Valid North Carolina Last Will and Testament Template

The North Carolina Last Will and Testament form serves as a crucial legal document that enables individuals to articulate their wishes regarding the distribution of their assets upon death. This form encompasses several essential components, including the identification of the testator, who is the person creating the will, and the designation of beneficiaries, who will inherit the testator's property. Furthermore, it outlines the appointment of an executor, an individual tasked with ensuring that the terms of the will are executed in accordance with the testator's intentions. The form also addresses the necessity of witnessing the document, as North Carolina law mandates that the will be signed in the presence of at least two witnesses to validate its authenticity. Additionally, the form may include specific provisions regarding guardianship for minor children, thereby providing a comprehensive framework for the testator's final wishes. Understanding these components is vital for individuals seeking to create a legally sound will that reflects their personal circumstances and desires.

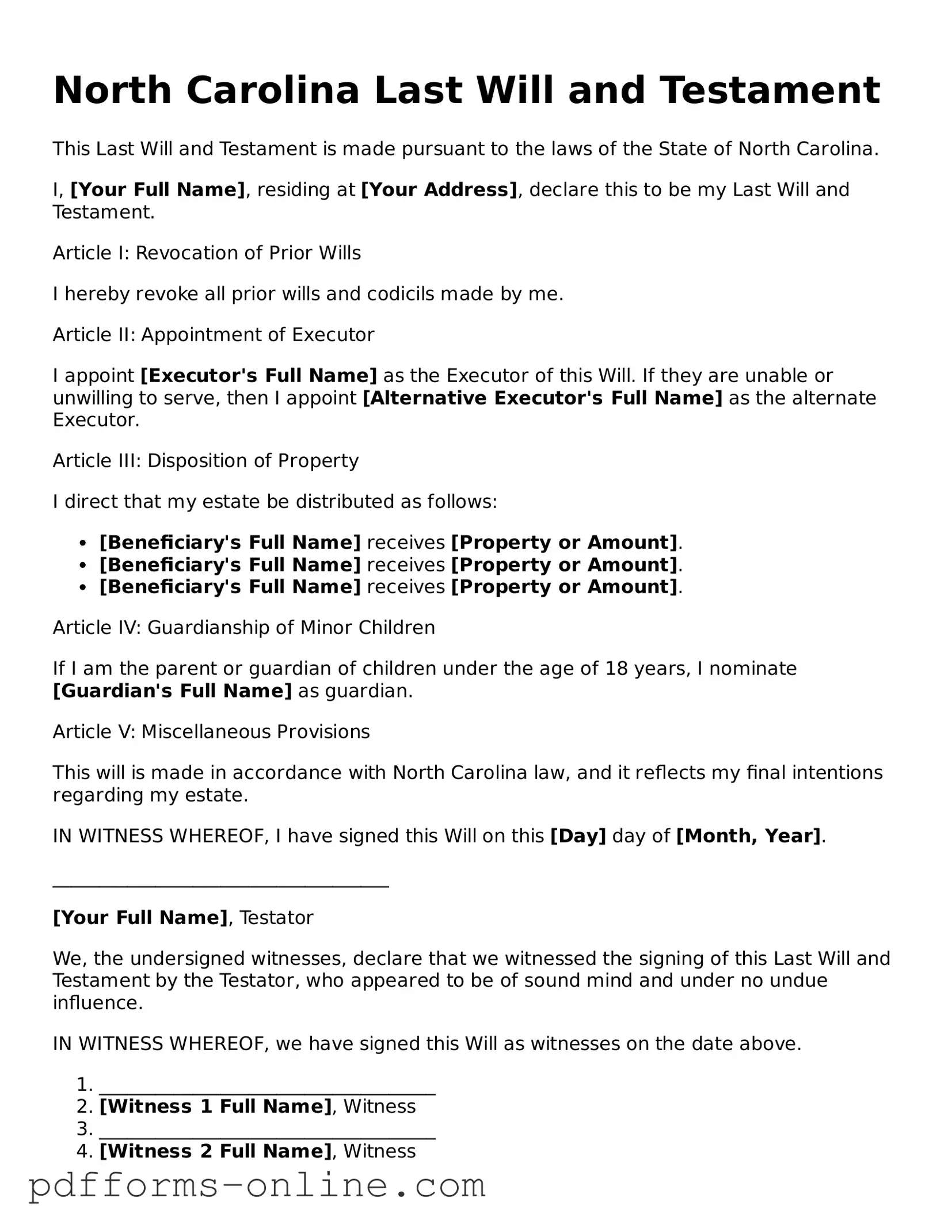

Document Example

North Carolina Last Will and Testament

This Last Will and Testament is made pursuant to the laws of the State of North Carolina.

I, [Your Full Name], residing at [Your Address], declare this to be my Last Will and Testament.

Article I: Revocation of Prior Wills

I hereby revoke all prior wills and codicils made by me.

Article II: Appointment of Executor

I appoint [Executor's Full Name] as the Executor of this Will. If they are unable or unwilling to serve, then I appoint [Alternative Executor's Full Name] as the alternate Executor.

Article III: Disposition of Property

I direct that my estate be distributed as follows:

- [Beneficiary's Full Name] receives [Property or Amount].

- [Beneficiary's Full Name] receives [Property or Amount].

- [Beneficiary's Full Name] receives [Property or Amount].

Article IV: Guardianship of Minor Children

If I am the parent or guardian of children under the age of 18 years, I nominate [Guardian's Full Name] as guardian.

Article V: Miscellaneous Provisions

This will is made in accordance with North Carolina law, and it reflects my final intentions regarding my estate.

IN WITNESS WHEREOF, I have signed this Will on this [Day] day of [Month, Year].

____________________________________

[Your Full Name], Testator

We, the undersigned witnesses, declare that we witnessed the signing of this Last Will and Testament by the Testator, who appeared to be of sound mind and under no undue influence.

IN WITNESS WHEREOF, we have signed this Will as witnesses on the date above.

- ____________________________________

- [Witness 1 Full Name], Witness

- ____________________________________

- [Witness 2 Full Name], Witness

Frequently Asked Questions

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It allows individuals to specify their wishes regarding the distribution of their property, the guardianship of minor children, and other important matters. Having a will can help ensure that your wishes are honored and can simplify the probate process for your loved ones.

-

Who can create a Last Will and Testament in North Carolina?

In North Carolina, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. Being of sound mind means that the person understands the nature of the document they are creating and the implications of their decisions. This legal capacity is crucial for the validity of the will.

-

What are the requirements for a valid will in North Carolina?

For a will to be valid in North Carolina, it must meet several criteria:

- The will must be in writing.

- The testator (the person making the will) must sign the will at the end.

- At least two witnesses must sign the will, attesting that they witnessed the testator sign the document or that the testator acknowledged their signature.

It is also advisable to have the will notarized, although this is not a requirement for validity.

-

Can I change or revoke my Last Will and Testament?

Yes, you can change or revoke your will at any time, as long as you are of sound mind. To make changes, you can create a new will that explicitly revokes the previous one, or you can add a codicil, which is an amendment to the existing will. It is important to follow the same formalities for signing and witnessing when making changes to ensure the validity of the new document.

-

What happens if I die without a will in North Carolina?

If you die without a will, your estate will be distributed according to North Carolina's intestacy laws. This means that the state will determine how your assets are divided, typically prioritizing spouses, children, and other relatives. Dying intestate can lead to outcomes that may not align with your wishes, making it essential to have a will in place.

-

Can I write my own Last Will and Testament?

Yes, you can write your own will in North Carolina, as long as it meets the legal requirements. However, it is often advisable to seek legal assistance to ensure that the document accurately reflects your wishes and complies with state laws. A well-drafted will can prevent potential disputes among heirs and ensure that your intentions are clear.

-

What should I include in my Last Will and Testament?

Your will should include several key components:

- Identification of the testator.

- A statement revoking any prior wills.

- Details about the distribution of assets, including specific bequests and the residue of the estate.

- Appointment of an executor to manage the estate.

- Provisions for guardianship of minor children, if applicable.

Including these elements can help create a comprehensive document that clearly communicates your wishes.

-

How do I ensure my Last Will and Testament is carried out?

To ensure that your will is carried out according to your wishes, select a trustworthy executor who understands your intentions. Discuss your wishes with them and provide them with a copy of the will. Keeping the will in a safe but accessible place and informing your loved ones about its location can also help facilitate the process after your passing. Regularly reviewing and updating your will, especially after major life events, is essential for maintaining its relevance.

Misconceptions

Understanding the North Carolina Last Will and Testament form is crucial for anyone looking to plan their estate. However, there are several misconceptions that can lead to confusion. Here are seven common misunderstandings:

- Everyone needs a will. Many people believe that only those with significant assets need a will. In reality, anyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are followed after your passing.

- A will can be handwritten. While North Carolina does allow handwritten (holographic) wills, they must meet specific criteria to be valid. It's often safer to use a formal will to avoid potential disputes.

- Wills are only for the wealthy. This is a common myth. Wills are important for individuals of all income levels. They provide clarity and direction for the distribution of personal belongings and assets.

- Once a will is made, it cannot be changed. Many people think that a will is set in stone once it is signed. In fact, wills can be updated or revoked at any time, as long as the person is of sound mind.

- Verbal wills are valid. Some believe that if they verbally express their wishes, those will be honored. In North Carolina, a will must be in writing to be legally recognized.

- All assets automatically go to the spouse. While many people assume that a spouse will inherit everything, this is not always the case. The distribution of assets can vary based on the will and state laws.

- Only lawyers can create a will. While it is advisable to consult a lawyer, especially for complex estates, individuals can create their own wills using templates. However, they must ensure that all legal requirements are met.

Clearing up these misconceptions can help individuals make informed decisions about their estate planning. A well-prepared will can provide peace of mind and ensure that your wishes are respected.

Common mistakes

-

Not being clear about intentions: Individuals often fail to clearly express their wishes regarding the distribution of their assets. Ambiguities can lead to disputes among heirs.

-

Improper witness signatures: Many people overlook the requirement for witnesses. In North Carolina, at least two witnesses must sign the will in the presence of the testator.

-

Neglecting to date the document: A will should always be dated. Without a date, it can be challenging to determine which version of the will is the most recent.

-

Failing to revoke previous wills: If individuals create a new will, they must clearly state that it revokes all previous wills to avoid confusion.

-

Not including a residuary clause: This clause is essential for addressing any assets not specifically mentioned in the will. Omitting it can lead to unintended consequences.

-

Forgetting to name an executor: An executor is responsible for carrying out the terms of the will. Failing to name one can complicate the probate process.

-

Using vague language: Terms that are not specific can lead to misinterpretation. Clear and precise language is crucial to ensure that intentions are understood.

-

Not considering tax implications: Individuals often neglect to think about potential estate taxes. Understanding these can help in planning the distribution of assets.

-

Overlooking state-specific requirements: Each state has its own laws regarding wills. Failing to adhere to North Carolina's specific requirements can invalidate the will.

Find Some Other Last Will and Testament Forms for Specific States

Last Will and Testament Template New York Pdf - It serves as a final statement of intent and desire for one's affairs posthumously.

Illinois Will Template - Essential for anyone wishing to have a say in how their affairs are handled after death.

Free Michigan Will Template - Using a Last Will helps ensure your preferred executor is in place to carry out your wishes.

Understanding the importance of safeguarding confidential information is crucial for any business, and using a Non-compete Agreement can be an essential step in this process. By implementing such an agreement, employers in Arizona can ensure that employees do not leverage their insider knowledge to fuel competition after they leave the company. For those looking to establish comprehensive protections, it's advisable to consider the appropriate forms and resources available; for further assistance, you can find All Arizona Forms that may be beneficial for your needs.

Pa Will Template - A Last Will provides clarity and certainty for surviving family members.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Laws | The North Carolina Last Will and Testament is governed by Chapter 31 of the North Carolina General Statutes. |

| Requirements | In North Carolina, the will must be in writing, signed by the testator, and witnessed by at least two individuals. |

| Revocation | A will can be revoked by the testator at any time, typically by creating a new will or physically destroying the existing one. |

| Self-Proving Wills | North Carolina allows for self-proving wills, which can simplify the probate process by including a notarized affidavit from the witnesses. |

Similar forms

The North Carolina Last Will and Testament form shares similarities with the Living Will. A Living Will outlines an individual’s preferences regarding medical treatment in the event they become incapacitated and cannot communicate their wishes. Both documents serve to express personal wishes and ensure that decisions made align with the individual's desires. However, while a Last Will and Testament deals with the distribution of assets after death, a Living Will focuses on healthcare choices during one’s lifetime.

Another document akin to the Last Will and Testament is the Durable Power of Attorney. This form allows an individual to designate someone else to make financial or legal decisions on their behalf if they become unable to do so. Like a Last Will, it is a crucial part of estate planning, ensuring that a trusted person manages affairs according to the individual's wishes. Both documents are essential for effective management of personal matters, but they activate under different circumstances—one upon death and the other during incapacity.

To create a legally sound agreement regarding loans, it's crucial to utilize a well-structured form, such as the form for a detailed Promissory Note outline. You can find more about this essential document here.

The Revocable Trust is also similar to the Last Will and Testament in that it provides a mechanism for distributing assets. A Revocable Trust allows an individual to place their assets into a trust during their lifetime, which can be managed and altered as needed. Upon death, the assets in the trust are distributed according to the terms set forth in the trust document. This differs from a Last Will, which only takes effect after death and may go through probate, while a trust typically avoids this process, offering a more private and efficient transfer of assets.

The Codicil is another related document. A Codicil serves as an amendment to an existing Last Will and Testament. It allows individuals to make changes or additions without creating an entirely new will. This document must be executed with the same formalities as a Last Will to be valid. Both documents work in tandem to ensure that an individual’s final wishes are accurately reflected, adapting to changes in circumstances or preferences over time.

The Affidavit of Heirship is similar in that it helps establish the heirs of a deceased individual, particularly when there is no formal will. This document is often used to clarify who inherits property when a Last Will and Testament is absent or disputed. While the Last Will explicitly states the distribution of assets, the Affidavit serves to affirm the identity of heirs, ensuring that rightful individuals receive their inheritance according to state laws.

Another document that parallels the Last Will and Testament is the Letter of Instruction. This informal document provides guidance to loved ones regarding personal wishes, funeral arrangements, and the location of important documents. While it does not have legal standing like a Last Will, it complements it by offering additional context and information to assist executors and family members in carrying out the deceased’s wishes effectively.

Lastly, the Declaration of Trust can also be compared to a Last Will and Testament. This document outlines the terms and conditions under which a trust is created, detailing how assets are managed and distributed. Similar to a will, it reflects the creator's intentions regarding asset distribution. However, a Declaration of Trust is often used to manage assets during the creator's lifetime and can provide benefits such as avoiding probate, unlike a Last Will, which only comes into effect after death.