Valid New York Transfer-on-Death Deed Template

In New York, property owners have a unique opportunity to manage the transfer of their real estate after passing away through the Transfer-on-Death Deed form. This legal instrument allows individuals to designate beneficiaries who will automatically inherit their property upon their death, bypassing the often lengthy and costly probate process. By completing this form, property owners can retain full control over their assets during their lifetime, ensuring that their wishes are honored without the complications that typically accompany estate planning. The form requires specific information, including the names of the beneficiaries and a clear description of the property involved. It must also be properly executed and recorded with the county clerk to be valid. Understanding the nuances of this deed is crucial for anyone looking to streamline their estate planning, as it can provide peace of mind and simplify the transfer of property to loved ones. With the right guidance, property owners can effectively utilize this tool to secure their legacy and support their family’s future.

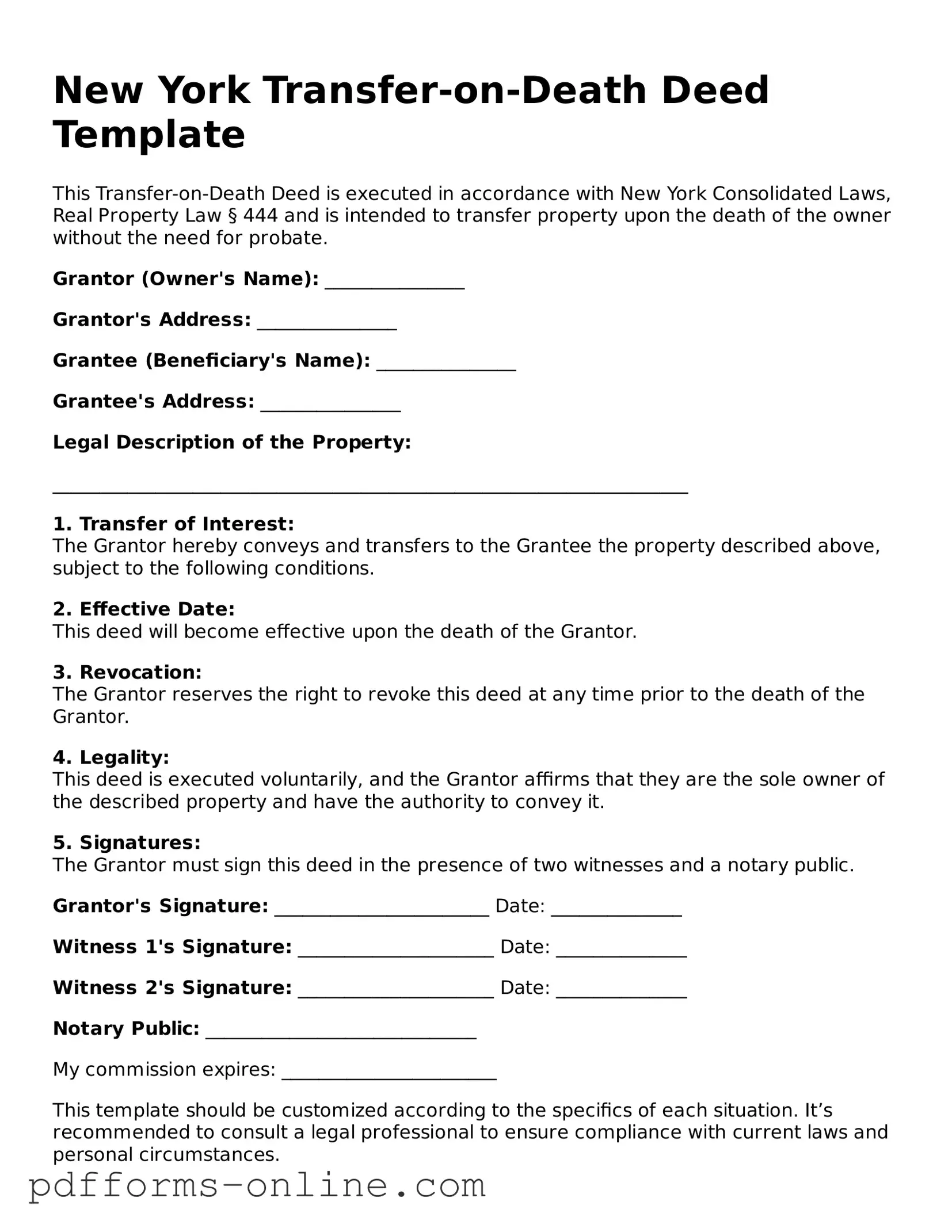

Document Example

New York Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with New York Consolidated Laws, Real Property Law § 444 and is intended to transfer property upon the death of the owner without the need for probate.

Grantor (Owner's Name): _______________

Grantor's Address: _______________

Grantee (Beneficiary's Name): _______________

Grantee's Address: _______________

Legal Description of the Property:

____________________________________________________________________

1. Transfer of Interest:

The Grantor hereby conveys and transfers to the Grantee the property described above, subject to the following conditions.

2. Effective Date:

This deed will become effective upon the death of the Grantor.

3. Revocation:

The Grantor reserves the right to revoke this deed at any time prior to the death of the Grantor.

4. Legality:

This deed is executed voluntarily, and the Grantor affirms that they are the sole owner of the described property and have the authority to convey it.

5. Signatures:

The Grantor must sign this deed in the presence of two witnesses and a notary public.

Grantor's Signature: _______________________ Date: ______________

Witness 1's Signature: _____________________ Date: ______________

Witness 2's Signature: _____________________ Date: ______________

Notary Public: _____________________________

My commission expires: _______________________

This template should be customized according to the specifics of each situation. It’s recommended to consult a legal professional to ensure compliance with current laws and personal circumstances.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real estate to a beneficiary upon their death, without the property going through probate. This means that the beneficiary can take ownership of the property directly, simplifying the process and potentially reducing costs associated with inheritance.

-

Who can use a Transfer-on-Death Deed in New York?

In New York, any individual who owns real property can utilize a Transfer-on-Death Deed. This includes homeowners and property owners who wish to designate a beneficiary for their property after their passing. However, it is important to ensure that the deed is executed properly to be valid.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, it must be signed in the presence of a notary public. Once notarized, the deed should be recorded with the county clerk’s office in the county where the property is located to ensure it is legally binding.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you would need to execute a new deed or a revocation form and ensure that it is properly recorded with the county clerk. It is advisable to keep a copy of the new or revoked deed for your records.

-

What happens if I do not have a Transfer-on-Death Deed?

If you do not have a Transfer-on-Death Deed, your property will typically go through the probate process after your death. This can be time-consuming and may involve legal fees, court costs, and potential disputes among heirs. Having a TODD can help avoid these complications.

-

Are there any restrictions on who I can name as a beneficiary?

While you have the freedom to name anyone as a beneficiary, it is essential to consider the implications of your choice. Beneficiaries can be individuals, such as family members or friends, or entities, like a trust or organization. However, naming minors or individuals who may not be able to manage the property can lead to complications.

-

Will a Transfer-on-Death Deed affect my taxes?

Generally, a Transfer-on-Death Deed does not affect your property taxes while you are alive. However, when the property transfers to the beneficiary, they may be subject to property taxes based on the assessed value at that time. It is advisable to consult a tax professional for specific guidance regarding potential tax implications.

-

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be an excellent choice for many individuals, especially those looking to simplify the transfer of property after death. However, it may not be suitable for everyone. Factors such as the complexity of your estate, family dynamics, and specific financial situations should be considered. Consulting with a legal professional can help determine if this option aligns with your needs.

-

Where can I obtain a Transfer-on-Death Deed form in New York?

You can obtain a Transfer-on-Death Deed form from various sources, including online legal document services, local county clerk offices, or legal aid organizations. Ensure that the form you use complies with New York state laws and is appropriate for your specific situation.

Misconceptions

Understanding the New York Transfer-on-Death Deed form can be challenging. Here are five common misconceptions about this legal document:

- It only applies to real estate. Many believe the Transfer-on-Death Deed can only transfer real property. However, it is specifically designed for real estate and does not cover personal property or other assets.

- It automatically avoids probate. Some people think that using this deed means the property will never go through probate. While it does allow for a smoother transfer upon death, certain circumstances may still require probate proceedings.

- It cannot be revoked. A misconception exists that once a Transfer-on-Death Deed is filed, it cannot be changed. In reality, the grantor can revoke or change the deed at any time before their death, as long as the correct procedures are followed.

- It is only for wealthy individuals. Many assume that only those with significant assets should consider a Transfer-on-Death Deed. In truth, it can be beneficial for anyone who wishes to simplify the transfer of their property to loved ones.

- It is a one-size-fits-all solution. Some believe that the Transfer-on-Death Deed is universally applicable. However, each individual's situation is unique, and it is essential to consider personal circumstances and consult with a professional when making estate planning decisions.

Addressing these misconceptions can help individuals make informed decisions about their estate planning options.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. This includes not only the names of the property owners but also the names of the beneficiaries. Double-checking that every field is filled out correctly can prevent delays or issues down the line.

-

Incorrect Property Description: The property description must be precise. Using vague terms or failing to include the correct address can lead to confusion or disputes. Ensure that the legal description of the property is accurate and matches public records.

-

Not Signing the Document: A Transfer-on-Death Deed must be signed by the property owner. Neglecting to sign can render the deed invalid. Additionally, it's important to have the signature notarized, as this adds an extra layer of authenticity.

-

Failure to Record the Deed: After completing the form, it must be recorded with the appropriate county office. Many individuals forget this crucial step, which means the deed will not take effect. Recording the deed ensures that it is part of the public record and legally binding.

-

Not Understanding the Implications: Some people fill out the form without fully understanding what a Transfer-on-Death Deed entails. It’s essential to comprehend how this deed affects property ownership and the rights of the beneficiaries. Consulting with a professional can clarify any uncertainties.

Find Some Other Transfer-on-Death Deed Forms for Specific States

How to Avoid Probate in Pa - This deed can enhance the overall efficacy of your estate plan.

Transfer on Death Instrument - It is important to ensure that beneficiaries are clearly named in the deed to prevent disputes later.

Utilizing a comprehensive Loan Agreement form ensures that both borrowers and lenders have a clear understanding of the financial arrangement. This form should be carefully filled out to outline all pertinent details, providing security and clarity in any lending situation. For more information, consider visiting the complete guide to Loan Agreement documentation.

Transfer on Death Deed Form Florida - This document simplifies the transfer of real estate, bypassing the lengthy probate process.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon the owner's death without the need for probate. |

| Governing Law | This deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 13-16. |

| Eligibility | Only individuals who own real property in New York can create a Transfer-on-Death Deed. |

| Beneficiaries | Multiple beneficiaries can be named, and they can receive equal or specified shares of the property. |

| Revocation | The deed can be revoked at any time by the owner, provided a formal revocation document is executed and recorded. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded with the county clerk in the county where the property is located. |

| No Immediate Effect | The deed does not transfer ownership during the owner's lifetime; it only takes effect upon death. |

| Tax Implications | Since ownership does not transfer until death, the property may still be subject to estate taxes. |

| Form Requirements | The deed must be signed by the owner and notarized to be valid. |

| Limitations | This type of deed cannot be used for all types of property, such as property held in a trust or certain types of jointly owned property. |

Similar forms

The New York Transfer-on-Death Deed (TOD) form is similar to a Last Will and Testament in that both documents allow individuals to dictate the distribution of their assets after death. A Last Will outlines how a person's property should be distributed, appoints guardians for minor children, and names an executor to manage the estate. However, unlike a will, a TOD deed transfers property directly to the designated beneficiary upon the owner's death, bypassing the probate process entirely. This can lead to quicker access to assets for beneficiaries and reduced legal costs.

To ensure that sensitive information is protected during asset transfer processes, parties may consider utilizing a Non-disclosure Agreement (NDA), which can be essential in maintaining confidentiality. Whether discussing the New York Transfer-on-Death Deed or other legal instruments, such as a Living Trust, the importance of safeguarding proprietary information cannot be underestimated. For comprehensive resources regarding NDAs, visit OnlineLawDocs.com to explore more about the legal frameworks that govern these agreements.

Another document comparable to the TOD deed is a Revocable Living Trust. Both instruments serve to manage and distribute assets while providing a level of control over how and when those assets are transferred. A Revocable Living Trust allows the creator to maintain control over the assets during their lifetime, with the ability to change the terms as needed. Upon death, the trust assets are distributed according to the terms set forth in the trust document, avoiding probate. This provides privacy and can streamline the transfer process, much like the TOD deed.

The TOD deed also shares similarities with a Joint Tenancy with Right of Survivorship. In both cases, property ownership can transfer directly to a surviving co-owner upon the death of one owner. This arrangement allows for a seamless transition of property without the need for probate. However, joint tenancy requires both parties to hold title during their lifetimes, while a TOD deed allows the original owner to maintain full control until death.

A Durable Power of Attorney is another document that parallels the TOD deed in terms of asset management. While a TOD deed focuses on the transfer of property after death, a Durable Power of Attorney allows an individual to appoint someone to manage their financial affairs while they are still alive but incapacitated. Both documents empower individuals to control their assets, but they operate in different contexts—one for the living and one for the deceased.

Similar to the TOD deed, a Beneficiary Designation form is used for certain types of accounts, such as retirement accounts and life insurance policies. This document allows individuals to name beneficiaries who will receive assets directly upon death, bypassing probate. Like the TOD deed, a Beneficiary Designation ensures that assets are transferred quickly and efficiently, providing financial security for loved ones without the complexities of a will.

The TOD deed can also be compared to a Family Limited Partnership (FLP). Both instruments can be used for estate planning and asset protection. An FLP allows family members to pool resources and manage assets collectively, while also facilitating the transfer of ownership interests to heirs. However, unlike the TOD deed, an FLP requires ongoing management and can involve complex tax considerations, making it less straightforward than a simple transfer-on-death arrangement.

A Life Estate is another document that has similarities with the TOD deed. A Life Estate allows an individual to retain the right to use and benefit from a property during their lifetime, while designating another party as the remainder beneficiary who will receive the property upon the individual's death. Both arrangements ensure that property is transferred outside of probate, but a Life Estate can complicate ownership rights during the grantor's lifetime, unlike the straightforward nature of a TOD deed.

Lastly, the TOD deed bears resemblance to a Testamentary Trust. While both documents are used for estate planning, a Testamentary Trust is created through a will and only comes into effect upon death. It can provide detailed instructions on how assets are to be managed for beneficiaries. In contrast, the TOD deed allows for immediate transfer of property without the need for probate, making it a more efficient option for transferring specific assets directly to beneficiaries.