Valid North Carolina Promissory Note Template

In North Carolina, a Promissory Note serves as a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form captures essential details, such as the amount of money being borrowed, the interest rate applicable, and the repayment schedule. It also specifies the consequences of default, ensuring that both parties understand their obligations and rights. By clearly stating the terms, the Promissory Note helps to prevent misunderstandings and disputes down the line. Additionally, this document may include provisions for late fees and prepayment options, further protecting the interests of the lender while providing flexibility for the borrower. Understanding the components and implications of a Promissory Note is vital for anyone involved in a lending transaction in North Carolina, as it lays the foundation for a legally binding agreement that can be enforced in court if necessary.

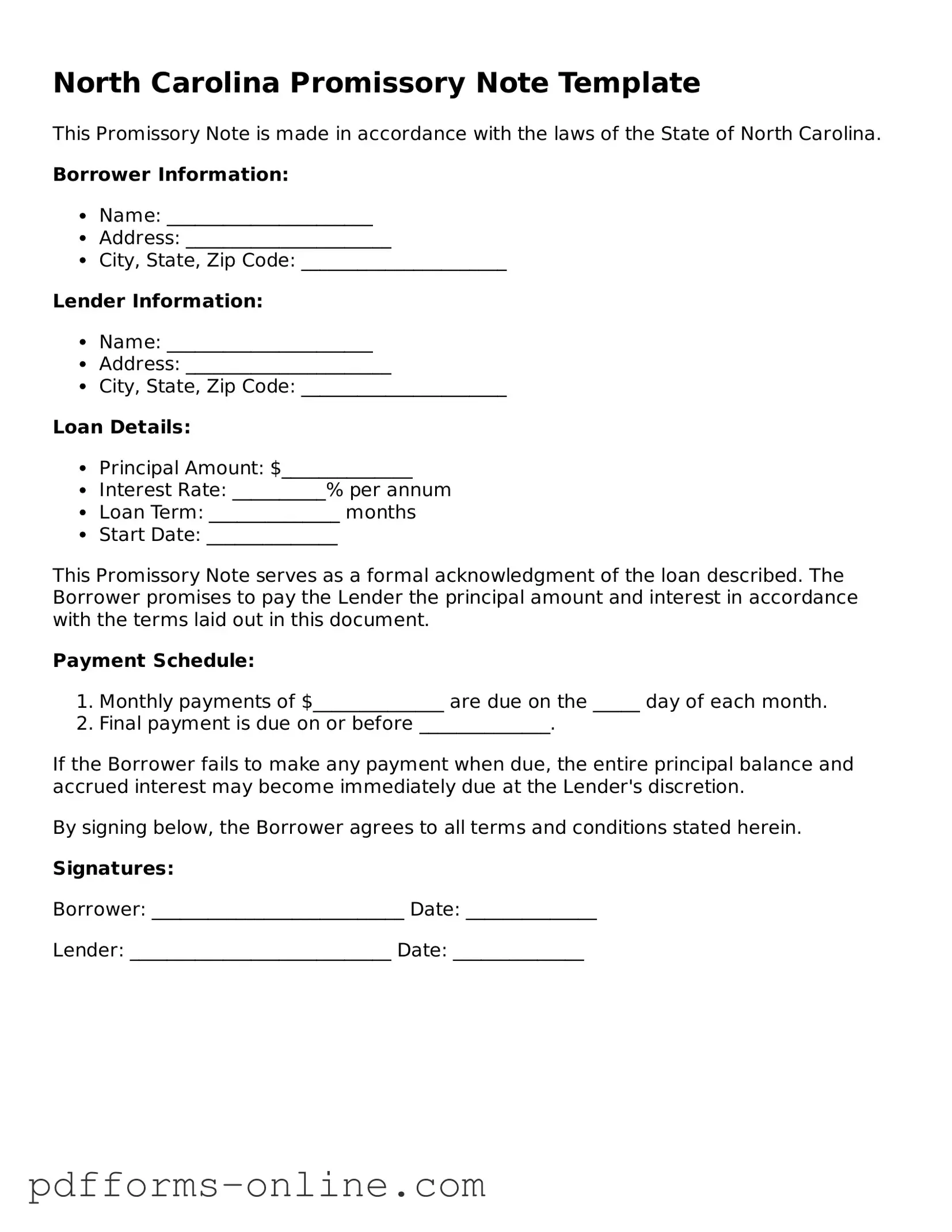

Document Example

North Carolina Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of North Carolina.

Borrower Information:

- Name: ______________________

- Address: ______________________

- City, State, Zip Code: ______________________

Lender Information:

- Name: ______________________

- Address: ______________________

- City, State, Zip Code: ______________________

Loan Details:

- Principal Amount: $______________

- Interest Rate: __________% per annum

- Loan Term: ______________ months

- Start Date: ______________

This Promissory Note serves as a formal acknowledgment of the loan described. The Borrower promises to pay the Lender the principal amount and interest in accordance with the terms laid out in this document.

Payment Schedule:

- Monthly payments of $______________ are due on the _____ day of each month.

- Final payment is due on or before ______________.

If the Borrower fails to make any payment when due, the entire principal balance and accrued interest may become immediately due at the Lender's discretion.

By signing below, the Borrower agrees to all terms and conditions stated herein.

Signatures:

Borrower: ___________________________ Date: ______________

Lender: ____________________________ Date: ______________

Frequently Asked Questions

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant conditions.

-

What is the purpose of the North Carolina Promissory Note form?

The North Carolina Promissory Note form is designed to provide a clear and legally binding agreement between a borrower and a lender. It helps protect the interests of both parties by detailing the terms of the loan and ensuring that both understand their rights and obligations.

-

Who can use the North Carolina Promissory Note form?

Any individual or business in North Carolina can use this form. It is commonly utilized by private lenders, family members, or friends who wish to formalize a loan arrangement. Both parties must be competent to enter into a contract and should ensure they understand the terms outlined in the note.

-

What information is required to complete the form?

To complete the North Carolina Promissory Note form, the following information is typically required:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate (if applicable)

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

-

Is notarization required for the North Carolina Promissory Note?

Notarization is not strictly required for a promissory note to be legally binding in North Carolina. However, having the document notarized can provide additional legal protection and help verify the identities of the parties involved. This can be particularly important if disputes arise in the future.

-

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender may have several options available. These can include demanding immediate payment of the remaining balance, charging late fees, or pursuing legal action to recover the owed amount. The specific remedies available will depend on the terms outlined in the promissory note and applicable state laws.

-

Can the terms of the Promissory Note be modified?

Yes, the terms of a promissory note can be modified if both the borrower and lender agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This helps ensure clarity and avoids potential misunderstandings in the future.

Misconceptions

Understanding the North Carolina Promissory Note form can be challenging, and several misconceptions often arise. Here are four common misunderstandings:

-

All Promissory Notes are the Same:

Many people believe that all promissory notes are identical. In reality, each note can be tailored to fit the specific agreement between the borrower and the lender. This means terms such as interest rates, payment schedules, and consequences for default can vary significantly.

-

A Promissory Note is a Loan Agreement:

Some individuals confuse a promissory note with a loan agreement. While both documents are related, a promissory note is a promise to repay a loan, whereas a loan agreement outlines the broader terms and conditions of the loan, including collateral and responsibilities of both parties.

-

Only Banks Use Promissory Notes:

It’s a common belief that only financial institutions utilize promissory notes. However, individuals can use them as well. Friends, family members, or private lenders may create a promissory note to formalize a loan, ensuring clarity and legal protection for both parties.

-

Signing a Promissory Note is Enough:

Many assume that simply signing a promissory note is sufficient to make it legally binding. While a signature is essential, the note must also meet certain legal requirements, such as clear terms and conditions. Failure to adhere to these can render the note unenforceable.

Common mistakes

-

Failing to include the correct date. The date should reflect when the note is signed. Leaving it blank can cause confusion later.

-

Not specifying the loan amount clearly. It is important to write the amount both in numbers and words to avoid any misunderstandings.

-

Omitting the names and addresses of both the borrower and the lender. This information is essential for identifying the parties involved in the agreement.

-

Neglecting to outline the repayment terms. Clearly stating when payments are due and how much they will be helps prevent disputes.

-

Using vague language. Be specific about the terms of the loan. Ambiguities can lead to different interpretations.

-

Not including the interest rate. If applicable, the interest rate should be clearly stated to ensure both parties understand the cost of borrowing.

-

Failing to sign the document. Both parties must sign the note for it to be legally binding. A missing signature can render the note invalid.

-

Forgetting to have a witness or notarization if required. Some situations may necessitate additional verification to protect all parties.

Find Some Other Promissory Note Forms for Specific States

Promissory Note Template Ohio - It may include language about the consequences of non-payment and the lender's rights.

Michigan Promissory Note Example - The form can often be customized to fit the needs of both the borrower and lender.

Texas Promissory Note - The note can clarify the rights of both borrower and lender in the event of default.

In addition to understanding the significance of a Non-compete Agreement in Arizona, it is essential to familiarize yourself with related legal documents that can aid in your business's protection. For a comprehensive overview of various agreements and forms applicable in Arizona, including the Non-compete Agreement, please refer to All Arizona Forms, ensuring you are fully informed and prepared to safeguard your business interests effectively.

Promissory Note for Personal Loan - The note clarifies the consequences of defaulting on the repayment obligations.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The North Carolina General Statutes, specifically Chapter 25, govern promissory notes in the state. |

| Parties Involved | The note involves two parties: the maker (the borrower) and the payee (the lender). |

| Interest Rates | Interest can be included in the note, and it must comply with North Carolina's usury laws. |

| Payment Terms | Payment terms should clearly outline the due dates and methods of payment. |

| Default Clauses | Provisions regarding default should be included, detailing what happens if payments are missed. |

| Signatures | Both the maker and the payee must sign the note for it to be legally binding. |

| Notarization | While notarization is not required, it is recommended to enhance the document's validity. |

Similar forms

The North Carolina Promissory Note is similar to a Loan Agreement. Both documents outline the terms under which one party borrows money from another. A Loan Agreement typically includes details about the loan amount, interest rate, repayment schedule, and any collateral involved. Like the Promissory Note, it serves as a legal obligation for the borrower to repay the loan under the agreed conditions, ensuring clarity and protection for both parties.

Another document that shares similarities is the Mortgage. A Mortgage is a specific type of loan secured by real property. While a Promissory Note details the borrower's promise to repay the loan, the Mortgage provides the lender with a legal claim to the property if the borrower defaults. Both documents work together to create a comprehensive understanding of the loan and its security.

When seeking a rental property, prospective tenants can benefit from utilizing a thorough Rental Application guide to ensure they provide all necessary information to landlords. This document not only streamlines the application process but also helps in presenting a tenant's qualifications effectively, thus enhancing their chances of securing a rental agreement.

The Secured Promissory Note is closely related as well. This document specifies that the loan is backed by collateral, which can be any asset of value. The Secured Promissory Note includes terms similar to those found in a standard Promissory Note but emphasizes the collateral aspect. In case of default, the lender has the right to seize the collateral, offering additional protection for the lender.

A Personal Guarantee is another document that complements the Promissory Note. In this case, an individual agrees to be personally responsible for the debt if the primary borrower defaults. This document adds an extra layer of security for the lender, similar to how a Promissory Note obligates the borrower to repay the loan.

The Installment Agreement also shares characteristics with the Promissory Note. This document outlines a payment plan where the borrower agrees to repay the loan in fixed installments over a specified period. Like the Promissory Note, it includes details about the total loan amount and the interest rate, ensuring that both parties understand the repayment terms.

The Loan Disclosure Statement is another relevant document. It provides borrowers with important information about the terms and conditions of their loan. While the Promissory Note serves as a binding agreement, the Loan Disclosure Statement ensures that the borrower is fully informed about aspects such as fees, interest rates, and payment schedules, fostering transparency in the lending process.

A Credit Agreement is also similar in nature. This document outlines the terms under which credit is extended to a borrower. It includes details such as the credit limit, interest rates, and repayment terms. Like the Promissory Note, it establishes a formal understanding between the lender and borrower regarding the financial obligations involved.

The Deed of Trust shares similarities with the Promissory Note as well. This document is often used in real estate transactions and acts as a security instrument for the loan. While the Promissory Note outlines the borrower's promise to repay, the Deed of Trust secures the loan with the property itself, ensuring that the lender has recourse in the event of default.

Finally, the Business Loan Agreement is comparable to the Promissory Note, particularly in commercial transactions. This document details the terms of a loan provided to a business, including repayment terms, interest rates, and any covenants that the business must adhere to. Like the Promissory Note, it serves as a legal contract that binds the borrower to specific financial obligations.