Valid Ohio Articles of Incorporation Template

When starting a business in Ohio, one of the essential steps is completing the Articles of Incorporation form. This document serves as the foundation for your corporation, outlining its purpose and structure. The form typically requires key information, such as the corporation's name, which must be unique and comply with state regulations. Additionally, it includes details about the registered agent, who will act as the official point of contact for legal matters. The Articles of Incorporation also specify the number of shares the corporation is authorized to issue, which is crucial for potential investors. Furthermore, the form may require the names and addresses of the initial directors, providing transparency and accountability right from the start. By carefully filling out this form, entrepreneurs can ensure they meet Ohio's legal requirements and set a solid groundwork for their business endeavors.

Document Example

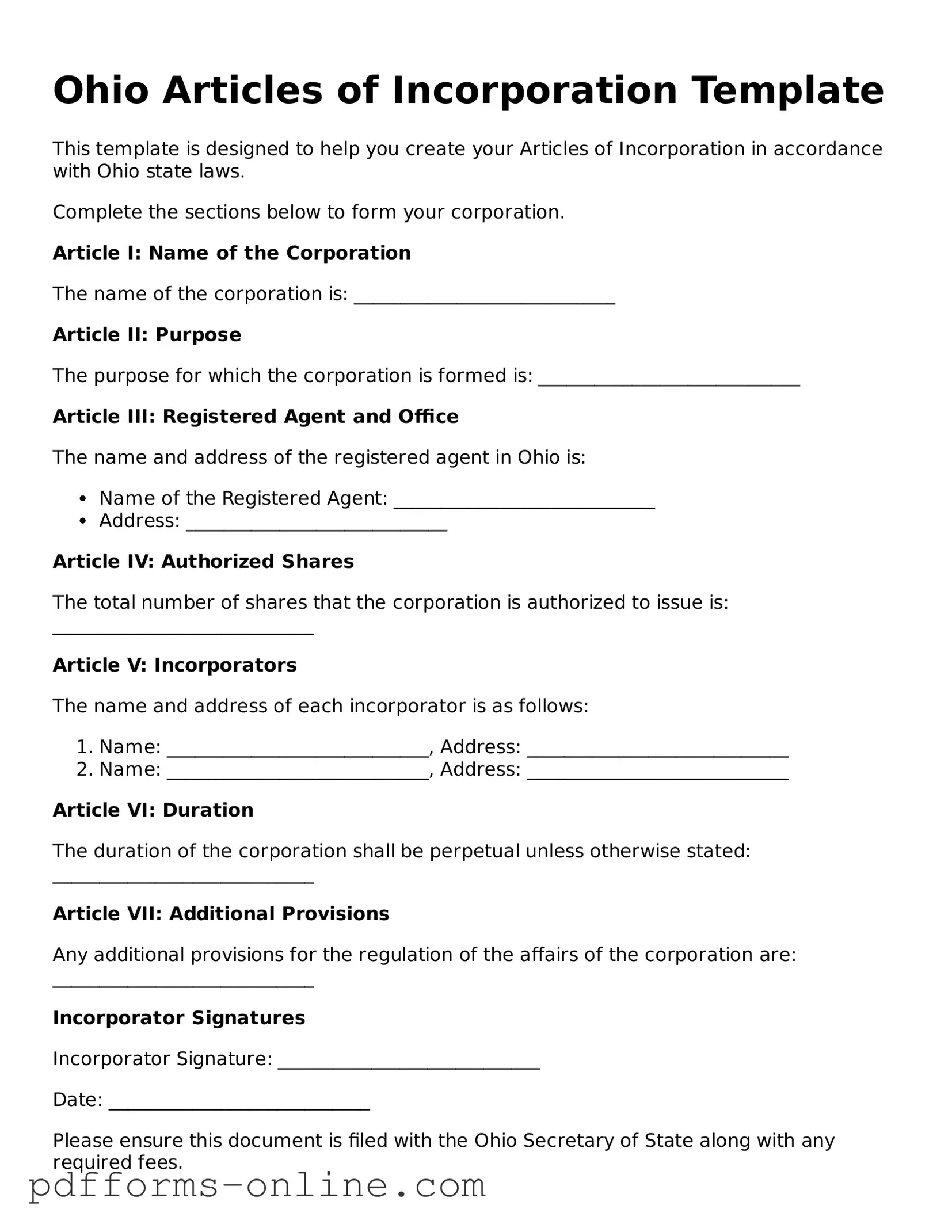

Ohio Articles of Incorporation Template

This template is designed to help you create your Articles of Incorporation in accordance with Ohio state laws.

Complete the sections below to form your corporation.

Article I: Name of the Corporation

The name of the corporation is: ____________________________

Article II: Purpose

The purpose for which the corporation is formed is: ____________________________

Article III: Registered Agent and Office

The name and address of the registered agent in Ohio is:

- Name of the Registered Agent: ____________________________

- Address: ____________________________

Article IV: Authorized Shares

The total number of shares that the corporation is authorized to issue is: ____________________________

Article V: Incorporators

The name and address of each incorporator is as follows:

- Name: ____________________________, Address: ____________________________

- Name: ____________________________, Address: ____________________________

Article VI: Duration

The duration of the corporation shall be perpetual unless otherwise stated: ____________________________

Article VII: Additional Provisions

Any additional provisions for the regulation of the affairs of the corporation are: ____________________________

Incorporator Signatures

Incorporator Signature: ____________________________

Date: ____________________________

Please ensure this document is filed with the Ohio Secretary of State along with any required fees.

Frequently Asked Questions

-

What are the Articles of Incorporation?

The Articles of Incorporation is a legal document that establishes a corporation in Ohio. It outlines essential details about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is the first step in forming a corporation and provides the framework for its operation.

-

Who needs to file Articles of Incorporation?

Any individual or group wishing to create a corporation in Ohio must file Articles of Incorporation. This includes businesses of all sizes, from small startups to larger enterprises. It is crucial for anyone looking to limit personal liability and create a separate legal entity for their business.

-

What information is required on the form?

The Articles of Incorporation form requires several key pieces of information:

- The corporation's name, which must be unique and comply with Ohio naming rules.

- The purpose of the corporation, which can be a general statement or a specific business activity.

- The address of the corporation's principal office.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue.

-

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in Ohio, you can complete the form online or download a paper version. After filling it out, submit it to the Ohio Secretary of State's office, along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Ohio varies based on the type of corporation being formed. As of the latest information, the fee typically ranges from $99 to $125. It’s important to check the Ohio Secretary of State’s website for the most current fee schedule and any additional costs that may apply.

-

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Generally, the Ohio Secretary of State's office processes Articles of Incorporation within a few business days if filed online. Paper submissions may take longer. For expedited service, additional fees may apply. Always check for the latest processing times on the Secretary of State’s website.

-

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are approved, the corporation officially comes into existence. You will receive a confirmation from the Secretary of State, and it is advisable to keep this document in your records. Following this, the corporation should obtain any necessary licenses and permits, set up a corporate bank account, and comply with ongoing reporting requirements.

Misconceptions

Understanding the Ohio Articles of Incorporation form can be challenging. Misconceptions can lead to confusion and mistakes during the incorporation process. Here are five common misconceptions:

- All businesses must file Articles of Incorporation. Not every business needs to file this document. Only corporations, which are a specific type of business structure, are required to submit Articles of Incorporation. Sole proprietorships and partnerships do not need to file this form.

- The Articles of Incorporation are the same as a business license. This is not accurate. The Articles of Incorporation establish a corporation's existence, while a business license permits a business to operate in a specific location. Both are necessary but serve different purposes.

- Filing the Articles of Incorporation guarantees approval. While submitting the form is an important step, it does not automatically mean that the corporation will be approved. The state reviews the application for compliance with legal requirements and may request additional information or corrections.

- Once filed, the Articles of Incorporation cannot be changed. This is a misconception. Amendments can be made to the Articles of Incorporation after they are filed. However, the amendment process must be followed, and it typically involves additional paperwork and state approval.

- The Articles of Incorporation are the only document needed to form a corporation. This is misleading. While the Articles of Incorporation are essential, other documents, such as bylaws and initial resolutions, may also be necessary to fully establish and operate a corporation.

Common mistakes

-

Incorrect Business Name: Failing to ensure that the chosen business name is unique and not already in use can lead to rejection of the application.

-

Missing Registered Agent Information: Not providing accurate details about the registered agent, such as their name and address, can cause delays.

-

Improper Purpose Statement: Writing a vague or overly broad purpose statement may not meet the requirements set by the state.

-

Inaccurate Incorporator Information: Listing incorrect names or addresses for the incorporators can lead to complications in the filing process.

-

Omitting Required Signatures: Failing to sign the form or having the wrong individuals sign can result in the application being deemed incomplete.

-

Incorrect Filing Fee: Not including the correct payment amount for the filing fee can delay the processing of the Articles of Incorporation.

-

Neglecting to Include Additional Provisions: Forgetting to add any necessary additional provisions can lead to issues later on.

-

Failure to Review the Form: Not double-checking the form for errors or omissions can result in unnecessary setbacks.

-

Ignoring State-Specific Requirements: Overlooking any specific requirements or guidelines set forth by the Ohio Secretary of State can lead to rejection.

Find Some Other Articles of Incorporation Forms for Specific States

Articles of Incorporation Georgia Template - State law may dictate the minimum information needed for incorporation.

When it comes to managing your legal and financial responsibilities, utilizing a comprehensive General Power of Attorney form can provide crucial support. This document empowers a designated agent to handle significant matters on your behalf, ensuring that your interests are well-protected.

California Articles of Incorporation - Includes provisions for conflict resolution among members.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Articles of Incorporation is a legal document used to establish a corporation in the state of Ohio. |

| Governing Law | The formation of corporations in Ohio is governed by the Ohio Revised Code, specifically Chapter 1701. |

| Filing Requirement | To officially form a corporation, the Articles of Incorporation must be filed with the Ohio Secretary of State. |

| Information Required | The form requires basic information, including the corporation's name, purpose, and the address of its principal office. |

| Registered Agent | A registered agent must be designated, who will receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. The fee amount can vary based on the type of corporation. |

| Approval Timeline | After submission, the Secretary of State typically processes the Articles of Incorporation within a few business days. |

| Amendments | If changes are needed after filing, amendments can be made to the Articles of Incorporation by submitting the appropriate form. |

Similar forms

The Articles of Incorporation in Ohio is similar to the Certificate of Incorporation used in many other states. Both documents serve as the official paperwork to establish a corporation. They typically include essential information such as the corporation's name, purpose, and registered agent. While the specific requirements can vary by state, the fundamental goal remains the same: to legally recognize the existence of a corporation.

The Bylaws of a corporation also share similarities with the Articles of Incorporation. Bylaws outline the internal rules and procedures for managing the corporation. While the Articles of Incorporation focus on external legal recognition, Bylaws provide the framework for governance. Both documents are crucial for the corporation's operation but serve different purposes in the organizational structure.

The Operating Agreement is another document that parallels the Articles of Incorporation, especially for Limited Liability Companies (LLCs). This agreement details the management structure and operational guidelines for the LLC. Like the Articles of Incorporation, it is essential for defining the entity's legal status and responsibilities, but it focuses more on internal management rather than external registration.

The Partnership Agreement is similar in that it establishes the terms and conditions under which a partnership operates. This document outlines the roles, responsibilities, and profit-sharing arrangements among partners. While the Articles of Incorporation are used for corporations, the Partnership Agreement serves a similar purpose for partnerships by formalizing the business relationship.

The proper preparation of legal documentation is crucial in the establishment and operation of a business. One important document in this landscape is the Last Will and Testament form, which outlines how a person's assets and affairs should be handled after their death, ensuring that their wishes are respected and that their property is distributed according to their intentions.

The Certificate of Good Standing is another relevant document. It serves as proof that a corporation has met all state requirements and is authorized to conduct business. While the Articles of Incorporation initiate the corporation's existence, the Certificate of Good Standing confirms its ongoing compliance with state laws.

The Statement of Information, often required in various states, is akin to the Articles of Incorporation in that it provides updated information about the corporation. This document typically includes details like the addresses of the corporation and its officers. While the Articles of Incorporation are filed at the formation stage, the Statement of Information is filed periodically to maintain current records.

The Business License is another document that bears similarity. While it does not establish a corporation, it is necessary for legal operation within a specific jurisdiction. Both the Articles of Incorporation and a Business License are essential for compliance with local laws, allowing a business to operate legally in its chosen area.

The Federal Employer Identification Number (EIN) application is also related to the Articles of Incorporation. An EIN is required for tax purposes and is often obtained shortly after incorporation. While the Articles of Incorporation create the corporation, the EIN allows it to operate in the tax system, making both documents critical for legal business operations.

Finally, the Annual Report can be compared to the Articles of Incorporation. An Annual Report is often required by states to keep the corporation in good standing. This document updates the state on the corporation's activities and any changes in its structure. While the Articles of Incorporation establish the corporation, the Annual Report ensures it remains compliant with state regulations over time.