Valid New York Quitclaim Deed Template

The New York Quitclaim Deed form is a crucial legal instrument used in real estate transactions, particularly when transferring property ownership. This form allows an individual, known as the grantor, to convey their interest in a property to another party, referred to as the grantee, without making any warranties about the title. It is particularly useful in situations where the grantor may not have a clear title or when the transfer is between family members or close associates. The Quitclaim Deed is straightforward in its design, typically requiring essential details such as the names of the parties involved, a description of the property, and the date of the transfer. Importantly, the form must be signed by the grantor in the presence of a notary public to ensure its validity. Additionally, once executed, it should be filed with the appropriate county clerk’s office to provide public notice of the change in ownership. Understanding the nuances of this form is essential for anyone involved in property transactions in New York, as it can significantly impact the rights and responsibilities of the parties involved.

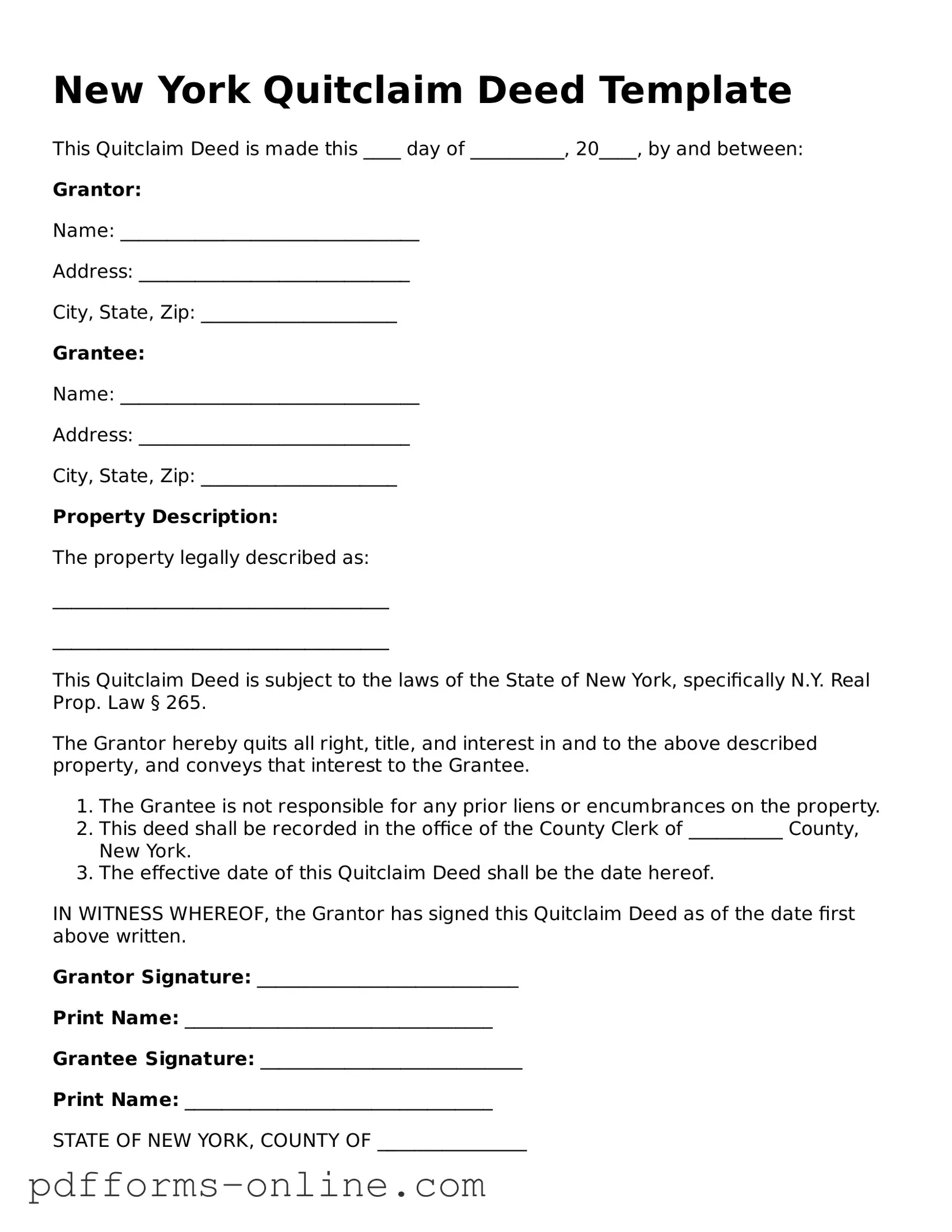

Document Example

New York Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20____, by and between:

Grantor:

Name: ________________________________

Address: _____________________________

City, State, Zip: _____________________

Grantee:

Name: ________________________________

Address: _____________________________

City, State, Zip: _____________________

Property Description:

The property legally described as:

____________________________________

____________________________________

This Quitclaim Deed is subject to the laws of the State of New York, specifically N.Y. Real Prop. Law § 265.

The Grantor hereby quits all right, title, and interest in and to the above described property, and conveys that interest to the Grantee.

- The Grantee is not responsible for any prior liens or encumbrances on the property.

- This deed shall be recorded in the office of the County Clerk of __________ County, New York.

- The effective date of this Quitclaim Deed shall be the date hereof.

IN WITNESS WHEREOF, the Grantor has signed this Quitclaim Deed as of the date first above written.

Grantor Signature: ____________________________

Print Name: _________________________________

Grantee Signature: ____________________________

Print Name: _________________________________

STATE OF NEW YORK, COUNTY OF ________________

On this ____ day of __________, 20____, before me, a Notary Public in and for said state, personally appeared ____________________, known to me to be the individual described in, and who executed, the foregoing instrument, and acknowledged that he/she executed the same.

____________________________________

Notary Public

Frequently Asked Questions

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. It provides no guarantee about the property title, meaning the grantor (the person transferring the property) does not assure the grantee (the person receiving the property) that the title is clear or free of any claims.

-

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations where property is transferred between family members, during divorce settlements, or to clear up title issues. If you trust the person you are transferring the property to and are not concerned about potential claims, a Quitclaim Deed may be appropriate.

-

How do I complete a Quitclaim Deed in New York?

To complete a Quitclaim Deed in New York, you need to fill out the form with the necessary information, including the names of the grantor and grantee, a description of the property, and the date of the transfer. Ensure that the document is signed by the grantor in the presence of a notary public.

-

Do I need a lawyer to create a Quitclaim Deed?

While it's not legally required to have a lawyer, consulting one is advisable, especially if the property has complications. A legal professional can help ensure the deed is properly executed and recorded.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, they are different. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees.

-

What happens if there are issues with the title after using a Quitclaim Deed?

If title issues arise after the transfer, the grantee has limited recourse against the grantor. Since the Quitclaim Deed does not come with warranties, the grantee assumes the risk of any title defects.

-

Do I need to record the Quitclaim Deed?

Yes, recording the Quitclaim Deed with the county clerk's office is essential. This step provides public notice of the transfer and protects the grantee's ownership rights.

-

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees for recording the deed, which vary by county. It’s important to check with your local county clerk’s office for specific costs.

-

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. The grantor would need to execute a new deed to transfer the property back or to another party.

-

What if the grantor is deceased?

If the grantor is deceased, the Quitclaim Deed cannot be executed by them. Instead, the property would typically be transferred through probate or according to the deceased's will or state law.

Misconceptions

When dealing with real estate transactions, misunderstandings about legal documents can lead to significant complications. The New York Quitclaim Deed is no exception. Below are eight common misconceptions surrounding this form, along with clarifications to help ensure informed decisions.

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed guarantees full ownership transfer. In reality, it only transfers the interest the grantor has, which may be limited or even nonexistent.

- A Quitclaim Deed Provides Title Insurance. Some assume that using a quitclaim deed automatically includes title insurance. This is incorrect; title insurance must be purchased separately to protect against future claims.

- Quitclaim Deeds Are Only for Family Transfers. While often used among family members, quitclaim deeds can be utilized in various transactions, including sales and transfers between unrelated parties.

- Using a Quitclaim Deed Eliminates All Liabilities. A common misconception is that a quitclaim deed absolves the grantor of all financial responsibilities. However, existing liens or mortgages may still affect the property, regardless of the deed.

- A Quitclaim Deed Is the Same as a Warranty Deed. Many people confuse these two types of deeds. Unlike a warranty deed, a quitclaim deed does not guarantee that the grantor has clear title to the property.

- A Quitclaim Deed Must Be Notarized. While notarization is recommended for the validity of the deed, it is not strictly required in New York. However, recording the deed with the county clerk is essential.

- A Quitclaim Deed Can Be Used to Avoid Probate. Some believe that transferring property via a quitclaim deed can bypass probate. This is not true; such transfers may still be subject to probate laws.

- Once Signed, a Quitclaim Deed Cannot Be Revoked. Many think that a quitclaim deed is irrevocable once executed. However, the grantor can revoke the deed if they have not transferred ownership to the grantee.

Understanding these misconceptions is crucial for anyone involved in real estate transactions in New York. Proper knowledge can prevent legal issues and ensure smoother property transfers.

Common mistakes

-

Incorrect Names: One common mistake is misspelling the names of the grantor (the person transferring the property) or the grantee (the person receiving the property). It is crucial to ensure that the names match exactly as they appear on legal documents.

-

Missing Signatures: The Quitclaim Deed must be signed by the grantor. Failing to include the signature can render the document invalid. Additionally, if there are multiple grantors, all must sign the document.

-

Improper Description of Property: The property description must be clear and accurate. Vague or incomplete descriptions can lead to confusion about the property being transferred. It's important to include the full address and any relevant details, such as lot numbers.

-

Not Notarizing the Document: A Quitclaim Deed typically requires notarization. If the document is not notarized, it may not be accepted by the county clerk's office. Always check local requirements to ensure compliance.

Find Some Other Quitclaim Deed Forms for Specific States

Quit Claim Deed Florida - A Quitclaim Deed is beneficial for transferring property in a business context.

How to File a Quitclaim Deed in California - A Quitclaim Deed can be especially helpful in real estate gifting scenarios.

When dealing with the sale of a trailer, it is crucial to utilize a Trailer Bill of Sale form to ensure a clear and legal transaction. This form not only records the details of the sale but also protects both the buyer and the seller by documenting the agreed-upon terms. For those seeking a reliable source to create or access this essential document, OnlineLawDocs.com is an excellent resource.

How to Gift Land to Family Member - Default ownership interests can be waived using a Quitclaim Deed.

Quitclaim Deed Form Ohio - A Quitclaim Deed might not be the best option for high-value transactions, given its limitations.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | In New York, the Quitclaim Deed is governed by the New York Real Property Law. |

| Purpose | This form is often used to transfer property between family members or to clear up title issues. |

| Consideration | While consideration (payment) is not required, it is common to include a nominal amount. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) in the presence of a notary public. |

| Recording | To be effective against third parties, the Quitclaim Deed must be recorded in the county where the property is located. |

| Limitations | A Quitclaim Deed does not guarantee that the grantor has clear title to the property, which can lead to potential disputes. |

Similar forms

A warranty deed is a document that guarantees the grantor holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, which offers no such guarantees, a warranty deed provides assurances to the buyer that they will not face any claims against the property. This makes warranty deeds a safer option for buyers, as they can trust that the property is free from liens or other issues. In contrast, a quitclaim deed simply transfers whatever interest the grantor has without any promises.

A special warranty deed is similar to a warranty deed but with a key difference. It only guarantees that the grantor has not done anything to harm the title during their ownership. This means that if there were issues with the title that predate the grantor’s ownership, the buyer may still face problems. In this way, a special warranty deed offers more protection than a quitclaim deed but less than a full warranty deed.

A bargain and sale deed transfers property without any warranties, similar to a quitclaim deed. However, it implies that the grantor has some interest in the property. This type of deed is often used in transactions where the buyer is willing to accept the risk of any title issues. While it does not provide the same level of security as a warranty deed, it can be more beneficial than a quitclaim deed in certain situations.

A deed of trust is a document used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. The trustee holds the title to the property until the loan is paid off. While a deed of trust is not a deed for transferring ownership like a quitclaim deed, it does involve the transfer of property rights, which can create confusion for those unfamiliar with real estate terms.

Understanding various legal documents is essential in real estate transactions, including the significance of the Ohio Lease Agreement. This agreement sets the foundation for the landlord-tenant relationship by detailing essential terms such as rent and responsibilities. For those looking for a detailed version of this agreement, you can refer to the following link: documentonline.org/blank-ohio-lease-agreement/.

An easement deed grants permission to use a portion of someone else's property for a specific purpose. This document is similar to a quitclaim deed in that it transfers rights without guaranteeing full ownership. Easements can be temporary or permanent and are often used for utilities or access roads. While a quitclaim deed transfers ownership interest, an easement deed allows limited use of the property.

A lease agreement is a contract between a landlord and a tenant that outlines the terms of renting a property. While it does not transfer ownership like a quitclaim deed, it does grant the tenant certain rights to use the property. Both documents involve the transfer of rights, but a lease is temporary, while a quitclaim deed is a permanent change in ownership.

A life estate deed allows a person to live in a property for the duration of their life, after which the property passes to another party. This type of deed shares similarities with a quitclaim deed in that it transfers an interest in property without warranties. However, a life estate deed creates a unique arrangement that can complicate ownership and rights after the life tenant's passing.

A foreclosure deed is issued when a property is sold due to foreclosure. This document transfers ownership from the borrower to the lender or a third party. Like a quitclaim deed, it does not provide any guarantees about the property’s title. However, it represents a forced transfer of ownership rather than a voluntary one, highlighting the differences in intent and circumstances surrounding the transfer.

An affidavit of heirship is a document used to establish the heirs of a deceased person’s property. It is similar to a quitclaim deed in that it can transfer property rights, but it does so based on familial relationships rather than a sale or gift. This document can simplify the process of transferring property after someone passes away, but it does not offer the same level of protection as other deeds.