Valid Michigan Durable Power of Attorney Template

In Michigan, a Durable Power of Attorney (DPOA) is an essential legal tool that empowers individuals to designate a trusted person to manage their financial and legal affairs when they are unable to do so themselves. This form remains effective even if the individual becomes incapacitated, providing peace of mind to both the principal and the agent. Key aspects of the DPOA include the ability to grant broad or limited powers, the option to specify when the authority begins, and the requirement for the document to be signed in the presence of a notary public. Understanding the nuances of this form is crucial, as it not only safeguards one's interests but also ensures that the appointed agent can act in accordance with the principal's wishes. By taking the time to create a Durable Power of Attorney, individuals can maintain control over their financial and legal matters, even in challenging circumstances.

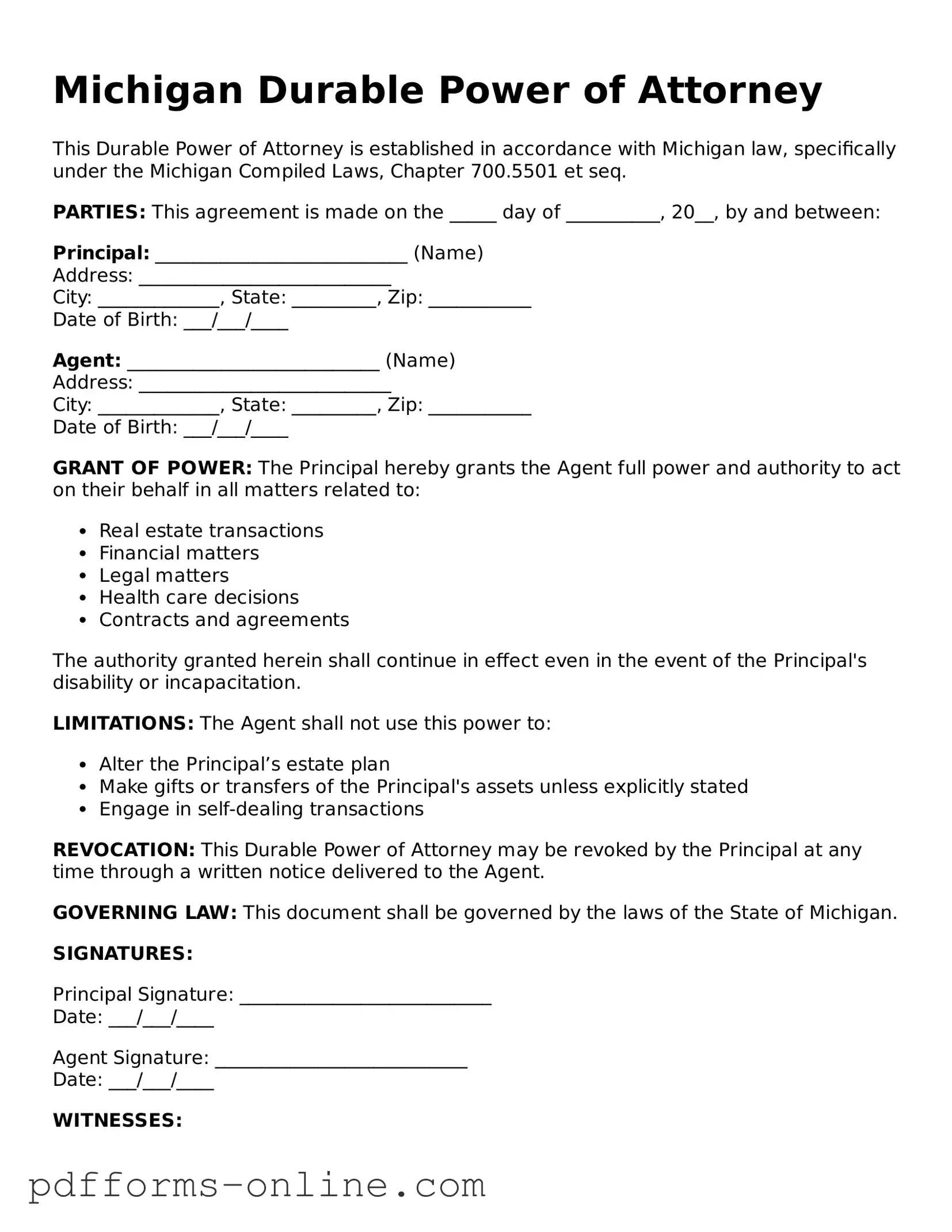

Document Example

Michigan Durable Power of Attorney

This Durable Power of Attorney is established in accordance with Michigan law, specifically under the Michigan Compiled Laws, Chapter 700.5501 et seq.

PARTIES: This agreement is made on the _____ day of __________, 20__, by and between:

Principal: ___________________________ (Name)

Address: ___________________________

City: _____________, State: _________, Zip: ___________

Date of Birth: ___/___/____

Agent: ___________________________ (Name)

Address: ___________________________

City: _____________, State: _________, Zip: ___________

Date of Birth: ___/___/____

GRANT OF POWER: The Principal hereby grants the Agent full power and authority to act on their behalf in all matters related to:

- Real estate transactions

- Financial matters

- Legal matters

- Health care decisions

- Contracts and agreements

The authority granted herein shall continue in effect even in the event of the Principal's disability or incapacitation.

LIMITATIONS: The Agent shall not use this power to:

- Alter the Principal’s estate plan

- Make gifts or transfers of the Principal's assets unless explicitly stated

- Engage in self-dealing transactions

REVOCATION: This Durable Power of Attorney may be revoked by the Principal at any time through a written notice delivered to the Agent.

GOVERNING LAW: This document shall be governed by the laws of the State of Michigan.

SIGNATURES:

Principal Signature: ___________________________

Date: ___/___/____

Agent Signature: ___________________________

Date: ___/___/____

WITNESSES:

Witness #1: ___________________________

Address: ___________________________

Date: ___/___/____

Witness #2: ___________________________

Address: ___________________________

Date: ___/___/____

NOTARY ACKNOWLEDGMENT:

State of Michigan

County of _______________

On this ____ day of __________, 20__, before me personally appeared __________________________ (Name of Principal), to me known to be the same person who executed the foregoing instrument, and acknowledged that they executed the same freely and voluntarily for the purposes therein expressed.

_______________________________

Notary Public

My Commission Expires: ___/___/____

Frequently Asked Questions

-

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated. Unlike a regular power of attorney, a DPOA remains effective even if you lose the ability to make decisions for yourself.

-

Who can be appointed as my agent?

You can choose anyone you trust to be your agent, such as a family member, friend, or professional advisor. It is essential to select someone who understands your wishes and will act in your best interest.

-

How do I create a Durable Power of Attorney in Michigan?

To create a DPOA in Michigan, you must fill out the appropriate form, which can be obtained from various legal resources or online. After completing the form, you must sign it in the presence of a notary public or two witnesses. This ensures the document is legally valid.

-

When does the Durable Power of Attorney take effect?

A DPOA can take effect immediately upon signing or can be set to activate only when you become incapacitated. This decision should be clearly stated in the document to avoid confusion later.

-

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your DPOA at any time as long as you are mentally competent. To do so, you should create a written revocation document and inform your agent and any relevant institutions of the change.

-

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including managing your finances, paying bills, handling real estate transactions, and making investment decisions. Be clear about the specific powers you wish to grant to avoid misunderstandings.

-

Is a Durable Power of Attorney the same as a Healthcare Proxy?

No, a Durable Power of Attorney typically covers financial and legal matters, while a Healthcare Proxy (or Medical Power of Attorney) specifically allows someone to make medical decisions on your behalf. It is advisable to have both documents to ensure comprehensive coverage of your needs.

-

What happens if I do not have a Durable Power of Attorney?

If you become incapacitated without a DPOA, your family may need to go through the court system to obtain guardianship or conservatorship. This process can be lengthy and costly, making it crucial to have a DPOA in place to avoid complications.

Misconceptions

Understanding the Michigan Durable Power of Attorney (DPOA) form is essential for making informed decisions about your future and your loved ones. However, there are several misconceptions surrounding this important document. Here’s a list of ten common misunderstandings:

- It only applies when I am incapacitated. Many believe that a DPOA is only effective when they become incapacitated. In Michigan, a DPOA can be effective immediately upon signing, allowing your agent to act on your behalf right away.

- My agent can do anything they want with my assets. While your agent has significant authority, they are bound by a fiduciary duty to act in your best interest. They cannot misuse your assets for personal gain.

- I can’t change my DPOA once it’s signed. This is false. You can revoke or modify your DPOA at any time, as long as you are mentally competent to do so.

- All DPOAs are the same. Not all DPOAs are created equal. Each state has its own laws and requirements, and the Michigan DPOA has specific provisions that may differ from those in other states.

- My spouse automatically has power of attorney. Many people think that being married gives a spouse automatic authority to make decisions. Without a signed DPOA, your spouse does not have legal authority to act on your behalf.

- My DPOA is valid forever. A DPOA remains valid until you revoke it, but it can also be affected by changes in your mental capacity or if the agent is unable or unwilling to serve.

- It’s only for financial decisions. A DPOA can cover a wide range of decisions, including health care, depending on how it is drafted. It's important to specify the powers you want to grant.

- I don’t need a DPOA if I have a will. A will only takes effect after your death. A DPOA is crucial for managing your affairs while you are still alive but unable to make decisions.

- My agent must be a family member. While many choose family members, your agent can be anyone you trust, including friends or professionals, as long as they are willing to accept the responsibility.

- Once I sign it, I lose control. Signing a DPOA does not mean you lose control over your decisions. As long as you are mentally competent, you can still make your own choices, even if your agent has authority.

Clarifying these misconceptions can help you make better choices regarding your legal and financial planning. Always consider consulting with a legal professional to ensure your DPOA meets your needs and complies with Michigan law.

Common mistakes

-

Not specifying the powers granted: Many individuals fail to clearly outline the specific powers they wish to grant to their agent. This can lead to confusion and limit the agent's ability to act effectively on behalf of the principal.

-

Choosing the wrong agent: Selecting an agent who is not trustworthy or lacks the necessary skills can result in mismanagement of finances or personal affairs. It's crucial to choose someone reliable and capable.

-

Failing to date the document: Omitting the date can create ambiguity regarding the document's validity. A dated document is essential for establishing when the powers were granted.

-

Not having witnesses or notarization: In Michigan, the Durable Power of Attorney must be signed in the presence of a notary public or witnesses. Neglecting this step can invalidate the document.

-

Using outdated forms: Laws change, and so do the requirements for legal documents. Using an outdated form may lead to legal complications or challenges to the document's validity.

-

Failing to communicate with the agent: Not discussing the role and expectations with the chosen agent can lead to misunderstandings. Open communication ensures that the agent understands their responsibilities.

-

Ignoring state-specific requirements: Each state has its own laws governing Durable Power of Attorney documents. Ignoring Michigan's specific requirements can result in a document that is not legally enforceable.

-

Not reviewing the document periodically: Life circumstances change, and so do relationships. Failing to review and update the Durable Power of Attorney can lead to outdated provisions that no longer reflect the principal's wishes.

Find Some Other Durable Power of Attorney Forms for Specific States

Durable Power Printable Power of Attorney Form - Your agent must act in your best interest and follow your instructions.

The tractor bill of sale is an important document that details the transaction between the buyer and the seller. For those looking for guidance, a helpful resource outlining the necessary information regarding a tractor bill of sale can be found at essential guidelines for the Tractor Bill of Sale process.

How to Notarize a Power of Attorney in Ohio - The document is flexible, allowing you to specify the powers granted to your agent as you see fit.

Illinois Durable Power of Attorney for Finances Form - It can address both health care and financial management issues.

How to Get Power of Attorney in Nc - Creating this document involves careful thought about potential outcomes.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Durable Power of Attorney form allows an individual to designate someone to make financial and legal decisions on their behalf if they become incapacitated. |

| Durability | This form remains effective even if the principal becomes mentally incapacitated, ensuring continuous authority for the agent. |

| Governing Law | The form is governed by the Michigan Estates and Protected Individuals Code (EPIC), specifically MCL 700.5501 et seq. |

| Agent Authority | The agent can be granted broad powers, including handling banking transactions, real estate transactions, and managing investments. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Witness Requirements | The form must be signed in the presence of at least one witness or notarized to be legally valid in Michigan. |

Similar forms

The Michigan Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. The key difference lies in the durability aspect; the DPOA remains effective even if the principal becomes incapacitated, while a General Power of Attorney typically becomes invalid under such circumstances. This makes the DPOA a crucial tool for long-term planning, ensuring that an agent can act when the principal is no longer able to manage their affairs.

Another document akin to the DPOA is the Medical Power of Attorney. While the DPOA deals primarily with financial and legal decisions, the Medical Power of Attorney focuses on healthcare choices. This document empowers an agent to make medical decisions for the principal if they are unable to do so themselves. Like the DPOA, the Medical Power of Attorney can also remain effective during periods of incapacity, providing peace of mind that someone trusted will advocate for the principal's health and treatment preferences.

The Healthcare Proxy is another related document. It serves a similar purpose to the Medical Power of Attorney, allowing an individual to designate someone to make healthcare decisions on their behalf. The key distinction is that a Healthcare Proxy is often more narrowly focused on medical matters, while the Medical Power of Attorney can encompass a broader range of healthcare-related decisions. Both documents ensure that a person's wishes regarding medical treatment are honored when they cannot communicate them directly.

For those navigating the complexities of business formation in Arizona, establishing an LLC necessitates the creation of an Operating Agreement that clearly outlines the management structure and member roles. This essential document can be crucial in preventing future disputes and ensuring smooth operations. To access the necessary resources for drafting one, you may find helpful information in All Arizona Forms, which provides guidance for completing this important task.

Additionally, the Living Will can be compared to the DPOA. A Living Will outlines a person's preferences regarding end-of-life care and medical treatment in situations where they are unable to express their wishes. Unlike the DPOA, which appoints an agent to make decisions, a Living Will provides specific instructions about the types of medical interventions a person does or does not want. Together, these documents create a comprehensive plan for both healthcare decisions and financial management.

Lastly, the Revocable Living Trust bears similarities to the Durable Power of Attorney in that both can manage assets and ensure that a person's wishes are carried out. A Revocable Living Trust allows an individual to place their assets into a trust, which is managed by a trustee for the benefit of the beneficiaries. While the DPOA grants an agent the authority to make financial decisions, a Revocable Living Trust can help avoid probate and manage assets during and after a person's lifetime. Both documents play vital roles in estate planning and asset management, providing flexibility and control over one’s affairs.