Valid North Carolina Real Estate Purchase Agreement Template

The North Carolina Real Estate Purchase Agreement form serves as a vital document in the process of buying and selling property within the state. This form outlines the essential terms and conditions agreed upon by the buyer and seller, providing clarity and structure to the transaction. Key components include the purchase price, financing details, and contingencies, which protect the interests of both parties. Additionally, the agreement specifies important dates, such as the closing date and any inspection periods, ensuring that both the buyer and seller are aware of their obligations and timelines. Provisions regarding earnest money deposits are also included, which signify the buyer's commitment to the purchase. Furthermore, the form addresses potential issues that may arise, such as title concerns and the responsibilities for repairs. By encompassing these elements, the North Carolina Real Estate Purchase Agreement not only facilitates a smoother transaction but also helps to minimize disputes, creating a more secure environment for both buyers and sellers in the real estate market.

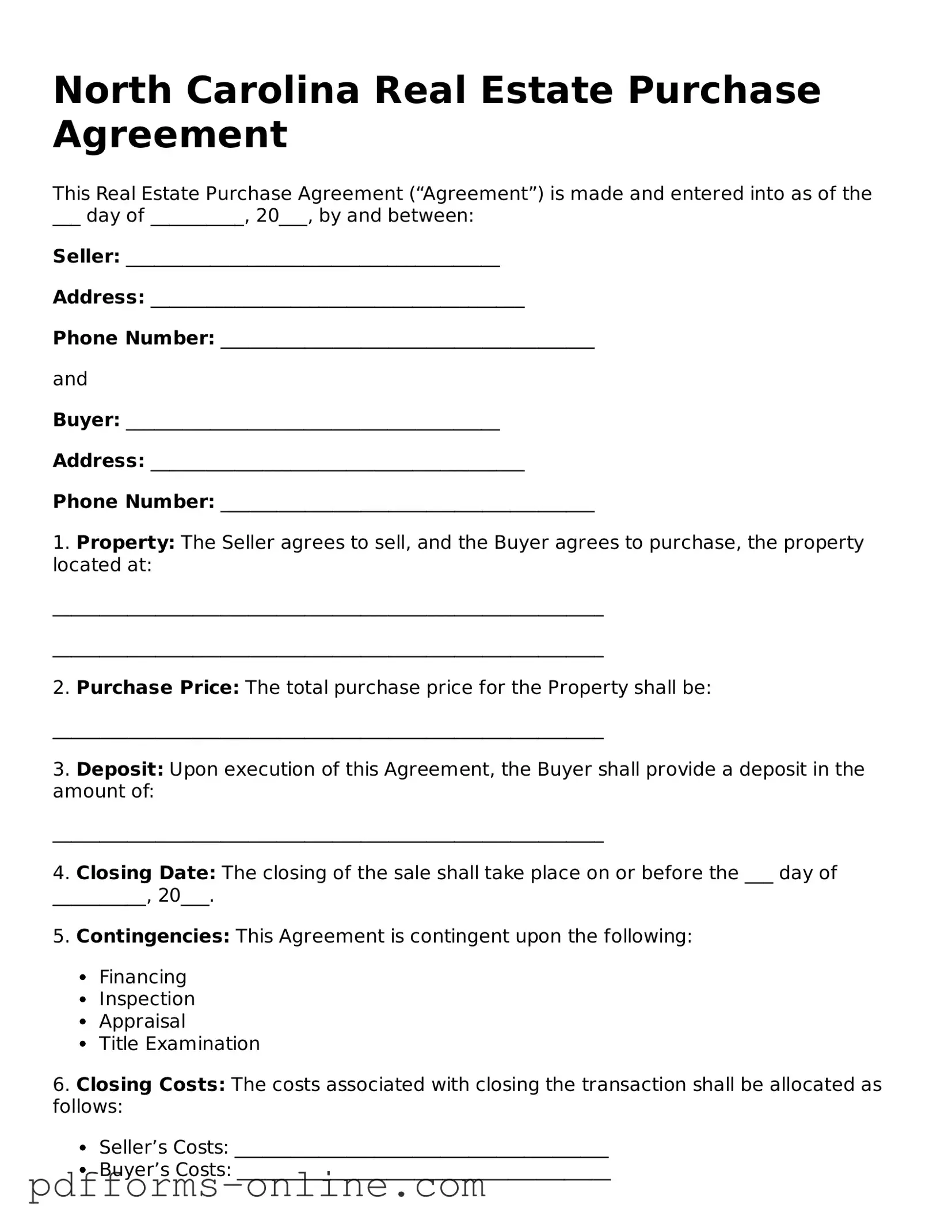

Document Example

North Carolina Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into as of the ___ day of __________, 20___, by and between:

Seller: ________________________________________

Address: ________________________________________

Phone Number: ________________________________________

and

Buyer: ________________________________________

Address: ________________________________________

Phone Number: ________________________________________

1. Property: The Seller agrees to sell, and the Buyer agrees to purchase, the property located at:

___________________________________________________________

___________________________________________________________

2. Purchase Price: The total purchase price for the Property shall be:

___________________________________________________________

3. Deposit: Upon execution of this Agreement, the Buyer shall provide a deposit in the amount of:

___________________________________________________________

4. Closing Date: The closing of the sale shall take place on or before the ___ day of __________, 20___.

5. Contingencies: This Agreement is contingent upon the following:

- Financing

- Inspection

- Appraisal

- Title Examination

6. Closing Costs: The costs associated with closing the transaction shall be allocated as follows:

- Seller’s Costs: ________________________________________

- Buyer’s Costs: ________________________________________

7. Possession: Possession of the Property shall be delivered to Buyer on the closing date unless otherwise agreed to in writing.

8. Governing Law: This Agreement shall be governed by the laws of the State of North Carolina.

9. Signatures: This Agreement must be signed by both parties to be valid. By signing below, both Seller and Buyer acknowledge their acceptance of the terms and conditions outlined in this Agreement.

Seller's Signature: ____________________________ Date: __________

Buyer's Signature: ____________________________ Date: __________

This document serves as a comprehensive Real Estate Purchase Agreement under North Carolina law. All parties are encouraged to consult legal counsel before signing.

Frequently Asked Questions

-

What is the North Carolina Real Estate Purchase Agreement?

The North Carolina Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. It serves as a binding contract that details the obligations of both parties involved in the transaction.

-

What information is included in the agreement?

The agreement typically includes the following information:

- Names and contact information of the buyer and seller

- Description of the property being sold

- Purchase price and payment terms

- Contingencies, such as financing or inspections

- Closing date and possession details

- Any disclosures required by law

-

Is the agreement legally binding?

Yes, once both parties sign the North Carolina Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to fulfill the terms outlined in the agreement, provided that all legal requirements are met.

-

Can the agreement be modified after signing?

Yes, modifications can be made to the agreement after it has been signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure they are enforceable.

-

What happens if one party breaches the agreement?

If either party fails to fulfill their obligations as outlined in the agreement, it is considered a breach. The non-breaching party may have several options, including seeking damages, enforcing the contract, or terminating the agreement. Legal advice may be necessary in such situations.

-

Are there any contingencies I should consider?

Contingencies are important aspects of the agreement. Common contingencies include:

- Financing contingency: Allows the buyer to back out if they cannot secure a mortgage.

- Inspection contingency: Permits the buyer to request repairs or negotiate after an inspection.

- Appraisal contingency: Protects the buyer if the property appraises for less than the purchase price.

-

Do I need an attorney to draft or review the agreement?

While it is not legally required to have an attorney, it is highly advisable. An attorney can help ensure that the agreement complies with North Carolina laws, protects your interests, and addresses any specific concerns you may have.

-

Where can I obtain a North Carolina Real Estate Purchase Agreement form?

You can obtain the form from various sources, including real estate agencies, legal websites, or directly from the North Carolina Association of Realtors. It is essential to ensure that you are using the most current version of the form to comply with state regulations.

Misconceptions

When it comes to real estate transactions in North Carolina, the Real Estate Purchase Agreement (REPA) is a crucial document. However, many people hold misconceptions about this form. Let's explore some of the most common misunderstandings.

- Misconception 1: The REPA is a one-size-fits-all document.

- Misconception 2: Once signed, the REPA cannot be changed.

- Misconception 3: The REPA protects the buyer only.

- Misconception 4: You don’t need a lawyer to review the REPA.

- Misconception 5: The REPA guarantees the sale will go through.

- Misconception 6: The REPA is only important for residential transactions.

Many believe that the REPA is a standard form that works for all transactions. In reality, while it provides a framework, each agreement can be customized to fit the specific needs and circumstances of the buyer and seller.

Some people think that the agreement is set in stone once it’s signed. However, amendments can be made if both parties agree to the changes. Open communication is key.

There’s a belief that the REPA is designed solely to protect the buyer's interests. In truth, it serves to protect both parties, outlining obligations and rights to ensure a fair transaction.

Some individuals think they can handle the agreement without legal assistance. While it’s possible, having a lawyer review the REPA can help avoid potential pitfalls and ensure all terms are understood.

Many assume that signing the REPA means the sale is guaranteed. Unfortunately, this is not the case. The agreement outlines terms but does not ensure that all conditions will be met for the sale to close.

Some people think the REPA is relevant only for residential real estate. However, it can also apply to commercial transactions, making it a versatile tool in various real estate dealings.

Understanding these misconceptions can empower both buyers and sellers in North Carolina's real estate market. Knowledge is a powerful tool in navigating any transaction successfully.

Common mistakes

-

Incomplete Information: One of the most common mistakes is not filling out all required fields. Ensure that every section is completed, including names, addresses, and property details.

-

Incorrect Property Description: Failing to accurately describe the property can lead to confusion. Always double-check the legal description and address to avoid potential disputes.

-

Missing Signatures: Both parties must sign the agreement for it to be valid. Forgetting to obtain all necessary signatures can delay the process or nullify the agreement.

-

Omitting Contingencies: Not including important contingencies, such as financing or inspection clauses, can expose buyers to unforeseen risks. Always include these protections.

-

Improper Dates: Entering incorrect dates for the offer or closing can create confusion and lead to misunderstandings. Verify all dates before finalizing the document.

-

Ignoring Local Laws: Each state has specific regulations regarding real estate transactions. Familiarize yourself with North Carolina laws to ensure compliance.

-

Not Consulting Professionals: Attempting to fill out the agreement without seeking advice from a real estate agent or attorney can lead to costly mistakes. Professional guidance is invaluable.

-

Failing to Review the Agreement: Rushing through the document without a thorough review can result in overlooked errors. Take the time to carefully read through the entire agreement before submission.

Find Some Other Real Estate Purchase Agreement Forms for Specific States

Real Estate Purchase Agreement Michigan - It contains important dates that need to be adhered to for a successful transaction.

For those in need of a reliable financing solution, the essential Promissory Note form provides a clear framework for outlining the terms of a loan agreement. For more information, you can visit the official resource detailing the Promissory Note specifics.

Midland Title Toledo - It can outline the consequences of not fulfilling the agreement's terms.

New York State Residential Contract of Sale - A Real Estate Purchase Agreement can detail any contingencies for title searches.

PDF Attributes

| Fact Name | Details |

|---|---|

| Governing Law | The North Carolina Real Estate Purchase Agreement is governed by North Carolina General Statutes Chapter 47. |

| Purpose | This form is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement involves at least two parties: the buyer and the seller. |

| Property Description | A detailed description of the property being sold is required, including address and legal description. |

| Purchase Price | The purchase price must be clearly stated in the agreement, along with any deposit amounts. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, that must be met for the sale to proceed. |

| Closing Date | The agreement should specify a closing date when the transaction will be finalized. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Similar forms

The North Carolina Real Estate Purchase Agreement form bears similarities to the Residential Purchase Agreement, commonly used across many states. Both documents serve the same fundamental purpose: to outline the terms and conditions under which a buyer agrees to purchase a property from a seller. Each agreement typically includes details such as the purchase price, contingencies, and closing dates, ensuring that both parties have a clear understanding of their obligations and rights throughout the transaction.

Understanding the various agreements involved in real estate transactions can significantly benefit both buyers and sellers. For instance, the USCIS I-134 form, which is essential for the immigration process, parallels the clarity aimed for in real estate contracts by ensuring sponsors provide the necessary support. More information regarding this form can be found at OnlineLawDocs.com, which provides valuable resources for those navigating these important legal documents.

Another comparable document is the Commercial Real Estate Purchase Agreement. While it focuses on commercial properties rather than residential ones, the structure remains similar. Both agreements detail the purchase price and conditions of sale, but the commercial version may include additional clauses that address zoning laws, business licenses, and other factors specific to commercial transactions. This ensures that buyers and sellers in the commercial sector are protected and informed.

The Lease Purchase Agreement is also akin to the North Carolina Real Estate Purchase Agreement. This document allows a tenant to lease a property with the option to purchase it later. Like the purchase agreement, it outlines the terms of the sale, including the price and timelines. However, it adds a layer of complexity by incorporating rental terms, making it essential for both parties to understand their rights and responsibilities during the lease period before the potential purchase.

In addition, the Option to Purchase Agreement shares similarities with the Real Estate Purchase Agreement. This document gives a buyer the exclusive right to purchase a property at a predetermined price within a specified timeframe. While it does not finalize the sale, it establishes clear terms for when and how the purchase can occur, mirroring the clarity found in the purchase agreement regarding price and conditions.

The Seller Financing Agreement is another related document. In this arrangement, the seller agrees to finance the purchase for the buyer, rather than requiring a traditional mortgage. Similar to the Real Estate Purchase Agreement, it outlines the purchase price and payment terms. However, it also includes specific financing details, such as interest rates and payment schedules, which are crucial for both parties to understand their financial commitments.

The Counteroffer form is also worth mentioning. When a buyer or seller wants to change the terms of an initial offer, a counteroffer is created. This document serves to modify the original agreement, much like how the Real Estate Purchase Agreement sets out the initial terms. Both documents require clear communication and mutual agreement to ensure that all parties are on the same page regarding the transaction.

Lastly, the Escrow Agreement is similar in that it involves the handling of funds and documents during a real estate transaction. While it does not serve as a purchase agreement itself, it works alongside it to ensure that the buyer's deposit and other funds are securely held until all conditions of the sale are met. This agreement provides an added layer of protection for both the buyer and seller, ensuring that their interests are safeguarded throughout the process.