Valid North Carolina Operating Agreement Template

When starting a business in North Carolina, having a solid foundation is crucial, and that’s where the North Carolina Operating Agreement form comes into play. This document serves as a blueprint for how your business will operate, outlining the roles and responsibilities of members, management structures, and decision-making processes. It addresses key aspects such as profit distribution, member contributions, and procedures for adding or removing members. Additionally, the Operating Agreement can help prevent disputes by clearly defining each member's rights and obligations. Whether you’re forming a limited liability company (LLC) or a partnership, having this agreement in place can provide clarity and protection for everyone involved. It’s not just a formality; it’s a vital tool for ensuring smooth operations and fostering good relationships among members.

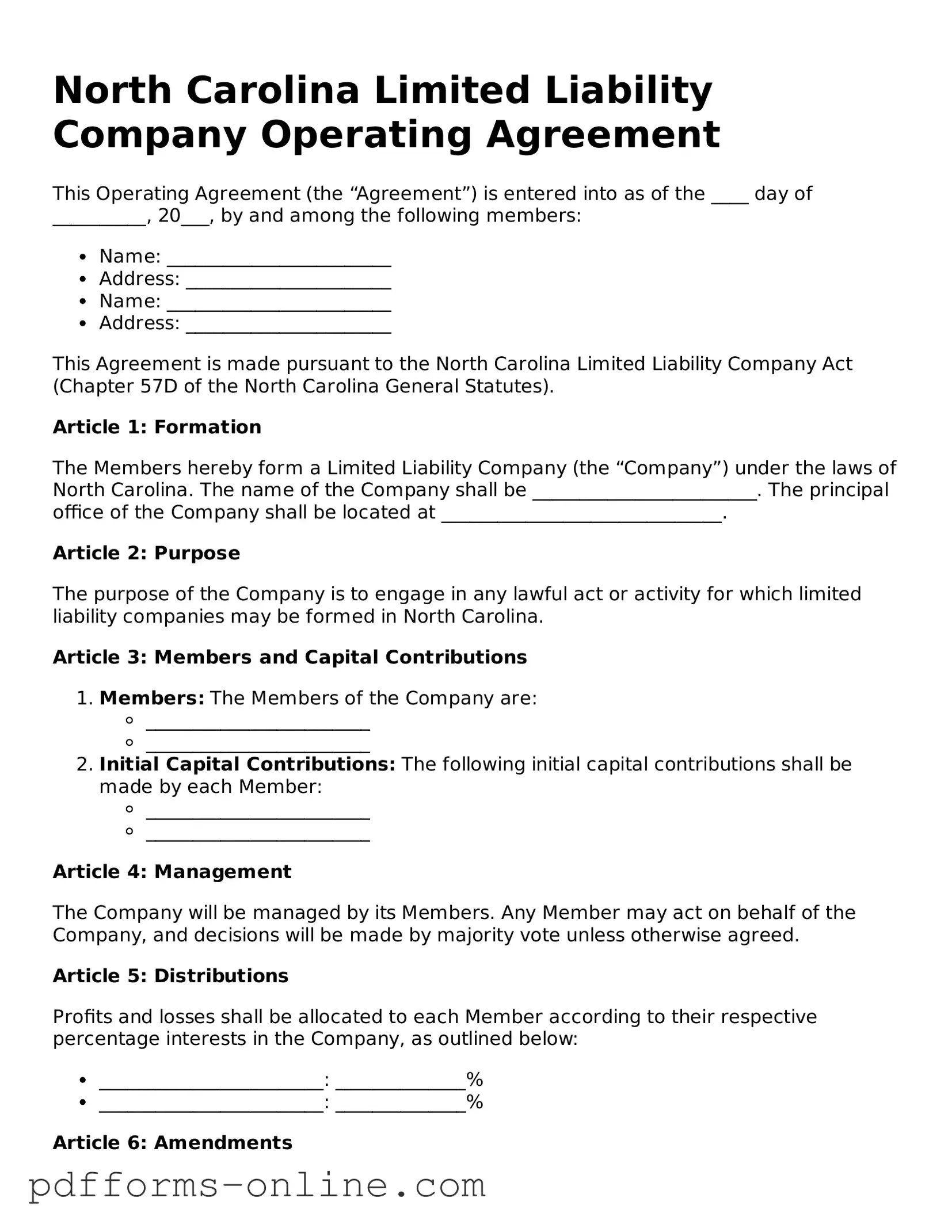

Document Example

North Carolina Limited Liability Company Operating Agreement

This Operating Agreement (the “Agreement”) is entered into as of the ____ day of __________, 20___, by and among the following members:

- Name: ________________________

- Address: ______________________

- Name: ________________________

- Address: ______________________

This Agreement is made pursuant to the North Carolina Limited Liability Company Act (Chapter 57D of the North Carolina General Statutes).

Article 1: Formation

The Members hereby form a Limited Liability Company (the “Company”) under the laws of North Carolina. The name of the Company shall be ________________________. The principal office of the Company shall be located at ______________________________.

Article 2: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be formed in North Carolina.

Article 3: Members and Capital Contributions

-

Members: The Members of the Company are:

- ________________________

- ________________________

-

Initial Capital Contributions: The following initial capital contributions shall be made by each Member:

- ________________________

- ________________________

Article 4: Management

The Company will be managed by its Members. Any Member may act on behalf of the Company, and decisions will be made by majority vote unless otherwise agreed.

Article 5: Distributions

Profits and losses shall be allocated to each Member according to their respective percentage interests in the Company, as outlined below:

- ________________________: ______________%

- ________________________: ______________%

Article 6: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article 7: Indemnification

To the fullest extent permitted by law, the Company shall indemnify and hold harmless each Member from any loss, liability, or expense incurred as a result of their activities on behalf of the Company, provided that such indemnification shall not apply in cases of gross negligence or willful misconduct.

Signature

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

__________________________ __________________________

Member (Printed Name) Member (Printed Name)

__________________________ __________________________

Signature Signature

Date: _____________________ Date: _____________________

This document should be reviewed and completed in accordance with North Carolina law. Consult with an attorney for specific legal advice.

Frequently Asked Questions

-

What is a North Carolina Operating Agreement?

An Operating Agreement is a vital document for Limited Liability Companies (LLCs) in North Carolina. It outlines the ownership structure, management responsibilities, and operational procedures of the LLC. While North Carolina does not legally require an Operating Agreement, having one is highly recommended. It helps to clarify expectations among members and can prevent disputes down the line.

-

Who should create the Operating Agreement?

All members of the LLC should be involved in creating the Operating Agreement. This collaborative approach ensures that everyone’s interests and concerns are addressed. It’s crucial for all members to have a say in how the company will be run, what each member's responsibilities will be, and how profits and losses will be distributed.

-

What key elements should be included in the Operating Agreement?

While every Operating Agreement will differ based on the specific needs of the LLC, there are several key elements that should be included:

- Ownership percentages of each member

- Management structure and decision-making processes

- Procedures for adding or removing members

- Distribution of profits and losses

- Dispute resolution methods

- Amendment procedures for the agreement

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. In fact, it is important to review and update the document periodically to reflect changes in the business or its members. The amendment process should be clearly outlined within the Operating Agreement itself, specifying how changes can be made and what majority is needed for approval.

-

Is the Operating Agreement a public document?

No, the Operating Agreement is not filed with the state and remains a private document. This confidentiality allows members to outline their internal processes without public scrutiny. However, it’s important to keep the document accessible to all members and to store it in a safe location.

-

What happens if an LLC does not have an Operating Agreement?

If an LLC operates without an Operating Agreement, it will be governed by North Carolina’s default LLC laws. This can lead to misunderstandings and disputes among members, as the default laws may not reflect the specific wishes of the members. Having an Operating Agreement helps to create a clear framework for how the business will operate, ultimately providing peace of mind for all involved.

Misconceptions

Understanding the North Carolina Operating Agreement form is essential for anyone looking to establish a limited liability company (LLC) in the state. However, several misconceptions can lead to confusion. Here are eight common misunderstandings about this important document:

- It's a mandatory document for all LLCs. While having an Operating Agreement is highly recommended, it is not legally required in North Carolina. However, it can protect your interests and clarify management roles.

- All members must sign the Operating Agreement. In many cases, it is beneficial for all members to sign, but it is not a strict requirement. A single member can create an Operating Agreement for a single-member LLC.

- It only needs to be created once. An Operating Agreement can and should be updated as circumstances change, such as adding new members or altering management structures.

- The Operating Agreement is the same as the Articles of Organization. These are two distinct documents. The Articles of Organization are filed with the state to create the LLC, while the Operating Agreement outlines the internal workings.

- It must be filed with the state. The Operating Agreement is an internal document and does not need to be filed with the North Carolina Secretary of State. However, it should be kept on record for reference.

- It can be a verbal agreement. While verbal agreements may be valid in some contexts, having a written Operating Agreement is crucial for clarity and enforceability in legal matters.

- It cannot include provisions that differ from state law. An Operating Agreement can include unique provisions tailored to the members' needs, as long as they do not violate state laws.

- All LLCs have the same Operating Agreement. Each Operating Agreement can be customized to fit the specific needs and goals of the LLC, reflecting the unique arrangement among its members.

Addressing these misconceptions can help ensure that your LLC operates smoothly and is prepared for any legal challenges that may arise. A well-crafted Operating Agreement can serve as a valuable tool for managing your business effectively.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or rejections. Ensure every section is filled out completely.

-

Incorrect Member Names: Listing members with incorrect names or spellings can create confusion. Double-check the names against official documents.

-

Missing Signatures: Forgetting to sign the agreement is a common mistake. All members must sign to validate the document.

-

Neglecting to Date the Agreement: Not dating the document can lead to questions about when the agreement was made. Always include the date.

-

Ignoring State Requirements: Each state has specific rules for operating agreements. Failing to adhere to North Carolina’s requirements can invalidate the agreement.

-

Using Ambiguous Language: Vague terms can lead to misunderstandings. Be clear and precise in your wording to avoid confusion later.

-

Not Reviewing the Agreement: Skipping a thorough review before submission can result in overlooked errors. Always take the time to review the completed form.

-

Failing to Update the Agreement: As your business evolves, so should your operating agreement. Regular updates are essential to reflect any changes in membership or structure.

Find Some Other Operating Agreement Forms for Specific States

Llc in Texas Cost - It often specifies the fiscal year of the company and financial record-keeping requirements.

Nys Llc Operating Agreement Template - This operating document is important for safeguarding personal assets.

For those looking to establish a clear and effective rental agreement, it is essential to utilize the Ohio Lease Agreement, which can be accessed at https://documentonline.org/blank-ohio-lease-agreement. This document not only delineates the responsibilities of both the landlord and tenant but also helps mitigate misunderstandings that may arise during the lease period.

Llc Operating Agreement Florida - It may also specify conditions under which members can create additional agreements.

How to Make an Operating Agreement - The Operating Agreement may include mechanisms for resolving disputes among members.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the North Carolina Limited Liability Company Act. |

| Members | All members of the LLC should be included in the operating agreement to ensure clarity in roles and responsibilities. |

| Flexibility | The operating agreement allows for flexibility in management and can be tailored to meet the specific needs of the LLC. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, which can help avoid costly litigation. |

| Amendments | Members can amend the operating agreement as needed, provided that all members agree to the changes. |

| Tax Treatment | The agreement can outline how the LLC will be taxed, whether as a partnership or corporation, based on member preferences. |

| Duration | The operating agreement can specify the duration of the LLC, whether it is perpetual or for a defined term. |

| Signatures | All members must sign the operating agreement for it to be valid and enforceable. |

Similar forms

The North Carolina Operating Agreement form is similar to the Partnership Agreement. Both documents outline the roles, responsibilities, and rights of the parties involved in a business. A Partnership Agreement is specifically designed for partnerships, detailing how profits and losses are shared, how decisions are made, and what happens if a partner wants to leave the business. Like the Operating Agreement, it serves as a foundational document to ensure all partners are on the same page regarding the operation of the business.

Understanding the significance of a Prenuptial Agreement is essential for couples preparing for marriage. This legally binding document, which outlines financial rights and responsibilities, can provide clarity and peace of mind. For more information, you can visit our comprehensive guide on Prenuptial Agreement options.

Another document that shares similarities with the North Carolina Operating Agreement is the Bylaws. While Bylaws are typically used for corporations, they also define the internal rules and procedures of an organization. Both documents establish governance structures, including how meetings are conducted, how decisions are made, and the roles of key individuals. The Bylaws provide a framework for corporate operations, much like the Operating Agreement does for limited liability companies (LLCs).

The Shareholders Agreement is another comparable document. This agreement is used by corporations to outline the rights and obligations of shareholders. It details how shares can be transferred, how decisions are made, and what happens in case of a dispute. Similar to the Operating Agreement, it protects the interests of the parties involved and helps prevent misunderstandings about ownership and management of the business.

Additionally, the LLC Membership Agreement is closely related to the North Carolina Operating Agreement. This document is specifically tailored for LLCs and serves a similar purpose by defining the relationship between members. It includes details about ownership percentages, voting rights, and profit distribution. Both agreements aim to clarify the expectations and responsibilities of each member, ensuring smooth operation and management of the business.

Finally, the Joint Venture Agreement bears resemblance to the Operating Agreement. This document outlines the terms of a partnership between two or more parties who agree to work together on a specific project or business activity. Like the Operating Agreement, it delineates the roles of each party, how profits and losses will be shared, and how disputes will be resolved. Both agreements serve to formalize the relationship and provide a clear framework for collaboration.