Valid Ohio Bill of Sale Template

The Ohio Bill of Sale form serves as an important document for individuals engaged in the sale or transfer of personal property within the state. This form provides a clear record of the transaction, detailing essential information such as the buyer's and seller's names, addresses, and contact information. It also specifies the item being sold, including a description and any identifying numbers, such as a Vehicle Identification Number (VIN) for cars. Additionally, the form outlines the sale price and the date of the transaction. By documenting these details, the Bill of Sale helps protect both parties by establishing proof of ownership and the terms of the sale. In Ohio, while not always required, having a Bill of Sale can be beneficial for vehicle registrations, tax purposes, and resolving disputes that may arise after the sale. Understanding how to properly complete and use this form can make the buying and selling process smoother and more transparent.

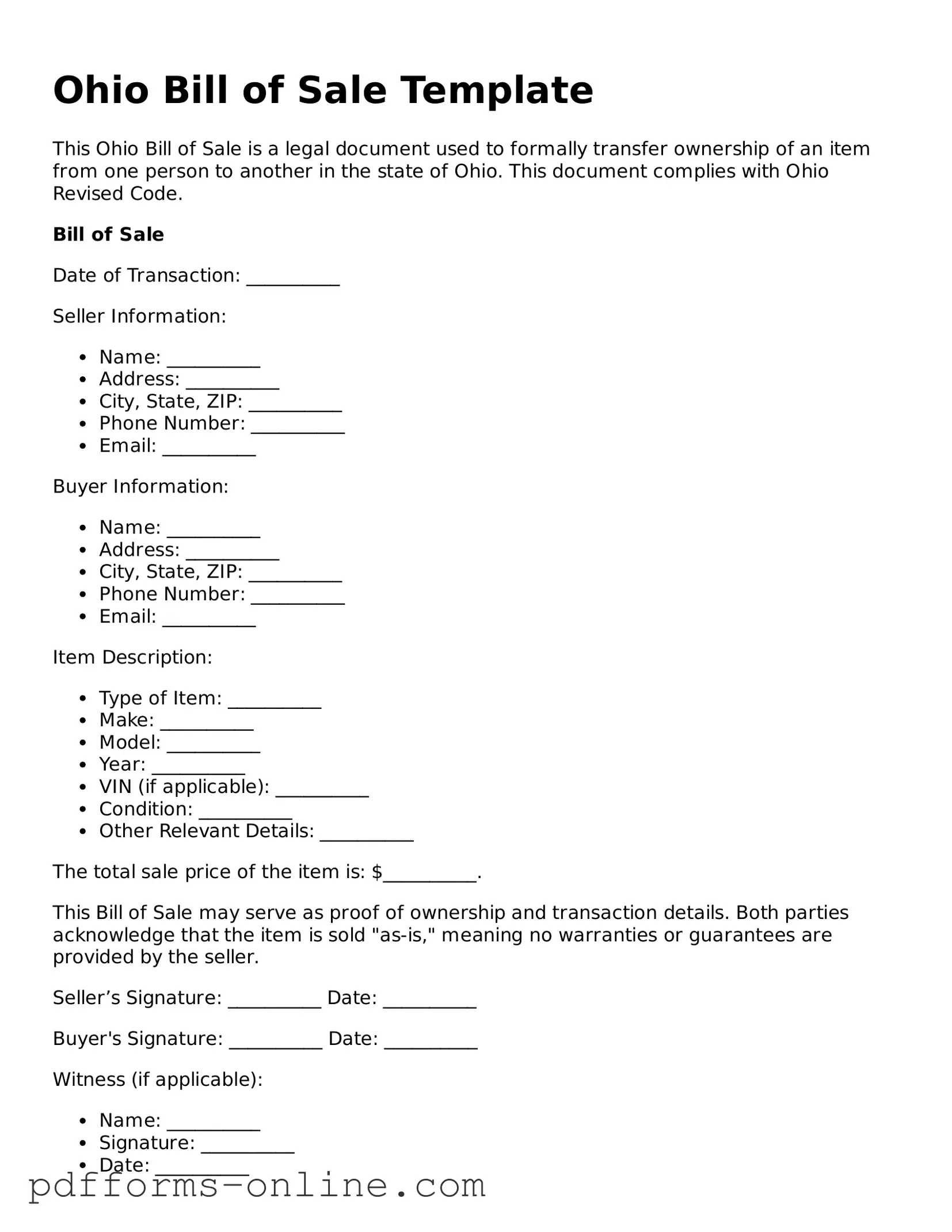

Document Example

Ohio Bill of Sale Template

This Ohio Bill of Sale is a legal document used to formally transfer ownership of an item from one person to another in the state of Ohio. This document complies with Ohio Revised Code.

Bill of Sale

Date of Transaction: __________

Seller Information:

- Name: __________

- Address: __________

- City, State, ZIP: __________

- Phone Number: __________

- Email: __________

Buyer Information:

- Name: __________

- Address: __________

- City, State, ZIP: __________

- Phone Number: __________

- Email: __________

Item Description:

- Type of Item: __________

- Make: __________

- Model: __________

- Year: __________

- VIN (if applicable): __________

- Condition: __________

- Other Relevant Details: __________

The total sale price of the item is: $__________.

This Bill of Sale may serve as proof of ownership and transaction details. Both parties acknowledge that the item is sold "as-is," meaning no warranties or guarantees are provided by the seller.

Seller’s Signature: __________ Date: __________

Buyer's Signature: __________ Date: __________

Witness (if applicable):

- Name: __________

- Signature: __________

- Date: __________

Both parties acknowledge that they have read and understand this Bill of Sale and agree to its terms.

Frequently Asked Questions

-

What is a Bill of Sale in Ohio?

A Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. In Ohio, it is commonly used for the sale of vehicles, boats, and other significant personal items. This document outlines the details of the transaction, including the description of the item, the purchase price, and the names of both the buyer and seller.

-

Is a Bill of Sale required in Ohio?

While a Bill of Sale is not legally required for all transactions in Ohio, it is highly recommended. For vehicle sales, a Bill of Sale is essential for the buyer to register the vehicle in their name. It provides necessary proof of purchase and can help resolve any disputes regarding ownership.

-

What information should be included in an Ohio Bill of Sale?

An effective Bill of Sale in Ohio should include the following information:

- The names and addresses of both the buyer and seller

- A detailed description of the item being sold, including make, model, year, and VIN for vehicles

- The purchase price

- The date of the transaction

- Any warranties or guarantees, if applicable

-

Do I need to have the Bill of Sale notarized?

In Ohio, notarization is not required for a Bill of Sale to be valid. However, having the document notarized can add an extra layer of authenticity and may be beneficial if disputes arise in the future. It can also provide peace of mind for both parties involved in the transaction.

-

Can I use a generic Bill of Sale template?

Yes, you can use a generic Bill of Sale template, but it is important to ensure that it complies with Ohio laws. Templates should be customized to include specific details about the transaction and the item being sold. Many online resources provide templates that can be tailored to meet your needs.

-

What if I lose my Bill of Sale?

If you lose your Bill of Sale, it can be challenging to prove ownership of the item. If you have a copy of the document or any related transaction records, those can help. If necessary, you may need to create a new Bill of Sale and have both parties sign it again to confirm the transaction.

-

How does a Bill of Sale affect taxes?

A Bill of Sale can impact taxes, particularly for vehicle sales. In Ohio, the buyer is typically responsible for paying sales tax based on the purchase price stated in the Bill of Sale. It is essential to keep the document for tax purposes and to provide it when registering the vehicle with the Ohio Bureau of Motor Vehicles.

-

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The seller should ensure that the buyer registers the item, especially for vehicles, with the appropriate state agency. This step helps to officially transfer ownership and can protect the seller from any future liabilities related to the item.

Misconceptions

Understanding the Ohio Bill of Sale form is crucial for anyone engaging in a transaction involving personal property. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- It is only necessary for vehicle sales. Many believe the Bill of Sale is required only for vehicle transactions. In reality, it can be used for various personal property sales, including boats, trailers, and even valuable items like art or jewelry.

- It is not legally binding. Some think that a Bill of Sale is just a casual agreement. However, when properly completed, it serves as a legal document that can protect both the buyer and seller in case of disputes.

- Notarization is always required. While notarization can add an extra layer of security, it is not a requirement for all transactions. A Bill of Sale can be valid without a notary, provided both parties sign it.

- It does not need to be in writing. A verbal agreement may seem sufficient to some. However, having a written Bill of Sale is essential for clarity and serves as proof of the transaction.

- Only the seller needs to keep a copy. Both parties should retain a copy of the Bill of Sale. This ensures that each party has proof of the transaction and the terms agreed upon.

- It is only for sales between individuals. The Bill of Sale can also be used for transactions involving businesses. Whether you are buying from a private seller or a company, a Bill of Sale is beneficial.

- It cannot be used for gifts. Some may think a Bill of Sale is only applicable for sales. However, it can also document the transfer of ownership for gifts, providing clarity and record-keeping.

- It is not necessary if the item is registered. Even if an item is registered, such as a vehicle, a Bill of Sale is still important. It serves as proof of ownership transfer and may be required for registration purposes.

- Filling it out is complicated. Many fear that completing a Bill of Sale is a complex process. In truth, it is a straightforward document that requires basic information about the transaction and the parties involved.

By addressing these misconceptions, individuals can better understand the importance of the Ohio Bill of Sale form and ensure their transactions are secure and legally sound.

Common mistakes

-

Incorrect Vehicle Information: Many people fail to accurately enter the vehicle identification number (VIN) or misspell the make and model. This can lead to confusion or issues with registration.

-

Missing Seller and Buyer Details: Not providing complete names and addresses for both the seller and the buyer is a common mistake. This information is crucial for legal identification.

-

Omitting Sale Price: Forgetting to include the sale price can create problems down the line, especially for tax purposes. It’s important to clearly state the amount agreed upon.

-

Not Signing the Document: Some individuals overlook the necessity of signatures. Both parties must sign the Bill of Sale to validate the transaction.

-

Failing to Date the Document: A date is essential. Without it, there may be disputes about when the sale occurred, which can affect liability and ownership.

-

Not Including Any Additional Terms: If there are special conditions or warranties, they should be clearly stated. Leaving these out can lead to misunderstandings later.

-

Ignoring State Requirements: Each state has specific requirements for a Bill of Sale. Failing to check Ohio’s regulations can result in an invalid document.

Find Some Other Bill of Sale Forms for Specific States

Car Bill of Sale Texas - This form can help resolve ownership disputes if they arise.

Bill of Sale Michigan Template - This document can be beneficial in proving ownership in case of theft or disputes.

Free Bill of Sale Georgia - A Bill of Sale is generally simple to execute but holds significant legal weight.

PDF Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from one party to another. |

| Governing Law | The Bill of Sale in Ohio is governed by Ohio Revised Code § 1302.01, which outlines the requirements for the sale of goods. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Required Information | Essential details include the names and addresses of the buyer and seller, a description of the property, and the sale price. |

Similar forms

The Ohio Bill of Sale form is similar to a Vehicle Title Transfer form. Both documents serve to transfer ownership of a vehicle from one person to another. While the Bill of Sale provides proof of the transaction and details about the sale, the Vehicle Title Transfer is an official document required by the state to update the ownership records. Both forms must be completed accurately to ensure a smooth transfer process and protect the rights of the buyer and seller.

Another document similar to the Ohio Bill of Sale is the Lease Agreement. A Lease Agreement outlines the terms under which one party rents property from another. Like a Bill of Sale, it details the involved parties, the property in question, and the terms of the agreement. Both documents serve to protect the rights of the parties and provide a record of the transaction, whether it's a sale or a rental arrangement.

The Ohio Bill of Sale also resembles a Purchase Agreement. This document is used when buying or selling goods, services, or property. It specifies the details of the transaction, including the price and the parties involved. Both documents help clarify the terms of the sale and can be used as evidence if disputes arise later on.

A Service Agreement is another document that shares similarities with the Ohio Bill of Sale. This type of agreement outlines the terms of services provided by one party to another. While a Bill of Sale focuses on the transfer of ownership, a Service Agreement details the responsibilities and expectations between the service provider and the client. Both documents aim to create a clear understanding of the transaction and protect the interests of all parties involved.

The Ohio Bill of Sale is also akin to a Warranty Deed. A Warranty Deed is used to transfer real estate ownership and guarantees that the seller holds clear title to the property. Similar to a Bill of Sale, it provides documentation of the transaction and protects the buyer by ensuring that the seller has the right to sell the property. Both documents are crucial in establishing legal ownership and can be used in court if necessary.

Another related document is the Affidavit of Title. This document is often used in conjunction with a Bill of Sale when transferring ownership of a vehicle. It serves as a sworn statement confirming that the seller has the legal right to sell the vehicle and that there are no liens against it. Both documents work together to ensure that the buyer receives clear title to the vehicle and protects against potential disputes.

Finally, the Ohio Bill of Sale is similar to a Gift Deed. A Gift Deed is used when property is transferred as a gift rather than a sale. While a Bill of Sale typically involves a financial transaction, both documents serve to legally document the transfer of ownership. They outline the parties involved and the property being transferred, ensuring that the transaction is recognized legally.