Valid New York Articles of Incorporation Template

The New York Articles of Incorporation form serves as a foundational document for establishing a corporation in the state of New York. This form outlines essential information about the corporation, including its name, the purpose of its existence, and the details of its registered agent. Additionally, it requires the identification of the initial directors and the number of shares the corporation is authorized to issue. By providing this information, the form not only facilitates the legal recognition of the corporation but also ensures compliance with state regulations. Furthermore, the Articles of Incorporation must include the address of the corporation's principal office, which is crucial for official correspondence. Understanding these components is vital for anyone looking to form a corporation, as they lay the groundwork for the entity's legal standing and operational framework.

Document Example

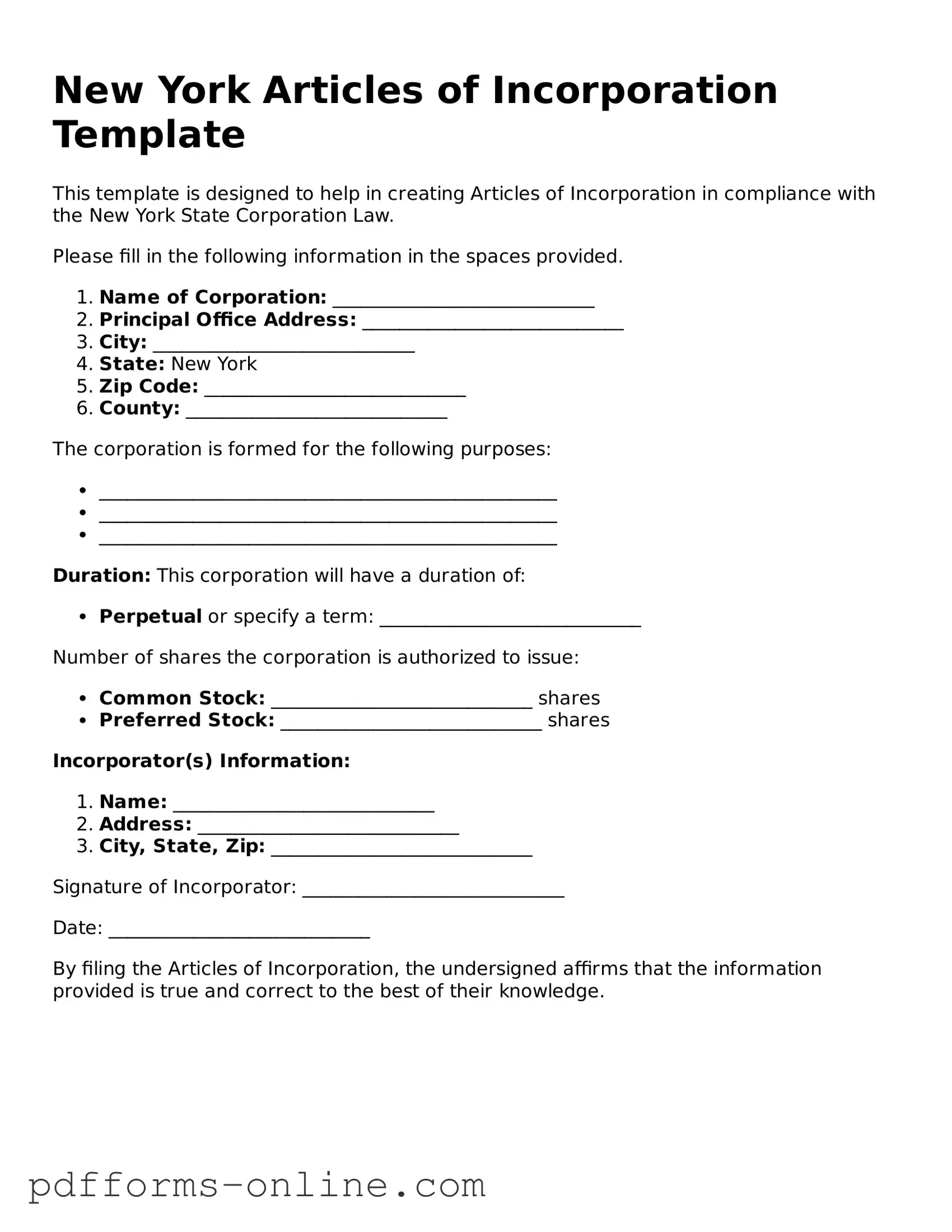

New York Articles of Incorporation Template

This template is designed to help in creating Articles of Incorporation in compliance with the New York State Corporation Law.

Please fill in the following information in the spaces provided.

- Name of Corporation: ____________________________

- Principal Office Address: ____________________________

- City: ____________________________

- State: New York

- Zip Code: ____________________________

- County: ____________________________

The corporation is formed for the following purposes:

- _________________________________________________

- _________________________________________________

- _________________________________________________

Duration: This corporation will have a duration of:

- Perpetual or specify a term: ____________________________

Number of shares the corporation is authorized to issue:

- Common Stock: ____________________________ shares

- Preferred Stock: ____________________________ shares

Incorporator(s) Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

Signature of Incorporator: ____________________________

Date: ____________________________

By filing the Articles of Incorporation, the undersigned affirms that the information provided is true and correct to the best of their knowledge.

Frequently Asked Questions

-

What is the purpose of the New York Articles of Incorporation form?

The New York Articles of Incorporation form is a legal document required to establish a corporation in the state of New York. This form outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is a critical step in forming a corporation and provides legal recognition to the business entity.

-

Who needs to file the Articles of Incorporation?

Any individual or group intending to form a corporation in New York must file the Articles of Incorporation. This includes for-profit corporations, nonprofit organizations, and professional corporations. It is essential that the individuals involved understand the requirements and implications of forming a corporation before proceeding with the filing.

-

What information is required to complete the form?

The Articles of Incorporation require several key pieces of information, including:

- The name of the corporation, which must be unique and not already in use.

- The purpose of the corporation, which can be general or specific.

- The address of the corporation's registered office in New York.

- The name and address of the registered agent who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue.

-

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, individuals must complete the form and submit it to the New York Department of State, Division of Corporations. This can be done online, by mail, or in person. A filing fee is required, and payment methods may vary depending on the submission method. It is advisable to review the latest guidelines on the Department of State's website to ensure compliance with current regulations.

-

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are filed and accepted, the corporation becomes a legal entity. The state will issue a Certificate of Incorporation, which serves as proof of the corporation's existence. After incorporation, the business must adhere to ongoing compliance requirements, including filing annual reports and maintaining good standing with the state.

-

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. This may be necessary if there are changes to the corporation's name, purpose, or other key details. To amend the Articles, a specific amendment form must be completed and filed with the New York Department of State, along with any required fees. It is important to keep corporate records updated to reflect these changes accurately.

Misconceptions

When it comes to forming a corporation in New York, the Articles of Incorporation are a crucial document. However, many people have misconceptions about this form and its requirements. Here’s a look at some common misunderstandings:

- It's the same as a business license. Many believe that filing Articles of Incorporation is equivalent to obtaining a business license. In reality, the Articles establish your corporation legally, while a business license permits you to operate within a specific jurisdiction.

- Only large businesses need to file Articles of Incorporation. Some think that only big companies need to incorporate. In truth, any business owner, regardless of size, can benefit from incorporating, as it provides liability protection and other advantages.

- Incorporation is a one-time process. Many assume that once they file their Articles, they are done. However, corporations must comply with ongoing requirements, such as annual reports and fees, to maintain their status.

- Filing Articles of Incorporation guarantees business success. While incorporation provides a solid foundation, it does not ensure success. Effective business strategies and operations are essential for growth and profitability.

- All corporations are the same. Some people think all corporations operate under the same rules. Different types of corporations (like S-Corps and C-Corps) have distinct tax implications and regulations.

- Anyone can file the Articles without assistance. While it is possible to file the form independently, many find it beneficial to consult with a legal professional to ensure all requirements are met correctly.

- Incorporating is too expensive. The costs associated with incorporating can vary, but many small businesses find that the benefits outweigh the initial expenses. It’s often a worthwhile investment.

- The Articles of Incorporation are a public document. Some believe that this means their personal information is fully accessible. While certain details are public, sensitive information can often be kept confidential.

- Once filed, the Articles cannot be changed. This is a common myth. Amendments can be made to the Articles of Incorporation if changes are necessary, such as altering the business name or structure.

Understanding these misconceptions can help you navigate the incorporation process more effectively. Being informed is the first step toward making sound business decisions.

Common mistakes

-

Incorrect Business Name: Choosing a name that is already in use or does not comply with New York naming regulations can lead to rejection. Ensure the name is unique and includes the required identifiers, such as "Incorporated" or "Corp."

-

Missing Purpose Statement: Failing to clearly define the purpose of the corporation can create confusion. The purpose should be specific enough to inform the public about the business activities.

-

Inaccurate Information on Directors: Providing incorrect details about the directors, such as names or addresses, can result in delays. It’s essential to ensure that all information is current and accurate.

-

Not Including Registered Agent Details: Omitting the name and address of the registered agent can lead to complications. The registered agent is responsible for receiving legal documents on behalf of the corporation.

-

Improper Signatures: Failing to have the appropriate individuals sign the form can invalidate it. All required signatures must be provided by the incorporators or directors as specified.

-

Ignoring Filing Fees: Neglecting to include the correct filing fee can result in the rejection of the application. Be sure to check the current fee schedule and include payment with the submission.

Find Some Other Articles of Incorporation Forms for Specific States

Texas Department of Corporations - It can aid in establishing credibility with investors and partners.

Llc Application Ohio - Provides a basis for securing legal protections for the brand.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The New York Articles of Incorporation form is used to legally establish a corporation in New York State. |

| Governing Law | The form is governed by the New York Business Corporation Law. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory to create a corporation in New York. |

| Information Needed | The form requires basic information such as the corporation's name, purpose, and address. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | There is a filing fee associated with submitting the Articles of Incorporation. |

| Approval Process | The New York Department of State reviews the form for compliance before approval. |

| Certificate Issuance | Upon approval, a Certificate of Incorporation is issued, confirming the corporation's existence. |

| Amendments | Changes to the Articles of Incorporation can be made through an amendment process. |

| Public Record | The Articles of Incorporation become part of the public record once filed with the state. |

Similar forms

The Articles of Incorporation is a foundational document for businesses in New York, similar to the Certificate of Incorporation used in other states. This document serves the same purpose of officially establishing a corporation and includes essential details such as the corporation's name, its purpose, and the names of its initial directors. Both documents are filed with the appropriate state authority, ensuring that the corporation is recognized legally and can operate within the state’s jurisdiction.

Another document comparable to the Articles of Incorporation is the Limited Liability Company (LLC) Articles of Organization. This document is used to form an LLC, which provides a different structure than a corporation. Like the Articles of Incorporation, the Articles of Organization requires information about the business, including its name and the address of its principal office. Both documents create a formal business entity, allowing for limited liability protection for the owners.

The Bylaws of a corporation also share similarities with the Articles of Incorporation. While the Articles lay the groundwork for the corporation’s existence, the Bylaws outline the internal rules and procedures for the corporation’s governance. This includes how meetings are conducted, how directors are elected, and how decisions are made. Both documents are crucial for establishing the framework within which a business operates, ensuring clarity and structure.

Incorporation by Reference is another document that parallels the Articles of Incorporation. This legal concept allows a corporation to include additional documents by reference, rather than repeating them in full. This can streamline the incorporation process, similar to how the Articles of Incorporation provide a concise overview of the corporation’s essential details. Both serve to clarify the corporation’s structure and operations, while maintaining legal compliance.

The Statement of Information is a document that shares a purpose with the Articles of Incorporation, particularly in states like California. This document is required to provide updated information about the corporation after its formation. While the Articles of Incorporation establish the corporation, the Statement of Information ensures that the state has current and accurate data regarding the corporation’s operations and management. Both documents are vital for maintaining transparency and accountability.

Another document that has a similar function is the Operating Agreement for LLCs. This document outlines the management structure and operational procedures for the LLC. Like the Articles of Incorporation, it is essential for defining the roles and responsibilities of the members and managers. Both documents serve to protect the interests of the owners and provide a clear framework for business operations.

The Partnership Agreement is akin to the Articles of Incorporation in that it establishes the terms of a partnership. While the Articles create a corporation, the Partnership Agreement outlines the relationship between partners in a business. It details each partner's contributions, responsibilities, and profit-sharing arrangements. Both documents are essential for providing clarity and preventing disputes among business owners.

The Certificate of Good Standing is another document that can be likened to the Articles of Incorporation. This certificate verifies that a corporation is legally registered and compliant with state regulations. While the Articles of Incorporation initiate the corporation's existence, the Certificate of Good Standing confirms its ongoing legitimacy. Both documents are crucial for establishing a corporation's legal status and credibility in the eyes of stakeholders.

Lastly, the Annual Report is similar to the Articles of Incorporation in that it is a required filing that provides updated information about a corporation. While the Articles of Incorporation are filed at the inception of the business, the Annual Report is submitted regularly to keep the state informed of any changes in the corporation’s structure or operations. Both documents play a significant role in ensuring that a corporation remains compliant with state laws and regulations.