Valid New York Durable Power of Attorney Template

In New York, a Durable Power of Attorney (DPOA) is an essential legal document that empowers an individual, known as the agent or attorney-in-fact, to make financial and legal decisions on behalf of another person, referred to as the principal. This form remains effective even if the principal becomes incapacitated, ensuring that their financial affairs can be managed without interruption. The DPOA can cover a wide range of responsibilities, from handling bank transactions and managing real estate to making investment decisions and filing taxes. Importantly, the principal retains the right to specify the extent of the agent's authority, allowing for a tailored approach that reflects their unique needs and preferences. Additionally, the DPOA must be executed in accordance with New York state laws, which include specific signing and witnessing requirements to ensure its validity. Understanding the nuances of this form is crucial for anyone considering its use, as it provides peace of mind and a clear plan for the future.

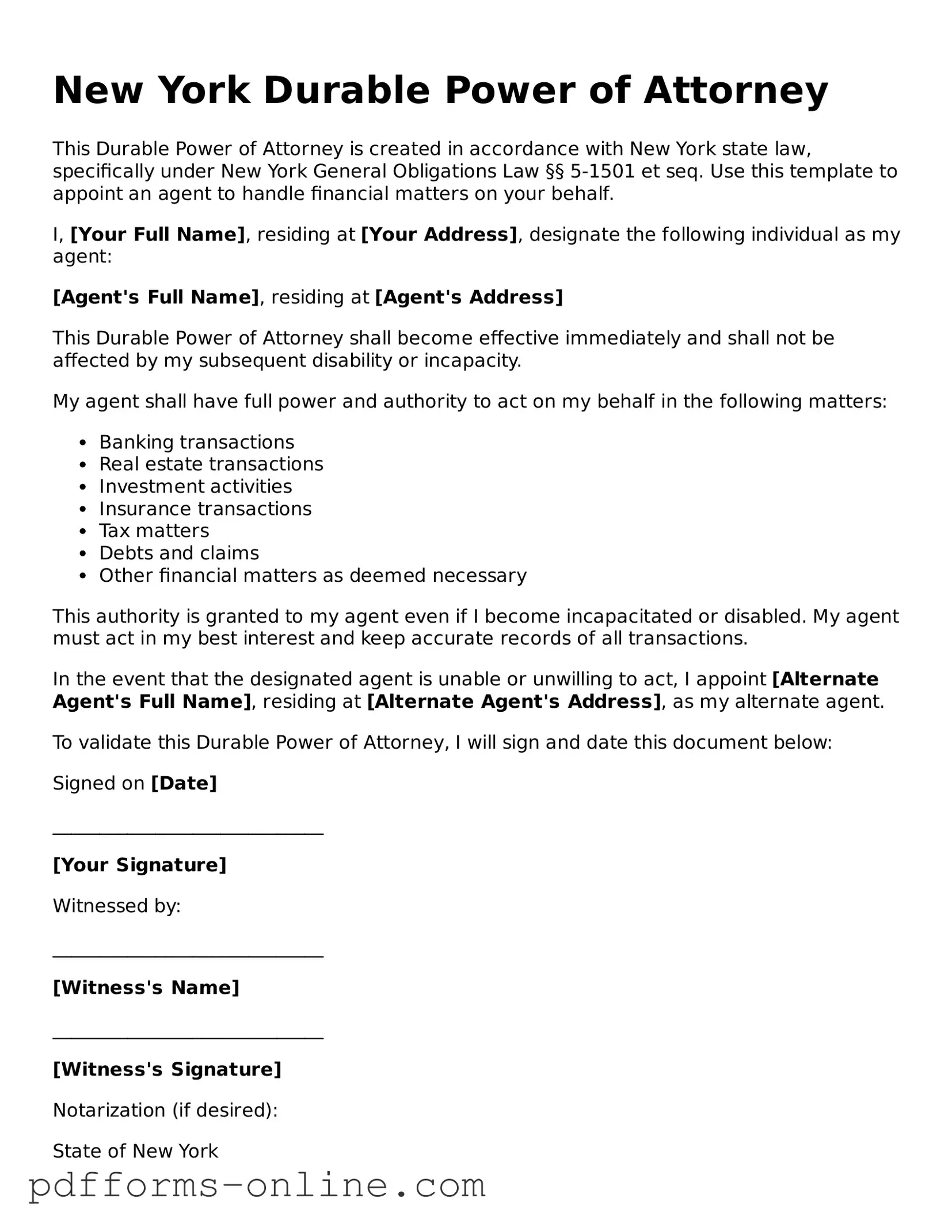

Document Example

New York Durable Power of Attorney

This Durable Power of Attorney is created in accordance with New York state law, specifically under New York General Obligations Law §§ 5-1501 et seq. Use this template to appoint an agent to handle financial matters on your behalf.

I, [Your Full Name], residing at [Your Address], designate the following individual as my agent:

[Agent's Full Name], residing at [Agent's Address]

This Durable Power of Attorney shall become effective immediately and shall not be affected by my subsequent disability or incapacity.

My agent shall have full power and authority to act on my behalf in the following matters:

- Banking transactions

- Real estate transactions

- Investment activities

- Insurance transactions

- Tax matters

- Debts and claims

- Other financial matters as deemed necessary

This authority is granted to my agent even if I become incapacitated or disabled. My agent must act in my best interest and keep accurate records of all transactions.

In the event that the designated agent is unable or unwilling to act, I appoint [Alternate Agent's Full Name], residing at [Alternate Agent's Address], as my alternate agent.

To validate this Durable Power of Attorney, I will sign and date this document below:

Signed on [Date]

_____________________________

[Your Signature]

Witnessed by:

_____________________________

[Witness's Name]

_____________________________

[Witness's Signature]

Notarization (if desired):

State of New York

County of [County Name]

Subscribed and sworn to before me on this [Date].

_____________________________

[Notary Public's Name]

Frequently Asked Questions

-

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows a person, known as the principal, to appoint someone else, called the agent or attorney-in-fact, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated.

-

Why should I create a Durable Power of Attorney?

Creating a DPOA ensures that someone you trust can handle your financial and legal matters if you are unable to do so. This can include paying bills, managing investments, or making healthcare decisions. Having a DPOA can prevent delays and complications in managing your affairs during a critical time.

-

Who can be my agent in a Durable Power of Attorney?

Your agent can be anyone you trust, such as a family member, friend, or professional advisor. However, it is essential to choose someone who is responsible and understands your wishes. The agent should also be willing to take on this responsibility.

-

How do I create a Durable Power of Attorney in New York?

To create a DPOA in New York, you must complete a specific form that includes your information, the agent's information, and the powers you wish to grant. The form must be signed by you and acknowledged by a notary public. It is advisable to keep the original document in a safe place and provide copies to your agent and any relevant institutions.

-

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time as long as you are mentally competent. To revoke the document, you must create a written revocation and notify your agent and any institutions that may have a copy of the original DPOA. It is important to ensure that the revocation is clear and properly executed.

-

What powers can I grant my agent?

You can grant your agent a wide range of powers, including managing bank accounts, selling property, and making healthcare decisions. However, you can also limit the powers to specific tasks or decisions. It is essential to be clear about what you want your agent to handle to avoid any confusion.

-

Is a Durable Power of Attorney the same as a healthcare proxy?

No, a Durable Power of Attorney and a healthcare proxy are different documents. A DPOA primarily deals with financial and legal matters, while a healthcare proxy specifically allows someone to make medical decisions on your behalf. It is advisable to have both documents in place to cover all aspects of your care and finances.

Misconceptions

Understanding the New York Durable Power of Attorney form is essential for anyone considering establishing this important legal document. However, several misconceptions often cloud the understanding of its purpose and function. Below is a list of seven common misconceptions, along with clarifications to help demystify the Durable Power of Attorney in New York.

- It only applies to financial matters. Many people believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also cover health care decisions if specified in the document.

- It becomes invalid upon the principal's incapacity. This is a significant misunderstanding. A Durable Power of Attorney remains effective even if the principal becomes incapacitated, hence the term "durable."

- Anyone can be appointed as an agent. While it is true that you can choose someone you trust, not everyone is eligible. The agent must be at least 18 years old and mentally competent.

- It is the same as a regular Power of Attorney. A Durable Power of Attorney differs from a regular Power of Attorney in that it remains effective during periods of incapacity. This distinction is crucial for long-term planning.

- It can be used for any legal purpose. The scope of authority granted to the agent is defined by the document itself. If certain powers are not included, the agent cannot act in those areas.

- Once created, it cannot be changed. This is not accurate. A Durable Power of Attorney can be revoked or modified at any time, as long as the principal is still competent to make those decisions.

- It is only necessary for the elderly. Many believe that only older adults need a Durable Power of Attorney. However, anyone over the age of 18 can benefit from having one in place, as unforeseen circumstances can affect individuals of any age.

By addressing these misconceptions, individuals can make more informed decisions regarding their legal and financial planning. A Durable Power of Attorney can provide peace of mind, knowing that trusted individuals can make important decisions when necessary.

Common mistakes

-

Not choosing the right agent: Many people select someone without considering their ability to handle financial matters. It’s important to choose an agent who is trustworthy and knowledgeable.

-

Failing to specify powers: Some individuals leave the powers too vague. Clearly listing the specific powers you want to grant can prevent confusion later on.

-

Not signing in front of a notary: The form must be signed and notarized to be valid. Skipping this step can render the document useless.

-

Ignoring state laws: Each state has its own rules regarding power of attorney. Not following New York’s specific requirements can lead to issues.

-

Not updating the document: Life changes, such as a divorce or the death of an agent, require updates to the power of attorney. Failing to make these updates can cause problems when the document is needed.

Find Some Other Durable Power of Attorney Forms for Specific States

How to Get a Power of Attorney in Florida - A Durable Power of Attorney allows someone to act on your behalf even if you become incapacitated.

How to Get Power of Attorney in Nc - Your Durable Power of Attorney can be customized for various scenarios.

General Power of Attorney Form Pennsylvania - A Durable Power of Attorney can make it easier for your agent to act quickly when necessary.

How to Notarize a Power of Attorney in Ohio - By using this form, you can avoid court intervention and ensure your affairs are tended to by a trusted individual.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate someone to make financial decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by New York General Obligations Law, specifically Article 5, Title 15. |

| Durability | The "durable" aspect means that the authority granted remains effective even if the principal is unable to make decisions. |

| Principal and Agent | The person creating the Durable Power of Attorney is known as the principal, while the person designated to act is referred to as the agent or attorney-in-fact. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Signature Requirements | The form must be signed by the principal and witnessed by at least one person or notarized to be valid. |

| Scope of Authority | The authority granted can be broad or limited, depending on the specific powers the principal chooses to include in the document. |

Similar forms

The New York Health Care Proxy is a document that allows an individual to appoint someone to make medical decisions on their behalf if they become unable to do so. Similar to the Durable Power of Attorney, it grants authority to another person to act in the principal's best interest, but it is specifically focused on health care decisions rather than financial matters. Both documents require the principal to be of sound mind at the time of signing and can be revoked at any time as long as the principal is competent.

The Living Will is another important document that complements the Durable Power of Attorney. It outlines an individual’s preferences regarding medical treatment and end-of-life care. While the Durable Power of Attorney allows someone to make decisions on behalf of the principal, the Living Will provides guidance on what those decisions should be, particularly in situations where the principal cannot communicate their wishes. Both documents work together to ensure that an individual’s health care preferences are respected.

A Revocable Trust is a financial arrangement that allows an individual to place assets into a trust during their lifetime. Similar to the Durable Power of Attorney, a Revocable Trust can help manage assets if the individual becomes incapacitated. The trust can provide for the management and distribution of assets without the need for court intervention, similar to how a Durable Power of Attorney allows for financial decisions to be made on behalf of the principal.

The Advance Directive is a broader category that includes both the Health Care Proxy and the Living Will. It allows individuals to express their wishes regarding medical treatment and appoint someone to make decisions on their behalf. Like the Durable Power of Attorney, it is designed to ensure that a person's preferences are honored even when they cannot communicate. Both documents emphasize the importance of personal choice in medical care.

The Guardianship Petition is a legal document that requests the court to appoint a guardian for an individual who is unable to manage their affairs due to incapacity. While the Durable Power of Attorney allows individuals to designate someone to act on their behalf voluntarily, a Guardianship Petition is a court-driven process. Both aim to protect the interests of the individual, but the former is based on the individual's choice, while the latter is imposed by the court.

The Financial Power of Attorney is similar to the Durable Power of Attorney in that it grants authority to another person to manage financial affairs. However, the Financial Power of Attorney may be more limited in scope, focusing solely on financial matters rather than encompassing broader powers. Both documents require careful consideration and should be tailored to the individual’s specific needs and circumstances.

The Medical Power of Attorney is specifically designed to give someone the authority to make health care decisions. Like the Durable Power of Attorney, it is effective when the principal is incapacitated. While the Durable Power of Attorney can cover a wide range of decisions, the Medical Power of Attorney is focused solely on health care, ensuring that medical decisions align with the principal’s values and wishes.

The Durable Power of Attorney for Health Care is a document that combines aspects of both the Durable Power of Attorney and the Health Care Proxy. It allows an individual to designate someone to make health care decisions and can remain effective even if the individual becomes incapacitated. This document ensures that both financial and health care decisions can be managed by a trusted individual when necessary.

The Special Needs Trust is designed to benefit individuals with disabilities while allowing them to retain eligibility for government assistance programs. Similar to the Durable Power of Attorney, it provides a framework for managing assets and making financial decisions. Both documents aim to protect the interests of individuals who may not be able to manage their affairs independently.

The Declaration of a Desire for a Natural Death is a document that expresses an individual’s wishes regarding end-of-life care. It serves a similar purpose to the Living Will but may not designate a specific person to make decisions. Both documents focus on ensuring that an individual’s preferences regarding medical treatment and end-of-life care are respected, particularly in situations where they cannot communicate their wishes.