Valid North Carolina Transfer-on-Death Deed Template

The North Carolina Transfer-on-Death Deed form provides a straightforward way for property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This deed allows individuals to retain full control of their property during their lifetime, ensuring that they can sell, lease, or modify the property as they see fit. The form must be completed and recorded with the county register of deeds to be effective. It is essential to accurately list the beneficiaries and ensure that all necessary information is included, as any errors could complicate the transfer process later. Additionally, this deed can be revoked or changed at any time before the owner's death, offering flexibility and peace of mind. Understanding the requirements and implications of this deed can significantly simplify estate planning for North Carolina residents.

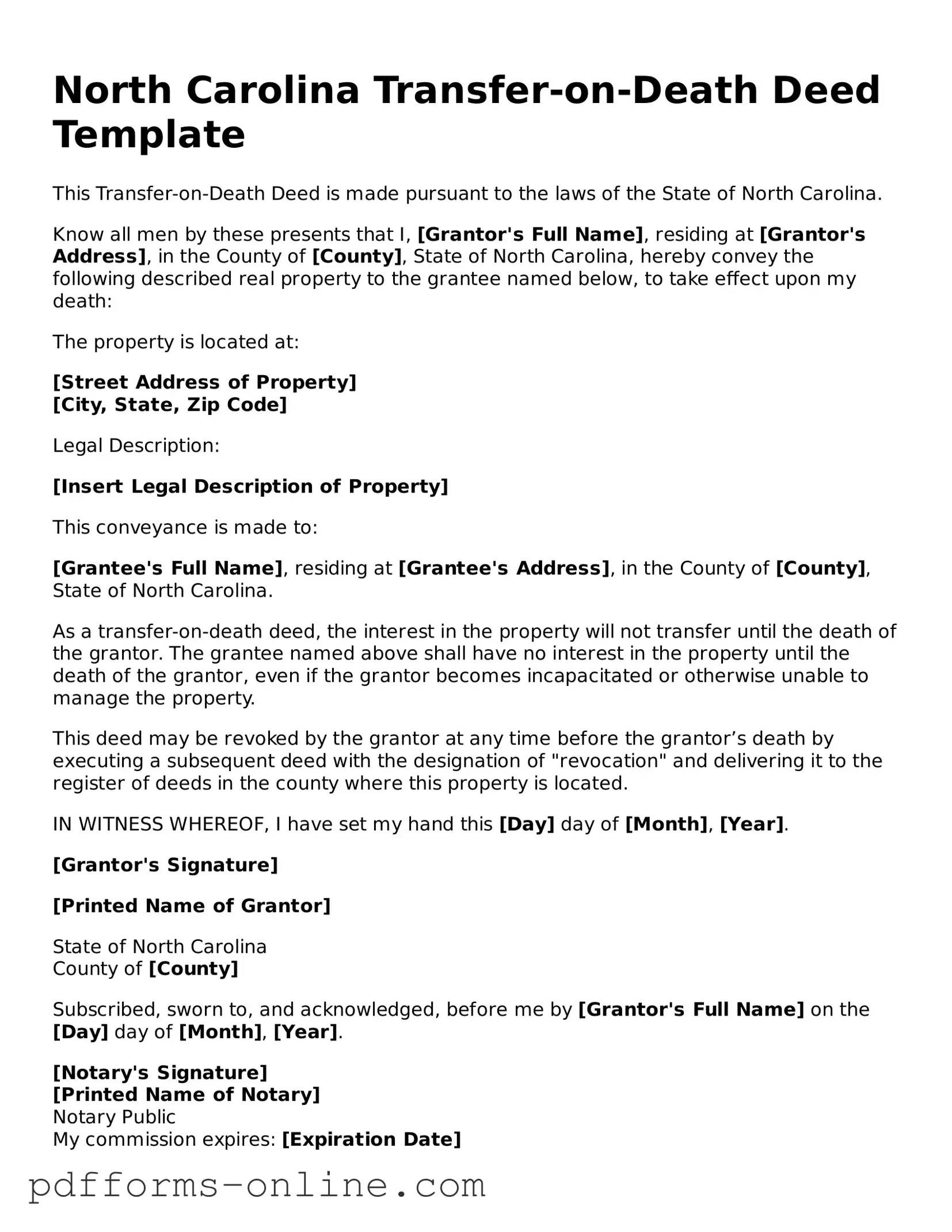

Document Example

North Carolina Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the State of North Carolina.

Know all men by these presents that I, [Grantor's Full Name], residing at [Grantor's Address], in the County of [County], State of North Carolina, hereby convey the following described real property to the grantee named below, to take effect upon my death:

The property is located at:

[Street Address of Property]

[City, State, Zip Code]

Legal Description:

[Insert Legal Description of Property]

This conveyance is made to:

[Grantee's Full Name], residing at [Grantee's Address], in the County of [County], State of North Carolina.

As a transfer-on-death deed, the interest in the property will not transfer until the death of the grantor. The grantee named above shall have no interest in the property until the death of the grantor, even if the grantor becomes incapacitated or otherwise unable to manage the property.

This deed may be revoked by the grantor at any time before the grantor’s death by executing a subsequent deed with the designation of "revocation" and delivering it to the register of deeds in the county where this property is located.

IN WITNESS WHEREOF, I have set my hand this [Day] day of [Month], [Year].

[Grantor's Signature]

[Printed Name of Grantor]

State of North Carolina

County of [County]

Subscribed, sworn to, and acknowledged, before me by [Grantor's Full Name] on the [Day] day of [Month], [Year].

[Notary's Signature]

[Printed Name of Notary]

Notary Public

My commission expires: [Expiration Date]

Frequently Asked Questions

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to transfer their real estate to a designated beneficiary upon their death. This deed helps avoid probate, allowing for a smoother transition of property ownership.

-

Who can use a Transfer-on-Death Deed in North Carolina?

Any individual who owns real estate in North Carolina can create a Transfer-on-Death Deed. This includes homeowners and property owners who wish to designate a beneficiary to receive their property after they pass away.

-

How do I complete a Transfer-on-Death Deed?

To complete a TOD Deed, you must provide specific information, including your name, the name of the beneficiary, and a description of the property. The deed must be signed and notarized. It is important to ensure that the form is filled out correctly to avoid any issues later.

-

Do I need to file the Transfer-on-Death Deed with the county?

Yes, the completed Transfer-on-Death Deed must be filed with the Register of Deeds in the county where the property is located. This filing is necessary for the deed to be valid and enforceable.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that either names a different beneficiary or explicitly states that the previous deed is revoked. It is recommended to file the new deed with the county to ensure clarity.

-

What happens if I do not name a beneficiary?

If you do not name a beneficiary on the Transfer-on-Death Deed, the property will not transfer as intended upon your death. Instead, it will go through probate, and the distribution of the property will be handled according to state laws or your will, if one exists.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications for transferring property via a Transfer-on-Death Deed. However, the beneficiary may be responsible for property taxes after the transfer occurs. It is advisable to consult a tax professional for personalized guidance.

-

Is legal assistance required to create a Transfer-on-Death Deed?

While legal assistance is not required, it can be beneficial. A legal professional can help ensure that the deed is properly completed and filed, reducing the risk of errors or complications in the future.

-

When does the Transfer-on-Death Deed take effect?

The Transfer-on-Death Deed takes effect upon the death of the property owner. Until that time, the owner retains full control over the property and can sell, lease, or otherwise manage it as they wish.

Misconceptions

Understanding the North Carolina Transfer-on-Death Deed can help clarify how property is transferred upon death. Here are some common misconceptions about this legal tool:

- It's only for wealthy individuals. Many believe that only those with significant assets can benefit from a Transfer-on-Death Deed. In reality, it can be useful for anyone who wants to simplify the transfer of property.

- It avoids all taxes. Some think that using a Transfer-on-Death Deed means avoiding taxes entirely. While it can help bypass probate, any applicable taxes still need to be addressed.

- It's the same as a will. A Transfer-on-Death Deed is not a will. It specifically transfers property outside of probate, while a will covers a broader range of assets and may require probate.

- It can be changed at any time. While it is true that you can revoke or change a Transfer-on-Death Deed, doing so may require following specific procedures to ensure the changes are legally recognized.

- All property types can be transferred this way. Not all property is eligible for transfer using this deed. For example, certain types of property, like joint tenancy or business interests, may not qualify.

- It automatically transfers upon signing. Just signing the deed does not transfer ownership. The deed must be properly recorded with the county register of deeds to be effective.

- It only benefits family members. Some people think that only family can be named as beneficiaries. In fact, anyone can be designated as a beneficiary on a Transfer-on-Death Deed.

- It eliminates the need for a trust. While a Transfer-on-Death Deed can simplify property transfer, it does not replace the need for a trust in all situations. Trusts can offer broader estate planning benefits.

- It's a one-size-fits-all solution. This deed may not suit everyone's needs. Each individual's situation is unique, and it's essential to consider personal circumstances when deciding on estate planning tools.

- It guarantees a smooth transfer. Although this deed can simplify the process, complications can still arise, such as disputes among beneficiaries or issues with the property itself.

By addressing these misconceptions, individuals can make more informed decisions regarding their estate planning and property transfers in North Carolina.

Common mistakes

-

Incorrect Property Description: People often fail to provide a complete and accurate description of the property. This includes not including the correct address, parcel number, or legal description. Such errors can lead to confusion and potential disputes in the future.

-

Missing Signatures: Some individuals neglect to sign the deed or forget to have the required witnesses sign. All signatures must be present for the deed to be valid. Without them, the deed may not hold up in court.

-

Improper Notarization: A common mistake is failing to have the deed properly notarized. The notary’s signature and seal are crucial for the document’s legitimacy. Without proper notarization, the deed may be challenged.

-

Not Recording the Deed: After completing the deed, some people forget to record it with the county register of deeds. Failing to record the deed can result in complications regarding ownership and transfer of the property.

-

Inadequate Beneficiary Information: Individuals may provide insufficient details about the beneficiaries. It is essential to clearly identify each beneficiary, including their full names and relationship to the property owner. Ambiguity can lead to disputes among heirs.

Find Some Other Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Form Florida - The deed takes effect only upon the death of the property owner, not before.

An Operating Agreement is a crucial document that outlines the management structure and operating procedures of a limited liability company (LLC). This agreement serves as a roadmap for members, detailing their rights, responsibilities, and the process for making important decisions. By having an Operating Agreement in place, members can help prevent misunderstandings and conflicts within the organization. For more information, you can access a sample document at https://documentonline.org/blank-operating-agreement/.

Transfer on Death Instrument - The Transfer-on-Death Deed must be properly executed and recorded to be valid.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in North Carolina to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by North Carolina General Statutes, specifically Chapter 32A, Article 2A. |

| Requirements | The deed must be signed by the property owner and must be recorded in the county where the property is located before the owner's death. |

| Revocation | The property owner can revoke the deed at any time before their death by executing a new deed or a written revocation. |

Similar forms

The North Carolina Transfer-on-Death Deed (TODD) is a unique estate planning tool that allows individuals to transfer real property to beneficiaries upon their death without the need for probate. This document shares similarities with several other legal instruments designed to facilitate the transfer of property or assets. Each of these documents has its own specific purpose and method of operation, yet they all aim to simplify the transfer process and minimize legal complications.

One such document is the Last Will and Testament. A will outlines how an individual wishes to distribute their assets after death. Like the TODD, a will can specify beneficiaries for real estate. However, the key difference lies in the probate process. While a will requires probate to validate and execute the distribution of assets, a TODD allows for a direct transfer to beneficiaries, bypassing probate entirely.

Another comparable document is the Revocable Living Trust. This trust holds assets during an individual's lifetime and allows for the distribution of those assets after death. Similar to a TODD, a living trust can avoid probate. However, the trust requires more ongoing management and may involve more complex legal requirements than a simple TODD.

The Joint Tenancy with Right of Survivorship is also akin to the TODD. In this arrangement, two or more individuals hold title to a property together. Upon the death of one owner, the property automatically passes to the surviving owner(s). This mechanism mirrors the TODD's ability to transfer property upon death but can complicate matters if the joint tenants wish to sell or encumber the property during their lifetimes.

A Beneficiary Designation is another similar concept, often used for financial accounts such as life insurance policies or retirement accounts. This document allows individuals to name beneficiaries who will receive the assets upon their death. Like the TODD, it avoids probate. However, it is limited to specific types of accounts and does not apply to real estate directly.

The Life Estate Deed is a document that grants an individual the right to use a property during their lifetime, with the property passing to another party upon their death. This form of deed shares the intent of transferring property outside of probate, similar to a TODD. However, a life estate deed can limit the life tenant's ability to sell or encumber the property without the consent of the remainderman.

A Power of Attorney (POA) can also be seen as related, although it primarily grants authority to another person to act on one’s behalf during their lifetime. While it does not directly transfer property upon death, a durable POA can be used in conjunction with a TODD to manage real estate affairs while the individual is still alive, ensuring a smoother transition after death.

The Affidavit of Heirship is a document used to establish the heirs of a deceased person, particularly when no will exists. This affidavit can help clarify ownership of property and facilitate its transfer. While it does not prevent probate, it serves a similar purpose of identifying beneficiaries, akin to the way a TODD names recipients for property after death.

In considering various estate planning tools, it's essential to be aware of the California Application Registered In Counsel form, which is vital for out-of-state attorneys wishing to practice law as in-house counsel in California, illustrating the broader landscape of legal documentation and its implications for asset management and transfer.

Finally, the Quitclaim Deed allows an individual to transfer any interest they may have in a property to another party without guaranteeing that the title is clear. While this deed can facilitate property transfers, it does not inherently provide for the transfer upon death, unlike the TODD. The quitclaim deed may also require additional legal steps to ensure the recipient’s interest is valid and enforceable.