Valid Michigan Lady Bird Deed Template

The Michigan Lady Bird Deed is an essential tool for property owners looking to simplify the transfer of real estate while maintaining control during their lifetime. This unique deed allows homeowners to transfer their property to a beneficiary upon their passing without the need for probate, ensuring a smoother transition of assets. One of the standout features of the Lady Bird Deed is the ability for the property owner to retain certain rights, such as the right to live in the home, sell it, or mortgage it during their lifetime. This flexibility can be crucial for individuals who wish to provide for their heirs while still enjoying the benefits of their property. Additionally, the Lady Bird Deed can help minimize tax implications and protect assets from potential creditors. Understanding how this deed works and its implications can significantly impact estate planning strategies, making it a vital consideration for Michigan residents who want to secure their legacy and provide peace of mind for their loved ones.

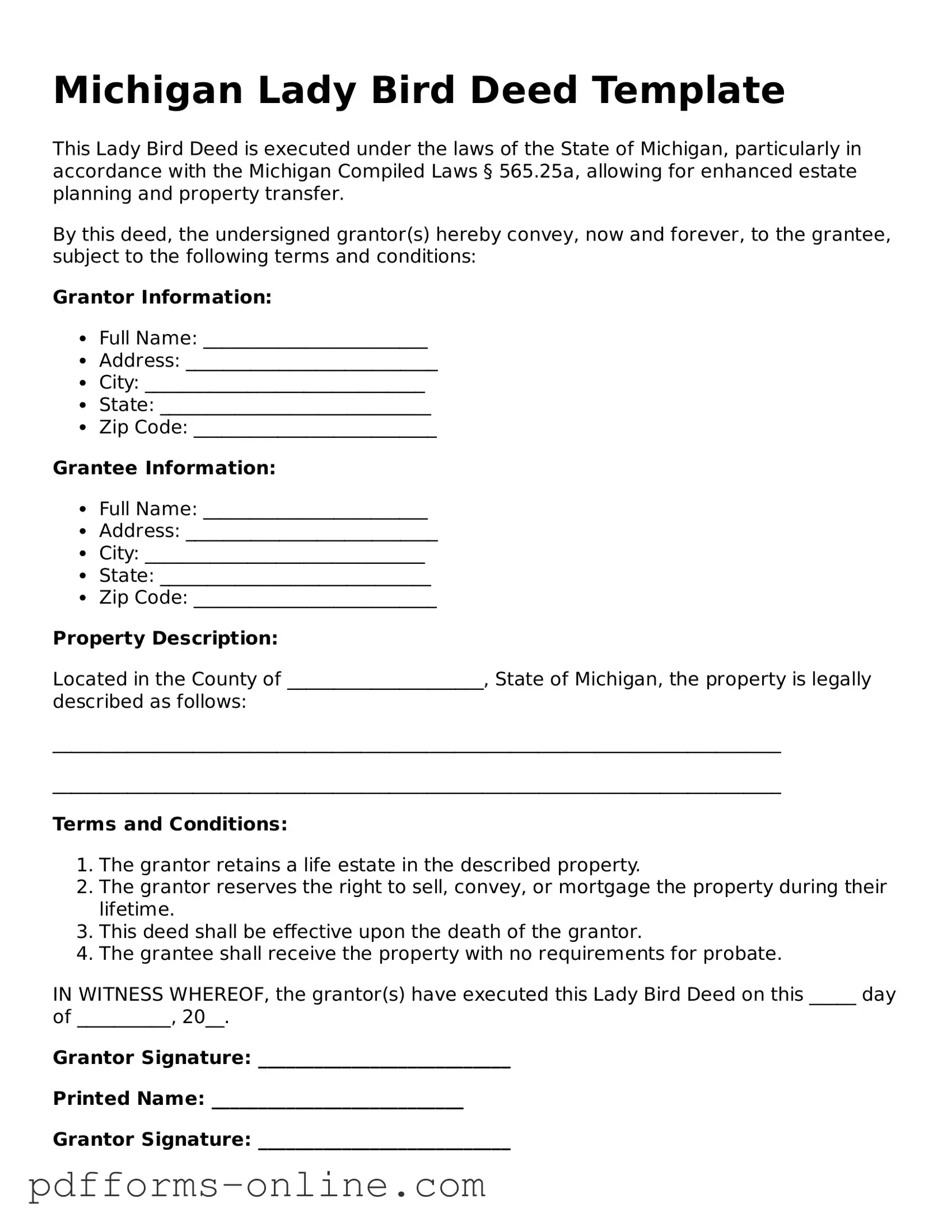

Document Example

Michigan Lady Bird Deed Template

This Lady Bird Deed is executed under the laws of the State of Michigan, particularly in accordance with the Michigan Compiled Laws § 565.25a, allowing for enhanced estate planning and property transfer.

By this deed, the undersigned grantor(s) hereby convey, now and forever, to the grantee, subject to the following terms and conditions:

Grantor Information:

- Full Name: ________________________

- Address: ___________________________

- City: ______________________________

- State: _____________________________

- Zip Code: __________________________

Grantee Information:

- Full Name: ________________________

- Address: ___________________________

- City: ______________________________

- State: _____________________________

- Zip Code: __________________________

Property Description:

Located in the County of _____________________, State of Michigan, the property is legally described as follows:

______________________________________________________________________________

______________________________________________________________________________

Terms and Conditions:

- The grantor retains a life estate in the described property.

- The grantor reserves the right to sell, convey, or mortgage the property during their lifetime.

- This deed shall be effective upon the death of the grantor.

- The grantee shall receive the property with no requirements for probate.

IN WITNESS WHEREOF, the grantor(s) have executed this Lady Bird Deed on this _____ day of __________, 20__.

Grantor Signature: ___________________________

Printed Name: ___________________________

Grantor Signature: ___________________________

Printed Name: ___________________________

Notarization:

State of Michigan

County of _______________________________

On this _____ day of __________, 20__, before me, a notary public, personally appeared ______________________, known to me to be the person(s) whose name(s) is(are) subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

Notary Public Signature: ______________________

My Commission Expires: ______________________

Frequently Asked Questions

-

What is a Lady Bird Deed?

A Lady Bird Deed is a legal document used in Michigan that allows a property owner to transfer their property to a beneficiary while retaining the right to live in and control the property during their lifetime. This type of deed can help avoid probate and simplify the transfer of property upon the owner’s death.

-

Who can use a Lady Bird Deed?

Any property owner in Michigan can use a Lady Bird Deed. It is particularly beneficial for those who wish to pass their property to a loved one, such as a child, without the complexities of probate. However, it’s advisable to consult with a legal expert to ensure it fits your specific situation.

-

What are the benefits of a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed:

- Avoids probate, making the transfer of property simpler and quicker.

- Allows the property owner to retain control and use of the property during their lifetime.

- Offers tax benefits, as the property may receive a step-up in basis upon the owner’s death.

-

How does a Lady Bird Deed differ from a traditional deed?

A traditional deed transfers ownership of the property immediately, while a Lady Bird Deed allows the owner to retain control until their death. With a traditional deed, the new owner can immediately make decisions regarding the property, whereas the Lady Bird Deed provides more flexibility for the original owner.

-

What information is required to complete a Lady Bird Deed?

To complete a Lady Bird Deed, you will need the following information:

- The legal description of the property.

- The names and addresses of the current owner(s).

- The names and addresses of the beneficiary or beneficiaries.

- Any specific terms or conditions you wish to include.

-

Is it necessary to have the Lady Bird Deed notarized?

Yes, a Lady Bird Deed must be signed in the presence of a notary public to be legally valid. This helps ensure that the document is executed properly and protects against any future disputes regarding its authenticity.

-

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked at any time by the property owner as long as they are alive and competent. This can be done by executing a new deed or by formally revoking the existing Lady Bird Deed.

-

What happens to the property if the beneficiary predeceases the owner?

If the beneficiary named in the Lady Bird Deed passes away before the owner, the property will not automatically transfer to the beneficiary’s heirs. Instead, the property will remain with the original owner, who can choose to name a new beneficiary or revoke the deed altogether.

-

Do I need an attorney to create a Lady Bird Deed?

While it is not legally required to have an attorney create a Lady Bird Deed, it is highly recommended. An attorney can help ensure that the deed is properly drafted, executed, and complies with all legal requirements, providing peace of mind.

-

Where should I file the Lady Bird Deed?

After completing the Lady Bird Deed, it should be filed with the county register of deeds in the county where the property is located. This makes the deed part of the public record, ensuring that the transfer is recognized and enforceable.

Misconceptions

The Michigan Lady Bird Deed is a useful tool for estate planning, but several misconceptions exist about its purpose and function. Understanding these misconceptions can help individuals make informed decisions.

- It only benefits wealthy individuals. Many believe that Lady Bird Deeds are only for the affluent. In reality, they can benefit anyone looking to simplify the transfer of property.

- It avoids probate entirely. While a Lady Bird Deed can help avoid probate for the property it covers, it does not eliminate probate for other assets.

- It is the same as a regular quitclaim deed. A Lady Bird Deed includes specific rights that a quitclaim deed does not, such as the ability to retain control over the property during the grantor's lifetime.

- It automatically transfers property upon death. The deed does facilitate transfer upon death, but it requires the grantee to survive the grantor for the transfer to occur.

- It can only be used for residential properties. Many think that Lady Bird Deeds are limited to homes. However, they can be used for various types of real estate.

- It eliminates the need for a will. While a Lady Bird Deed can transfer property outside of probate, it does not replace the need for a will to address other assets.

- It is only valid in Michigan. Though the Lady Bird Deed is named after Michigan, similar deeds exist in other states, though they may have different names and rules.

- It cannot be revoked. This deed can be revoked or changed at any time by the grantor, as long as they are alive and competent.

- It protects against creditors. While a Lady Bird Deed can help with estate planning, it does not provide absolute protection against creditors during the grantor's lifetime.

Understanding these misconceptions can clarify the role of the Michigan Lady Bird Deed in estate planning and help individuals utilize it effectively.

Common mistakes

-

Not understanding the purpose of the Lady Bird Deed: Many individuals fill out the form without fully grasping its function. This type of deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. Understanding this can prevent future complications.

-

Failing to include all necessary parties: It's crucial to ensure that all owners of the property are included on the deed. Omitting a co-owner can lead to disputes and may invalidate the deed.

-

Incorrectly identifying the property: Accurate property descriptions are vital. A common mistake is using vague language or incorrect parcel numbers. This can create confusion and legal issues down the line.

-

Not considering tax implications: Some individuals overlook the potential tax consequences of transferring property through a Lady Bird Deed. It's wise to consult with a tax professional to understand how this decision may affect estate and inheritance taxes.

-

Neglecting to have the deed notarized: A Lady Bird Deed must be notarized to be legally valid. Forgetting this step can render the deed ineffective, leading to complications in the future.

-

Not recording the deed: Once the deed is completed and notarized, it must be recorded with the local county clerk's office. Failing to do so can result in the deed not being recognized, which could create problems for heirs.

Find Some Other Lady Bird Deed Forms for Specific States

What Are the Disadvantages of a Ladybird Deed? - The Lady Bird Deed is particularly useful for elder care planning.

In addition to the fundamental aspects of a Power of Attorney form, it is crucial to ensure that the document is completed correctly to avoid any legal issues. Resources, such as OnlineLawDocs.com, can provide valuable guidance and templates to help individuals effectively create this important legal tool.

Life Estate Deed Sample - Property owners may appreciate the tax benefits associated with this type of deed.

PDF Attributes

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed is a type of property deed that allows the property owner to transfer their property to a beneficiary while retaining the right to use and control the property during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Michigan law, specifically under the Michigan Compiled Laws, Section 565.25. |

| Benefits of a Lady Bird Deed | This deed can help avoid probate, allowing for a smoother transition of property to heirs without the need for court involvement. |

| Retained Rights | The property owner retains the right to sell, mortgage, or change the deed at any time during their lifetime. |

| Tax Implications | With a Lady Bird Deed, the property may receive a step-up in basis for tax purposes upon the owner's death, potentially reducing capital gains taxes for heirs. |

| Revocation | The property owner can revoke the Lady Bird Deed at any time before their death, allowing for flexibility in estate planning. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death, which can streamline the transfer process. |

| Limitations | Lady Bird Deeds are only applicable to real estate and cannot be used for personal property or other types of assets. |

| Legal Assistance | While it is possible to create a Lady Bird Deed without an attorney, seeking legal assistance is advisable to ensure compliance with state laws and to address specific individual circumstances. |

Similar forms

The Michigan Lady Bird Deed is similar to a traditional quitclaim deed. Both documents transfer property ownership from one person to another. However, the key difference lies in the rights retained by the property owner. With a quitclaim deed, the transfer is immediate and complete, meaning the original owner relinquishes all rights. In contrast, a Lady Bird Deed allows the original owner to retain control of the property during their lifetime, ensuring they can continue to live there and manage the property without interference.

For those looking to document the transfer of ownership effectively, the comprehensive Mobile Home Bill of Sale form is an important tool that assists both sellers and buyers in clarifying their responsibilities. For more information, visit the comprehensive Mobile Home Bill of Sale.

An enhanced life estate deed shares some similarities with the Lady Bird Deed. Both types of deeds allow property owners to transfer their property while retaining certain rights. Like the Lady Bird Deed, the enhanced life estate deed lets the owner live in the property until their death. However, the Lady Bird Deed provides more flexibility, allowing the owner to sell or mortgage the property without needing consent from the beneficiaries, which is not always the case with enhanced life estate deeds.

Lastly, the revocable living trust can be compared to the Lady Bird Deed in terms of estate planning. Both tools allow individuals to manage their property during their lifetime while providing a mechanism for transferring it after death. A revocable living trust can hold various assets, including real estate, and allows for more comprehensive management of an estate. However, the Lady Bird Deed is simpler and more straightforward for transferring real estate specifically, while a trust requires more detailed administration and management.