Valid Michigan Operating Agreement Template

The Michigan Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating in the state. This form outlines the management structure, roles, and responsibilities of members, ensuring clarity and reducing potential conflicts. It typically includes provisions on how profits and losses will be distributed, the process for adding or removing members, and the procedures for decision-making. Additionally, the agreement may address how disputes will be resolved and the terms for dissolving the LLC if necessary. By establishing these guidelines, the Operating Agreement not only protects the interests of all members but also provides a solid foundation for the company’s operations. Understanding the key components of this form is essential for anyone looking to form or manage an LLC in Michigan.

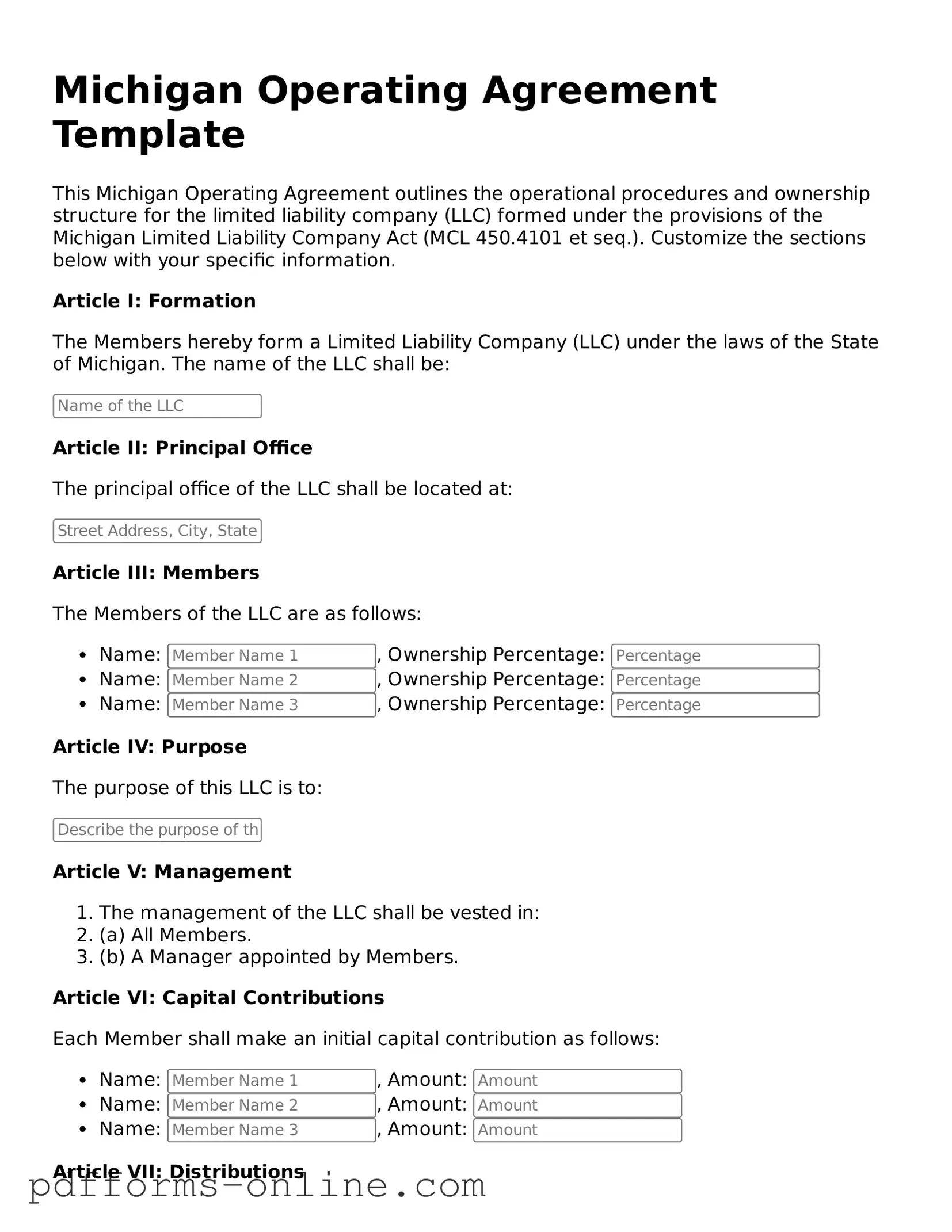

Document Example

Michigan Operating Agreement Template

This Michigan Operating Agreement outlines the operational procedures and ownership structure for the limited liability company (LLC) formed under the provisions of the Michigan Limited Liability Company Act (MCL 450.4101 et seq.). Customize the sections below with your specific information.

Article I: Formation

The Members hereby form a Limited Liability Company (LLC) under the laws of the State of Michigan. The name of the LLC shall be:

Article II: Principal Office

The principal office of the LLC shall be located at:

Article III: Members

The Members of the LLC are as follows:

- Name: , Ownership Percentage:

- Name: , Ownership Percentage:

- Name: , Ownership Percentage:

Article IV: Purpose

The purpose of this LLC is to:

Article V: Management

- The management of the LLC shall be vested in:

- (a) All Members.

- (b) A Manager appointed by Members.

Article VI: Capital Contributions

Each Member shall make an initial capital contribution as follows:

- Name: , Amount:

- Name: , Amount:

- Name: , Amount:

Article VII: Distributions

Distributions of profits and losses shall be made according to each Member's ownership percentage as outlined in Article III.

Article VIII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article IX: Dissolution

The LLC may be dissolved upon the occurrence of any of the following events:

- The Members agree to dissolve the LLC.

- A judicial decree is obtained for dissolution.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the ___ day of __________, 20__.

___________________________

(Member Name 1)

___________________________

(Member Name 2)

___________________________

(Member Name 3)

Frequently Asked Questions

-

What is a Michigan Operating Agreement?

A Michigan Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Michigan. It serves as an internal guideline for how the LLC will function, detailing the rights and responsibilities of its members. While not required by law, having an Operating Agreement is highly recommended as it helps prevent misunderstandings among members and provides a clear framework for decision-making.

-

Why do I need an Operating Agreement for my LLC?

Having an Operating Agreement is crucial for several reasons. First, it establishes the rules and procedures for your LLC, ensuring everyone is on the same page. Second, it helps protect your limited liability status by demonstrating that your LLC is a separate entity from its members. Lastly, in the event of disputes or changes in membership, an Operating Agreement provides a reference point for resolving issues, which can save time and money.

-

What should be included in a Michigan Operating Agreement?

Your Operating Agreement should cover several key areas, including:

- Member information: Names and addresses of all members.

- Management structure: Whether the LLC will be member-managed or manager-managed.

- Voting rights: How decisions will be made and what constitutes a quorum.

- Profit and loss distribution: How profits and losses will be shared among members.

- Membership changes: Procedures for adding or removing members.

- Dissolution: Steps for dissolving the LLC if necessary.

Including these elements can help ensure that your LLC operates smoothly and that all members are aware of their roles and responsibilities.

-

Do I need a lawyer to create an Operating Agreement?

While it is not mandatory to hire a lawyer to draft your Operating Agreement, consulting with one can be beneficial. A lawyer can provide tailored advice based on your specific business needs and help you navigate any complexities. If your LLC has multiple members or if you anticipate potential disputes, seeking legal assistance may be a wise investment.

-

Can I change my Operating Agreement after it has been created?

Yes, you can amend your Operating Agreement after it has been created. It is important to follow the amendment procedures outlined in the original document. Typically, this requires a vote among members or written consent. Keeping your Operating Agreement up to date is essential as your business evolves, ensuring that it reflects current practices and agreements among members.

-

Is the Operating Agreement filed with the state?

No, the Operating Agreement is not filed with the state of Michigan. It is an internal document that remains with the LLC. However, it is advisable to keep it in a safe place and share copies with all members. Having an easily accessible Operating Agreement can facilitate smooth operations and decision-making within your LLC.

Misconceptions

Understanding the Michigan Operating Agreement form is essential for anyone involved in a limited liability company (LLC) in Michigan. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- 1. An Operating Agreement is not necessary. Many believe that an Operating Agreement is optional for LLCs in Michigan. While it is not required by law, having one is highly advisable. It helps define the management structure and can prevent disputes among members.

- 2. The Operating Agreement must be filed with the state. Some people think that the Operating Agreement needs to be submitted to the state of Michigan. In reality, this document is kept internally and does not need to be filed. This allows for privacy and flexibility in how the LLC operates.

- 3. All members must sign the Operating Agreement. It is a common belief that every member of the LLC must sign the Operating Agreement for it to be valid. While it is best practice to have all members sign, the agreement can still be enforceable even if not all signatures are present, provided there is a clear understanding among the members.

- 4. The Operating Agreement cannot be changed. Some individuals think that once an Operating Agreement is created, it cannot be modified. In fact, it can be amended as needed, allowing the LLC to adapt to changes in membership or business needs, as long as the process for amendments is outlined in the agreement itself.

- 5. The Operating Agreement is only for multi-member LLCs. There is a misconception that Operating Agreements are only necessary for LLCs with multiple members. However, even single-member LLCs benefit from having an Operating Agreement, as it establishes the owner's rights and responsibilities and can help with personal liability protection.

- 6. The Operating Agreement covers all legal aspects of the LLC. Some people assume that the Operating Agreement addresses every legal issue the LLC might encounter. While it is a vital document, it does not replace the need for compliance with state laws or other legal requirements. It is important to understand that the Operating Agreement is just one piece of the overall legal framework for the LLC.

By addressing these misconceptions, LLC members can better understand the importance of the Michigan Operating Agreement and how it can serve their business interests.

Common mistakes

-

Neglecting to include all members: It's crucial to list all members of the LLC. Omitting a member can lead to disputes and confusion in the future.

-

Inaccurate member contributions: Ensure that each member's financial contributions are correctly documented. Mistakes here can affect ownership percentages and profit distributions.

-

Vague purpose statement: The purpose of the LLC should be clearly defined. A vague statement can create legal issues or misunderstandings about the business's direction.

-

Improper voting rights: Clearly outline the voting rights of each member. Failing to do so can lead to conflicts when important decisions need to be made.

-

Ignoring state-specific requirements: Each state has its own rules regarding operating agreements. Not adhering to Michigan's specific requirements can render the agreement ineffective.

-

Not including a dispute resolution process: Having a plan for resolving disputes is essential. Without it, conflicts can escalate and harm the business.

-

Failing to update the agreement: As the business evolves, so should the operating agreement. Regularly reviewing and updating the document is necessary to reflect changes in membership or structure.

Find Some Other Operating Agreement Forms for Specific States

Nys Llc Operating Agreement Template - It can set forth the process for adding new members to the business.

The Florida Promissory Note is a vital document for anyone looking to secure a loan, as it clearly stipulates the terms of repayment. For those seeking guidance on this important agreement, our guide on how to fill out the Promissory Note form will provide clarity and ensure all necessary details are included. You can explore this resource at your essential Promissory Note form guide.

Single Member Llc Operating Agreement Illinois - It helps ensure compliance with state regulations regarding LLC formation.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | The Michigan Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Michigan. |

| Governing Law | This agreement is governed by the Michigan Limited Liability Company Act, specifically Act 23 of 1993. |

| Purpose | It serves to clarify the roles of members and managers, specify how profits and losses are distributed, and establish procedures for decision-making. |

| Flexibility | The agreement allows for significant flexibility in how the LLC is managed and can be tailored to fit the specific needs of its members. |

| Member Rights | It outlines the rights and responsibilities of each member, including voting rights and capital contributions. |

| Amendments | Members can amend the operating agreement as needed, provided they follow the procedures outlined within the document. |

| Not Mandatory | While it is not legally required to have an operating agreement in Michigan, having one is highly recommended to prevent disputes. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which can help avoid costly litigation. |

Similar forms

The Michigan Operating Agreement is similar to the Partnership Agreement. Both documents outline the structure and operational procedures of a business entity. A Partnership Agreement specifically addresses the roles and responsibilities of partners, profit-sharing arrangements, and decision-making processes. Like the Operating Agreement, it serves to clarify expectations and reduce disputes among the parties involved.

In the realm of business formation, understanding the essential documents is key to ensuring smooth operations and compliance with state laws. For those planning to incorporate in Arizona, it is vital to familiarize yourself with the necessary forms, such as the Articles of Incorporation. This form lays the foundation for your corporation by detailing its structure and purpose. For convenience and further guidance, you can find resources on All Arizona Forms, which will help you navigate the incorporation process effectively.

Another document that shares similarities is the Limited Liability Company (LLC) Formation Document. This document is essential for establishing an LLC and includes basic information such as the business name, address, and registered agent. While the LLC Formation Document lays the groundwork for the business, the Operating Agreement provides detailed governance and operational guidelines for the LLC's members.

The Bylaws of a corporation also resemble the Michigan Operating Agreement. Bylaws govern the internal management of a corporation, detailing the roles of directors and officers, meeting procedures, and voting rights. Both documents aim to ensure smooth operations and clear communication among members or shareholders, thus promoting organizational stability.

A Shareholders’ Agreement is another comparable document. This agreement is used in corporations to define the rights and obligations of shareholders. It covers aspects such as share transfers, voting rights, and dispute resolution. Similar to the Operating Agreement, it seeks to protect the interests of all parties involved and provide a framework for decision-making.

The Joint Venture Agreement is also similar in nature. This document outlines the terms of collaboration between two or more parties for a specific project or business activity. It specifies the contributions, responsibilities, and profit-sharing arrangements of each party. Like the Operating Agreement, it aims to clarify roles and minimize conflicts during the partnership.

The Non-Disclosure Agreement (NDA) can be viewed as related due to its focus on protecting sensitive information. While the Operating Agreement governs internal operations, an NDA ensures that proprietary information shared among members remains confidential. Both documents are crucial for maintaining trust and security within a business entity.

Lastly, the Employment Agreement shares some characteristics with the Michigan Operating Agreement. This document outlines the terms of employment for an individual within a business, detailing job responsibilities, compensation, and termination conditions. Similar to the Operating Agreement, it aims to establish clear expectations and reduce misunderstandings between the employer and employee.