Valid North Carolina Motor Vehicle Bill of Sale Template

The North Carolina Motor Vehicle Bill of Sale form serves as a crucial document in the transfer of ownership for vehicles within the state. This form not only provides essential details about the vehicle being sold, such as its make, model, year, and Vehicle Identification Number (VIN), but it also includes important information about the buyer and seller. Both parties must sign the document to validate the transaction, ensuring that the sale is legally recognized. Additionally, the bill of sale may include the sale price, which is vital for tax purposes, as well as any disclosures regarding the vehicle's condition. By documenting the transfer of ownership, this form protects the rights of both the seller and the buyer, making it a key component of vehicle transactions in North Carolina. Understanding the nuances of this form can help individuals navigate the buying and selling process more effectively, ensuring compliance with state regulations and promoting a smoother transaction experience.

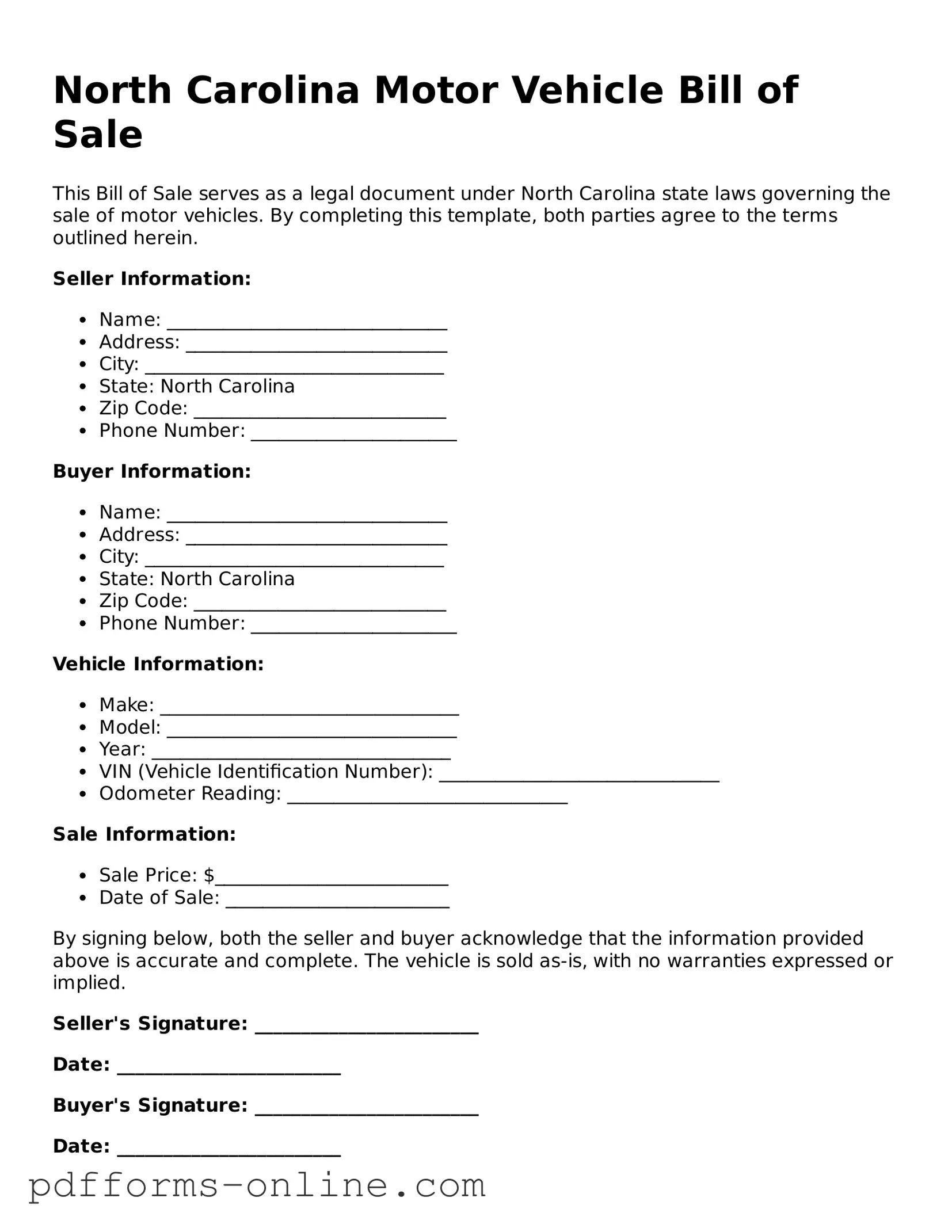

Document Example

North Carolina Motor Vehicle Bill of Sale

This Bill of Sale serves as a legal document under North Carolina state laws governing the sale of motor vehicles. By completing this template, both parties agree to the terms outlined herein.

Seller Information:

- Name: ______________________________

- Address: ____________________________

- City: ________________________________

- State: North Carolina

- Zip Code: ___________________________

- Phone Number: ______________________

Buyer Information:

- Name: ______________________________

- Address: ____________________________

- City: ________________________________

- State: North Carolina

- Zip Code: ___________________________

- Phone Number: ______________________

Vehicle Information:

- Make: ________________________________

- Model: _______________________________

- Year: ________________________________

- VIN (Vehicle Identification Number): ______________________________

- Odometer Reading: ______________________________

Sale Information:

- Sale Price: $_________________________

- Date of Sale: ________________________

By signing below, both the seller and buyer acknowledge that the information provided above is accurate and complete. The vehicle is sold as-is, with no warranties expressed or implied.

Seller's Signature: ________________________

Date: ________________________

Buyer's Signature: ________________________

Date: ________________________

It is recommended that both parties keep a copy for their records.

Frequently Asked Questions

-

What is a Motor Vehicle Bill of Sale in North Carolina?

A Motor Vehicle Bill of Sale is a legal document that serves as proof of the sale and transfer of ownership of a vehicle from one party to another. This document includes important details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), as well as the names and addresses of both the seller and the buyer.

-

Is a Bill of Sale required in North Carolina?

While a Bill of Sale is not legally required to sell a vehicle in North Carolina, it is highly recommended. This document provides a record of the transaction and can help protect both the buyer and the seller in case of disputes or issues that arise after the sale.

-

What information should be included in the Bill of Sale?

The Bill of Sale should include the following information:

- The full names and addresses of the buyer and seller

- The date of the sale

- The vehicle's make, model, year, and VIN

- The sale price

- Any warranties or representations made by the seller

- Signatures of both the buyer and the seller

-

Do I need to have the Bill of Sale notarized?

Notarization is not a requirement for a Bill of Sale in North Carolina. However, having the document notarized can add an extra layer of legitimacy and may be beneficial if any disputes arise in the future.

-

Can I use a generic Bill of Sale form?

Yes, you can use a generic Bill of Sale form as long as it contains all the necessary information required for the transaction. However, using a form specifically designed for North Carolina may help ensure compliance with local laws.

-

What should I do with the Bill of Sale after the sale?

After the sale is completed, both the buyer and seller should keep a copy of the Bill of Sale for their records. The buyer may need it when registering the vehicle with the North Carolina Division of Motor Vehicles (DMV).

-

How does the Bill of Sale affect vehicle registration?

The Bill of Sale is an important document when registering a vehicle in North Carolina. The buyer must present the Bill of Sale to the DMV along with other required documents, such as proof of insurance and the title, to complete the registration process.

Misconceptions

Understanding the North Carolina Motor Vehicle Bill of Sale form is crucial for both buyers and sellers. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- It is not necessary for a private sale. Many believe a bill of sale is only required for dealership transactions. In fact, it is essential for private sales to document the transfer of ownership.

- It does not need to be notarized. Some think that notarization is optional. While it is not required, having the bill of sale notarized can add an extra layer of protection for both parties.

- It is only a formality. Many view the bill of sale as a simple formality. In reality, it serves as legal proof of the transaction and can be important for tax purposes.

- Only the seller needs to sign it. Some assume that only the seller's signature is necessary. Both the buyer and seller should sign the bill of sale to validate the transaction.

- It is the same as the title. Some people think the bill of sale and the vehicle title are interchangeable. They are different documents; the title proves ownership, while the bill of sale documents the sale.

- It does not need to include vehicle details. There is a misconception that details about the vehicle are not important. Including the make, model, year, and VIN is crucial for clarity and legal protection.

- It is only for used vehicles. Many believe the bill of sale is only relevant for used vehicles. However, it is also applicable for new vehicle purchases to document the sale.

- Once signed, it cannot be changed. Some think that after signing, the bill of sale is set in stone. If both parties agree, they can amend the document, but both should initial any changes.

Being aware of these misconceptions can help ensure a smooth transaction when buying or selling a vehicle in North Carolina.

Common mistakes

-

Missing Information: One common mistake is failing to fill in all required fields. Every section needs to be completed to ensure the form is valid.

-

Incorrect Vehicle Identification Number (VIN): Double-check the VIN. An error here can lead to issues with registration and ownership transfer.

-

Not Including the Sale Price: It's essential to state the sale price clearly. Leaving this blank can create confusion and complications later.

-

Inaccurate Dates: Ensure the date of sale is correct. Using the wrong date can affect the legality of the transaction.

-

Signatures Missing: Both the buyer and seller must sign the document. Without these signatures, the bill of sale is not enforceable.

-

Not Keeping Copies: Failing to make copies of the completed bill of sale can lead to problems if disputes arise later. Always keep a copy for your records.

-

Ignoring Local Laws: Some counties may have specific requirements for the bill of sale. Ignoring these can result in delays or issues with the vehicle transfer.

Find Some Other Motor Vehicle Bill of Sale Forms for Specific States

Bill of Sale Requirements - Useful for tax purposes, providing needed information about the sale price.

Reg 256 Dmv - Enables buyers to verify details before completing the purchase.

PDF Attributes

| Fact Name | Details |

|---|---|

| Purpose | The North Carolina Motor Vehicle Bill of Sale form serves as a legal document to record the sale of a motor vehicle between a buyer and a seller. |

| Governing Law | This form is governed by North Carolina General Statutes, specifically N.C. Gen. Stat. § 20-77. |

| Required Information | Essential details include the vehicle's make, model, year, VIN, and the sale price. |

| Signatures | Both the buyer and seller must sign the document to validate the transaction. |

| Notarization | While notarization is not required, it is recommended to add an extra layer of authenticity. |

| Transfer of Ownership | The Bill of Sale facilitates the transfer of ownership and is often required for vehicle registration. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it may be needed for future reference. |

| Tax Implications | Sales tax may apply based on the sale price, and the Bill of Sale can be used to report this during tax filings. |

Similar forms

The North Carolina Motor Vehicle Bill of Sale form shares similarities with the Vehicle Title Transfer form. Both documents serve as official records for transferring ownership of a vehicle from one party to another. The Vehicle Title Transfer form requires information such as the vehicle identification number (VIN), the seller’s and buyer’s details, and the sale price, mirroring the essential components found in the bill of sale. This ensures that the transaction is documented and legally recognized by the state.

Another document that is comparable is the Odometer Disclosure Statement. This form is often required when selling a vehicle, as it provides a record of the vehicle’s mileage at the time of sale. Similar to the Motor Vehicle Bill of Sale, it protects both the buyer and seller by preventing odometer fraud. Both documents require signatures from the seller and buyer, affirming the accuracy of the information provided.

The North Carolina Vehicle Registration Application also resembles the Motor Vehicle Bill of Sale in purpose. While the bill of sale documents the sale, the registration application is necessary for the buyer to officially register the vehicle in their name. Both forms require the same key vehicle details, such as the VIN and the previous owner's information, ensuring a seamless transition of ownership in the eyes of the state.

The Affidavit of Ownership is another relevant document. This form is used when an individual claims ownership of a vehicle but lacks a title or bill of sale. It serves a similar function by establishing proof of ownership, much like the Motor Vehicle Bill of Sale. Both documents require the individual to provide personal details and vehicle information, reinforcing the legitimacy of the ownership claim.

The North Carolina DMV Application for Title is also related. This document is necessary when applying for a new title after purchasing a vehicle. It includes similar information to the Motor Vehicle Bill of Sale, such as the buyer’s and seller’s names and the vehicle details. Both forms are essential for completing the ownership transfer process and ensuring that the new owner has the legal right to the vehicle.

In addition, the Sales Tax Declaration form is pertinent. When a vehicle is sold, sales tax must be collected based on the sale price. The Sales Tax Declaration form requires the same information found in the Motor Vehicle Bill of Sale, such as the sale price and buyer’s information. Both documents work together to ensure compliance with tax regulations during the vehicle transfer process.

The Release of Liability form is another important document. This form protects the seller by notifying the state that they are no longer responsible for the vehicle after the sale. Similar to the Motor Vehicle Bill of Sale, it requires details about the vehicle and both parties involved in the transaction. This helps to prevent future liabilities related to the vehicle for the seller.

The Vehicle Donation Receipt is also akin to the Motor Vehicle Bill of Sale. This document is used when a vehicle is donated rather than sold. It serves to document the transfer of ownership and provides proof for tax deductions. Both forms require similar information about the vehicle and the parties involved, ensuring that the transaction is recorded properly.

Finally, the Power of Attorney for Vehicle Transactions can be compared to the Motor Vehicle Bill of Sale. This document allows one party to act on behalf of another in vehicle-related matters. It often accompanies the bill of sale when a seller authorizes someone else to complete the sale. Both documents require detailed information about the vehicle and the parties involved, ensuring clarity and legality in the transaction.