Valid North Carolina Articles of Incorporation Template

When starting a business in North Carolina, one of the first and most critical steps is to complete the Articles of Incorporation form. This document serves as the foundation for establishing a corporation in the state, outlining essential information that defines the business structure. Key aspects of the form include the corporation's name, which must be unique and comply with state regulations, as well as the purpose of the corporation, which describes the nature of the business activities. Additionally, the form requires details about the registered agent, who will serve as the official point of contact for legal documents. Information regarding the number of shares the corporation is authorized to issue is also necessary, along with the names and addresses of the initial directors. Completing this form accurately is vital, as it not only ensures compliance with state laws but also lays the groundwork for future operations and governance. Understanding these components can help streamline the incorporation process and pave the way for a successful business venture.

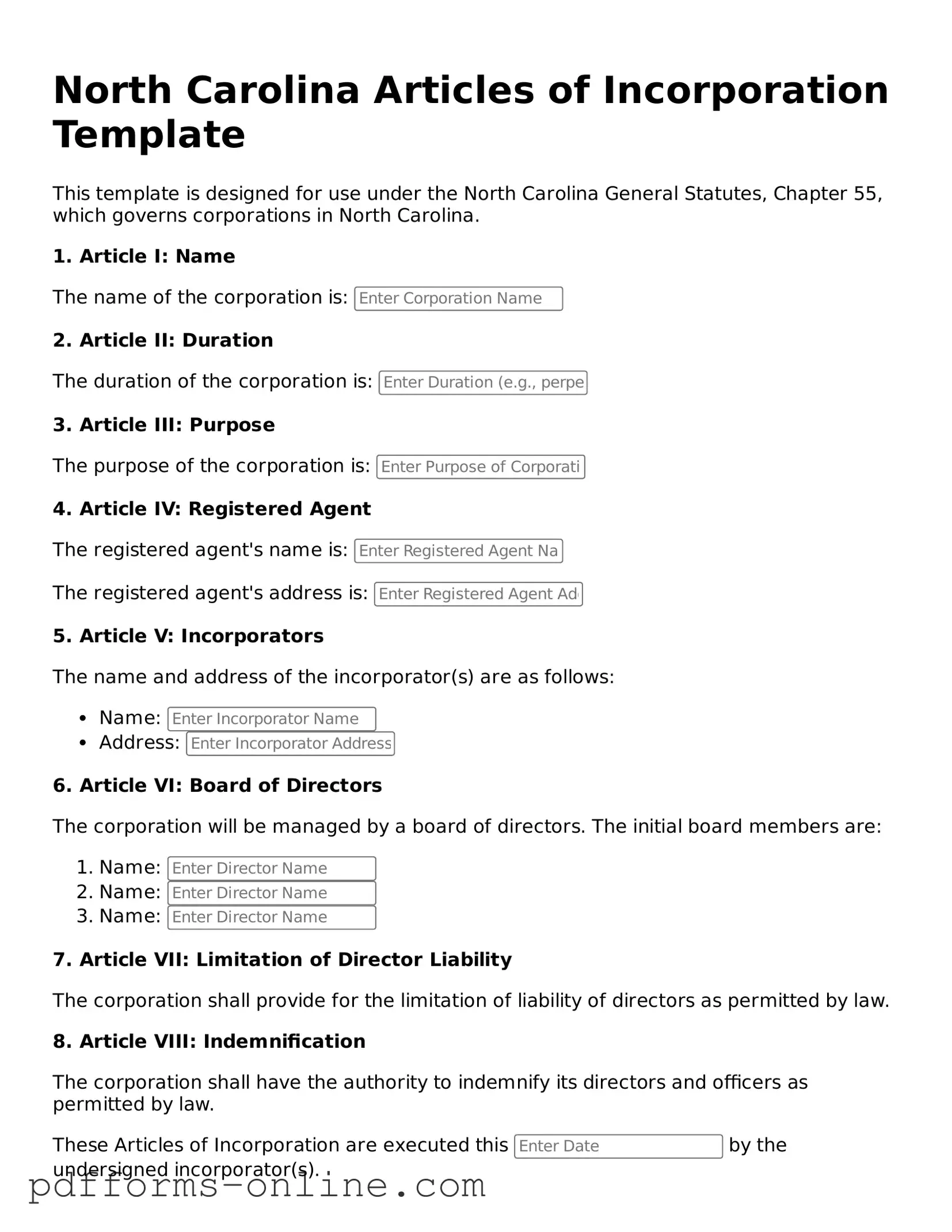

Document Example

North Carolina Articles of Incorporation Template

This template is designed for use under the North Carolina General Statutes, Chapter 55, which governs corporations in North Carolina.

1. Article I: Name

The name of the corporation is:

2. Article II: Duration

The duration of the corporation is:

3. Article III: Purpose

The purpose of the corporation is:

4. Article IV: Registered Agent

The registered agent's name is:

The registered agent's address is:

5. Article V: Incorporators

The name and address of the incorporator(s) are as follows:

- Name:

- Address:

6. Article VI: Board of Directors

The corporation will be managed by a board of directors. The initial board members are:

- Name:

- Name:

- Name:

7. Article VII: Limitation of Director Liability

The corporation shall provide for the limitation of liability of directors as permitted by law.

8. Article VIII: Indemnification

The corporation shall have the authority to indemnify its directors and officers as permitted by law.

These Articles of Incorporation are executed this by the undersigned incorporator(s).

Name of Incorporator:

Signature: _____________________

Frequently Asked Questions

-

What is the purpose of the Articles of Incorporation in North Carolina?

The Articles of Incorporation serve as the foundational document for a corporation in North Carolina. This document officially establishes the corporation as a legal entity in the state. It outlines essential details, such as the corporation's name, the purpose of the business, the registered agent, and the number of shares authorized for issuance. Filing this document is a critical step in the process of forming a corporation, as it provides legal recognition and protects the owners from personal liability for the corporation's debts and obligations.

-

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in North Carolina must file the Articles of Incorporation. This includes businesses of various sizes and types, such as for-profit corporations, non-profit organizations, and professional corporations. It is important to ensure that the corporation's name is unique and complies with state regulations before filing. Additionally, if the corporation will operate in multiple states, it may need to consider the requirements of those states as well.

-

What information is required on the Articles of Incorporation form?

The Articles of Incorporation form requires several key pieces of information. This includes:

- The name of the corporation, which must include a designator such as "Corporation," "Incorporated," or an abbreviation like "Inc."

- The purpose of the corporation, which can be a general statement or a specific business activity.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue, along with any classes of shares if applicable.

- The names and addresses of the initial directors, if applicable.

Providing accurate and complete information is essential to avoid delays or issues with the filing process.

-

How is the Articles of Incorporation filed, and what are the fees?

The Articles of Incorporation can be filed online or by mail with the North Carolina Secretary of State. If filing online, the process is typically faster and may involve lower fees. When submitting by mail, the form must be completed and sent to the appropriate office along with the required filing fee. As of October 2023, the standard fee for filing the Articles of Incorporation is $125, but this may vary based on the type of corporation being formed. It is advisable to check the North Carolina Secretary of State's website for the most current fee schedule and filing instructions.

Misconceptions

When it comes to incorporating a business in North Carolina, many people harbor misconceptions about the Articles of Incorporation form. Understanding these misconceptions can save time and effort, ensuring a smoother incorporation process. Here are six common misunderstandings:

- Misconception 1: You need to have a physical office in North Carolina.

- Misconception 2: The Articles of Incorporation are the only document needed.

- Misconception 3: You can’t change the Articles of Incorporation once filed.

- Misconception 4: Incorporation guarantees personal liability protection.

- Misconception 5: The process is too complicated and time-consuming.

- Misconception 6: All businesses must incorporate.

Many believe that having a physical office in the state is a requirement for incorporation. In reality, you can incorporate in North Carolina even if your business operates elsewhere, as long as you have a registered agent with a physical address in the state.

Some think that filing the Articles of Incorporation is all that's necessary to legally operate a business. However, additional filings and permits may be required depending on your business type and location.

It’s a common belief that the Articles of Incorporation are set in stone. In truth, amendments can be made to the Articles after filing, allowing businesses to adapt as they grow.

While incorporation generally provides personal liability protection, this is not absolute. Personal guarantees or improper business practices can still expose owners to liability.

Many people shy away from incorporation, thinking the process is overly complex. In fact, with the right resources and guidance, filing the Articles of Incorporation can be straightforward and efficient.

Some assume that every business must go through the incorporation process. However, many small businesses operate as sole proprietorships or partnerships without the need for formal incorporation.

By dispelling these misconceptions, aspiring business owners can make informed decisions about their incorporation journey in North Carolina. Knowledge is power, and understanding the nuances of the Articles of Incorporation can pave the way for successful business ventures.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required information. Essential details such as the corporation's name, principal office address, and registered agent are often omitted. This can lead to delays in processing the application.

-

Incorrect Name Format: The name of the corporation must adhere to specific guidelines. Some people mistakenly use names that are too similar to existing entities or do not include the required designator, such as "Corporation," "Incorporated," or abbreviations like "Inc." This can result in rejection of the application.

-

Failure to Identify the Registered Agent: The registered agent must be a person or business entity authorized to conduct business in North Carolina. Some applicants neglect to provide accurate information about the registered agent, including their address, which is crucial for legal notifications.

-

Not Specifying the Purpose of the Corporation: While some applicants may leave the purpose section blank or write vague descriptions, it is important to clearly state the corporation's purpose. This helps ensure compliance with state regulations and provides clarity about the business's activities.

-

Ignoring Filing Fees: Each submission requires payment of a filing fee. Some individuals overlook this requirement, leading to processing delays. It is essential to check the current fee schedule and include the appropriate payment with the application.

Find Some Other Articles of Incorporation Forms for Specific States

Form a Florida Corporation - Details regarding the initial stock issuance can be outlined in the Articles.

Nys Department of State Division of Corporations - This document provides a framework for corporation management.

For those considering marriage, a well-crafted Prenuptial Agreement can be crucial in protecting individual interests. This important document serves as a financial roadmap, allowing couples to establish their rights and responsibilities. To learn more, check out this useful resource on how to create the best Prenuptial Agreement form for your needs: effective Prenuptial Agreement options.

Lara Michigan Llc Application - This document is filed with the state to initiate the incorporation process.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The North Carolina Articles of Incorporation are governed by the North Carolina General Statutes, specifically Chapter 55. |

| Purpose | This form is used to legally create a corporation in North Carolina. |

| Filing Requirement | The Articles of Incorporation must be filed with the North Carolina Secretary of State. |

| Information Required | Key information includes the corporation's name, address, registered agent, and purpose. |

| Fees | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Approval Process | Once submitted, the Secretary of State reviews the form. Approval leads to the official formation of the corporation. |

Similar forms

The North Carolina Articles of Incorporation form shares similarities with the Certificate of Incorporation, which is used in many other states. Both documents serve as the foundational legal paperwork required to establish a corporation. They typically include essential details such as the corporation's name, purpose, registered agent, and the number of shares authorized. The Certificate of Incorporation, like the Articles, must be filed with the appropriate state authority, ensuring that the corporation is recognized legally and can operate within the state’s jurisdiction.

Another document that parallels the North Carolina Articles of Incorporation is the Bylaws. While the Articles of Incorporation lay the groundwork for the corporation's existence, the Bylaws outline the internal rules and procedures for governance. They detail how meetings are conducted, how officers are elected, and how decisions are made. Both documents are crucial for the operation of a corporation, but the Bylaws focus more on the day-to-day management and organizational structure.

The Operating Agreement is another document that shares similarities with the Articles of Incorporation, particularly for limited liability companies (LLCs). Like the Articles, the Operating Agreement establishes the entity's framework and operational guidelines. It typically includes information about ownership, management responsibilities, and profit distribution. While the Articles are specific to corporations, the Operating Agreement serves a similar purpose for LLCs, ensuring clarity and structure in business operations.

In understanding the various documentation necessary for establishing a business entity, it's essential to recognize that each form serves a specific purpose and adheres to legal requirements, similar to how the USCIS I-134 form, as outlined by OnlineLawDocs.com, functions as a financial guarantee for sponsors in the immigration process.

Additionally, the Statement of Information, often required in various states, is akin to the North Carolina Articles of Incorporation. This document provides updated information about a corporation, such as the address of its principal office and the names of its officers. While the Articles of Incorporation are filed at the time of formation, the Statement of Information is usually submitted periodically, keeping the state informed about the corporation's current status and leadership.

Lastly, the Partnership Agreement can also be compared to the Articles of Incorporation. While the Articles establish a corporation, the Partnership Agreement outlines the terms and conditions under which a partnership operates. It includes details on profit sharing, responsibilities of each partner, and procedures for resolving disputes. Both documents are essential for defining the structure and operational guidelines of their respective business entities, ensuring that all parties understand their roles and obligations.