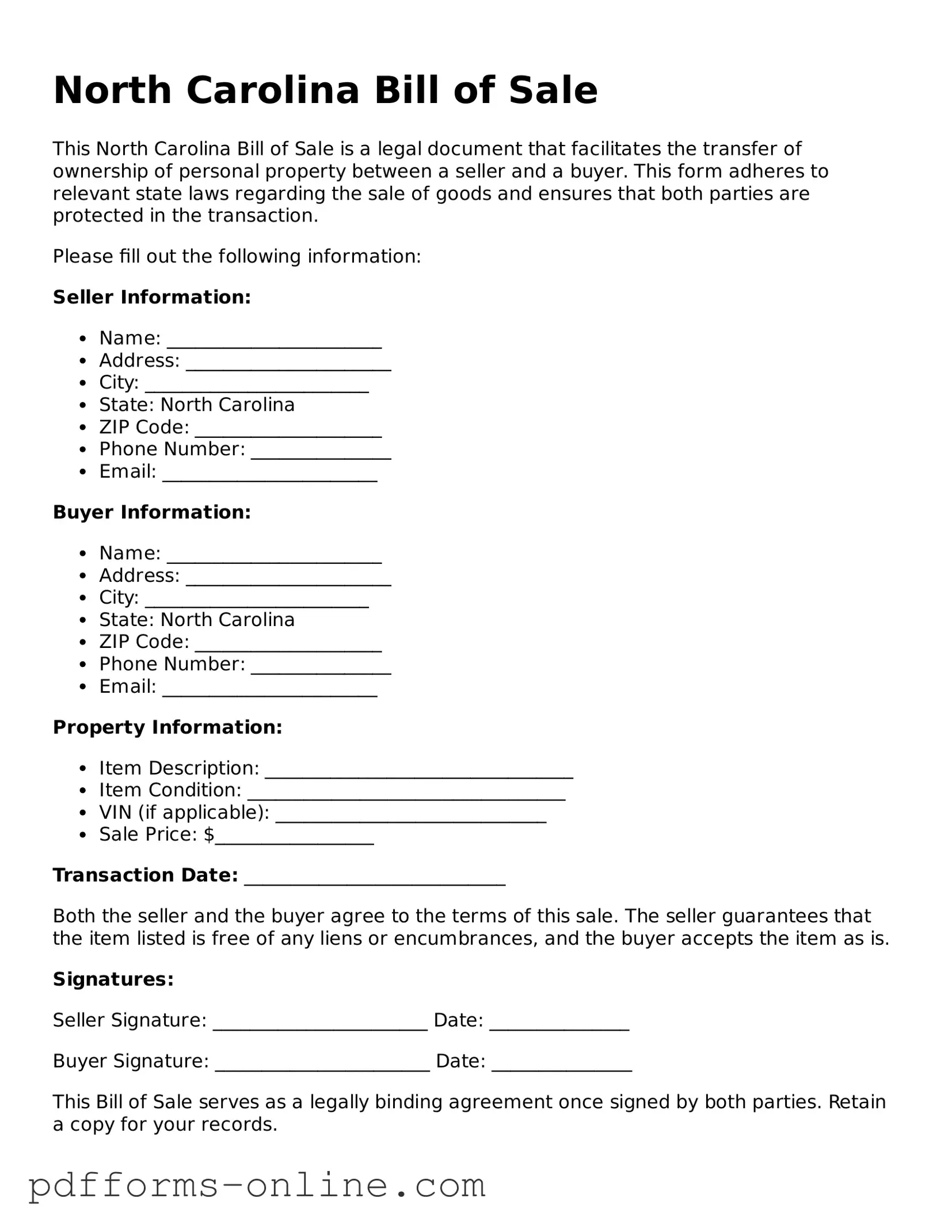

North Carolina Bill of Sale

This North Carolina Bill of Sale is a legal document that facilitates the transfer of ownership of personal property between a seller and a buyer. This form adheres to relevant state laws regarding the sale of goods and ensures that both parties are protected in the transaction.

Please fill out the following information:

Seller Information:

- Name: _______________________

- Address: ______________________

- City: ________________________

- State: North Carolina

- ZIP Code: ____________________

- Phone Number: _______________

- Email: _______________________

Buyer Information:

- Name: _______________________

- Address: ______________________

- City: ________________________

- State: North Carolina

- ZIP Code: ____________________

- Phone Number: _______________

- Email: _______________________

Property Information:

- Item Description: _________________________________

- Item Condition: __________________________________

- VIN (if applicable): _____________________________

- Sale Price: $_________________

Transaction Date: ____________________________

Both the seller and the buyer agree to the terms of this sale. The seller guarantees that the item listed is free of any liens or encumbrances, and the buyer accepts the item as is.

Signatures:

Seller Signature: _______________________ Date: _______________

Buyer Signature: _______________________ Date: _______________

This Bill of Sale serves as a legally binding agreement once signed by both parties. Retain a copy for your records.