Valid North Carolina Durable Power of Attorney Template

In North Carolina, a Durable Power of Attorney (DPOA) is a crucial legal document that allows individuals to designate someone they trust to make financial and legal decisions on their behalf, even if they become incapacitated. This form empowers the appointed agent to handle a variety of tasks, such as managing bank accounts, signing checks, and making investment decisions. Importantly, the DPOA remains effective during periods of mental or physical incapacity, ensuring that your affairs are managed according to your wishes. The form must be completed with specific requirements, including the signature of the principal and the agent, as well as the presence of a notary public. Understanding the nuances of the Durable Power of Attorney is essential for anyone looking to safeguard their financial interests and ensure that their chosen representative can act decisively when needed. By taking this step, individuals can secure peace of mind, knowing that their affairs will be handled by someone they trust, even in challenging times.

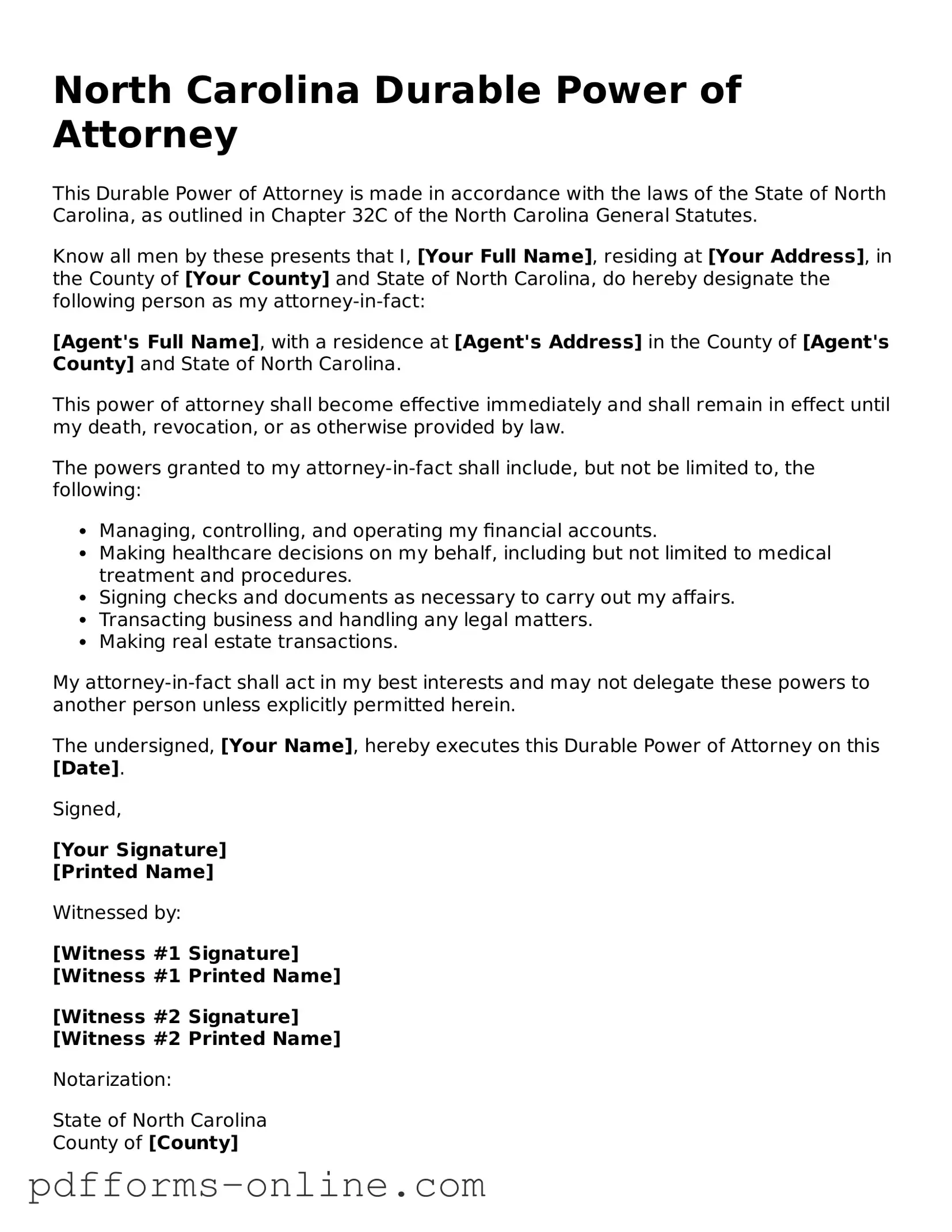

Document Example

North Carolina Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the laws of the State of North Carolina, as outlined in Chapter 32C of the North Carolina General Statutes.

Know all men by these presents that I, [Your Full Name], residing at [Your Address], in the County of [Your County] and State of North Carolina, do hereby designate the following person as my attorney-in-fact:

[Agent's Full Name], with a residence at [Agent's Address] in the County of [Agent's County] and State of North Carolina.

This power of attorney shall become effective immediately and shall remain in effect until my death, revocation, or as otherwise provided by law.

The powers granted to my attorney-in-fact shall include, but not be limited to, the following:

- Managing, controlling, and operating my financial accounts.

- Making healthcare decisions on my behalf, including but not limited to medical treatment and procedures.

- Signing checks and documents as necessary to carry out my affairs.

- Transacting business and handling any legal matters.

- Making real estate transactions.

My attorney-in-fact shall act in my best interests and may not delegate these powers to another person unless explicitly permitted herein.

The undersigned, [Your Name], hereby executes this Durable Power of Attorney on this [Date].

Signed,

[Your Signature]

[Printed Name]

Witnessed by:

[Witness #1 Signature]

[Witness #1 Printed Name]

[Witness #2 Signature]

[Witness #2 Printed Name]

Notarization:

State of North Carolina

County of [County]

Subscribed, sworn to and acknowledged before me this [Date].

[Notary's Signature]

[Notary's Printed Name]

Notary Public, [State]

Frequently Asked Questions

-

What is a Durable Power of Attorney in North Carolina?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf if you become incapacitated. Unlike a regular power of attorney, a DPOA remains effective even if you are unable to make decisions for yourself.

-

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose anyone to be your agent, as long as they are at least 18 years old and mentally competent. This could be a family member, a friend, or a trusted advisor. It’s important to select someone you trust to act in your best interests.

-

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including the ability to manage your finances, make healthcare decisions, and handle real estate transactions. You can specify which powers you want to grant or limit certain actions to ensure your preferences are respected.

-

How do I create a Durable Power of Attorney in North Carolina?

To create a DPOA, you need to fill out a specific form that complies with North Carolina law. The form must be signed by you and witnessed by at least one person, or notarized. It’s advisable to consult with a legal professional to ensure that your document meets all requirements.

-

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your DPOA at any time, as long as you are mentally competent. To revoke it, you should create a written notice stating your intention to revoke the DPOA and provide copies to your agent and any institutions that may have a copy of the original document.

-

What happens if I don’t have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may need to appoint a guardian to make decisions on your behalf. This process can be lengthy, costly, and may not reflect your personal wishes, making it beneficial to have a DPOA in place.

Misconceptions

Understanding the North Carolina Durable Power of Attorney form is crucial for effective estate planning. However, several misconceptions often arise regarding its use and implications. Here are nine common misconceptions:

- It is only for the elderly. Many believe that a Durable Power of Attorney is only necessary for older individuals. In reality, anyone can benefit from this document, regardless of age, as unexpected situations can arise at any time.

- It becomes invalid if the principal becomes incapacitated. This is a fundamental misunderstanding. A Durable Power of Attorney remains effective even if the principal becomes incapacitated, allowing the agent to make decisions on their behalf.

- It can only be used for financial matters. While many use this form for financial decisions, it can also cover health care and other personal matters. The scope of authority can be tailored to fit the principal's needs.

- It must be notarized to be valid. Although notarization is recommended for added validity, it is not a strict requirement in North Carolina. However, having a notary can help avoid disputes in the future.

- Once signed, it cannot be revoked. This is incorrect. The principal has the right to revoke a Durable Power of Attorney at any time, as long as they are mentally competent to do so.

- Agents must act in the principal's best interest at all times. While agents are expected to act in good faith, there are circumstances where their decisions may not align perfectly with the principal's preferences. Clear communication can help mitigate this issue.

- It is a one-size-fits-all document. Each Durable Power of Attorney can be customized to meet the specific needs of the principal. It is important to consider the unique circumstances and preferences when drafting this document.

- It automatically expires after a certain period. A Durable Power of Attorney does not have an expiration date unless specified within the document itself. It remains effective until revoked or the principal passes away.

- All agents have the same authority. The authority granted to an agent can vary significantly based on the principal's wishes. It is essential to clearly outline the powers granted to avoid any confusion.

By addressing these misconceptions, individuals can make informed decisions regarding the use of a Durable Power of Attorney in North Carolina.

Common mistakes

-

Not Specifying Powers Clearly: Individuals often fail to clearly outline the specific powers they wish to grant. This can lead to confusion and disputes later on. It’s essential to be precise about what decisions the agent can make on behalf of the principal.

-

Choosing the Wrong Agent: Selecting an agent who lacks the necessary skills or trustworthiness can create problems. It’s crucial to choose someone who understands your wishes and can act in your best interest.

-

Neglecting to Sign and Date: Some people forget to sign and date the document. Without a signature, the form is not valid. Ensure that all required signatures are present and dated appropriately.

-

Failing to Have Witnesses or Notarization: In North Carolina, the Durable Power of Attorney must be signed in the presence of a notary public or witnesses. Skipping this step can invalidate the document. Always verify the requirements to ensure compliance.

Find Some Other Durable Power of Attorney Forms for Specific States

General Power of Attorney Form Pennsylvania - It can cover a wide range of activities, from paying bills to managing investments.

When engaging in the sale of a trailer, it is important to utilize a proper legal document, such as a Trailer Bill of Sale form, to ensure clarity and protection for both parties involved. This form not only details the transaction but also acts as a binding agreement. For additional guidance and resources on this topic, you can visit OnlineLawDocs.com.

Power of Attorney Michigan - The agent's actions should be documented for accountability and transparency.

Statutory Durable Power of Attorney Texas - This document remains effective even if you become incapacitated.

How to Get a Power of Attorney in Florida - Direct your chosen representative to act as per your preferences during incapacity.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in North Carolina allows an individual to designate someone to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The North Carolina Durable Power of Attorney is governed by Chapter 32A of the North Carolina General Statutes. |

| Durability | This form remains effective even if the principal becomes unable to manage their affairs due to mental or physical incapacity. |

| Agent Authority | The agent appointed can be granted broad or limited powers, depending on the principal’s preferences outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

Similar forms

The North Carolina Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents grant authority to an agent to act on behalf of the principal in financial and legal matters. However, the key distinction lies in the durability of the powers granted. A General Power of Attorney typically becomes invalid if the principal becomes incapacitated, whereas a Durable Power of Attorney remains effective even if the principal is unable to make decisions due to health reasons. This makes the Durable Power of Attorney a more robust option for long-term planning.

Another document that resembles the North Carolina Durable Power of Attorney is the Medical Power of Attorney. While the Durable Power of Attorney focuses on financial and legal decisions, the Medical Power of Attorney specifically allows an agent to make healthcare decisions on behalf of the principal. Both documents empower an individual to act in the best interest of the principal, but they cater to different aspects of decision-making—one for financial matters and the other for health-related issues.

The Living Will is another document that parallels the Durable Power of Attorney. A Living Will outlines an individual’s preferences regarding medical treatment in scenarios where they are unable to communicate their wishes. Although it does not appoint an agent, it works in conjunction with a Medical Power of Attorney to ensure that healthcare decisions align with the principal’s desires. Both documents emphasize the importance of personal choice in medical care, but the Living Will focuses solely on treatment preferences rather than appointing an agent.

The Revocable Trust also shares characteristics with the Durable Power of Attorney. Both instruments allow for the management of assets during the principal's lifetime and can help facilitate the transfer of assets upon death. A Revocable Trust can provide a framework for managing assets without the need for probate, while the Durable Power of Attorney allows an agent to manage financial matters on behalf of the principal. Both documents aim to simplify financial management but do so through different mechanisms.

Similar to the Durable Power of Attorney is the Advance Directive. This document combines elements of a Living Will and a Medical Power of Attorney, allowing individuals to specify their healthcare preferences and appoint an agent for medical decisions. While the Durable Power of Attorney is focused on financial and legal matters, the Advance Directive serves to ensure that healthcare decisions reflect the principal's values and wishes. Both documents emphasize the importance of preemptive planning for future incapacity.

In the context of lease agreements, it's important for both landlords and tenants to thoroughly understand the terms outlined in the contract. A well-drafted agreement can help prevent disputes and ensure a harmonious rental experience. For specific requirements regarding lease agreements in Ohio, you can refer to the comprehensive guidelines provided at https://documentonline.org/blank-ohio-lease-agreement.

Finally, the Guardianship Agreement can be compared to the North Carolina Durable Power of Attorney. While a Durable Power of Attorney allows individuals to designate an agent to manage their affairs, a Guardianship Agreement is typically established through a court process to appoint a guardian for someone who is unable to care for themselves. Both documents address the management of a person’s affairs, but the Guardianship Agreement often involves more oversight and is enacted when the individual is deemed incapacitated without prior planning, unlike the Durable Power of Attorney.