Valid Michigan Tractor Bill of Sale Template

The Michigan Tractor Bill of Sale form serves as a crucial document for anyone involved in the buying or selling of tractors in the state. This form not only provides a legal record of the transaction but also helps protect the interests of both the buyer and the seller. Essential details such as the names and addresses of the parties involved, the tractor's identification number, and a description of the vehicle are typically included. Furthermore, the form often outlines the sale price and any warranties or representations made by the seller. By documenting these key aspects, the bill of sale ensures clarity and accountability, reducing the likelihood of disputes in the future. It is important for both parties to understand the implications of this document, as it can impact ownership rights and responsibilities. Proper completion of the form is vital to ensure compliance with Michigan state laws, making it an indispensable tool for anyone engaged in agricultural equipment transactions.

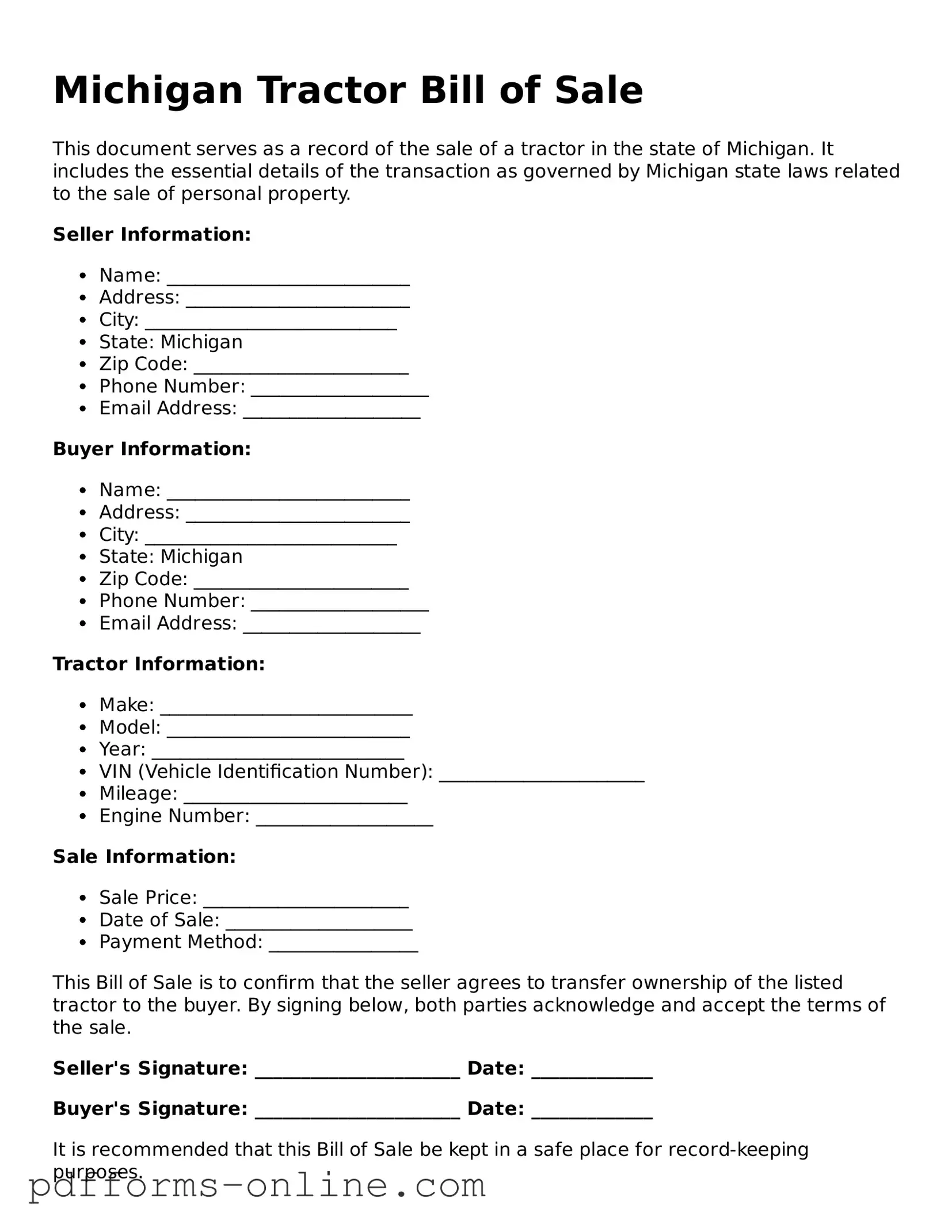

Document Example

Michigan Tractor Bill of Sale

This document serves as a record of the sale of a tractor in the state of Michigan. It includes the essential details of the transaction as governed by Michigan state laws related to the sale of personal property.

Seller Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Michigan

- Zip Code: _______________________

- Phone Number: ___________________

- Email Address: ___________________

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Michigan

- Zip Code: _______________________

- Phone Number: ___________________

- Email Address: ___________________

Tractor Information:

- Make: ___________________________

- Model: __________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): ______________________

- Mileage: ________________________

- Engine Number: ___________________

Sale Information:

- Sale Price: ______________________

- Date of Sale: ____________________

- Payment Method: ________________

This Bill of Sale is to confirm that the seller agrees to transfer ownership of the listed tractor to the buyer. By signing below, both parties acknowledge and accept the terms of the sale.

Seller's Signature: ______________________ Date: _____________

Buyer's Signature: ______________________ Date: _____________

It is recommended that this Bill of Sale be kept in a safe place for record-keeping purposes.

Frequently Asked Questions

-

What is a Michigan Tractor Bill of Sale form?

The Michigan Tractor Bill of Sale form is a document used to record the sale and transfer of ownership of a tractor in the state of Michigan. This form provides essential details about the transaction, including the buyer and seller's information, the tractor's specifications, and the sale price.

-

Why is a Bill of Sale important?

A Bill of Sale serves as legal proof of the transaction. It protects both the buyer and seller by documenting the terms of the sale. This record can be important for future reference, particularly if disputes arise regarding ownership or condition of the tractor.

-

What information is required on the form?

The form typically requires the following information:

- Full names and addresses of both the buyer and seller

- Description of the tractor, including make, model, year, and VIN (Vehicle Identification Number)

- Sale price

- Date of sale

-

Do I need to have the form notarized?

Notarization is not a requirement for a Bill of Sale in Michigan; however, having it notarized can add an extra layer of authenticity and may be beneficial if the document needs to be presented in legal situations.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale, but it must include all necessary information to be valid. Using a standard form can help ensure that you don’t miss any critical details.

-

Is there a fee to file the Bill of Sale?

There is no fee to file a Bill of Sale in Michigan; however, if you plan to register the tractor with the state, there may be fees associated with registration and title transfer.

-

How does the Bill of Sale affect tractor registration?

The Bill of Sale is often required when registering the tractor in the new owner's name. It provides proof of ownership, which is necessary for the title transfer process.

-

What should I do if I lose the Bill of Sale?

If the Bill of Sale is lost, it is advisable to create a new one with the same details and have both parties sign it again. This helps maintain a clear record of the transaction.

-

Are there any specific state laws regarding the Bill of Sale?

While Michigan does not have specific laws governing the Bill of Sale, it is important to ensure that the document is accurate and includes all relevant details to avoid any future complications.

-

Where can I obtain a Michigan Tractor Bill of Sale form?

You can find a Michigan Tractor Bill of Sale form at various online resources, including state government websites and legal form providers. It is also possible to draft one using templates available online.

Misconceptions

The Michigan Tractor Bill of Sale form is an important document for anyone buying or selling a tractor in Michigan. However, there are several misconceptions surrounding this form that can lead to confusion. Here are nine common misconceptions:

- It is not required for all tractor sales. Many people believe that a bill of sale is only necessary for high-value transactions. In reality, even for lower-value sales, having a bill of sale provides proof of ownership and can help avoid disputes.

- It must be notarized. Some assume that notarization is mandatory for the Tractor Bill of Sale. While notarization can add an extra layer of authenticity, it is not a requirement in Michigan.

- Only the seller needs to sign it. A common misconception is that only the seller's signature is necessary. Both the buyer and seller should sign the document to ensure that both parties agree to the terms of the sale.

- It is only for new tractors. Some people think that the bill of sale is only applicable for new tractors. In fact, it is equally important for used tractors, as it documents the transfer of ownership regardless of the tractor's age.

- It can be verbal. Many believe that a verbal agreement is sufficient for the sale of a tractor. However, having a written bill of sale protects both parties and provides clear evidence of the transaction.

- All information must be filled out perfectly. Some individuals worry about making mistakes on the form. While it is important to provide accurate information, minor errors can often be corrected without invalidating the document.

- It is only useful for private sales. There is a misconception that the bill of sale is only relevant for private transactions. However, it can also be useful in sales through dealerships or auctions as a record of the transaction.

- It does not need to be kept after the sale. Some people think that once the sale is complete, the bill of sale can be discarded. In reality, it is advisable to keep a copy for future reference, especially for tax purposes or if any disputes arise.

- It does not affect registration. Lastly, many believe that the bill of sale has no bearing on the registration process. However, it is often required when registering the tractor in the new owner's name, making it a crucial part of the process.

Understanding these misconceptions can help ensure a smoother transaction when buying or selling a tractor in Michigan. It is always best to be informed and prepared when dealing with any legal documents.

Common mistakes

-

Failing to include the complete names of both the buyer and the seller. It is essential to provide full legal names to avoid any confusion.

-

Not providing the correct vehicle identification number (VIN). The VIN must match the number on the tractor to ensure accurate identification.

-

Omitting the date of sale. This information is crucial for establishing the timeline of the transaction.

-

Neglecting to indicate the purchase price. This detail is important for both parties and may be necessary for tax purposes.

-

Using incomplete addresses for the buyer and seller. Full addresses help in verifying identities and can prevent future disputes.

-

Not signing the form. Both parties must provide their signatures to validate the transaction.

-

Forgetting to include any warranties or conditions related to the sale. If there are specific terms, they should be clearly stated.

-

Submitting the form without notarization when required. Certain transactions may necessitate a notary to confirm the authenticity of the signatures.

-

Failing to keep a copy of the completed form for personal records. Both parties should retain a copy for their own documentation.

Find Some Other Tractor Bill of Sale Forms for Specific States

How to Transfer Ownership of a Tractor - Should be kept as a record of ownership for future reference.

To further clarify the process, individuals engaging in the sale of a motorcycle should utilize the New York Motorcycle Bill of Sale form to ensure all necessary details are documented. This crucial document not only serves as proof of purchase but also helps avoid potential disputes, making transactions more straightforward. For convenience, the form can be accessed at https://documentonline.org/blank-new-york-motorcycle-bill-of-sale/.

Do Tractors Need to Be Registered - Can clarify the sale as being “as is” or with specific guarantees.

Is Bill of Sale Same as Title - Ensures compliance with state requirements for vehicle sales.

Farm Equipment Bill of Sale - A document to record the sale of a tractor between a seller and a buyer.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Tractor Bill of Sale form serves as a legal document to transfer ownership of a tractor from one party to another. |

| Governing Law | This form is governed by the Michigan Vehicle Code, specifically MCL 257.233. |

| Required Information | The form requires details such as the seller's and buyer's names, addresses, and signatures, along with the tractor's make, model, and VIN. |

| Notarization | While notarization is not required, having the document notarized can provide additional legal protection. |

| Use in Registration | The completed Bill of Sale can be used to register the tractor with the Michigan Secretary of State. |

| Sales Tax | Sales tax may apply to the transaction, and it is the buyer's responsibility to pay it when registering the tractor. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records to avoid disputes in the future. |

| Condition of Tractor | The form typically includes a section where the seller can disclose the condition of the tractor, helping to inform the buyer. |

| Transfer of Liability | Once the Bill of Sale is signed, the seller may be relieved of liability for the tractor, provided that the buyer registers it promptly. |

Similar forms

The Michigan Vehicle Bill of Sale is similar to the Tractor Bill of Sale in that both documents serve as proof of a transaction involving a vehicle. This form typically includes details such as the buyer and seller's names, the vehicle's identification number (VIN), and the sale price. Just like the Tractor Bill of Sale, the Vehicle Bill of Sale helps protect both parties by providing a clear record of the sale. Additionally, it can be used to register the vehicle with the state, ensuring that ownership is officially transferred and documented.

When dealing with legal documents like those mentioned, it's crucial to understand the implications and requirements of each one. Just as various Bill of Sale forms serve to facilitate the transfer of ownership, the Texas Durable Power of Attorney form allows individuals to designate a trusted person to manage their financial matters. For further guidance on this important legal instrument, visit OnlineLawDocs.com.

The Boat Bill of Sale also shares similarities with the Tractor Bill of Sale. This document is used when a boat is sold, and it contains essential information about the buyer, seller, and the boat itself, such as the hull identification number and sale price. Both documents serve to confirm that a sale has occurred and protect the interests of both parties involved. They also provide a necessary record for registration purposes, ensuring that ownership is properly transferred to the new owner.