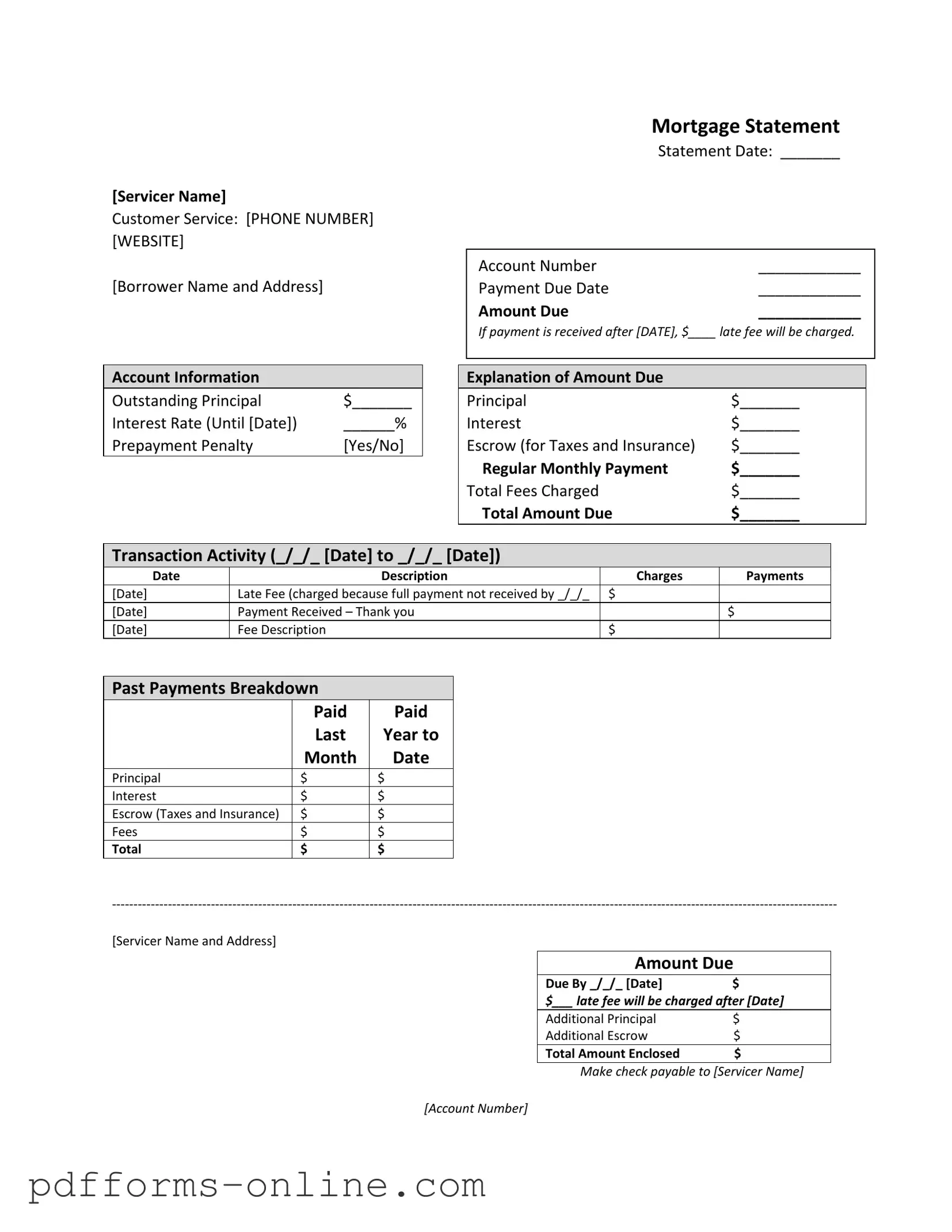

Blank Mortgage Statement Template

The Mortgage Statement form is a crucial document for homeowners, providing essential information about their mortgage account. It includes details such as the servicer's name and contact information, the borrower's name and address, and the statement date. Key financial figures are prominently displayed, including the account number, payment due date, and the total amount due. Homeowners can also find information about outstanding principal, interest rates, and any applicable prepayment penalties. The form breaks down the amount due into principal, interest, and escrow for taxes and insurance, giving borrowers a clear view of their financial obligations. Additionally, transaction activity highlights recent payments and any late fees incurred, while a past payments breakdown offers a summary of payments made over the last year. Important messages regarding partial payments and potential delinquency provide necessary warnings to borrowers. This document serves not only as a reminder of financial responsibilities but also as a resource for those facing difficulties, guiding them toward mortgage counseling or assistance options.

Document Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Frequently Asked Questions

-

What is a Mortgage Statement?

A mortgage statement is a detailed document provided by your mortgage servicer that outlines your current mortgage account status. It includes essential information such as the outstanding principal balance, interest rate, payment due date, and any fees that may apply. This statement serves as a snapshot of your mortgage, helping you understand your financial obligations.

-

What information can I find on my Mortgage Statement?

Your mortgage statement contains various critical details, including:

- Account number

- Outstanding principal and interest rates

- Payment due date and amount

- Transaction history, including charges and payments

- Any late fees applicable if payments are not received on time

- Information about escrow for taxes and insurance

This comprehensive overview enables you to track your payments and understand your mortgage balance.

-

What happens if I miss a payment?

If a payment is missed, the mortgage statement will indicate that you are delinquent. This can lead to additional fees and, in severe cases, foreclosure. It's essential to stay informed about your payment status to avoid these consequences. The statement will specify how many days you are delinquent and the total amount required to bring your account current.

-

What is a partial payment, and how is it handled?

A partial payment refers to any payment that is less than the full amount due. According to the mortgage statement, such payments are not applied to your mortgage balance. Instead, they are held in a separate suspense account until you pay the remaining balance. Once the full payment is received, the funds are then applied to your mortgage account.

-

What should I do if I am experiencing financial difficulty?

If you find yourself in financial distress, the mortgage statement often includes information about mortgage counseling or assistance programs. It is crucial to reach out to your servicer promptly. They can guide you through available options, which may include loan modifications or forbearance, to help you manage your payments effectively.

-

How can I make a payment?

To make a payment, refer to the instructions on your mortgage statement. Typically, you can pay by check or online through the servicer's website. Be sure to include your account number on any payment to ensure it is applied correctly. Note the due date and any late fees that may apply if payment is not received on time.

Misconceptions

Many individuals misunderstand the Mortgage Statement form. Here are five common misconceptions:

- All payments are applied immediately to the mortgage balance. This is not true. Partial payments are held in a separate suspense account and are only applied once the full payment is made.

- The late fee is automatically waived if payment is made before the due date. In reality, late fees apply if the payment is not received by the specified due date, regardless of when it is paid thereafter.

- Escrow amounts are optional and can be skipped. This is misleading. Escrow payments for taxes and insurance are typically required and included in the total monthly payment.

- Receiving a delinquency notice means foreclosure is imminent. While it indicates that payments are overdue, it does not mean foreclosure will happen immediately. There are usually options for resolution.

- Mortgage counseling is only for those who are about to lose their homes. This is a misconception. Counseling services are available for anyone experiencing financial difficulties, regardless of their current status.

Understanding these aspects of the Mortgage Statement can help borrowers manage their finances more effectively and avoid potential pitfalls.

Common mistakes

-

Incorrect Servicer Information: Failing to provide the correct name and contact details of the mortgage servicer can lead to delays in processing payments or inquiries.

-

Missing Account Number: Not including the account number can result in confusion and misallocation of payments, which may lead to additional fees.

-

Omitting Payment Due Date: Forgetting to note the payment due date can cause individuals to miss deadlines, resulting in late fees.

-

Failure to Specify Amount Due: Leaving the amount due blank can create uncertainty about what payment is required, leading to potential financial penalties.

-

Ignoring Late Fee Details: Not acknowledging the late fee policy can result in unexpected charges if payments are not made on time.

-

Inaccurate Outstanding Principal: Providing the wrong outstanding principal amount can mislead borrowers about their financial obligations.

-

Overlooking Interest Rate Information: Failing to include the correct interest rate can lead to misunderstandings about the cost of borrowing.

-

Misunderstanding Prepayment Penalties: Not clarifying whether a prepayment penalty applies can result in unexpected fees if borrowers choose to pay off their mortgage early.

-

Neglecting Transaction Activity: Omitting transaction details can obscure the history of payments and charges, making it difficult to track financial progress.

-

Ignoring Important Messages: Disregarding notices about partial payments or delinquency can lead to serious consequences, including foreclosure.

Additional PDF Templates

How to Get a No Trespass Order in Ohio - This letter is your first step towards asserting property rights.

Obtaining a trustworthy guide on General Power of Attorney can facilitate important decisions regarding your finances and personal affairs, ensuring that your chosen agent has the authority needed to act effectively on your behalf.

Texas Odometer Disclosure Statement - It includes warnings about penalties for providing false odometer information.

Document Data

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website, providing borrowers with essential contact information. |

| Payment Details | It specifies the payment due date, amount due, and potential late fees, which are applicable if the payment is not received by the specified date. |

| Account Information | This section outlines the outstanding principal, interest rate, and whether a prepayment penalty applies, giving borrowers a clear understanding of their loan terms. |

| Transaction Activity | The statement provides a detailed transaction history, including dates of charges and payments, helping borrowers track their payment status. |

| Delinquency Notice | A warning is included for borrowers who are late on payments, highlighting the risk of fees and foreclosure, thus emphasizing the importance of timely payments. |

Similar forms

The first document that bears similarities to the Mortgage Statement is the Billing Statement. Both documents serve to inform the recipient about amounts due and payment history. A Billing Statement typically includes details such as the account holder's name, the billing cycle, and any outstanding charges. Just like the Mortgage Statement, it breaks down the total amount due, specifying different components like principal and interest. This clarity helps individuals manage their finances by providing a comprehensive view of what they owe and when payments are due.

Another document closely related to the Mortgage Statement is the Loan Statement. Loan Statements are issued for various types of loans, including personal, auto, and student loans. Similar to the Mortgage Statement, they outline the principal balance, interest rates, and payment due dates. Both documents aim to keep borrowers informed about their financial obligations. They often include transaction histories, showing payments made and any fees incurred, which can help borrowers track their repayment progress over time.

The Credit Card Statement is yet another document akin to the Mortgage Statement. Credit Card Statements provide a summary of charges made within a billing cycle, including the total amount due, minimum payment required, and payment due date. Both statements serve the purpose of keeping the account holder informed about their financial standing. They also highlight any fees, such as late fees or interest charges, which can motivate individuals to make timely payments to avoid additional costs.

A Utility Bill is also similar in function to a Mortgage Statement. Utility Bills inform customers about their usage and the amount owed for services like electricity, water, or gas. Like the Mortgage Statement, a Utility Bill details the total amount due and the payment deadline. Both documents aim to prompt timely payments, and they often include information about any late fees that may be charged if the payment is not received by the due date. This transparency encourages responsible financial management.

For those looking to understand the process of transferring ownership, the document detailing the Tractor Bill of Sale can be very helpful. It outlines all necessary aspects related to the sale, including buyer and seller information. You can find more on this important form by exploring the essentials of the Florida Tractor Bill of Sale process.

Finally, the Insurance Premium Statement shares similarities with the Mortgage Statement. Insurance Premium Statements outline the amount due for insurance coverage, including details about the policyholder, coverage period, and payment options. Just as the Mortgage Statement breaks down the total amount due into various components, the Insurance Premium Statement often itemizes the premium, any applicable fees, and the due date. Both documents are essential for ensuring that the recipient remains aware of their financial responsibilities and avoids lapses in coverage or service.