Valid New York Promissory Note Template

In the realm of personal and business financing, the New York Promissory Note form serves as a crucial tool for establishing clear terms between lenders and borrowers. This legally binding document outlines the specifics of a loan agreement, including the principal amount borrowed, the interest rate, and the repayment schedule. Additionally, it may detail any collateral involved, ensuring both parties understand their rights and obligations. The form also typically includes provisions for late fees and default scenarios, which protect the lender's interests while providing transparency to the borrower. Understanding the intricacies of this form is essential for anyone engaging in a loan transaction in New York, as it not only fosters trust but also minimizes potential disputes down the line. Whether you are an individual seeking a personal loan or a business in need of capital, familiarity with the New York Promissory Note can empower you to navigate the lending landscape with confidence.

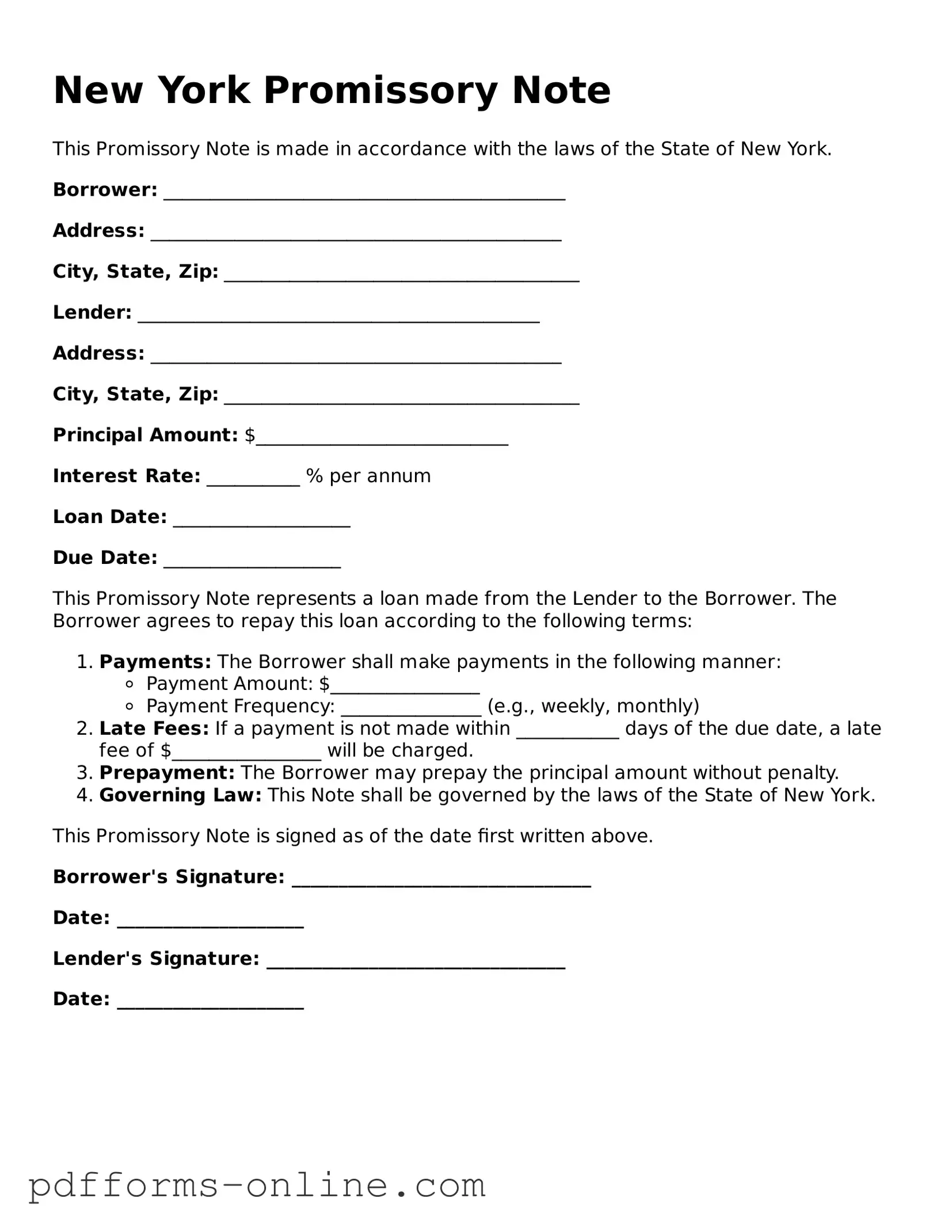

Document Example

New York Promissory Note

This Promissory Note is made in accordance with the laws of the State of New York.

Borrower: ___________________________________________

Address: ____________________________________________

City, State, Zip: ______________________________________

Lender: ___________________________________________

Address: ____________________________________________

City, State, Zip: ______________________________________

Principal Amount: $___________________________

Interest Rate: __________ % per annum

Loan Date: ___________________

Due Date: ___________________

This Promissory Note represents a loan made from the Lender to the Borrower. The Borrower agrees to repay this loan according to the following terms:

- Payments: The Borrower shall make payments in the following manner:

- Payment Amount: $________________

- Payment Frequency: _______________ (e.g., weekly, monthly)

- Late Fees: If a payment is not made within ___________ days of the due date, a late fee of $________________ will be charged.

- Prepayment: The Borrower may prepay the principal amount without penalty.

- Governing Law: This Note shall be governed by the laws of the State of New York.

This Promissory Note is signed as of the date first written above.

Borrower's Signature: ________________________________

Date: ____________________

Lender's Signature: ________________________________

Date: ____________________

Frequently Asked Questions

-

What is a New York Promissory Note?

A New York Promissory Note is a legal document in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the amount borrowed, the interest rate, the payment schedule, and any other conditions related to the loan.

-

What are the key components of a New York Promissory Note?

Key components typically include:

- The names and addresses of both the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The payment schedule, including due dates.

- Consequences of default, such as late fees or acceleration of the loan.

- Signatures of both parties to indicate agreement.

-

Is a New York Promissory Note legally binding?

Yes, a properly executed New York Promissory Note is legally binding. Once signed by both parties, it creates an enforceable obligation for the borrower to repay the loan according to the specified terms. However, it is advisable for both parties to retain copies of the document for their records.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is recommended that any modifications be documented in writing and signed by both the borrower and lender to avoid potential disputes in the future.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include pursuing a court judgment against the borrower. The specific consequences of default should be clearly outlined in the Promissory Note to ensure both parties understand their rights and obligations.

Misconceptions

Understanding the New York Promissory Note form is essential for anyone engaging in lending or borrowing money. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings.

- All Promissory Notes are the Same: Many believe that all promissory notes have identical terms and conditions. In reality, each note can be customized to fit the specific agreement between the parties involved.

- A Promissory Note Must Be Notarized: Some think notarization is required for a promissory note to be valid. While notarization can add an extra layer of authenticity, it is not a legal requirement in New York.

- Only Written Promissory Notes are Valid: There's a misconception that verbal agreements are not enforceable. However, a verbal promise can be considered a promissory note, though proving its terms may be challenging.

- Interest Rates Must Be Included: Many assume that a promissory note must always specify an interest rate. While including an interest rate is common, it is not mandatory. A note can be interest-free.

- Promissory Notes are Only for Large Loans: Some people think these notes are only relevant for significant sums. In truth, they can be used for any amount, regardless of size.

- Once Signed, a Promissory Note Cannot Be Changed: It is a common belief that signed notes are set in stone. Modifications can be made, but both parties must agree to the changes and document them properly.

- Promissory Notes are Always Enforceable: Not all promissory notes are automatically enforceable. If they lack essential elements, such as clarity on payment terms, they may be deemed invalid.

- Only Banks Can Issue Promissory Notes: Many think only financial institutions can create these documents. In reality, any individual or business can issue a promissory note.

- Defaulting on a Promissory Note Has No Consequences: Some believe that failing to repay a promissory note has no repercussions. However, defaulting can lead to legal action and damage to credit ratings.

- Promissory Notes are Irrelevant in Legal Disputes: There is a misconception that these notes hold no weight in court. On the contrary, they can serve as crucial evidence in legal disputes regarding loans.

Being aware of these misconceptions can help individuals navigate the complexities of promissory notes more effectively. Understanding the true nature of these documents is essential for both lenders and borrowers.

Common mistakes

-

Incorrect Dates: People often forget to include the correct date on the note. This can lead to confusion about when payments are due.

-

Missing Signatures: A common mistake is not signing the document. Without a signature, the note may not be legally binding.

-

Wrong Amounts: Entering the wrong loan amount is frequent. Double-checking numbers can prevent future disputes.

-

Ambiguous Terms: Some people use vague language to describe repayment terms. Clear terms help avoid misunderstandings.

-

Failure to Specify Interest Rates: Not including an interest rate can create problems later. It’s important to state whether the loan is interest-free or has a specific rate.

-

Omitting Payment Schedule: Some forget to outline how and when payments will be made. A clear schedule helps both parties stay on track.

-

Not Notarizing the Document: While not always required, failing to notarize can weaken the note’s enforceability. Consider this step for added security.

Find Some Other Promissory Note Forms for Specific States

Texas Promissory Note - Borrowers should always read the fine print before signing to understand all terms.

Promissory Note Template Ohio - The significance of a promissory note extends beyond the immediate transaction, as it shapes future financial relationships.

To ensure financial clarity and security, couples should consider utilizing a well-crafted prenuptial agreement in Florida as part of their marriage preparation. For more information, check out this essential prenuptial agreement form for your needs.

Loan Note Template - This form outlines the terms of a loan and the borrower's commitment to repay it.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a defined time. |

| Governing Law | The New York Uniform Commercial Code (UCC) governs promissory notes in New York. |

| Parties Involved | The note involves at least two parties: the maker (borrower) and the payee (lender). |

| Essential Elements | A valid promissory note must include the amount, interest rate, maturity date, and signatures of the maker. |

| Transferability | Promissory notes can be transferred to others through endorsement, making them negotiable instruments. |

| Default Consequences | If the maker defaults, the payee may pursue legal action to recover the owed amount. |

| Interest Rates | Interest rates on promissory notes in New York must comply with state usury laws to avoid excessive charges. |

| Written Requirement | To be enforceable, a promissory note must be in writing; oral promises are generally not sufficient. |

| Statute of Limitations | In New York, the statute of limitations for enforcing a promissory note is six years from the due date. |

Similar forms

A loan agreement is a document that outlines the terms and conditions under which a borrower receives funds from a lender. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, loan agreements tend to be more comprehensive, often including clauses related to collateral, default conditions, and remedies available to the lender. This added detail provides both parties with a clearer understanding of their obligations and rights throughout the loan process.

A mortgage is another document closely related to a promissory note. In essence, a mortgage secures the promissory note by tying the loan to a specific piece of real estate. While the promissory note represents the borrower's promise to repay the loan, the mortgage serves as a legal claim against the property. If the borrower defaults, the lender has the right to foreclose on the property, making the mortgage a critical component of real estate transactions.

An IOU, or "I owe you," is a simpler form of a promissory note. It acknowledges a debt but typically lacks the formal structure and detailed terms found in a promissory note. While an IOU can serve as evidence of a debt, it may not include specifics like interest rates or repayment schedules. This informality makes IOUs more suitable for casual or personal loans, whereas promissory notes are often used in more formal lending situations.

A personal guarantee is a document in which an individual agrees to be personally responsible for a debt or obligation. Similar to a promissory note, it ensures that the lender has recourse if the primary borrower defaults. Personal guarantees often accompany business loans, where the lender seeks additional assurance that they will be repaid. This document reinforces the lender's position, much like a promissory note does for individual loans.

A security agreement is a legal document that grants a lender a security interest in specific assets of the borrower. This is similar to a promissory note in that it establishes a financial obligation. However, while the promissory note outlines the terms of repayment, the security agreement details the collateral that secures the loan. This dual-layer protection ensures that the lender has a claim to the borrower's assets in the event of default.

A bond is a formal contract between a borrower and a lender where the borrower promises to pay back borrowed funds at a specified time, usually with interest. Like a promissory note, a bond represents a promise to repay. However, bonds are typically issued by corporations or governments and can be traded in the financial markets, adding a layer of complexity and liquidity that a standard promissory note does not possess.

In addition to these important contracts, it is essential to explore related legal documents, such as the Hold Harmless Agreement, which plays a vital role in protecting parties from liability. This form, especially relevant in New York, is designed to prevent one party from holding the other accountable for any potential harms that might occur during an engagement. For more information on this crucial legal document, visit https://onlinelawdocs.com.

A lease agreement may also share similarities with a promissory note, particularly in the context of rental payments. Both documents outline a promise to pay a specified amount over a defined period. While a promissory note pertains to loans, a lease agreement governs the rental of property. The lease typically includes terms regarding the duration of the rental, maintenance responsibilities, and conditions for termination, adding more detail than a standard promissory note.

Finally, a credit agreement is a document that establishes the terms of a credit relationship between a lender and a borrower. Similar to a promissory note, it specifies the amount of credit extended, interest rates, and repayment terms. However, credit agreements often include provisions for future borrowing, fees, and conditions under which the lender can terminate the credit line. This makes credit agreements more complex than standard promissory notes, which usually pertain to a single loan transaction.