Valid North Carolina Lady Bird Deed Template

The North Carolina Lady Bird Deed is a unique estate planning tool that allows property owners to transfer real estate to their beneficiaries while retaining certain rights during their lifetime. This deed is particularly beneficial for individuals who wish to avoid probate and maintain control over their property until death. By utilizing this form, property owners can ensure that their assets are passed directly to their heirs without the lengthy and often costly probate process. Additionally, the Lady Bird Deed provides the flexibility to sell or modify the property without the need for beneficiary consent. This deed not only simplifies the transfer of property but also offers peace of mind, knowing that the intended beneficiaries will receive the property automatically upon the owner's passing. Understanding the key features and implications of the Lady Bird Deed is essential for anyone considering this option in their estate planning strategy.

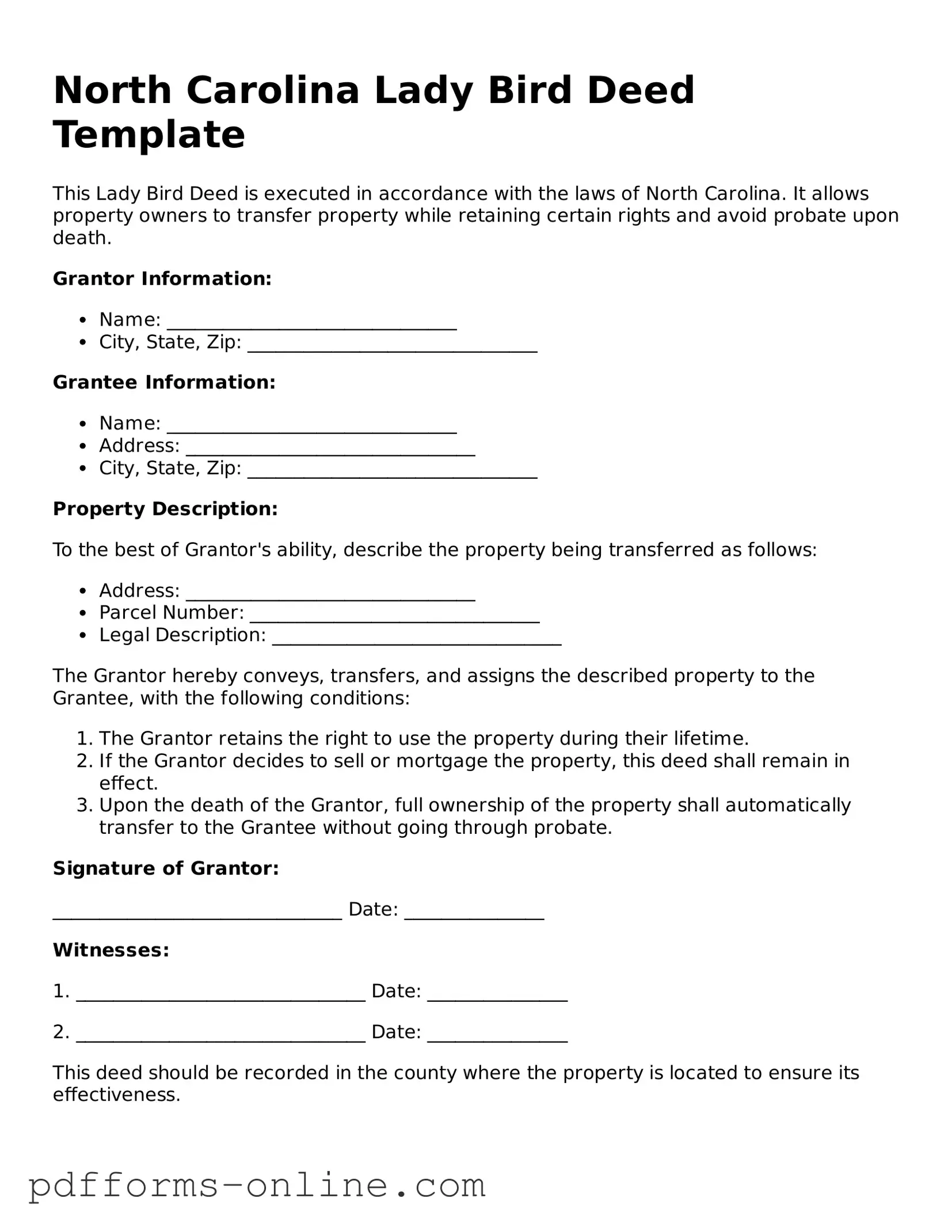

Document Example

North Carolina Lady Bird Deed Template

This Lady Bird Deed is executed in accordance with the laws of North Carolina. It allows property owners to transfer property while retaining certain rights and avoid probate upon death.

Grantor Information:

- Name: _______________________________

- City, State, Zip: _______________________________

Grantee Information:

- Name: _______________________________

- Address: _______________________________

- City, State, Zip: _______________________________

Property Description:

To the best of Grantor's ability, describe the property being transferred as follows:

- Address: _______________________________

- Parcel Number: _______________________________

- Legal Description: _______________________________

The Grantor hereby conveys, transfers, and assigns the described property to the Grantee, with the following conditions:

- The Grantor retains the right to use the property during their lifetime.

- If the Grantor decides to sell or mortgage the property, this deed shall remain in effect.

- Upon the death of the Grantor, full ownership of the property shall automatically transfer to the Grantee without going through probate.

Signature of Grantor:

_______________________________ Date: _______________

Witnesses:

1. _______________________________ Date: _______________

2. _______________________________ Date: _______________

This deed should be recorded in the county where the property is located to ensure its effectiveness.

Frequently Asked Questions

-

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, is a legal document that allows property owners in North Carolina to transfer their property to beneficiaries while retaining certain rights. This type of deed enables the original owner to maintain control over the property during their lifetime, including the right to sell, mortgage, or change the beneficiaries. Upon the owner’s death, the property automatically transfers to the designated beneficiaries without going through probate.

-

What are the benefits of using a Lady Bird Deed in North Carolina?

One of the primary advantages of a Lady Bird Deed is the avoidance of probate, which can be a lengthy and costly process. Additionally, this deed allows the original owner to retain full control over the property during their lifetime, providing peace of mind. It can also help protect the property from certain creditors after the owner’s death, ensuring that the beneficiaries receive the property as intended.

-

Who can be named as beneficiaries in a Lady Bird Deed?

Beneficiaries can be individuals, such as family members or friends, or entities like trusts or charities. It is essential to clearly specify the names of the beneficiaries in the deed to avoid any confusion later. The property owner can also designate multiple beneficiaries, specifying how the property should be divided among them.

-

Are there any tax implications associated with a Lady Bird Deed?

Generally, a Lady Bird Deed does not trigger immediate tax consequences. The property typically retains its original tax basis, which can be beneficial for the beneficiaries when they inherit the property. However, it is crucial to consult with a tax professional to understand how the deed may impact estate taxes or property taxes in specific situations.

-

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time during the property owner’s lifetime. This flexibility allows the owner to change beneficiaries or alter terms as circumstances change. To make changes, the owner must execute a new deed and follow the proper legal procedures for recording it.

-

How do I create a Lady Bird Deed in North Carolina?

Creating a Lady Bird Deed involves drafting the document with specific language that complies with North Carolina laws. It is advisable to work with an attorney or a qualified professional to ensure that the deed is correctly prepared and executed. Once completed, the deed must be signed, notarized, and recorded with the county register of deeds to be legally effective.

Misconceptions

The North Carolina Lady Bird Deed is a valuable estate planning tool, but several misconceptions can lead to confusion. Here are nine common misunderstandings about this form:

- It is only for married couples. The Lady Bird Deed can be used by anyone, regardless of marital status. It allows individuals to transfer property while retaining certain rights.

- It avoids probate automatically. While the Lady Bird Deed can help avoid probate for the property it covers, it is essential to ensure that all assets are properly managed to avoid probate for other assets.

- It eliminates all taxes. The deed does not eliminate property taxes. The property will still be subject to local taxes, and the owner remains responsible for payment.

- It is only for real estate. The Lady Bird Deed specifically applies to real property. It does not cover personal property, such as vehicles or bank accounts.

- It requires a lawyer to create. While it is advisable to consult a lawyer for guidance, individuals can draft a Lady Bird Deed themselves if they understand the requirements and implications.

- It cannot be changed once executed. A Lady Bird Deed can be revoked or amended at any time before the owner's death, allowing for flexibility in estate planning.

- It is only valid in North Carolina. While the Lady Bird Deed is recognized in North Carolina, similar deeds exist in other states. However, the laws and implications may vary.

- It transfers ownership immediately. The deed allows the owner to retain control during their lifetime. Ownership transfers only upon the owner's death.

- It is a one-size-fits-all solution. Each individual's situation is unique. The Lady Bird Deed may not be the best option for everyone, and personalized estate planning is crucial.

Understanding these misconceptions can help individuals make informed decisions about their estate planning options. Always consider seeking professional advice to ensure your needs are met effectively.

Common mistakes

-

Incorrect Property Description: Failing to accurately describe the property can lead to confusion or legal disputes. Ensure that the property address and legal description are precise.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can render the deed invalid. Double-check that everyone involved has signed.

-

Improper Notarization: The deed must be notarized correctly. If the notary's information is incomplete or the signature is missing, the deed may not be enforceable.

-

Failure to Understand Tax Implications: Not considering potential tax consequences can lead to unexpected liabilities. Consult with a tax advisor to understand how the deed affects your tax situation.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding property transfers. Make sure to review North Carolina's specific requirements for Lady Bird Deeds to avoid complications.

Find Some Other Lady Bird Deed Forms for Specific States

Life Estate Deed Sample - This type of deed can work in conjunction with other estate planning tools.

A Georgia Quitclaim Deed form is a legal document used to transfer interest in real estate from one person to another without any guarantees about the title being clear. This form is often employed between family members or to clear up title issues. For those looking for more information on how to properly execute this deed, visiting https://onlinelawdocs.com/ can provide valuable resources and guidance. It is crucial for individuals considering using this deed to understand its implications fully.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by North Carolina General Statutes, specifically under § 41-2.1. |

| Retained Rights | Property owners maintain the right to sell, mortgage, or change the property without the beneficiaries' consent. |

| Automatic Transfer | Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate. |

| Tax Implications | Using a Lady Bird Deed may help avoid gift tax issues, as the transfer occurs at death rather than during the owner's lifetime. |

| Revocability | The deed can be revoked or modified by the property owner at any time before their death. |

| Eligibility | Only individuals, not entities, can be named as beneficiaries in a Lady Bird Deed in North Carolina. |

| Real Estate Only | The Lady Bird Deed applies only to real property, such as land and buildings, and does not cover personal property. |

Similar forms

The North Carolina Lady Bird Deed is similar to a traditional life estate deed. Both documents allow a property owner to retain certain rights while transferring the property to another party. With a life estate deed, the original owner can live on the property for their lifetime, after which the property automatically passes to the designated beneficiary. However, a Lady Bird Deed offers additional flexibility, allowing the owner to sell or mortgage the property without needing the consent of the beneficiary, which can be beneficial for estate planning purposes.

Another document that shares similarities with the Lady Bird Deed is the revocable living trust. Like the Lady Bird Deed, a revocable living trust allows individuals to maintain control over their assets during their lifetime while facilitating a smoother transfer of those assets upon death. The trust can be altered or revoked at any time, providing flexibility. However, unlike the Lady Bird Deed, assets placed in a living trust are not subject to probate, which can simplify the estate settlement process.

A transfer-on-death (TOD) deed also resembles the Lady Bird Deed. Both documents allow for the direct transfer of property to beneficiaries upon the owner's death, bypassing probate. The key difference lies in the fact that a TOD deed does not provide the same level of control during the owner's lifetime. With a Lady Bird Deed, the owner can retain the right to sell or change the property, while a TOD deed only becomes effective upon death.

The warranty deed is another document that has similarities with the Lady Bird Deed. A warranty deed is used to transfer ownership of property and guarantees that the seller has clear title to the property. While both deeds facilitate property transfer, a warranty deed does not offer the same lifetime rights or flexibility that a Lady Bird Deed provides. The warranty deed focuses on the assurance of ownership rather than the ongoing rights of the original owner.

Understanding various property transfer options is essential for effective estate planning, and one valuable resource to consider is the documentonline.org/blank-new-york-operating-agreement/ which provides insights into operational agreements that outline ownership and management structure.

Finally, the quitclaim deed shares some characteristics with the Lady Bird Deed. Both are used to transfer property interests, but they differ significantly in terms of the guarantees offered. A quitclaim deed transfers whatever interest the grantor has in the property, without any warranties or guarantees about the title. In contrast, the Lady Bird Deed allows the original owner to retain rights while ensuring a smoother transfer to the beneficiary upon death, making it a more secure option for estate planning.