Valid New York Deed Template

The New York Deed form serves as a crucial document in the process of transferring property ownership in the state. It outlines the legal transfer of real estate from one party to another, ensuring that the transaction is recorded and recognized by local authorities. This form typically includes essential details such as the names of the grantor (the seller) and grantee (the buyer), a description of the property being transferred, and the consideration or price paid for the property. Additionally, the form may require notarization to validate the signatures of the parties involved, thereby enhancing its legal standing. Understanding the various types of deeds, such as warranty deeds and quitclaim deeds, is vital for anyone engaging in real estate transactions in New York. Each type serves different purposes and offers varying levels of protection for the parties involved. By familiarizing oneself with the New York Deed form, individuals can navigate the complexities of property ownership transfer with greater confidence and clarity.

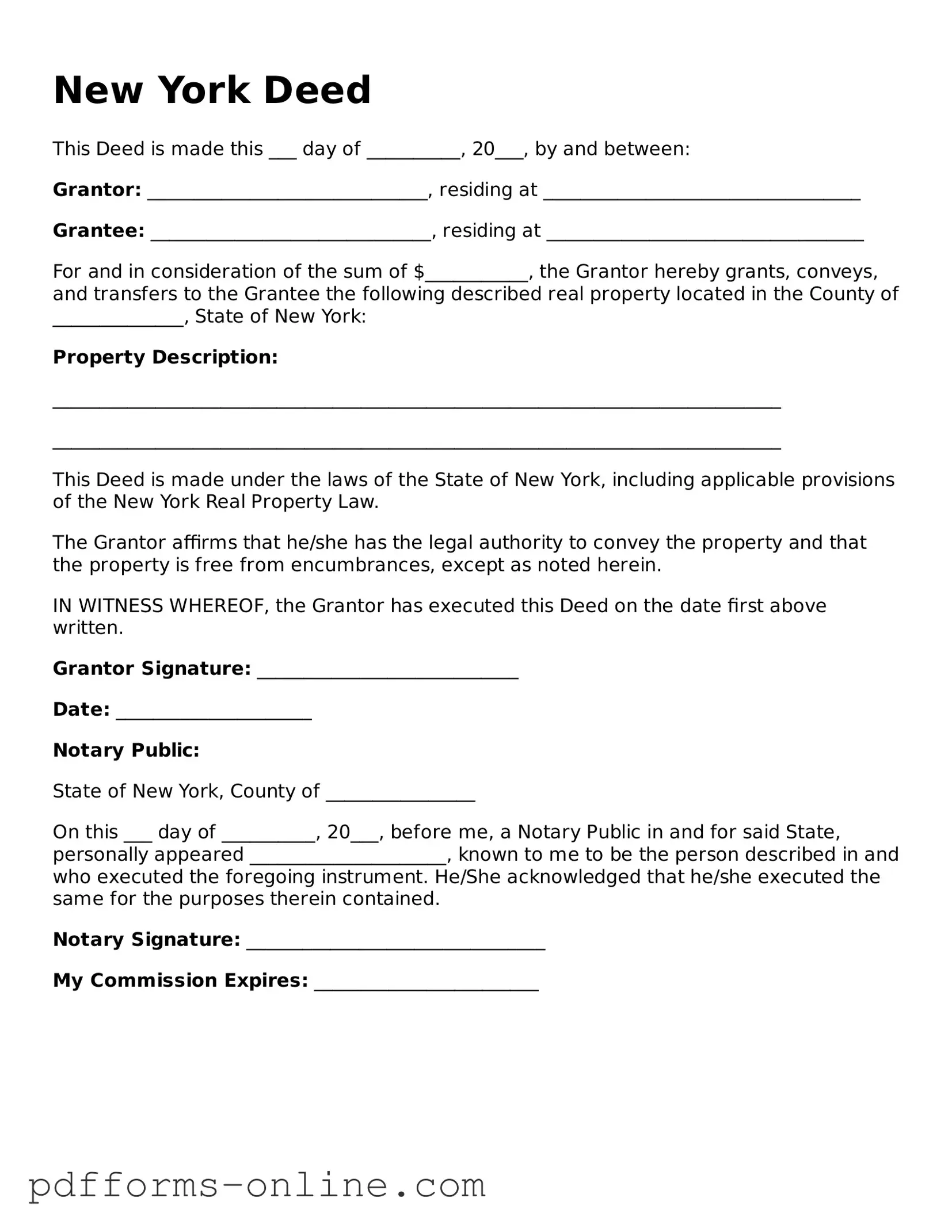

Document Example

New York Deed

This Deed is made this ___ day of __________, 20___, by and between:

Grantor: ______________________________, residing at __________________________________

Grantee: ______________________________, residing at __________________________________

For and in consideration of the sum of $___________, the Grantor hereby grants, conveys, and transfers to the Grantee the following described real property located in the County of ______________, State of New York:

Property Description:

______________________________________________________________________________

______________________________________________________________________________

This Deed is made under the laws of the State of New York, including applicable provisions of the New York Real Property Law.

The Grantor affirms that he/she has the legal authority to convey the property and that the property is free from encumbrances, except as noted herein.

IN WITNESS WHEREOF, the Grantor has executed this Deed on the date first above written.

Grantor Signature: ____________________________

Date: _____________________

Notary Public:

State of New York, County of ________________

On this ___ day of __________, 20___, before me, a Notary Public in and for said State, personally appeared _____________________, known to me to be the person described in and who executed the foregoing instrument. He/She acknowledged that he/she executed the same for the purposes therein contained.

Notary Signature: ________________________________

My Commission Expires: ________________________

Frequently Asked Questions

-

What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property in the state of New York. This form outlines the details of the property being transferred, the parties involved in the transaction, and any conditions or restrictions that may apply. It serves as an official record of the change in ownership and must be filed with the appropriate local government office.

-

What types of deeds are available in New York?

New York recognizes several types of deeds, each serving different purposes. The most common include:

- Warranty Deed: Guarantees that the seller has clear title to the property and will defend against any claims.

- Quitclaim Deed: Transfers whatever interest the seller has in the property, without any guarantees.

- Grant Deed: Similar to a warranty deed, but with fewer warranties regarding the title.

-

How do I complete a New York Deed form?

Completing a New York Deed form involves several steps. First, gather all necessary information, including the names of the parties, a legal description of the property, and any relevant details about the transaction. Next, fill out the form accurately, ensuring that all information is clear and legible. Finally, both the grantor (seller) and grantee (buyer) must sign the deed in the presence of a notary public.

-

Do I need a lawyer to prepare a New York Deed form?

While it is not legally required to have a lawyer prepare a New York Deed form, it is often advisable. A legal professional can ensure that the deed is properly drafted, complies with state laws, and meets all necessary requirements. This can help prevent potential disputes or complications in the future.

-

How do I file a New York Deed form?

After completing the New York Deed form, it must be filed with the county clerk's office in the county where the property is located. There may be a filing fee, and the deed will be recorded in the public records. This step is crucial, as it provides public notice of the transfer and protects the rights of the new owner.

-

What happens if I don't file the Deed form?

If you do not file the New York Deed form, the transfer of property ownership may not be legally recognized. This could lead to complications, such as challenges to ownership or difficulties in selling the property in the future. To ensure that your ownership rights are protected, it is essential to complete the filing process promptly.

Misconceptions

Misconceptions about the New York Deed form can lead to confusion for property owners and potential buyers. Here are nine common misunderstandings:

-

The New York Deed form is the same for all property types.

In reality, different types of properties, such as residential, commercial, or agricultural, may require specific deed forms that cater to their unique legal needs.

-

All deeds must be notarized to be valid.

While notarization is a common practice, not all deeds require it. Some deeds may be valid without a notary, depending on the circumstances.

-

Once a deed is recorded, it cannot be changed.

Although recording a deed establishes public notice, it is possible to modify or correct a deed through a legal process, such as a corrective deed.

-

Only a lawyer can prepare a New York Deed form.

While legal assistance can be beneficial, individuals can also prepare their own deeds, provided they follow the required legal guidelines.

-

A deed must be signed by all parties involved.

In some cases, only the grantor's signature is necessary for the deed to be valid. The grantee does not always need to sign.

-

Deeds are only needed during the sale of a property.

Deeds are also necessary for transferring property through gifts, inheritance, or other types of transactions, not just sales.

-

The New York Deed form is a one-size-fits-all document.

Different situations may require different forms or additional clauses to address specific legal issues, making customization important.

-

Once a deed is executed, it is automatically valid.

For a deed to be valid, it must be delivered to and accepted by the grantee. Execution alone does not complete the transfer.

-

All deeds in New York are subject to the same tax implications.

Different types of property transfers may incur varying tax obligations, including transfer taxes, which depend on the specifics of the transaction.

Common mistakes

-

Incorrect Property Description: One of the most common mistakes is failing to accurately describe the property. This includes omitting details like the street address, lot number, or tax identification number.

-

Missing Signatures: All required parties must sign the deed. A missing signature can invalidate the document, leading to complications in ownership transfer.

-

Not Notarizing the Document: In New York, a deed must be notarized. Neglecting this step can render the deed unenforceable.

-

Failure to Use the Correct Form: Different types of deeds exist, such as warranty deeds and quitclaim deeds. Using the wrong form can lead to unintended legal consequences.

-

Inaccurate Grantee Information: The grantee's name must be spelled correctly and match their legal identification. Errors here can create issues in property ownership.

-

Not Including Consideration: The deed must state the consideration, or payment, for the property. Omitting this information can lead to confusion about the transaction.

Find Some Other Deed Forms for Specific States

What Does a House Deed Look Like in Pa - Recording a deed with the local government helps protect ownership rights.

In addition to the Living Will form, individuals in Arizona can also explore other essential documents that aid in healthcare decision-making, ensuring that every aspect of their preferences is accounted for, including All Arizona Forms which provide a comprehensive overview of available legal options.

Who Has the Deed to My House - Incorrectly filled Deeds can lead to disputes over ownership.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A New York Deed form is a legal document used to transfer ownership of real property in New York State. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Bargain and Sale Deed. |

| Governing Laws | The transfer of property is governed by the New York Real Property Law. |

| Signature Requirements | The deed must be signed by the grantor (the seller) in the presence of a notary public. |

| Recording | To be effective against third parties, the deed must be recorded with the county clerk's office. |

| Consideration | The deed should state the consideration, or payment, exchanged for the property. |

| Tax Implications | New York imposes a transfer tax on property sales, which must be paid at the time of recording. |

Similar forms

The New York Deed form shares similarities with the Quitclaim Deed. A Quitclaim Deed is used to transfer ownership of property without any guarantees about the title. Like the New York Deed, it serves to convey interest in real estate, but it does so without the assurances that the title is free from claims or encumbrances. This means that if there are any issues with the property’s title, the recipient of a Quitclaim Deed may have limited recourse. Both forms facilitate property transfers, but the Quitclaim Deed is typically used in situations where the parties know each other, such as family transfers or divorces.

Another document akin to the New York Deed is the Warranty Deed. This type of deed offers more protection to the buyer because it guarantees that the seller holds clear title to the property. The Warranty Deed assures the buyer that there are no hidden liens or claims against the property. While both the Warranty Deed and the New York Deed are used to transfer property, the key difference lies in the level of assurance provided. The Warranty Deed is often preferred in transactions where the buyer seeks greater security regarding the property’s title.

The Bargain and Sale Deed is also similar to the New York Deed. This deed conveys property but does not provide any warranties against claims. It implies that the seller has the right to sell the property, but it does not guarantee that the title is free from defects. Like the New York Deed, it facilitates the transfer of ownership but leaves some risk with the buyer. This type of deed is often used in foreclosure sales or other transactions where the seller may not be able to offer full assurances regarding the title.

A further document that resembles the New York Deed is the Special Purpose Deed. This deed is used for specific transactions, such as transferring property into a trust or as part of a court order. It serves a unique purpose, similar to the New York Deed, in that it facilitates the transfer of property ownership. However, the Special Purpose Deed may include specific language or conditions tailored to the particular situation, ensuring that the transfer meets legal requirements for that context.

In the context of property transactions, understanding the various legal documents is crucial, particularly when needing to protect sensitive information. For instance, a Georgia Non-disclosure Agreement (NDA) form can play a pivotal role, as detailed on onlinelawdocs.com, in safeguarding confidential information that may be shared during negotiations or agreements related to real estate, ensuring that all parties involved maintain the privacy necessary to protect their interests.

Lastly, the Grant Deed can be compared to the New York Deed. A Grant Deed is a common form used to transfer real estate, ensuring that the seller has not sold the property to anyone else and that the property is free from undisclosed encumbrances. Like the New York Deed, the Grant Deed facilitates ownership transfer, but it carries with it certain assurances about the title. This makes it a preferred option in many real estate transactions where buyers seek some level of protection regarding their investment.