Valid New York Deed in Lieu of Foreclosure Template

In the face of financial hardship, homeowners in New York may seek alternatives to foreclosure, and one such option is the Deed in Lieu of Foreclosure form. This legal document allows a homeowner to voluntarily transfer the ownership of their property back to the lender, effectively resolving the mortgage obligation without going through the lengthy and often stressful foreclosure process. By executing this form, the homeowner can potentially avoid the negative consequences associated with foreclosure, such as damage to their credit score and the public stigma of foreclosure proceedings. The Deed in Lieu of Foreclosure typically includes essential details such as the names of the parties involved, the legal description of the property, and the terms under which the transfer is made. It also outlines any agreements regarding the release of liability for the remaining mortgage balance, which can be a significant concern for homeowners looking to move forward. Understanding the nuances of this form can empower individuals to make informed decisions during challenging financial times.

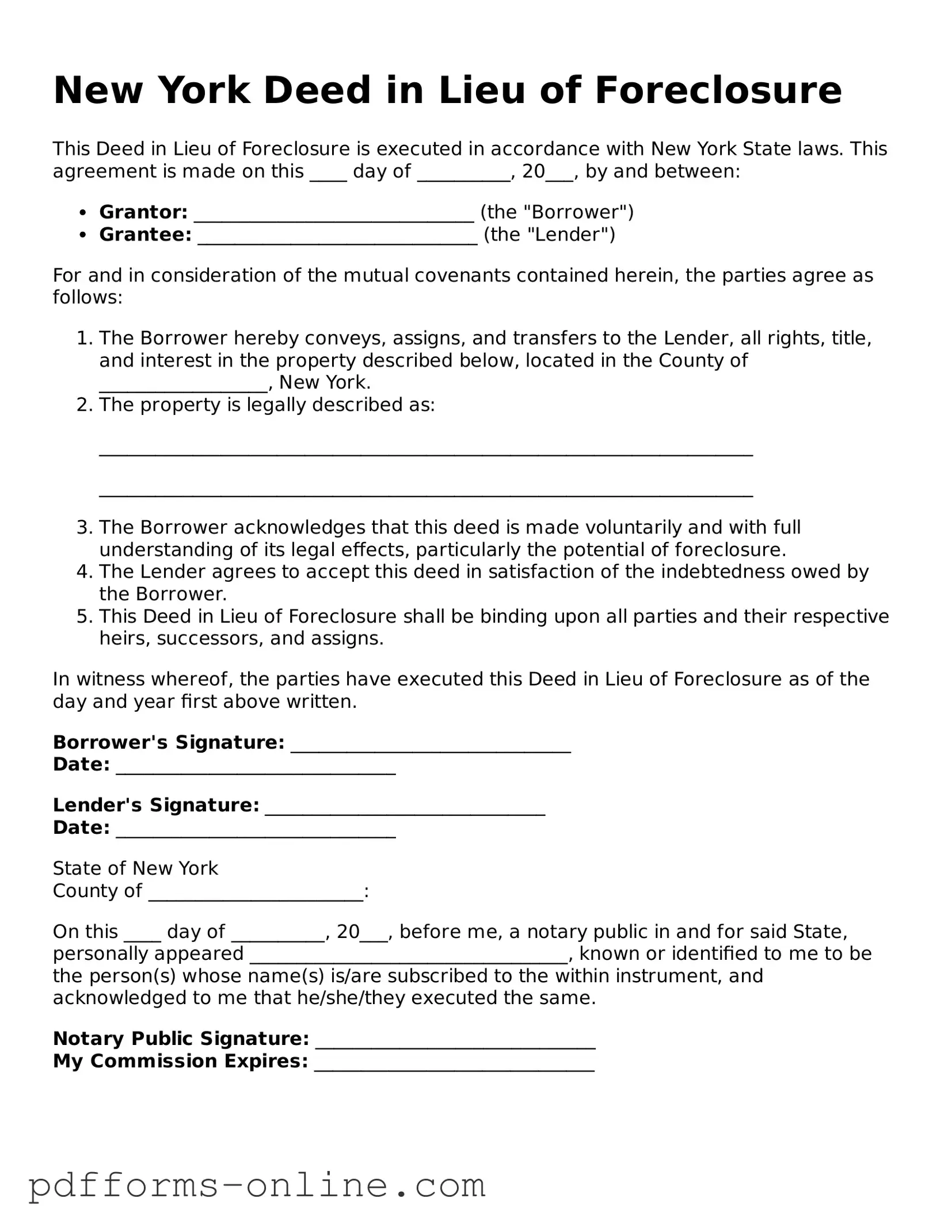

Document Example

New York Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed in accordance with New York State laws. This agreement is made on this ____ day of __________, 20___, by and between:

- Grantor: ______________________________ (the "Borrower")

- Grantee: ______________________________ (the "Lender")

For and in consideration of the mutual covenants contained herein, the parties agree as follows:

- The Borrower hereby conveys, assigns, and transfers to the Lender, all rights, title, and interest in the property described below, located in the County of __________________, New York.

-

The property is legally described as:

______________________________________________________________________

______________________________________________________________________

- The Borrower acknowledges that this deed is made voluntarily and with full understanding of its legal effects, particularly the potential of foreclosure.

- The Lender agrees to accept this deed in satisfaction of the indebtedness owed by the Borrower.

- This Deed in Lieu of Foreclosure shall be binding upon all parties and their respective heirs, successors, and assigns.

In witness whereof, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Borrower's Signature: ______________________________

Date: ______________________________

Lender's Signature: ______________________________

Date: ______________________________

State of New York

County of _______________________:

On this ____ day of __________, 20___, before me, a notary public in and for said State, personally appeared __________________________________, known or identified to me to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same.

Notary Public Signature: ______________________________

My Commission Expires: ______________________________

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement between a homeowner and a lender. In this arrangement, the homeowner voluntarily transfers ownership of the property to the lender to avoid the lengthy and costly foreclosure process. This option can help both parties by allowing the homeowner to walk away from the mortgage debt and the lender to take possession of the property more quickly.

-

Who qualifies for a Deed in Lieu of Foreclosure?

Typically, homeowners who are struggling to make mortgage payments and facing foreclosure may qualify. However, lenders often require that the homeowner has tried other alternatives first, such as loan modifications or short sales. Each lender has its own criteria, so it's essential to check with them directly.

-

What are the benefits of a Deed in Lieu of Foreclosure?

- It can be less damaging to a homeowner's credit score compared to a foreclosure.

- Homeowners may be able to negotiate a cash incentive or relocation assistance from the lender.

- The process is generally quicker and less stressful than going through a foreclosure.

-

What are the potential downsides of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks. For example, homeowners may still be responsible for any deficiency balance if the property sells for less than the mortgage amount. Additionally, this option may not be available if there are multiple liens on the property.

-

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will review the homeowner's financial situation and property details. If approved, the homeowner will sign the deed, transferring ownership to the lender. After this, the lender may sell the property or manage it as part of their real estate portfolio.

-

Is legal assistance necessary?

While it is not mandatory, seeking legal assistance can be beneficial. An attorney can help navigate the complexities of the process, ensure that your rights are protected, and assist in negotiating terms with the lender.

-

Will a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure will impact your credit score, but usually less severely than a foreclosure. The exact effect will depend on your credit history and the specifics of your situation.

-

Can I still pursue a Deed in Lieu of Foreclosure if I have already started the foreclosure process?

In many cases, yes. However, it is crucial to communicate with your lender as soon as possible. They may still be willing to consider a Deed in Lieu of Foreclosure, even if you are already in the foreclosure process.

-

What happens to my mortgage debt after the transfer?

In most cases, the transfer of the property through a Deed in Lieu of Foreclosure will extinguish the mortgage debt. However, it is essential to clarify this with your lender, as some situations may involve remaining liabilities.

-

Are there alternatives to a Deed in Lieu of Foreclosure?

Yes, there are several alternatives. Homeowners may consider loan modifications, short sales, or even bankruptcy in some cases. Each option has its pros and cons, so it is advisable to explore all available choices before making a decision.

Misconceptions

Understanding the Deed in Lieu of Foreclosure in New York is essential for homeowners facing financial difficulties. However, several misconceptions often cloud this process. Here are eight common misconceptions:

-

It eliminates all debts.

A Deed in Lieu of Foreclosure does not automatically erase all debts associated with the mortgage. Homeowners may still be responsible for any deficiency judgments if the property sells for less than the mortgage balance.

-

It is a quick fix.

Many believe that a Deed in Lieu is a fast solution to avoid foreclosure. In reality, the process can take time and requires approval from the lender, which may involve negotiations and paperwork.

-

It affects only the homeowner.

This misconception overlooks the impact on the homeowner's credit score. A Deed in Lieu can still negatively affect credit ratings, although it may be less severe than a foreclosure.

-

All lenders accept it.

Not all lenders are willing to accept a Deed in Lieu of Foreclosure. Each lender has its own policies, and some may prefer to proceed with foreclosure instead.

-

It is the same as a short sale.

A Deed in Lieu is different from a short sale. In a short sale, the property is sold for less than the mortgage balance with lender approval, while a Deed in Lieu involves transferring the property back to the lender without a sale.

-

It is a legal loophole.

Some view the Deed in Lieu as a way to bypass the legal process of foreclosure. However, it is a formal agreement that requires legal documentation and adherence to specific procedures.

-

It guarantees a fresh start.

While it can provide relief from mortgage payments, it does not guarantee a fresh start. Homeowners may still face challenges in securing new financing or housing after the deed is executed.

-

It is free of consequences.

Homeowners often believe that a Deed in Lieu comes without repercussions. However, it can lead to tax implications and affect future borrowing opportunities.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a clear and accurate description of the property. This includes not specifying the correct address or legal description, which can lead to complications in the transfer process.

-

Missing Signatures: All required parties must sign the form. Omitting a signature can invalidate the deed. Ensure that all owners of the property, as well as any necessary witnesses, have signed.

-

Not Including a Notary: A deed must typically be notarized to be legally binding. Skipping this step can render the document unenforceable. Make sure to have a notary public present when signing.

-

Failing to Review Financial Obligations: Before signing the deed, it’s essential to understand any remaining financial obligations. Ignoring these can lead to unexpected liabilities after the deed is executed.

-

Not Consulting with a Legal Professional: Many people attempt to fill out the form without seeking legal advice. This can lead to mistakes that may have been easily avoided. Consulting with a legal expert can provide clarity and ensure compliance with all requirements.

-

Ignoring Tax Implications: Some individuals overlook the potential tax consequences of transferring property through a deed in lieu of foreclosure. It's important to understand how this action may affect your tax situation.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Ultimately, a Deed in Lieu of Foreclosure can help both parties reach a constructive resolution.

A Georgia Power of Attorney form is a legal document that gives one person the authority to act on behalf of another. This authority can cover a wide range of activities, from managing finances to making healthcare decisions. For more information on this important document, you can visit onlinelawdocs.com. It's a crucial tool for planning and managing personal affairs, especially in unforeseen circumstances.

California Property Transfer Deed - The form can also allow lenders to manage their assets more effectively.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This form helps borrowers avoid the lengthy and stressful foreclosure process by allowing them to give up their property in exchange for debt relief. |

| Governing Law | The deed in lieu of foreclosure in New York is governed by New York Real Property Actions and Proceedings Law (RPAPL). |

| Eligibility | Borrowers must be facing financial hardship and unable to keep up with mortgage payments to qualify for this option. |

| Process | The borrower must submit a written request to the lender, along with any required documentation, to initiate the process. |

| Benefits | Benefits include a quicker resolution, less damage to credit scores compared to foreclosure, and potential forgiveness of remaining debt. |

| Risks | Risks involve possible tax implications on forgiven debt and the loss of the property without the possibility of recouping any equity. |

| Documentation | Required documents often include the original mortgage, a hardship letter, and financial statements. |

| Impact on Credit | A deed in lieu of foreclosure can impact credit scores but generally less severely than a foreclosure. |

| Alternatives | Alternatives include loan modification, short sale, or filing for bankruptcy, depending on individual circumstances. |

Similar forms

The New York Deed in Lieu of Foreclosure form shares similarities with a Loan Modification Agreement. This document allows borrowers to adjust the terms of their existing mortgage, often to make payments more manageable. In both cases, the goal is to avoid foreclosure and provide a solution that works for both the borrower and the lender. While a deed in lieu transfers ownership of the property to the lender, a loan modification keeps the borrower in their home but alters the loan terms to alleviate financial strain.

For those navigating a separation, understanding the significance of a legal framework is essential. The Marital Separation Agreement plays a vital role in this context, serving to delineate the terms agreed upon by both parties. More information can be found in this resource about the important Marital Separation Agreement guidelines that can facilitate a smoother process.

Another document that aligns closely with the Deed in Lieu of Foreclosure is the Short Sale Agreement. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender’s approval. Similar to a deed in lieu, a short sale aims to prevent foreclosure. Both processes require lender cooperation and can help the homeowner avoid the negative consequences of foreclosure, although the homeowner still retains some control over the sale process in a short sale.

The Forebearance Agreement is also akin to the Deed in Lieu of Foreclosure. This document allows borrowers to temporarily pause or reduce their mortgage payments due to financial hardship. While the deed in lieu involves relinquishing the property, a forbearance agreement keeps the homeowner in their home while providing breathing room. Both documents are designed to help borrowers navigate difficult financial situations, but they differ in their ultimate outcomes regarding property ownership.

A further comparable document is the Mortgage Release or Satisfaction of Mortgage. This document signifies that a mortgage has been fully paid off or settled, effectively releasing the borrower from any further obligations. In a deed in lieu, the lender accepts the property in exchange for releasing the borrower from the mortgage. Both documents conclude the borrower's relationship with the mortgage, but the circumstances leading to their execution differ significantly.

The Power of Attorney (POA) can also be likened to the Deed in Lieu of Foreclosure. A POA allows someone to act on behalf of another person in legal or financial matters. In the context of a deed in lieu, a borrower may grant a POA to someone to handle the transaction with the lender. Both documents facilitate a transfer of authority or property, although a POA does not inherently involve the transfer of ownership like a deed in lieu does.

The Bankruptcy Filing is another document that shares a connection with the Deed in Lieu of Foreclosure. When individuals face insurmountable debt, they may file for bankruptcy to seek relief. This process can halt foreclosure proceedings temporarily. While a deed in lieu directly transfers property to the lender, bankruptcy can lead to a variety of outcomes, including the potential for a fresh start without losing the home. Both options aim to provide relief from financial distress but operate within different legal frameworks.

Additionally, the Repayment Plan is similar to the Deed in Lieu of Foreclosure in that it allows borrowers to catch up on missed payments over time. This plan is often negotiated with the lender and can help avoid foreclosure. While a deed in lieu results in the transfer of property, a repayment plan keeps the borrower in their home, allowing them to regain financial stability. Both documents require lender cooperation and emphasize finding a solution that works for both parties.

The Release of Liability is another document that can be compared to the Deed in Lieu of Foreclosure. This document releases a borrower from personal liability for a mortgage after a property has been sold or transferred. Similar to a deed in lieu, where the lender accepts the property in exchange for releasing the borrower from the mortgage, a release of liability ensures that the borrower is no longer responsible for the debt. Both documents aim to provide closure for the borrower, though the circumstances surrounding their execution may vary.

Lastly, the Quitclaim Deed is a document that can resemble the Deed in Lieu of Foreclosure in terms of property transfer. A quitclaim deed allows one party to transfer their interest in a property to another without any guarantees about the title. In a deed in lieu, the borrower voluntarily transfers the property to the lender to avoid foreclosure. Both documents involve the relinquishment of property rights, but a quitclaim deed does not necessarily involve the lender's acceptance of the property in exchange for debt relief.