Valid New York Loan Agreement Template

When entering into a loan agreement in New York, it is crucial to understand the key components that define the terms and conditions of the loan. This legally binding document outlines the responsibilities of both the lender and the borrower, ensuring clarity and protection for both parties involved. The agreement typically includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, it specifies the consequences of default, which can include late fees or legal action. Understanding these aspects helps borrowers make informed decisions and fosters a transparent relationship with lenders. By grasping the significance of each section, individuals can navigate the complexities of borrowing with confidence, ensuring that their rights and obligations are clearly defined.

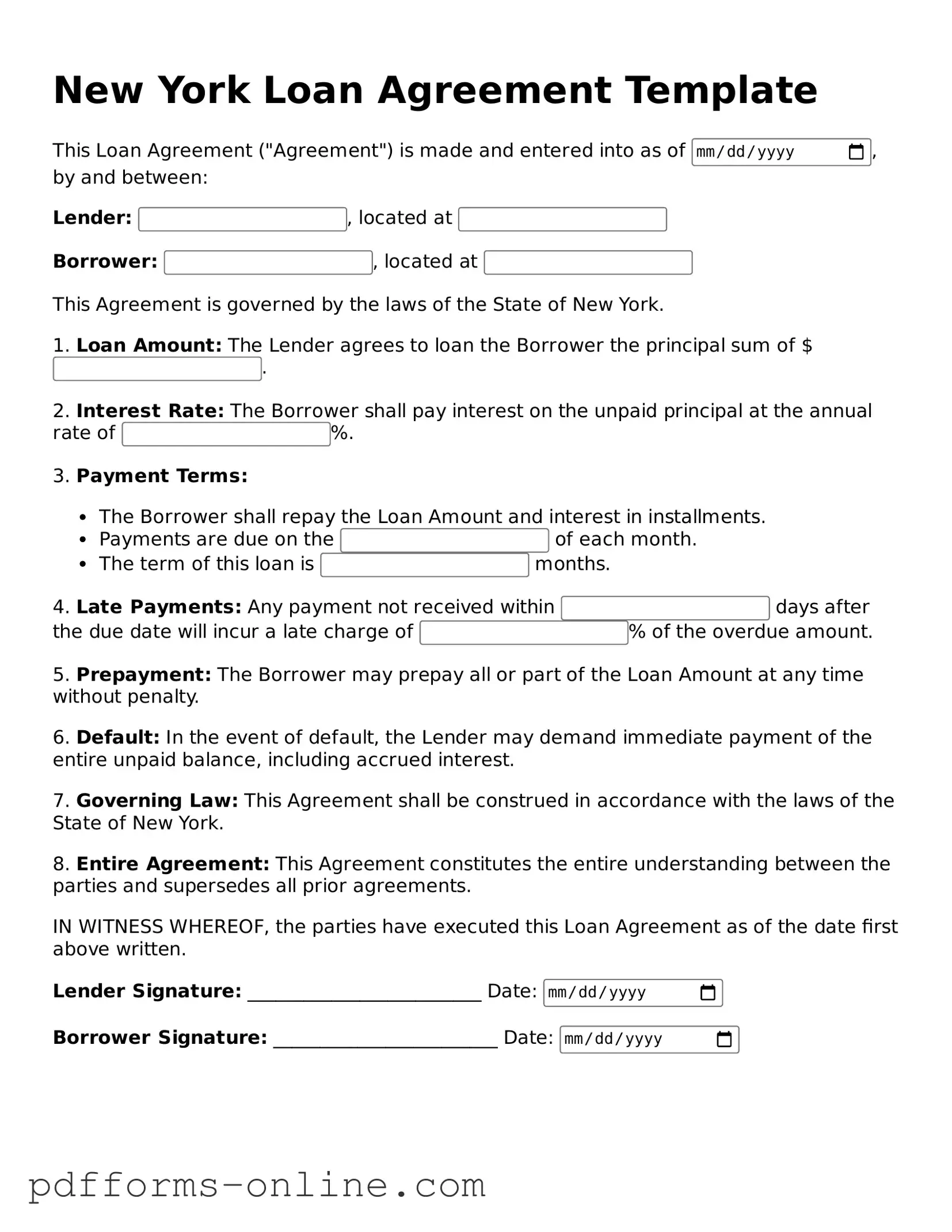

Document Example

New York Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of , by and between:

Lender: , located at

Borrower: , located at

This Agreement is governed by the laws of the State of New York.

1. Loan Amount: The Lender agrees to loan the Borrower the principal sum of $.

2. Interest Rate: The Borrower shall pay interest on the unpaid principal at the annual rate of %.

3. Payment Terms:

- The Borrower shall repay the Loan Amount and interest in installments.

- Payments are due on the of each month.

- The term of this loan is months.

4. Late Payments: Any payment not received within days after the due date will incur a late charge of % of the overdue amount.

5. Prepayment: The Borrower may prepay all or part of the Loan Amount at any time without penalty.

6. Default: In the event of default, the Lender may demand immediate payment of the entire unpaid balance, including accrued interest.

7. Governing Law: This Agreement shall be construed in accordance with the laws of the State of New York.

8. Entire Agreement: This Agreement constitutes the entire understanding between the parties and supersedes all prior agreements.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Lender Signature: _________________________ Date:

Borrower Signature: ________________________ Date:

Frequently Asked Questions

-

What is a New York Loan Agreement?

A New York Loan Agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount of money being borrowed, the interest rate, repayment schedule, and any collateral involved. This agreement serves to protect both parties by clearly defining their rights and obligations.

-

Who can enter into a Loan Agreement in New York?

Any individual or business entity can enter into a Loan Agreement in New York, provided they have the legal capacity to do so. This typically means that the parties must be of legal age (18 years or older) and mentally competent. Both lenders and borrowers should ensure they understand the terms before signing.

-

What are the key components of a New York Loan Agreement?

A comprehensive New York Loan Agreement generally includes the following components:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: This includes the schedule for payments, whether monthly, quarterly, or otherwise.

- Collateral: Any assets pledged to secure the loan.

- Default Clauses: Conditions under which the lender may demand repayment.

- Governing Law: A statement that the agreement is governed by New York law.

-

How is a Loan Agreement enforced in New York?

If a borrower fails to adhere to the terms of the Loan Agreement, the lender has the right to take legal action. This may involve seeking a court judgment to recover the owed amount. Having a well-drafted agreement is crucial, as it provides the necessary evidence in court to support the lender's claims.

-

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the lender and the borrower to ensure that the new terms are enforceable. It’s important to keep a record of any amendments for future reference.

-

What happens if a Loan Agreement is not followed?

If either party fails to comply with the Loan Agreement, it can lead to serious consequences. The lender may initiate collection actions, which could include legal proceedings. The borrower might face additional fees, damage to their credit score, or even foreclosure if collateral is involved. Understanding the implications of non-compliance is essential for both parties.

Misconceptions

When it comes to the New York Loan Agreement form, there are several misconceptions that can lead to confusion. Here are seven common misunderstandings:

- It’s only for large loans. Many people think that this form is only necessary for substantial amounts of money. In reality, it can be used for loans of any size, making it versatile for various lending situations.

- It’s too complicated to understand. While legal documents can seem daunting, the New York Loan Agreement form is designed to be straightforward. Most individuals can grasp its key components with a little attention.

- It’s not legally binding. Some believe that without a lawyer present, the agreement holds no legal weight. However, once both parties sign, it becomes a binding contract enforceable by law.

- Only lenders need to worry about it. Borrowers often overlook the importance of this document. Understanding the terms protects their interests just as much as it does the lender's.

- It’s the same as a promissory note. While both documents relate to loans, they serve different purposes. The Loan Agreement outlines the terms, while a promissory note is a promise to repay the loan.

- It can be verbal. Some think that a verbal agreement suffices. However, having a written document is crucial for clarity and legal protection.

- It doesn’t need to be updated. People often assume that once signed, the agreement is set in stone. Changes in circumstances may require updates to the terms, so it’s important to revisit the agreement as needed.

Understanding these misconceptions can help both borrowers and lenders navigate the loan process more effectively. Clear communication and a solid agreement lead to smoother transactions.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields, leaving sections blank. This can delay the approval process.

-

Incorrect Personal Details: Mistakes in names, addresses, or Social Security numbers can lead to complications. Always double-check these details.

-

Misunderstanding Loan Terms: Some borrowers do not fully grasp the terms of the loan, including interest rates and repayment schedules. It's crucial to read and understand these sections.

-

Not Providing Supporting Documents: Failing to attach necessary documents, such as proof of income or credit history, can result in rejection of the application.

-

Ignoring Signature Requirements: Some applicants forget to sign the form or provide an electronic signature where needed. This step is essential for validation.

-

Overlooking Fees: Applicants often overlook additional fees associated with the loan. It's important to review all costs before submission.

-

Failing to Review the Agreement: Rushing through the agreement without a thorough review can lead to misunderstandings or acceptance of unfavorable terms.

-

Using Outdated Forms: Some individuals may submit older versions of the loan agreement. Always ensure you are using the most current form.

-

Neglecting Contact Information: Providing incorrect or outdated contact information can hinder communication with the lender. Always verify your contact details.

Find Some Other Loan Agreement Forms for Specific States

Texas Promissory Note Requirements - A Loan Agreement outlines the terms and conditions for borrowing money between parties.

Promissory Note Template Georgia - Identifies any collateral tied to the loan agreement.

In order to ensure a mutual understanding of responsibilities between the landlord and tenant, it is essential to have a properly executed Florida Residential Lease Agreement. This form details key aspects of the rental arrangement, including the lease duration and monthly rent. To facilitate this process, landlords and tenants can easily print the form for their specific needs.

Promissory Note Florida - The agreement can help establish a repayment plan that fits the borrower's budget.

Free Promissory Note Template California - This form is an essential component of the borrowing process, providing clarity and security.

PDF Attributes

| Fact Name | Details |

|---|---|

| Purpose | The New York Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York. |

| Key Components | It typically includes the loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signature Requirement | Both parties must sign the agreement to make it legally binding. |

| Default Clauses | The form often contains clauses that outline what happens in the event of a default on the loan. |

| Modification | Any changes to the agreement must be made in writing and signed by both parties. |

| Dispute Resolution | It may include provisions for resolving disputes, such as mediation or arbitration. |

Similar forms

The New York Loan Agreement form shares similarities with a Promissory Note. A Promissory Note is a financial instrument that outlines a borrower's promise to repay a loan under specified terms. Like the Loan Agreement, it includes details such as the loan amount, interest rate, repayment schedule, and consequences of default. However, while the Loan Agreement typically involves multiple parties and may contain broader terms, the Promissory Note focuses primarily on the borrower's commitment to repay the debt. Both documents serve as essential tools in the lending process, ensuring clarity and mutual understanding between the lender and borrower.

Another document akin to the New York Loan Agreement is the Mortgage Agreement. This document is specifically used when real property is involved as collateral for the loan. Similar to the Loan Agreement, the Mortgage Agreement outlines the terms of the loan, including the amount borrowed, interest rates, and repayment terms. Additionally, it details the rights and responsibilities of both the borrower and the lender concerning the property. While the Loan Agreement may cover various types of loans, the Mortgage Agreement is specifically tied to real estate transactions, providing a legal claim to the property in case of default.

The Secured Loan Agreement is also comparable to the New York Loan Agreement. A Secured Loan Agreement involves a borrower pledging an asset as collateral for the loan, which reduces the lender's risk. Like the Loan Agreement, it specifies the loan amount, interest rate, and repayment terms. However, it emphasizes the collateral aspect, detailing what happens if the borrower fails to repay. Both documents aim to protect the lender's interests while providing the borrower with access to funds, but the Secured Loan Agreement adds an extra layer of security through collateralization.

Understanding the importance of documented transactions, the Georgia Bill of Sale form is essential for ensuring clarity in ownership transfers. This form not only legitimizes the exchange between parties but also safeguards their respective rights. For further details and access to the form, visit https://onlinelawdocs.com, which provides valuable resources for individuals engaging in such transactions.

Additionally, the Credit Agreement bears resemblance to the New York Loan Agreement. A Credit Agreement outlines the terms under which a lender will extend credit to a borrower, often used in business financing. Similar to the Loan Agreement, it includes details about the amount of credit, interest rates, and repayment terms. However, a Credit Agreement may also include covenants that require the borrower to meet specific financial metrics or operational benchmarks. This added complexity makes it suitable for larger, more intricate lending arrangements, yet both documents fundamentally serve to formalize the lending relationship.

Lastly, the Personal Loan Agreement is another document that shares characteristics with the New York Loan Agreement. This type of agreement is used for personal loans, which are typically unsecured and based on the borrower's creditworthiness. Like the Loan Agreement, it details the loan amount, interest rate, and repayment schedule. However, personal loans generally do not involve collateral, making them riskier for lenders. Both agreements aim to provide a clear understanding of the terms and obligations, ensuring that both parties are aware of their rights and responsibilities in the lending relationship.