Valid Michigan Last Will and Testament Template

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Michigan, this legal document serves as a guide for distributing your assets, appointing guardians for minor children, and designating an executor to manage your estate. The Michigan Last Will and Testament form includes crucial elements such as the identification of the testator, the declaration of revocation of any prior wills, and clear instructions on how your property should be divided among beneficiaries. Additionally, it allows you to specify any personal wishes, such as funeral arrangements or specific bequests. Understanding the structure and requirements of this form can simplify the process and provide peace of mind, knowing that your loved ones will be taken care of according to your wishes. Whether you are creating a will for the first time or updating an existing one, familiarizing yourself with the Michigan form is a vital step in effective estate planning.

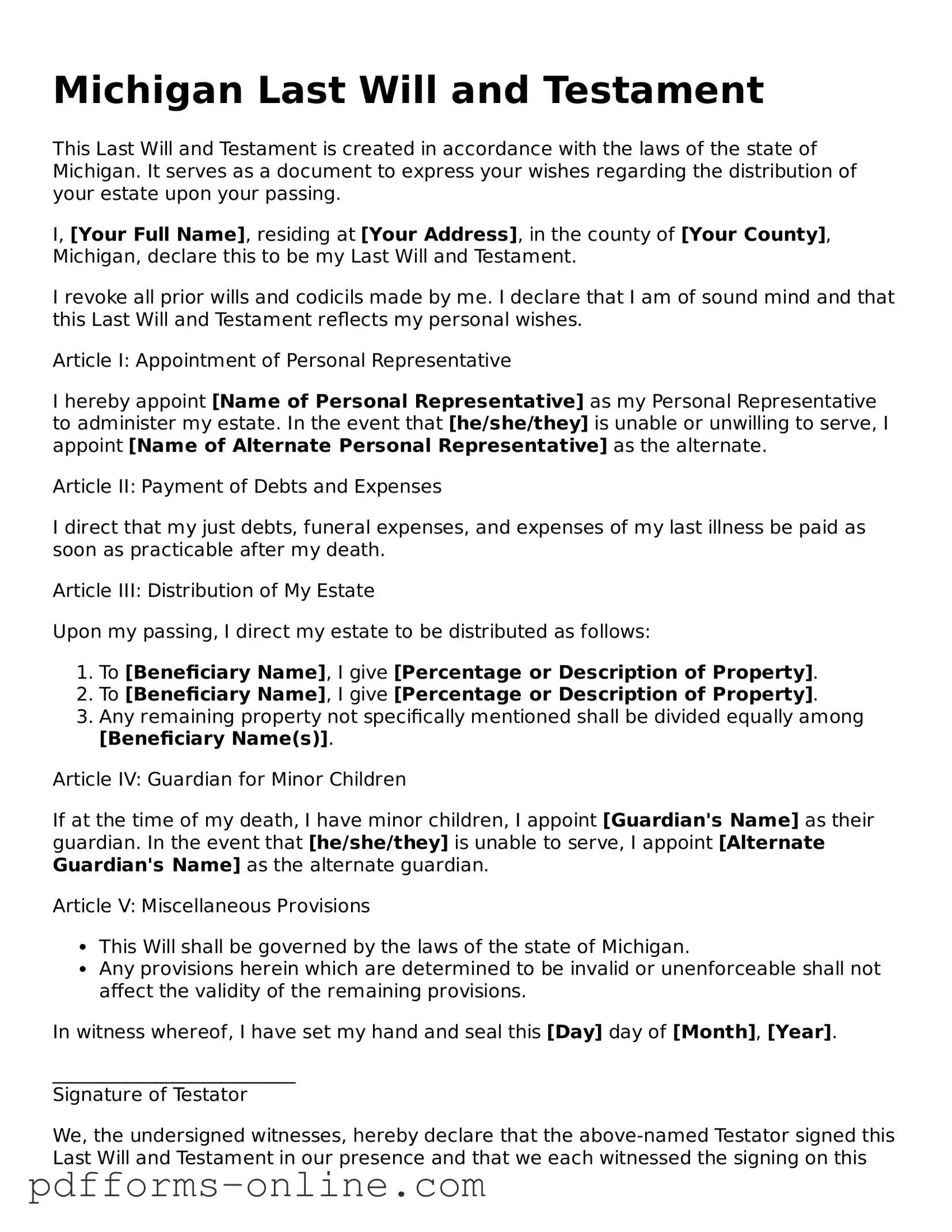

Document Example

Michigan Last Will and Testament

This Last Will and Testament is created in accordance with the laws of the state of Michigan. It serves as a document to express your wishes regarding the distribution of your estate upon your passing.

I, [Your Full Name], residing at [Your Address], in the county of [Your County], Michigan, declare this to be my Last Will and Testament.

I revoke all prior wills and codicils made by me. I declare that I am of sound mind and that this Last Will and Testament reflects my personal wishes.

Article I: Appointment of Personal Representative

I hereby appoint [Name of Personal Representative] as my Personal Representative to administer my estate. In the event that [he/she/they] is unable or unwilling to serve, I appoint [Name of Alternate Personal Representative] as the alternate.

Article II: Payment of Debts and Expenses

I direct that my just debts, funeral expenses, and expenses of my last illness be paid as soon as practicable after my death.

Article III: Distribution of My Estate

Upon my passing, I direct my estate to be distributed as follows:

- To [Beneficiary Name], I give [Percentage or Description of Property].

- To [Beneficiary Name], I give [Percentage or Description of Property].

- Any remaining property not specifically mentioned shall be divided equally among [Beneficiary Name(s)].

Article IV: Guardian for Minor Children

If at the time of my death, I have minor children, I appoint [Guardian's Name] as their guardian. In the event that [he/she/they] is unable to serve, I appoint [Alternate Guardian's Name] as the alternate guardian.

Article V: Miscellaneous Provisions

- This Will shall be governed by the laws of the state of Michigan.

- Any provisions herein which are determined to be invalid or unenforceable shall not affect the validity of the remaining provisions.

In witness whereof, I have set my hand and seal this [Day] day of [Month], [Year].

__________________________

Signature of Testator

We, the undersigned witnesses, hereby declare that the above-named Testator signed this Last Will and Testament in our presence and that we each witnessed the signing on this [Day] day of [Month], [Year].

__________________________

Signature of Witness 1

__________________________

Signature of Witness 2

Frequently Asked Questions

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and property will be distributed after their death. It can also specify guardianship for minor children and other important wishes regarding end-of-life decisions.

-

Why should I have a Last Will and Testament?

Having a Last Will and Testament ensures that your wishes are respected and followed after you pass away. It helps avoid confusion and disputes among family members, and it can streamline the probate process, making it easier for your loved ones to manage your estate.

-

Who can create a Last Will and Testament in Michigan?

In Michigan, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means you should be able to understand the implications of your decisions when drafting your will.

-

What are the requirements for a valid Last Will and Testament in Michigan?

For your will to be valid in Michigan, it must be in writing, signed by you (the testator), and witnessed by at least two individuals who are not beneficiaries. These witnesses must also sign the will in your presence.

-

Can I change my Last Will and Testament after it's been created?

Yes, you can change your Last Will and Testament at any time while you are alive and of sound mind. You can do this by creating a new will or by drafting a document known as a codicil, which amends the original will.

-

What happens if I die without a Last Will and Testament?

If you pass away without a will, your estate will be distributed according to Michigan's intestacy laws. This means the state will determine how your assets are divided, which may not align with your wishes.

-

Can I write my own Last Will and Testament?

Yes, you can write your own Last Will and Testament, but it's important to ensure that it meets all legal requirements to be valid. Consider consulting with a legal professional to ensure your will is properly drafted and executed.

-

How can I ensure my Last Will and Testament is properly executed?

To ensure your will is executed properly, follow these steps: sign the document in front of two witnesses, make sure the witnesses are not beneficiaries, and consider having it notarized. Keeping the will in a safe place and informing your loved ones of its location is also crucial.

-

What should I include in my Last Will and Testament?

Your will should include details about how you want your assets distributed, names of beneficiaries, and any specific bequests. If you have minor children, you should also name a guardian for them. Additionally, consider including instructions for your funeral arrangements.

-

Is a Last Will and Testament the same as a living will?

No, a Last Will and Testament and a living will serve different purposes. A Last Will deals with the distribution of assets after death, while a living will outlines your wishes regarding medical treatment and end-of-life care while you are still alive.

Misconceptions

When it comes to creating a Last Will and Testament in Michigan, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

Misconception 1: A handwritten will is not valid in Michigan.

Many believe that a will must be typed and formally executed to be valid. However, Michigan does recognize handwritten wills, also known as holographic wills, as long as they are signed by the testator and the material provisions are in their handwriting.

-

Misconception 2: You need an attorney to create a valid will.

While consulting an attorney can be beneficial, it is not a legal requirement in Michigan. Individuals can create their own will using templates, as long as they meet the state's legal requirements for execution.

-

Misconception 3: A will automatically goes into effect upon signing.

Some people think that signing a will immediately makes it effective. In reality, a will only takes effect upon the death of the testator, and it must go through the probate process to be enforced.

-

Misconception 4: All assets must be included in the will.

Not all assets need to be mentioned in a will. For instance, assets held in joint tenancy or those with designated beneficiaries, like life insurance policies, pass outside of the will and do not need to be included.

-

Misconception 5: A will can be used to make healthcare decisions.

Some individuals mistakenly believe that a will can dictate healthcare decisions. In Michigan, a separate document, such as a Durable Power of Attorney for Healthcare, is needed to make medical decisions on behalf of someone who is incapacitated.

Common mistakes

-

Not signing the will properly. In Michigan, a will must be signed by the testator, the person creating the will. If the signature is missing or not done in the presence of witnesses, the will may be deemed invalid.

-

Failing to have witnesses present. Michigan law requires that a will be signed in the presence of at least two witnesses. If these witnesses are not present during the signing, the will may not hold up in court.

-

Using outdated forms. Laws can change, and using an outdated version of the Last Will and Testament form may lead to complications. It's essential to ensure that the form is current and complies with Michigan law.

-

Not clearly identifying beneficiaries. Vague language can lead to confusion and disputes. Clearly naming beneficiaries and specifying what each will receive helps avoid potential conflicts among heirs.

-

Neglecting to update the will. Life changes, such as marriage, divorce, or the birth of children, can impact how assets should be distributed. Failing to update the will to reflect these changes can result in unintended consequences.

-

Overlooking the need for a self-proving affidavit. While not mandatory, including a self-proving affidavit can simplify the probate process. This document allows the will to be validated without requiring witnesses to testify in court.

Find Some Other Last Will and Testament Forms for Specific States

Who Can Prepare a Will - A statement detailing charitable contributions you wish to support posthumously.

When handling transactions for mobile homes, it's important to consider the significance of a well-structured form. The use of a precise Mobile Home Bill of Sale ensures both parties are protected and informed throughout the process, thereby streamlining the transfer of ownership.

Pa Will Template - This document should be signed in the presence of witnesses for validation.

Illinois Will Template - May set forth conditions for receiving assets, such as age or achievement milestones.

Last Will and Testament Nc - Offers clarity on complex family situations.

PDF Attributes

| Fact Name | Details |

|---|---|

| Governing Law | The Michigan Last Will and Testament is governed by the Michigan Estates and Protected Individuals Code (EPIC), specifically MCL 700.2501 et seq. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Michigan. |

| Testamentary Capacity | The testator must have the mental capacity to understand the nature of making a will and the effects of their decisions. |

| Witness Requirement | In Michigan, a will must be signed by at least two witnesses, who must also be present at the same time. |

| Holographic Wills | Michigan recognizes holographic wills, which are handwritten and signed by the testator, without the need for witnesses. |

| Revocation of Wills | A will can be revoked by a subsequent will or by physically destroying the original document with the intent to revoke. |

| Self-Proving Wills | A will can be made self-proving by including an affidavit signed by the witnesses at the time of signing, simplifying the probate process. |

| Intestate Succession | If an individual dies without a will, Michigan's intestate succession laws determine how their assets are distributed. |

| Durable Powers of Attorney | A will does not cover the appointment of a durable power of attorney, which is a separate legal document for managing affairs while alive. |

| Digital Assets | Michigan law allows individuals to specify the handling of digital assets in their wills, reflecting the growing importance of online presence. |

Similar forms

The Michigan Last Will and Testament form shares similarities with a Living Will, which outlines an individual's preferences regarding medical treatment in situations where they may be unable to communicate their wishes. Both documents serve to express personal desires and ensure that those wishes are respected. While a Last Will primarily deals with the distribution of assets after death, a Living Will focuses on healthcare decisions during one’s lifetime, particularly in end-of-life scenarios. Each document provides clarity and guidance to family members and healthcare providers, reducing uncertainty during difficult times.

Another document akin to the Michigan Last Will and Testament is the Durable Power of Attorney. This legal form allows an individual to appoint someone else to make financial or legal decisions on their behalf if they become incapacitated. Like a Last Will, it is a proactive measure to ensure that one’s preferences are honored. While the Last Will takes effect after death, the Durable Power of Attorney is active during a person's life, providing a mechanism for managing affairs when the individual cannot do so themselves.

For individuals involved in the sale of trailers, understanding the necessary documentation is crucial. The New York Trailer Bill of Sale is a key legal form that details the ownership transfer, ensuring both parties are safeguarded throughout the transaction. You can find a comprehensive template for this important document at documentonline.org/blank-new-york-trailer-bill-of-sale, which can help facilitate a smooth process when registering with the Department of Motor Vehicles (DMV).

The Revocable Living Trust also resembles the Last Will and Testament in that it facilitates the transfer of assets upon death. This document allows a person to place their assets into a trust during their lifetime, which then distributes those assets according to their wishes after death. Unlike a Last Will, which must go through probate, a Revocable Living Trust can often bypass this process, providing a more streamlined transition for beneficiaries. Both documents aim to ensure that an individual’s estate is handled according to their wishes.

A Healthcare Proxy is another document that parallels the Michigan Last Will and Testament. This form allows a person to designate someone to make medical decisions on their behalf if they are unable to do so. Similar to a Living Will, it addresses healthcare preferences, but it specifically empowers another individual to act in critical situations. Both documents ensure that a person’s medical wishes are respected, though they do so in different ways and contexts.

The Codicil is a legal document that modifies an existing Last Will and Testament. It allows individuals to make changes without drafting an entirely new will. This can include updates to beneficiaries, changes in asset distribution, or the appointment of a new executor. Like the Last Will, a Codicil must be executed with the same formalities to be valid. It serves as a useful tool for those who wish to make adjustments to their estate plan while retaining the original will’s structure.

The Testamentary Trust is similar in that it is created through a Last Will and Testament. This trust becomes effective upon the death of the individual and allows for the management of assets on behalf of beneficiaries, particularly minors or individuals who may not be financially responsible. While a Last Will outlines who receives what, a Testamentary Trust provides a structured way to manage those assets, ensuring they are used according to the deceased's wishes.

The Affidavit of Heirship is another document that serves a similar purpose. This document is often used to establish the heirs of a deceased person when there is no formal will. It provides a sworn statement regarding the identity of heirs and can help facilitate the transfer of property. While it does not replace a Last Will, it serves as a means to confirm the distribution of assets when a will is absent or unclear, ensuring that the estate is settled according to the deceased’s intentions.

Lastly, the Joint Will is a document that is executed by two individuals, typically spouses, to outline their wishes regarding the distribution of their combined assets upon death. This document can simplify estate planning for couples, as it reflects their mutual agreements. While it serves a similar purpose to a Last Will, a Joint Will can complicate matters if one party wishes to change their wishes after the other’s passing, as it may not be easily modified without mutual consent.