lastly, the Ohio Deed is akin to a Deed of Trust. This document is used to secure a loan by transferring the property title to a trustee until the borrower repays the debt. While both the Ohio Deed and Deed of Trust involve the transfer of property, the Deed of Trust serves a specific financial purpose. The Ohio Deed focuses on the transfer of ownership, whereas the Deed of Trust involves additional obligations related to securing a loan. Each document plays a unique role in property transactions, highlighting the various ways ownership can be transferred or secured.