Valid Michigan Quitclaim Deed Template

The Michigan Quitclaim Deed form serves as a crucial legal instrument in real estate transactions, allowing property owners to transfer their interest in a property to another party without guaranteeing the title's validity. This form is particularly useful in situations such as family transfers, divorces, or when a property is being conveyed between parties who trust one another. Unlike other types of deeds, such as warranty deeds, the quitclaim deed offers no warranties regarding the property's title, meaning the grantor does not promise that the title is free of claims or encumbrances. This lack of warranty makes it essential for the grantee to conduct thorough due diligence before accepting the property. Furthermore, the Michigan Quitclaim Deed must be completed with specific information, including the names of both the grantor and grantee, a legal description of the property, and the date of transfer. Once executed, the deed must be filed with the county register of deeds to ensure that the transfer is officially recorded, providing public notice of the change in ownership. Understanding the implications and requirements of this form can help individuals navigate the complexities of property transfers in Michigan effectively.

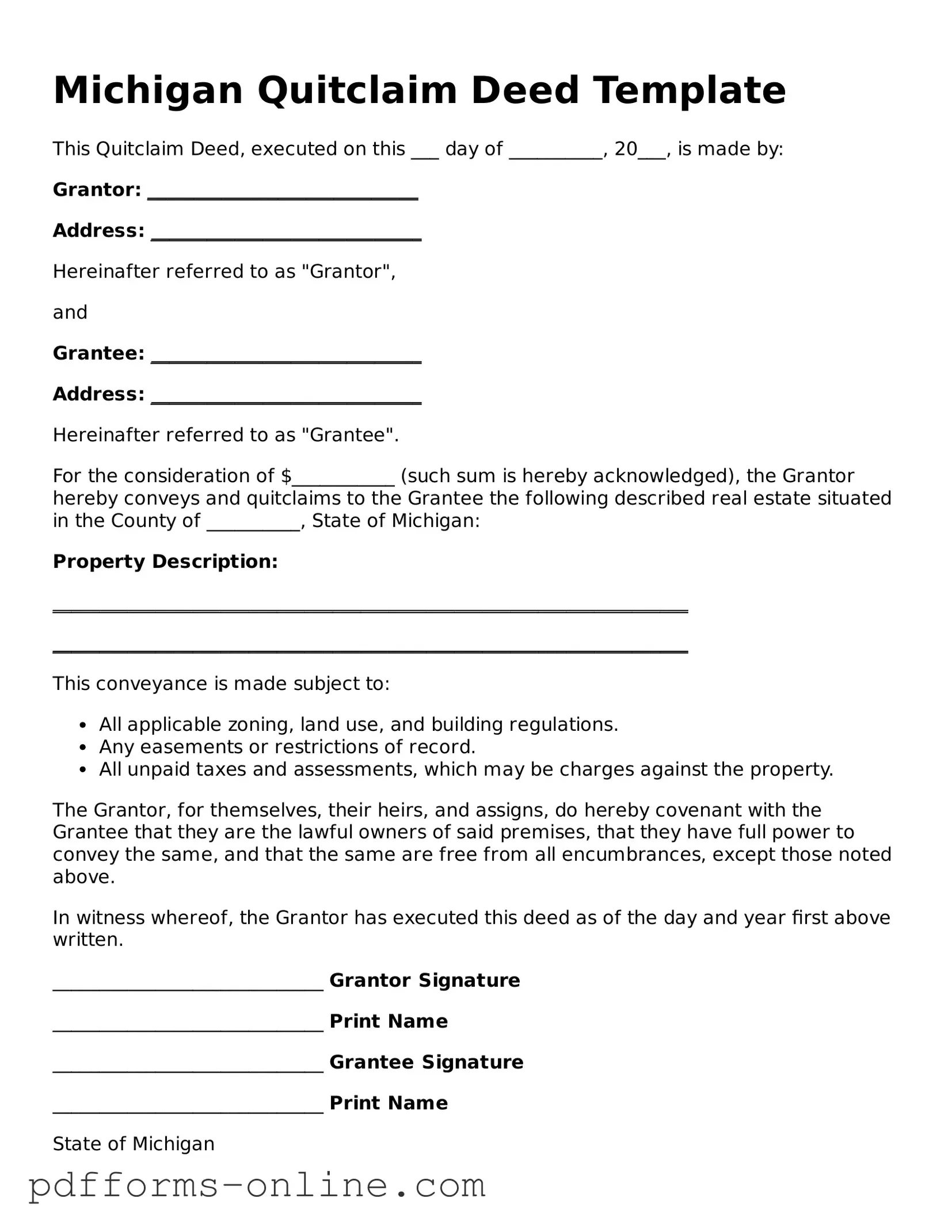

Document Example

Michigan Quitclaim Deed Template

This Quitclaim Deed, executed on this ___ day of __________, 20___, is made by:

Grantor: _____________________________

Address: _____________________________

Hereinafter referred to as "Grantor",

and

Grantee: _____________________________

Address: _____________________________

Hereinafter referred to as "Grantee".

For the consideration of $___________ (such sum is hereby acknowledged), the Grantor hereby conveys and quitclaims to the Grantee the following described real estate situated in the County of __________, State of Michigan:

Property Description:

____________________________________________________________________

____________________________________________________________________

This conveyance is made subject to:

- All applicable zoning, land use, and building regulations.

- Any easements or restrictions of record.

- All unpaid taxes and assessments, which may be charges against the property.

The Grantor, for themselves, their heirs, and assigns, do hereby covenant with the Grantee that they are the lawful owners of said premises, that they have full power to convey the same, and that the same are free from all encumbrances, except those noted above.

In witness whereof, the Grantor has executed this deed as of the day and year first above written.

_____________________________ Grantor Signature

_____________________________ Print Name

_____________________________ Grantee Signature

_____________________________ Print Name

State of Michigan

County of _______________

On this ___ day of __________, 20___, before me, a Notary Public, personally appeared ________________________ and _________________________, who acknowledged that they executed the foregoing instrument for the purposes therein contained.

Notary Public

_____________________________ Signature

_____________________________ Printed Name

My commission expires: _______________

This document should be recorded in the office of the County Register of Deeds in the county where the property is located.

Frequently Asked Questions

-

What is a Quitclaim Deed in Michigan?

A Quitclaim Deed is a legal document used to transfer ownership of real estate in Michigan. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor may have in the property at the time of the transfer. This makes it a common choice for transferring property between family members or in situations where the parties know each other well.

-

When should I use a Quitclaim Deed?

Consider using a Quitclaim Deed in situations such as:

- Transferring property between family members, such as parents to children.

- Clearing up title issues, like removing a former spouse’s name after a divorce.

- Transferring property into a trust or business entity.

- Making a gift of property without the need for a sale.

However, it’s important to understand that a Quitclaim Deed does not provide any warranties or guarantees about the property’s title.

-

What information is required on a Michigan Quitclaim Deed?

A valid Quitclaim Deed in Michigan must include the following information:

- The names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A legal description of the property being transferred.

- The date of the transfer.

- The signature of the grantor, which must be notarized.

Including this information ensures that the deed is legally binding and can be recorded with the county register of deeds.

-

How do I record a Quitclaim Deed in Michigan?

To record a Quitclaim Deed in Michigan, follow these steps:

- Complete the Quitclaim Deed form with all required information.

- Have the grantor sign the deed in the presence of a notary public.

- Submit the signed and notarized deed to the county register of deeds office in the county where the property is located.

- Pay any applicable recording fees, which may vary by county.

Recording the deed provides public notice of the transfer and protects the grantee’s interest in the property.

Misconceptions

When it comes to the Michigan Quitclaim Deed form, several misconceptions can lead to confusion for property owners and buyers alike. Understanding the truth behind these misconceptions can help individuals make informed decisions regarding property transfers. Below is a list of common misconceptions along with clarifications.

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed guarantees a complete transfer of ownership. However, it only transfers the interest that the grantor has in the property at the time of the transfer. If the grantor has no legal claim to the property, the recipient receives nothing.

- A Quitclaim Deed Provides Warranty of Title. Some people think that a quitclaim deed comes with a warranty or guarantee that the title is clear. In reality, this type of deed offers no warranties. It simply conveys whatever interest the grantor possesses, which may include liens or other encumbrances.

- Quitclaim Deeds Are Only for Family Transfers. While quitclaim deeds are often used in family transactions, they are not limited to such situations. They can be used in various contexts, including divorce settlements, business partnerships, or any situation where the parties agree to transfer property interests.

- Using a Quitclaim Deed is Complicated. Some individuals perceive the process of using a quitclaim deed as overly complicated. In fact, the process can be straightforward. It typically requires filling out the form, signing it, and then filing it with the appropriate county office. However, understanding the implications of the transfer is crucial.

- A Quitclaim Deed is the Same as a Warranty Deed. Many people mistakenly believe that a quitclaim deed functions the same way as a warranty deed. The key difference lies in the protections offered. A warranty deed guarantees that the grantor holds clear title to the property and will defend against any claims, while a quitclaim deed does not offer such assurances.

By dispelling these misconceptions, individuals can better navigate the complexities of property transfers in Michigan. It is always advisable to seek professional guidance when dealing with legal documents to ensure that all parties understand their rights and responsibilities.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Both the grantor and grantee must be clearly identified, including full names and addresses. Omitting any of this information can lead to confusion or disputes later.

-

Incorrect Property Description: Accurately describing the property is crucial. Many individuals mistakenly include vague or incomplete descriptions, which can complicate future property transactions. It’s essential to use the legal description found in the property’s deed.

-

Not Notarizing the Document: A quitclaim deed must be notarized to be valid. Some people forget this step, which can render the document ineffective. Without a notary’s signature, the deed may not be accepted by the county register of deeds.

-

Improper Execution: The deed must be signed by the grantor, and in some cases, witnesses may be required. Neglecting to follow these requirements can lead to issues with the deed’s validity.

-

Failing to File the Deed: After completing the form, it’s important to file it with the appropriate county office. Some individuals mistakenly believe that simply signing the deed is sufficient. Without proper filing, the transfer of ownership is not officially recorded.

-

Ignoring Tax Implications: Many overlook potential tax consequences associated with transferring property. Understanding how a quitclaim deed may affect property taxes is vital to avoid unexpected financial burdens.

-

Not Seeking Legal Advice: Finally, some individuals attempt to complete the quitclaim deed without consulting a legal professional. This can lead to errors or misunderstandings about the implications of the deed. Seeking guidance can help ensure all aspects are properly addressed.

Find Some Other Quitclaim Deed Forms for Specific States

Quit Deed Form Texas - By utilizing this deed, parties can minimize the time typically needed for transfers.

To create a well-structured and informative workplace environment, it is essential for businesses to utilize resources like the Arizona Employee Handbook. This document not only clarifies company policies and expectations but also enhances employee understanding of their roles. Employers can ensure that everyone is on the same page by properly filling out the Employee Handbook form. For more information on various necessary documents, you can refer to All Arizona Forms.

How to File a Quitclaim Deed in California - Use this form when you want to relinquish your claim to a property quietly.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any guarantees about the title. |

| Governing Law | The Michigan Quitclaim Deed is governed by the Michigan Compiled Laws, specifically MCL 565.25. |

| Parties Involved | The form involves two parties: the grantor (seller) and the grantee (buyer). |

| No Warranty | Quitclaim deeds do not provide any warranties or guarantees regarding the property title. |

| Use Cases | Commonly used among family members, in divorce settlements, or to clear up title issues. |

| Filing Requirements | To be valid, the deed must be signed by the grantor and acknowledged before a notary public. |

| Recording | It is recommended to record the quitclaim deed with the county register of deeds to provide public notice of the transfer. |

| Tax Implications | While a quitclaim deed itself does not incur transfer taxes, it may have implications for property taxes. |

| Revocation | A quitclaim deed cannot be revoked once executed and recorded without a new deed or legal action. |

| Legal Advice | Consulting with a legal professional is advisable before executing a quitclaim deed to understand the implications. |

Similar forms

The Warranty Deed is a document that provides a guarantee from the seller to the buyer. Unlike the Quitclaim Deed, which transfers ownership without any warranties, the Warranty Deed assures the buyer that the seller holds clear title to the property and has the right to sell it. This document protects the buyer from future claims against the property, making it a more secure option for those looking to purchase real estate.

When purchasing a vehicle in Ohio, it's essential to ensure that the transaction is documented correctly to protect both the buyer and the seller; thus, utilizing the Ohio Motor Vehicle Bill of Sale is highly recommended. This form, which can be found at https://documentonline.org/blank-ohio-motor-vehicle-bill-of-sale, serves as a legal record of the sale and includes details about the vehicle and the parties involved, ensuring clarity and reducing potential disputes in the future.

The Bargain and Sale Deed is another document that shares similarities with the Quitclaim Deed. It conveys property from the seller to the buyer but does not include warranties regarding the title. While the Quitclaim Deed offers no guarantees, the Bargain and Sale Deed implies that the seller has an interest in the property. This type of deed is often used in transactions where the seller does not want to assume any liability for title issues.

A Special Warranty Deed is similar in that it transfers property ownership but provides limited warranties. The seller guarantees that they have not encumbered the property during their ownership, but there are no guarantees regarding prior claims. This document is often used in commercial transactions, where the seller wants to limit their liability while still offering some assurance to the buyer.

The Grant Deed is another document that offers a middle ground between the Quitclaim and Warranty Deeds. It conveys property while providing certain guarantees, such as the assurance that the property has not been sold to someone else. This makes the Grant Deed a more secure option than a Quitclaim Deed, but less comprehensive than a Warranty Deed, providing some protection for the buyer.

The Deed of Trust is somewhat different but still related. It is used to secure a loan with real property as collateral. While it does not transfer ownership in the same way as a Quitclaim Deed, it involves the transfer of an interest in the property to a trustee until the loan is paid off. This document is crucial in real estate transactions involving financing, ensuring that lenders have a claim to the property if the borrower defaults.

Finally, the Affidavit of Title is a document that serves to verify the seller's ownership of the property and any potential encumbrances. While it does not transfer ownership like the Quitclaim Deed, it complements the deed by providing a sworn statement about the property's title. This document can help alleviate concerns for buyers, especially in transactions involving Quitclaim Deeds, by confirming the seller's claims about their ownership.