Valid Michigan Transfer-on-Death Deed Template

The Michigan Transfer-on-Death Deed (TODD) form offers a straightforward and effective way for property owners to ensure their real estate is transferred to designated beneficiaries without the need for probate. This legal tool allows individuals to retain full control over their property during their lifetime while simplifying the transfer process upon their passing. By completing this form, property owners can specify who will inherit their property, making it a valuable option for estate planning. The TODD form must be properly executed and recorded to be valid, and it can be revoked or altered at any time before the owner's death. This flexibility, combined with the avoidance of probate, makes the Michigan Transfer-on-Death Deed an appealing choice for many looking to secure their legacy and provide for their loved ones. Understanding the requirements and implications of this form can empower property owners to make informed decisions about their estate planning needs.

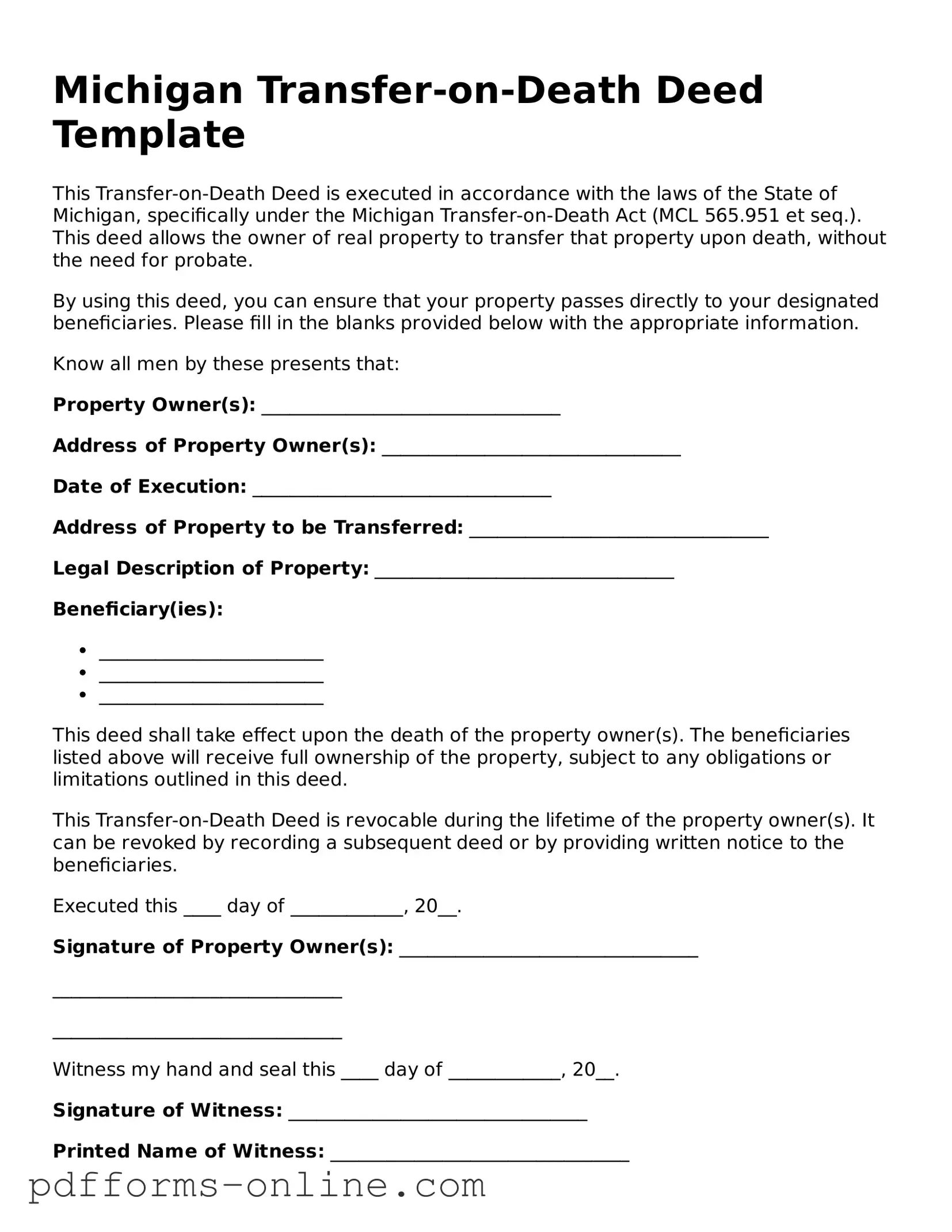

Document Example

Michigan Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of the State of Michigan, specifically under the Michigan Transfer-on-Death Act (MCL 565.951 et seq.). This deed allows the owner of real property to transfer that property upon death, without the need for probate.

By using this deed, you can ensure that your property passes directly to your designated beneficiaries. Please fill in the blanks provided below with the appropriate information.

Know all men by these presents that:

Property Owner(s): ________________________________

Address of Property Owner(s): ________________________________

Date of Execution: ________________________________

Address of Property to be Transferred: ________________________________

Legal Description of Property: ________________________________

Beneficiary(ies):

- ________________________

- ________________________

- ________________________

This deed shall take effect upon the death of the property owner(s). The beneficiaries listed above will receive full ownership of the property, subject to any obligations or limitations outlined in this deed.

This Transfer-on-Death Deed is revocable during the lifetime of the property owner(s). It can be revoked by recording a subsequent deed or by providing written notice to the beneficiaries.

Executed this ____ day of ____________, 20__.

Signature of Property Owner(s): ________________________________

_______________________________

_______________________________

Witness my hand and seal this ____ day of ____________, 20__.

Signature of Witness: ________________________________

Printed Name of Witness: ________________________________

Notary Public:

State of Michigan

County of ________________

Subscribed and sworn before me this ____ day of ____________, 20__.

Signature of Notary Public: ________________________________

My Commission Expires: ________________________________

Frequently Asked Questions

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) allows property owners in Michigan to transfer their real estate to a designated beneficiary upon their death. This deed helps avoid probate, making the transfer process simpler and faster for the beneficiary.

-

Who can use a Transfer-on-Death Deed in Michigan?

Any individual who owns real estate in Michigan can use a TOD Deed. This includes homeowners, landowners, and anyone with legal ownership of property. However, it is important that the property is not owned jointly with rights of survivorship, as this may affect the transfer process.

-

How do I complete a Transfer-on-Death Deed?

To complete a TOD Deed, you will need to provide specific information, such as:

- Your name and address as the property owner.

- The name and address of the beneficiary you wish to designate.

- A legal description of the property being transferred.

Once the form is filled out, it must be signed in the presence of a notary public and then recorded with the county register of deeds to be valid.

-

Can I change the beneficiary after I have filed the Transfer-on-Death Deed?

Yes, you can change the beneficiary at any time while you are alive. To do this, you must file a new TOD Deed with the updated beneficiary information. The previous deed will remain valid unless you explicitly revoke it by filing a revocation form.

-

What happens if I do not name a beneficiary?

If you do not name a beneficiary on your Transfer-on-Death Deed, the property will not transfer as intended. Instead, it will go through the probate process, and the distribution of the property will be determined according to Michigan's intestacy laws.

-

Is there a fee to record the Transfer-on-Death Deed?

Yes, there is typically a recording fee charged by the county register of deeds when you file the TOD Deed. The amount can vary by county, so it is advisable to check with your local office for the exact fee.

Misconceptions

When it comes to the Michigan Transfer-on-Death Deed form, there are several misconceptions that can lead to confusion. Here are four common misunderstandings:

- It's only for wealthy individuals. Many people believe that Transfer-on-Death Deeds are only beneficial for those with large estates. In reality, anyone can use this form to simplify the transfer of property to their heirs, regardless of the property's value.

- It requires probate. A common myth is that property transferred via a Transfer-on-Death Deed must go through probate. This is not true. The property transfers directly to the beneficiary upon the owner's death, avoiding the probate process altogether.

- It can be revoked easily. Some think that once a Transfer-on-Death Deed is signed, it cannot be changed. However, the deed can be revoked or modified at any time before the owner's death, as long as the proper legal procedures are followed.

- It only applies to real estate. While Transfer-on-Death Deeds are primarily used for real estate, some people mistakenly believe they can’t be used for other types of property. In Michigan, this deed specifically applies to real property, but it does not cover personal property or financial accounts.

Understanding these misconceptions can help you make informed decisions about estate planning in Michigan.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. The legal description should be precise and match the information in public records. Omitting details or using vague language can lead to confusion or disputes in the future.

-

Improper Signatures: The form requires the signatures of the property owner(s). A mistake often made is not having all necessary parties sign the document. If multiple owners exist, all must consent to the transfer for it to be valid.

-

Not Recording the Deed: After completing the form, individuals sometimes forget to record the deed with the appropriate county office. Failing to do so means the transfer may not be recognized, which can defeat the purpose of the deed.

-

Ignoring State Requirements: Each state has specific requirements for transfer-on-death deeds. A frequent error is overlooking Michigan's unique regulations. Not adhering to these can invalidate the deed, so it is essential to familiarize oneself with state laws.

Find Some Other Transfer-on-Death Deed Forms for Specific States

How to Avoid Probate in Pa - The Transfer-on-Death Deed can be revoked, allowing you to change beneficiaries if needed.

Ladybird Deed Texas Form - This deed does not require the consent of the beneficiaries during the owner's lifetime.

For those looking to enter into a rental agreement in Ohio, it is crucial to utilize a well-drafted lease template, such as the one available at documentonline.org/blank-ohio-residential-lease-agreement, which helps facilitate a clear understanding of the obligations of both landlords and tenants.

Does a Beneficiary Deed Avoid Probate - The form aims to provide a worry-free method for transferring property while allowing full enjoyment of it during the owner's lifetime.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Michigan Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Michigan Compiled Laws, specifically MCL 565.25. |

| Eligibility | Any person who owns real estate in Michigan can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. |

| Revocation | The deed can be revoked at any time by the property owner before their death. |

| Recording Requirement | The deed must be recorded with the local register of deeds to be effective. |

| Tax Implications | The transfer does not trigger gift taxes during the owner's lifetime. |

| Effect on Creditors | Property transferred via this deed may still be subject to the owner's creditors after death. |

| Survivorship | If multiple beneficiaries are named, the property is transferred to them as joint tenants with rights of survivorship unless stated otherwise. |

| Legal Assistance | While not required, consulting an attorney can help ensure the deed meets all legal requirements. |

Similar forms

The Michigan Transfer-on-Death Deed (TODD) form shares similarities with the Last Will and Testament. Both documents facilitate the transfer of property upon death. However, while a will requires probate, which can be a lengthy and public process, a TODD allows for the direct transfer of property to beneficiaries without the need for probate. This makes the TODD a more straightforward option for individuals looking to pass on their real estate efficiently and privately.

Another document akin to the TODD is the Revocable Living Trust. Like the TODD, a living trust allows individuals to dictate how their assets will be distributed after their passing. However, a trust can encompass a wider range of assets beyond just real estate. It also provides more control over the distribution process and can help avoid probate, similar to the TODD, making it a popular choice for estate planning.

The Beneficiary Designation form is also comparable to the TODD. This document is often used for financial accounts, such as life insurance policies and retirement accounts, allowing the account holder to name beneficiaries who will receive the assets upon their death. Just like the TODD, this form bypasses probate, ensuring that the assets are transferred directly to the designated individuals without delay.

Power of Attorney (POA) documents share some functional similarities with the TODD, particularly regarding the management of assets. A POA allows an appointed individual to make decisions on behalf of another person, including handling property matters. While a TODD is specific to transferring property after death, a POA is effective during the individual's lifetime, providing a different but complementary way to manage and transfer assets.

The Joint Tenancy with Right of Survivorship agreement is another document that functions similarly to the TODD. In this arrangement, two or more individuals hold title to a property together. When one owner passes away, their share automatically transfers to the surviving owner(s) without going through probate. This mechanism mirrors the TODD’s intent to simplify the transfer of property upon death.

Life Estate Deeds also bear resemblance to the TODD. A life estate deed allows a person to retain the right to live in a property for their lifetime while designating a beneficiary who will receive the property upon their death. Like the TODD, this deed provides a way to transfer property without the hassle of probate, ensuring a smooth transition of ownership after death.

To navigate the complexities of employee management and ensure compliance with workplace standards, it is vital to refer to comprehensive resources. For businesses operating in Arizona, familiarizing yourself with essential documents such as the Employee Handbook can significantly streamline operations. For more information, you can access All Arizona Forms which provide necessary tools to support your business practices effectively.

Lastly, the Enhanced Life Estate Deed, often referred to as a Lady Bird Deed, is similar in that it allows property owners to retain control over their property during their lifetime while designating a beneficiary for automatic transfer upon death. This deed provides flexibility, allowing the owner to sell or mortgage the property if needed, while still ensuring that the property will pass outside of probate, much like the TODD.