Valid North Carolina Quitclaim Deed Template

When it comes to transferring property ownership in North Carolina, understanding the Quitclaim Deed form is crucial for both buyers and sellers. This legal document serves as a means to convey whatever interest the grantor holds in a property, without providing any guarantees regarding the title's validity. Unlike other types of deeds, a Quitclaim Deed does not assure the grantee that the property is free from liens or encumbrances, which makes it a straightforward yet potentially risky option. Typically used among family members, in divorce settlements, or during estate settlements, this form is particularly valued for its simplicity and speed. However, it is essential to ensure that the deed is properly executed and recorded to protect the interests of all parties involved. Understanding the implications of using a Quitclaim Deed can help prevent future disputes and ensure a smooth transfer of property rights.

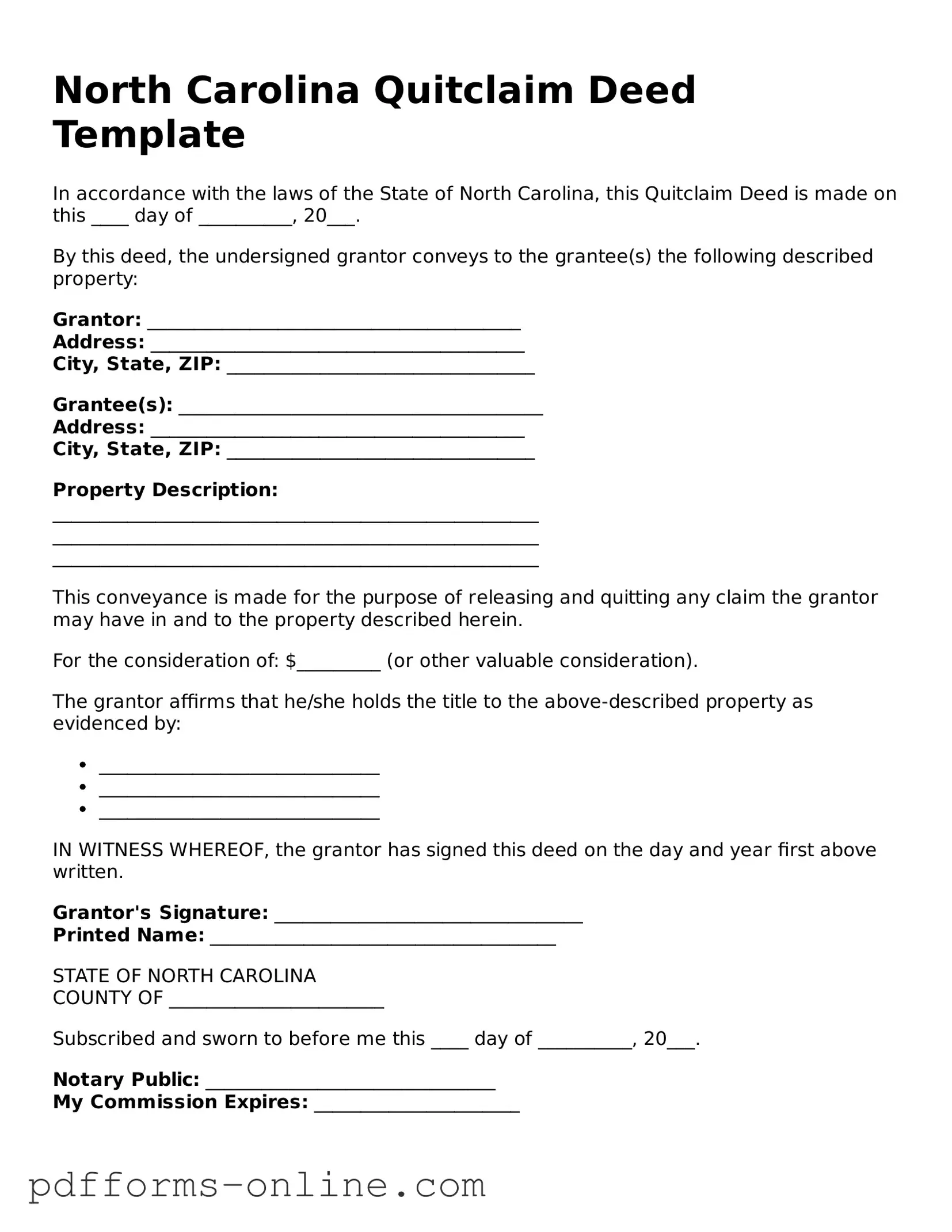

Document Example

North Carolina Quitclaim Deed Template

In accordance with the laws of the State of North Carolina, this Quitclaim Deed is made on this ____ day of __________, 20___.

By this deed, the undersigned grantor conveys to the grantee(s) the following described property:

Grantor: ________________________________________

Address: ________________________________________

City, State, ZIP: _________________________________

Grantee(s): _______________________________________

Address: ________________________________________

City, State, ZIP: _________________________________

Property Description:

____________________________________________________

____________________________________________________

____________________________________________________

This conveyance is made for the purpose of releasing and quitting any claim the grantor may have in and to the property described herein.

For the consideration of: $_________ (or other valuable consideration).

The grantor affirms that he/she holds the title to the above-described property as evidenced by:

- ______________________________

- ______________________________

- ______________________________

IN WITNESS WHEREOF, the grantor has signed this deed on the day and year first above written.

Grantor's Signature: _________________________________

Printed Name: _____________________________________

STATE OF NORTH CAROLINA

COUNTY OF _______________________

Subscribed and sworn to before me this ____ day of __________, 20___.

Notary Public: _______________________________

My Commission Expires: ______________________

Frequently Asked Questions

-

What is a Quitclaim Deed in North Carolina?

A Quitclaim Deed is a legal document used to transfer ownership of real property. In North Carolina, it allows one person, known as the grantor, to transfer their interest in a property to another person, called the grantee. This type of deed does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor has, if any.

-

When should I use a Quitclaim Deed?

People often use a Quitclaim Deed in specific situations. For example, it is commonly used among family members, such as when transferring property between spouses or to children. It is also useful in divorce settlements or when clearing up title issues. However, it is important to remember that this deed does not provide warranties or guarantees about the property’s title.

-

How do I complete a Quitclaim Deed in North Carolina?

Completing a Quitclaim Deed involves several steps. First, you need to obtain the form, which can be found online or at local legal offices. Fill in the required information, including the names of the grantor and grantee, the property description, and the date of transfer. After filling out the form, the grantor must sign it in the presence of a notary public. Finally, you should file the deed with the local county register of deeds office to make the transfer official.

-

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees involved when filing a Quitclaim Deed in North Carolina. These fees can vary by county, so it is wise to check with your local register of deeds office for the exact amount. Additionally, if you are using a lawyer to assist with the process, there may be legal fees to consider as well.

-

What are the risks of using a Quitclaim Deed?

Using a Quitclaim Deed carries certain risks. Since it does not provide any guarantees about the property title, the grantee may end up with unexpected issues, such as liens or claims against the property. It is crucial to conduct thorough research on the property’s title before proceeding with this type of deed. Consulting with a legal professional can help mitigate these risks and ensure a smoother transaction.

Misconceptions

When it comes to the North Carolina Quitclaim Deed, many individuals hold misconceptions that can lead to confusion or missteps in property transactions. Here are six common misunderstandings:

- A Quitclaim Deed transfers ownership completely. Many believe that a quitclaim deed conveys full ownership of a property. In reality, it transfers whatever interest the grantor has in the property, which may be none at all.

- A Quitclaim Deed guarantees clear title. Some people think that using a quitclaim deed ensures a clear title. However, this type of deed does not provide any warranties or guarantees regarding the title’s status.

- Quitclaim Deeds are only for divorces or family transfers. While quitclaim deeds are often used in family situations, they can also be utilized in other scenarios, such as transferring property between friends or in business transactions.

- All states use the same Quitclaim Deed form. Many assume that the quitclaim deed form is uniform across all states. In truth, each state has its own specific requirements and formats for these documents.

- Once signed, a Quitclaim Deed cannot be revoked. Some believe that signing a quitclaim deed is irreversible. However, it can be challenged or revoked under certain circumstances, such as fraud or lack of capacity.

- A Quitclaim Deed is the same as a Warranty Deed. There is a common misconception that quitclaim deeds and warranty deeds serve the same purpose. In fact, a warranty deed provides assurances about the title, while a quitclaim deed does not.

Understanding these misconceptions is crucial for anyone involved in property transactions in North Carolina. Taking the time to clarify these points can help ensure smoother dealings and protect one's interests in real estate matters.

Common mistakes

-

Incorrect Names: One common mistake is failing to include the full legal names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Initials or nicknames should not be used. Always ensure that names match those on legal documents.

-

Missing Signatures: The Quitclaim Deed must be signed by the grantor. Sometimes, people forget this crucial step. Without a signature, the document is not valid, and the transfer of property cannot take place.

-

Improper Notarization: A Quitclaim Deed needs to be notarized to be legally binding. If the notarization is missing or improperly completed, the deed may not be accepted by the county clerk. Make sure to have a qualified notary public witness the signing.

-

Incorrect Property Description: Providing an accurate description of the property is essential. Many people mistakenly include vague or incomplete details. The legal description should match what is recorded in the county's property records to avoid confusion or disputes.

-

Failure to Record the Deed: After completing the Quitclaim Deed, it’s important to file it with the appropriate county office. Some individuals overlook this step, which can lead to complications in proving ownership. Recording the deed protects the rights of the grantee.

Find Some Other Quitclaim Deed Forms for Specific States

Quit Deed Form Texas - This type of deed remains a common choice for informal property transactions.

For those seeking reliable documentation, the flexible Promissory Note structure is vital for ensuring clear financial agreements. This form provides a comprehensive overview of the terms under which a loan is issued, making it easier for both parties to understand their obligations. To create your own document, visit the useful Promissory Note template available online.

Quit Claim Deed Pa - A Quitclaim Deed is often used in divorce settlements to transfer property rights.

Quit Claim Deed Sample - This tool can facilitate the transfer of property between trusts as well.

Quitclaim Deed Form Ohio - Although it simplifies the process, understanding the risks is crucial for new property owners.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of property from one party to another without any warranties. |

| Purpose | It is often used to clear up title issues or transfer property between family members. |

| Governing Law | The North Carolina Quitclaim Deed is governed by North Carolina General Statutes Chapter 47. |

| Requirements | The deed must be signed by the grantor and notarized to be valid. |

| Consideration | While consideration is not required, it is customary to include a nominal amount. |

| Recording | After execution, the deed should be recorded with the county register of deeds to ensure public notice. |

| Limitations | A quitclaim deed does not guarantee that the grantor holds clear title to the property. |

Similar forms

A Warranty Deed is a document that conveys property ownership with a guarantee that the title is clear of any claims or liens. Unlike a Quitclaim Deed, which offers no warranties, a Warranty Deed assures the buyer that the seller has the legal right to transfer the property and that it is free from any encumbrances. This added layer of protection makes Warranty Deeds a preferred choice for buyers seeking security in their real estate transactions.

A Bargain and Sale Deed transfers property ownership but does not guarantee that the title is free of defects. Similar to a Quitclaim Deed, it implies that the seller has an interest in the property but does not provide the same level of assurance as a Warranty Deed. It is often used in situations where the seller may not want to assume liability for any potential issues with the title.

An Executor's Deed is used when an estate is being settled after a person's death. This document allows the executor to transfer property from the deceased's estate to heirs or beneficiaries. Like a Quitclaim Deed, an Executor's Deed does not guarantee clear title, but it serves as a legal means to convey property rights, often in probate situations.

A Trustee's Deed is similar to an Executor's Deed but involves property held in a trust. When a trustee sells or transfers property, they use this document to convey ownership. Like a Quitclaim Deed, a Trustee's Deed does not provide warranties about the title, making it essential for buyers to conduct thorough title searches before proceeding with such transactions.

A Special Warranty Deed is another type of deed that provides limited warranties. It guarantees that the seller has not encumbered the property during their ownership but does not cover any issues that may have existed before the seller acquired the property. This is somewhat akin to a Quitclaim Deed, as both documents offer less protection than a full Warranty Deed, appealing to sellers who wish to limit their liability.

A Deed in Lieu of Foreclosure is a document that allows a homeowner to transfer property back to the lender to avoid foreclosure. This deed serves as an alternative to foreclosure proceedings and is often executed when the homeowner can no longer maintain mortgage payments. While it shares similarities with a Quitclaim Deed in that it transfers ownership, it is primarily used as a remedy for financial distress rather than a straightforward transfer of property rights.

Understanding various types of property deeds, such as warranty deeds, grant deeds, and special warranty deeds, is essential for ensuring secure transactions. These documents establish the rights and obligations of parties involved, safeguarding against potential disputes. To further strengthen your legal documents and ensure comprehensive protection, you might want to explore additional resources, including All Arizona Forms that serve specific legal needs.

A Leasehold Deed conveys a leasehold interest in a property rather than full ownership. This document is used when a property owner leases their land to another party for a specified period. While it differs from a Quitclaim Deed in that it does not transfer ownership outright, both documents facilitate the transfer of rights related to real estate, showcasing the various ways property interests can be conveyed.