Valid New York Operating Agreement Template

The New York Operating Agreement form plays a crucial role in the establishment and management of limited liability companies (LLCs) within the state. This document outlines the internal structure and operational guidelines for an LLC, ensuring that all members are on the same page regarding their rights and responsibilities. Key aspects of the form include details about ownership percentages, profit distribution, and decision-making processes. Additionally, it addresses how new members can be added and what happens if a member decides to leave the company. By clearly defining these elements, the Operating Agreement helps prevent misunderstandings and disputes among members. Furthermore, while New York law does not mandate that an LLC have an Operating Agreement, having one in place is highly recommended to provide a solid foundation for the business. This article will delve into the essential components of the New York Operating Agreement form, highlighting its significance in fostering a harmonious and well-organized business environment.

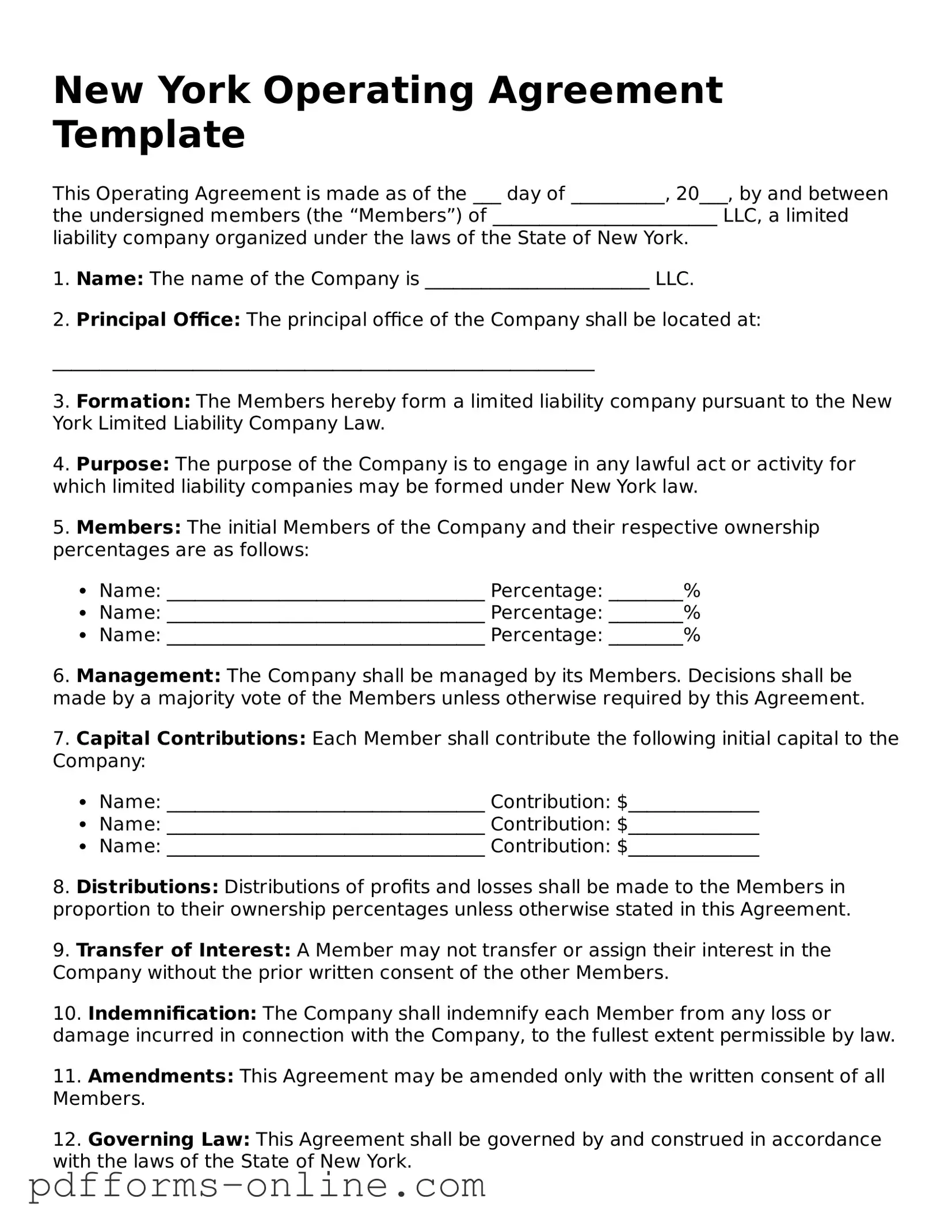

Document Example

New York Operating Agreement Template

This Operating Agreement is made as of the ___ day of __________, 20___, by and between the undersigned members (the “Members”) of ________________________ LLC, a limited liability company organized under the laws of the State of New York.

1. Name: The name of the Company is ________________________ LLC.

2. Principal Office: The principal office of the Company shall be located at:

__________________________________________________________

3. Formation: The Members hereby form a limited liability company pursuant to the New York Limited Liability Company Law.

4. Purpose: The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be formed under New York law.

5. Members: The initial Members of the Company and their respective ownership percentages are as follows:

- Name: __________________________________ Percentage: ________%

- Name: __________________________________ Percentage: ________%

- Name: __________________________________ Percentage: ________%

6. Management: The Company shall be managed by its Members. Decisions shall be made by a majority vote of the Members unless otherwise required by this Agreement.

7. Capital Contributions: Each Member shall contribute the following initial capital to the Company:

- Name: __________________________________ Contribution: $______________

- Name: __________________________________ Contribution: $______________

- Name: __________________________________ Contribution: $______________

8. Distributions: Distributions of profits and losses shall be made to the Members in proportion to their ownership percentages unless otherwise stated in this Agreement.

9. Transfer of Interest: A Member may not transfer or assign their interest in the Company without the prior written consent of the other Members.

10. Indemnification: The Company shall indemnify each Member from any loss or damage incurred in connection with the Company, to the fullest extent permissible by law.

11. Amendments: This Agreement may be amended only with the written consent of all Members.

12. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

Member Signatures:

- _____________________________ Date: ________________

- _____________________________ Date: ________________

- _____________________________ Date: ________________

Frequently Asked Questions

-

What is a New York Operating Agreement?

A New York Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in New York. This agreement serves as a roadmap for how the LLC will be run, detailing the rights and responsibilities of its members, as well as how profits and losses will be distributed.

-

Is an Operating Agreement required in New York?

While New York law does not require LLCs to have an Operating Agreement, it is highly recommended. Having one can help prevent misunderstandings among members and provide clarity in operations. Additionally, it can protect the limited liability status of the LLC by demonstrating that it is a separate legal entity.

-

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC, but it is often beneficial to involve a legal professional. This ensures that the agreement complies with state laws and adequately addresses the specific needs of the business and its members.

-

What key elements should be included in the Operating Agreement?

Essential elements of an Operating Agreement typically include:

- The name and purpose of the LLC

- The names and contributions of the members

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Members must follow the procedures outlined in the agreement for making changes. Typically, amendments require a vote or unanimous consent of the members, depending on what the agreement specifies.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, New York’s default laws will govern the operation of the LLC. This may not align with the members' intentions and could lead to disputes or complications in management and profit distribution.

-

How does an Operating Agreement protect members?

An Operating Agreement provides a clear outline of each member's rights and responsibilities, which helps to minimize conflicts. It also reinforces the LLC’s status as a separate legal entity, which can protect members from personal liability for the business's debts and obligations.

-

Is there a standard template for an Operating Agreement?

While there are many templates available online, it is crucial to tailor the Operating Agreement to fit the specific needs of your LLC. Customizing the document ensures that it accurately reflects the intentions of the members and complies with New York laws.

-

How do members sign the Operating Agreement?

Members typically sign the Operating Agreement in person, although electronic signatures may also be acceptable if all parties agree. It is advisable to keep a signed copy of the agreement with the LLC’s official records.

-

Can an Operating Agreement be used in legal disputes?

Yes, an Operating Agreement can be used in legal disputes among members. If conflicts arise, the agreement serves as a reference point to resolve issues according to the agreed-upon terms. Courts may refer to the Operating Agreement to understand the intentions of the members.

Misconceptions

When it comes to the New York Operating Agreement form, many people hold misconceptions that can lead to confusion or missteps. Here are seven common misunderstandings about this important document:

- It’s only necessary for large businesses. Many believe that only big companies need an Operating Agreement. In reality, any LLC, regardless of size, can benefit from having one. It outlines the structure and management of the business, which is essential for all entities.

- It’s a legally required document. While New York does not mandate an Operating Agreement, having one is highly recommended. It provides clarity and can help prevent disputes among members.

- It must be filed with the state. Some think that the Operating Agreement needs to be submitted to a state agency. In truth, it is an internal document that should be kept with the company’s records but does not need to be filed.

- All members must sign the Operating Agreement. While it is advisable for all members to sign, it is not a legal requirement. However, having signatures can help in proving the agreement’s validity in case of disputes.

- It can’t be changed once it’s created. Many assume that an Operating Agreement is set in stone. In fact, it can be amended as needed, allowing flexibility to adapt to changes in the business or membership.

- It only covers financial matters. Some people think the Operating Agreement is solely about money. In reality, it addresses various aspects, including management structure, decision-making processes, and member responsibilities.

- It’s only for multi-member LLCs. There’s a belief that Operating Agreements are only necessary for LLCs with multiple members. However, single-member LLCs can also benefit from having one, as it helps establish the business as a separate entity.

Understanding these misconceptions can help business owners make informed decisions about their LLC and ensure they have the proper documentation in place.

Common mistakes

-

Neglecting to Include All Members: One common mistake is failing to list all members of the LLC. Each member's name and address must be clearly stated to ensure proper representation and decision-making.

-

Omitting Capital Contributions: Members often forget to specify their initial capital contributions. This information is crucial as it determines each member's ownership percentage and financial obligations.

-

Ignoring Voting Rights: Another frequent error involves not outlining the voting rights of each member. Clarity on how decisions are made can prevent disputes and misunderstandings in the future.

-

Failing to Establish a Management Structure: Some individuals overlook the importance of detailing the management structure. Whether the LLC is member-managed or manager-managed should be explicitly stated to clarify roles and responsibilities.

-

Not Addressing Dispute Resolution: Lastly, many people do not include provisions for resolving disputes. Establishing a clear process for conflict resolution can save time and resources if disagreements arise among members.

Find Some Other Operating Agreement Forms for Specific States

How to Make an Operating Agreement - It allows members to define the business’s purpose and vision clearly.

How to Make an Operating Agreement - The Operating Agreement can address how tax matters will be handled among members.

How to Create an Operating Agreement - The Operating Agreement frequently helps secure financing or loans.

Llc Operating Agreement Florida - This agreement can also define how tax responsibilities are managed among members.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The New York Operating Agreement outlines the management structure and operational procedures of a Limited Liability Company (LLC). |

| Governing Law | This agreement is governed by the New York Limited Liability Company Law. |

| Members | All members of the LLC should be included in the Operating Agreement to ensure clarity in roles and responsibilities. |

| Flexibility | New York allows LLCs to customize their Operating Agreements to fit their unique business needs. |

| Not Mandatory | While not required by law, having an Operating Agreement is highly recommended for LLCs in New York. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which can help prevent conflicts. |

| Amendments | Members can amend the Operating Agreement as needed, provided that the process for doing so is outlined within the document. |

| Tax Treatment | The Operating Agreement can specify how the LLC will be taxed, whether as a sole proprietorship, partnership, or corporation. |

| Duration | The agreement can specify the duration of the LLC, which may be perpetual or limited to a certain time frame. |

| Signatures | All members must sign the Operating Agreement to indicate their consent and understanding of the terms outlined. |

Similar forms

The New York Operating Agreement serves as a foundational document for limited liability companies (LLCs) in New York. It outlines the management structure, member roles, and operational procedures of the company. Similar to the Operating Agreement, the Partnership Agreement governs the relationship between partners in a partnership. This document details each partner's contributions, profit-sharing arrangements, and responsibilities, ensuring that all parties have a clear understanding of their rights and obligations within the partnership.

The Bylaws of a corporation are another document that shares similarities with the Operating Agreement. Bylaws set forth the rules and procedures for managing a corporation, including the roles of officers and directors, meeting protocols, and voting procedures. Like an Operating Agreement, bylaws provide a framework for governance, promoting clarity and organization within the entity.

A Shareholders' Agreement is also comparable to the Operating Agreement. This document is used in corporations to outline the rights and responsibilities of shareholders. It often includes provisions on the transfer of shares, voting rights, and how decisions are made. Both agreements aim to protect the interests of the members or shareholders and ensure smooth operations within the organization.

The Joint Venture Agreement is another document with parallels to the Operating Agreement. This agreement is created when two or more parties come together for a specific business purpose. It outlines each party's contributions, responsibilities, and how profits or losses will be shared. Similar to an Operating Agreement, it establishes a clear framework for collaboration and helps prevent disputes.

The LLC Membership Agreement serves a purpose akin to that of the Operating Agreement. This document outlines the rights and obligations of members within an LLC, detailing aspects such as capital contributions, profit distributions, and management roles. Both agreements are essential for defining the relationship among members and ensuring that everyone is on the same page regarding the operation of the business.

The Employment Agreement is another document that shares some features with the Operating Agreement. While it specifically addresses the relationship between an employer and an employee, it often includes terms related to job responsibilities, compensation, and termination. Like an Operating Agreement, it sets clear expectations and helps prevent misunderstandings in the workplace.

The Non-Disclosure Agreement (NDA) is also relevant in this context, as it aims to protect confidential information shared between parties. While the Operating Agreement focuses on the internal workings of an LLC, an NDA ensures that sensitive information remains private. Both documents are crucial for maintaining trust and integrity within business relationships.

The Franchise Agreement bears similarities to the Operating Agreement as well. This document outlines the terms under which a franchisee can operate a franchise. It includes details about fees, operational guidelines, and the rights and responsibilities of both the franchisor and franchisee. Like an Operating Agreement, it establishes a framework for operation and helps to protect the interests of all parties involved.

Finally, the Loan Agreement can be compared to the Operating Agreement in that it outlines the terms of a loan between a borrower and a lender. This document specifies repayment terms, interest rates, and the obligations of both parties. While the focus is different, both agreements serve to clarify expectations and responsibilities, thereby reducing the potential for disputes.