Valid Michigan Promissory Note Template

In the realm of financial transactions, a promissory note serves as a vital instrument for establishing a clear understanding between a borrower and a lender. Specifically in Michigan, this form outlines the terms under which money is borrowed and the obligations that accompany the loan. Essential components of the Michigan Promissory Note include the principal amount borrowed, the interest rate, and the repayment schedule, all of which are crucial for both parties to comprehend their responsibilities. Additionally, the document may specify any collateral involved, ensuring that the lender has a form of security should the borrower default on the agreement. The note also typically includes provisions for late fees and the consequences of non-payment, which further protect the lender’s interests. By providing a structured framework for the loan, the Michigan Promissory Note not only facilitates trust but also promotes accountability in financial dealings, making it an indispensable tool in personal and business finance alike.

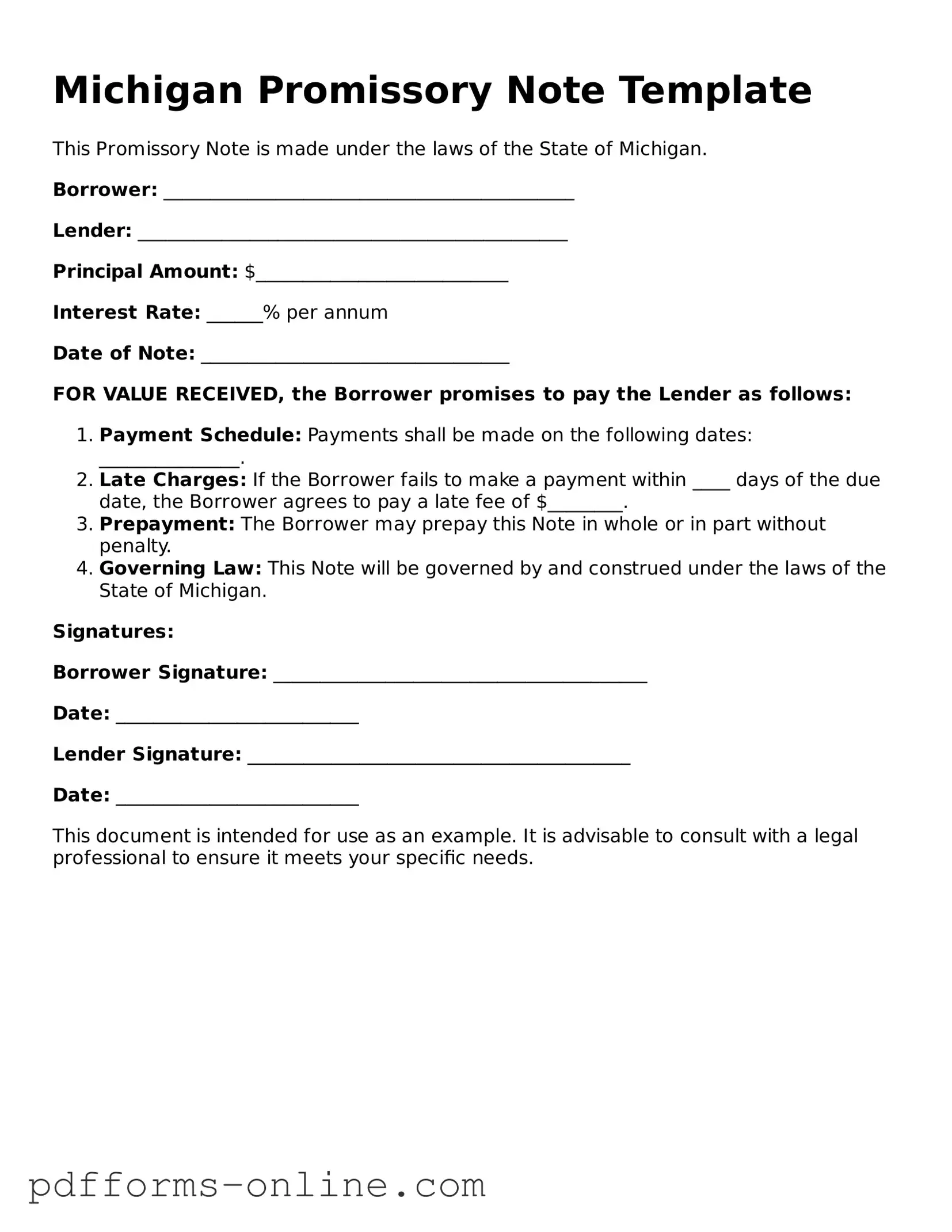

Document Example

Michigan Promissory Note Template

This Promissory Note is made under the laws of the State of Michigan.

Borrower: ____________________________________________

Lender: ______________________________________________

Principal Amount: $___________________________

Interest Rate: ______% per annum

Date of Note: _________________________________

FOR VALUE RECEIVED, the Borrower promises to pay the Lender as follows:

- Payment Schedule: Payments shall be made on the following dates: _______________.

- Late Charges: If the Borrower fails to make a payment within ____ days of the due date, the Borrower agrees to pay a late fee of $________.

- Prepayment: The Borrower may prepay this Note in whole or in part without penalty.

- Governing Law: This Note will be governed by and construed under the laws of the State of Michigan.

Signatures:

Borrower Signature: ________________________________________

Date: __________________________

Lender Signature: _________________________________________

Date: __________________________

This document is intended for use as an example. It is advisable to consult with a legal professional to ensure it meets your specific needs.

Frequently Asked Questions

-

What is a Michigan Promissory Note?

A Michigan Promissory Note is a legal document in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the amount borrowed, the interest rate, repayment schedule, and any other relevant conditions.

-

What information is included in a Promissory Note?

The note typically includes the names and addresses of both the borrower and lender, the principal amount, interest rate, repayment terms, due dates, and any penalties for late payments. It may also specify whether the loan is secured or unsecured.

-

Do I need to have a lawyer review my Promissory Note?

While it is not legally required to have a lawyer review your Promissory Note, doing so can be beneficial. A legal professional can help ensure that the document complies with Michigan law and that your interests are adequately protected.

-

How is a Promissory Note enforced?

If the borrower fails to repay the loan as agreed, the lender can enforce the Promissory Note through legal action. This may involve filing a lawsuit to recover the owed amount. Courts typically uphold the terms of the note, provided it is clear and legally valid.

-

Can I modify a Promissory Note after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement to avoid future disputes.

-

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is a legally binding contract. Both parties are obligated to adhere to the terms outlined in the document. If either party fails to comply, the other party may seek legal remedies.

-

What happens if I lose my Promissory Note?

If you lose your Promissory Note, it is important to notify the other party as soon as possible. You may need to create a replacement note or a written acknowledgment of the debt. Keeping records of payments and communications can also help clarify the situation.

Misconceptions

Understanding the Michigan Promissory Note form is essential for both lenders and borrowers. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this financial document.

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the specific agreement between the parties involved.

- A Michigan Promissory Note Must Be Notarized: Some individuals think that notarization is a requirement for all promissory notes. However, while notarization can add a layer of authenticity, it is not legally required in Michigan.

- Only Financial Institutions Can Issue Promissory Notes: A common misconception is that only banks and financial institutions can create these documents. In fact, any individual or entity can draft a promissory note as long as it meets the legal requirements.

- Promissory Notes Are Only for Large Loans: Many people associate promissory notes with significant financial transactions. However, they can be used for loans of any size, including small personal loans between friends or family members.

- Verbal Agreements Are Sufficient: Some assume that a verbal agreement is enough to establish a loan. In reality, having a written promissory note provides clear evidence of the terms and helps avoid disputes.

- Interest Rates Must Be Included: A misconception exists that all promissory notes must specify an interest rate. While it is common to include interest, it is not mandatory; a note can be structured as an interest-free loan.

- Once Signed, a Promissory Note Cannot Be Changed: Some believe that the terms of a signed promissory note are set in stone. However, parties can agree to modify the terms as long as both sides consent to the changes.

- Promissory Notes Are Only for Personal Loans: There is a belief that these documents are solely for personal loans. In fact, they are also widely used in business transactions, including commercial loans and investment agreements.

- Defaulting on a Promissory Note Has No Consequences: Many think that failing to repay a loan documented by a promissory note is without repercussions. In reality, defaulting can lead to legal action and damage to credit ratings.

- All Promissory Notes Are Enforceable: Some individuals assume that every promissory note is automatically enforceable. However, for a note to be enforceable, it must meet specific legal criteria and be properly executed.

Clarifying these misconceptions can aid individuals in making informed decisions regarding their financial agreements. Understanding the nuances of the Michigan Promissory Note form is crucial for both lenders and borrowers.

Common mistakes

-

Incorrect Names: Individuals often misspell their names or use nicknames instead of their legal names. This can lead to issues with enforceability.

-

Missing Dates: Failing to include the date when the note is signed can create confusion about when the agreement takes effect.

-

Inaccurate Loan Amount: Entering the wrong loan amount is a common error. It is crucial to double-check this figure to avoid disputes later.

-

Omitting Payment Terms: Not clearly stating the repayment schedule can lead to misunderstandings. Specify how and when payments will be made.

-

Neglecting Interest Rate: If applicable, failing to include an interest rate can affect the total amount owed. Clearly outline this information.

-

Not Including Signatures: Both parties must sign the document. Forgetting to obtain a signature can render the note invalid.

-

Ignoring Witnesses or Notarization: Some situations require a witness or notarization. Failing to follow these requirements can impact the note's legality.

-

Using Ambiguous Language: Vague terms can lead to different interpretations. Use clear and precise language to ensure mutual understanding.

-

Not Keeping Copies: After filling out the form, individuals often forget to make copies. Retaining a copy is essential for future reference.

Find Some Other Promissory Note Forms for Specific States

California Promissory Note Requirements - The document can state the jurisdiction under which any disputes will be settled.

Online Promissory Note - Promissory notes can be useful for both large and small loans.

Promissory Note for Personal Loan - Late fees can be included in the agreement for missed payments, providing further protection for the lender.

To streamline the application process, prospective tenants can utilize a well-structured resource that highlights the importance of completing the Rental Application accurately and thoroughly. For a more efficient submission, consider our guide on how to fill out the Rental Application form effectively.

Promissory Note Template Ohio - The original note is often referred to as the wet ink version until it is digitized or copied.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Michigan Uniform Commercial Code (UCC) governs promissory notes in Michigan. |

| Parties Involved | The two main parties involved are the maker (the person who promises to pay) and the payee (the person who receives the payment). |

| Interest Rate | Promissory notes can specify an interest rate. If not stated, the legal rate of interest applies. |

| Payment Terms | Payment terms must be clearly outlined, including the amount due and the due date. |

| Signature Requirement | The note must be signed by the maker to be legally binding. |

| Transferability | Promissory notes can be transferred to another party, making them negotiable instruments. |

| Default Consequences | If the maker fails to pay, the payee can take legal action to recover the owed amount. |

| State-Specific Form | While Michigan does not require a specific form, using a standard template is advisable for clarity and compliance. |

Similar forms

The Michigan Promissory Note is similar to a Loan Agreement, which outlines the terms of a loan between a lender and a borrower. While a promissory note focuses on the borrower's promise to repay the loan, a loan agreement provides a more comprehensive overview, detailing the loan amount, interest rate, repayment schedule, and any collateral involved. Both documents serve to protect the lender's interests, but the loan agreement often includes additional clauses regarding default and remedies, making it a more extensive legal instrument.

Another document that shares similarities with the Michigan Promissory Note is the Mortgage. A mortgage is a specific type of loan secured by real estate, where the property serves as collateral for the loan. Like a promissory note, a mortgage includes the borrower's commitment to repay the loan, but it also outlines the lender's rights to the property in case of default. Both documents are essential in real estate transactions, ensuring that the lender has a legal claim to the property until the loan is fully repaid.

The Arizona Employee Handbook form serves as an essential resource for businesses, ensuring that both employers and employees are well-informed about workplace standards. By outlining the company's policies and expectations clearly, it creates a framework for a harmonious work environment. For those in Arizona looking to streamline their operations, the importance of completing the Employee Handbook form cannot be understated. For more information on this process, you can access All Arizona Forms.

The Secured Note is another document akin to the Michigan Promissory Note. This type of note is backed by collateral, which provides the lender with additional security. In a secured note, if the borrower fails to repay, the lender can claim the specified collateral. This adds a layer of protection for the lender, similar to how a promissory note guarantees repayment but with the added assurance of collateral backing the promise.

A Credit Agreement also bears similarities to the Michigan Promissory Note. This document governs the terms under which a borrower can access credit from a lender. While a promissory note focuses on a specific loan, a credit agreement may cover multiple loans or lines of credit, detailing the terms of borrowing, interest rates, and repayment obligations. Both documents establish a formal relationship between the borrower and lender, ensuring that both parties understand their rights and responsibilities.

The Installment Agreement is another document that resembles the Michigan Promissory Note. An installment agreement outlines a repayment plan where the borrower agrees to pay back the loan in a series of scheduled payments over time. Like a promissory note, it includes the total loan amount and interest rate, but it emphasizes the payment structure. This type of agreement is particularly useful for borrowers who need a clear plan for repayment and helps lenders track payments effectively.

Lastly, the Personal Guarantee is similar to a Michigan Promissory Note in that it involves a commitment to repay a debt. However, this document specifically involves a third party who agrees to take responsibility for the debt if the primary borrower defaults. While a promissory note binds the borrower to repay the loan, a personal guarantee adds another layer of accountability, ensuring that lenders have recourse to recover their funds even if the original borrower fails to meet their obligations.