Valid Michigan Deed Template

The Michigan Deed form serves as a crucial legal instrument in the transfer of real property ownership within the state. This document not only outlines the parties involved in the transaction—typically the grantor, or seller, and the grantee, or buyer—but also specifies the property being conveyed, including a detailed description to ensure clarity. Various types of deeds exist under Michigan law, such as warranty deeds and quitclaim deeds, each serving distinct purposes and offering different levels of protection to the buyer. Importantly, the form must be executed with proper notarization to ensure its validity and must comply with state-specific requirements regarding language and format. Additionally, the deed must be recorded with the local county register of deeds to provide public notice of the transfer, thus protecting the interests of the new owner. Understanding these elements is essential for anyone involved in real estate transactions in Michigan, as they form the foundation for secure property transfers and the safeguarding of ownership rights.

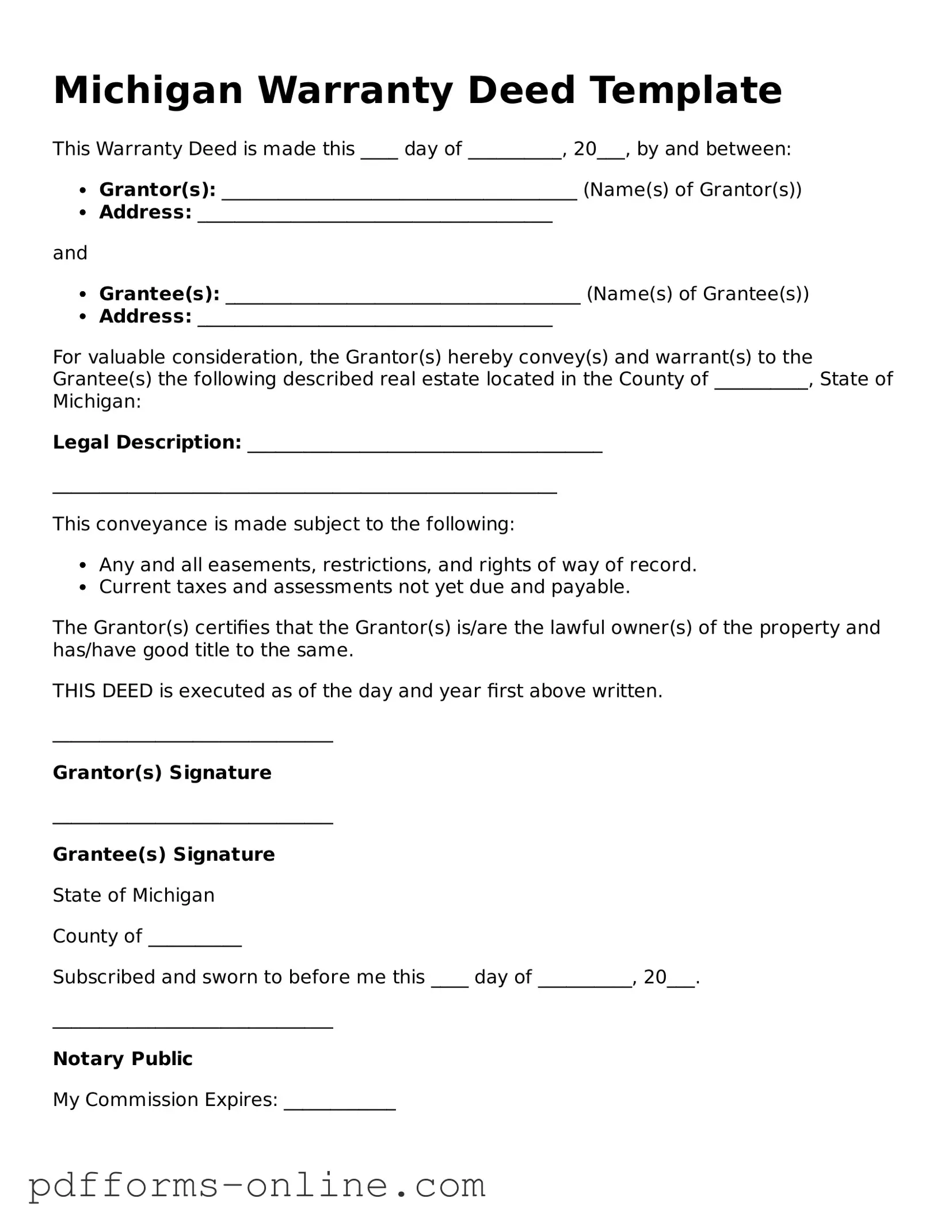

Document Example

Michigan Warranty Deed Template

This Warranty Deed is made this ____ day of __________, 20___, by and between:

- Grantor(s): ______________________________________ (Name(s) of Grantor(s))

- Address: ______________________________________

and

- Grantee(s): ______________________________________ (Name(s) of Grantee(s))

- Address: ______________________________________

For valuable consideration, the Grantor(s) hereby convey(s) and warrant(s) to the Grantee(s) the following described real estate located in the County of __________, State of Michigan:

Legal Description: ______________________________________

______________________________________________________

This conveyance is made subject to the following:

- Any and all easements, restrictions, and rights of way of record.

- Current taxes and assessments not yet due and payable.

The Grantor(s) certifies that the Grantor(s) is/are the lawful owner(s) of the property and has/have good title to the same.

THIS DEED is executed as of the day and year first above written.

______________________________

Grantor(s) Signature

______________________________

Grantee(s) Signature

State of Michigan

County of __________

Subscribed and sworn to before me this ____ day of __________, 20___.

______________________________

Notary Public

My Commission Expires: ____________

Frequently Asked Questions

-

What is a Michigan Deed form?

A Michigan Deed form is a legal document used to transfer ownership of real estate in the state of Michigan. It outlines the details of the property being transferred, the parties involved in the transaction, and any conditions or restrictions that apply. There are different types of deeds, such as warranty deeds and quitclaim deeds, each serving specific purposes in property transfers.

-

What types of deeds are available in Michigan?

In Michigan, the most common types of deeds are:

- Warranty Deed: This type guarantees that the seller holds clear title to the property and has the right to sell it. It provides the highest level of protection for the buyer.

- Quitclaim Deed: This deed transfers whatever interest the seller has in the property without any guarantees. It is often used between family members or in situations where the seller may not be sure of their ownership status.

- Personal Representative's Deed: Used in the context of estate settlements, this deed allows a personal representative to transfer property from a deceased person's estate.

-

How do I complete a Michigan Deed form?

To complete a Michigan Deed form, you need to provide specific information, including:

- The names and addresses of the grantor (seller) and grantee (buyer).

- A legal description of the property, which can usually be found in previous deeds or property tax records.

- The date of the transaction.

- Any applicable consideration (the amount paid for the property).

After filling out the form, both parties should sign it in the presence of a notary public to ensure its validity.

-

Do I need to file the deed with the county?

Yes, after completing the deed, you must file it with the county register of deeds in the county where the property is located. This step is crucial as it provides public notice of the change in ownership and protects the rights of the new owner.

-

Are there any fees associated with filing a Michigan Deed?

Yes, there are fees for filing a deed in Michigan. The fees vary by county, so it’s essential to check with the local register of deeds office for the exact amount. Additionally, there may be other costs, such as transfer taxes, that apply to the transaction.

Misconceptions

Understanding the Michigan Deed form is crucial for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are eight common misconceptions explained.

- All Deeds are the Same: Many believe that all deed forms are identical. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving a specific purpose.

- A Deed Does Not Need to be Recorded: Some think that recording a deed is optional. In Michigan, recording is essential to protect your ownership rights and inform others of your interest in the property.

- Only Lawyers Can Prepare Deeds: While it is advisable to consult a lawyer, individuals can prepare their own deeds as long as they follow the legal requirements.

- Once a Deed is Signed, It Cannot be Changed: This is not entirely true. While a deed is a legal document, it can be amended or revoked under certain circumstances.

- All Deeds Transfer Ownership Immediately: Some assume that signing a deed means instant ownership transfer. However, the transfer is effective only when the deed is delivered and accepted.

- Property Taxes are Automatically Transferred with the Deed: Many believe that property taxes transfer with the property. In Michigan, new owners may face reassessment, which could lead to higher taxes.

- A Deed Guarantees Clear Title: Just because a deed is executed does not guarantee that the title is free from liens or disputes. Title insurance is recommended to protect against hidden issues.

- All Parties Must be Present to Sign the Deed: Some think that all parties must be physically present to sign the deed. In Michigan, remote notarization is allowed under certain conditions.

By clarifying these misconceptions, individuals can navigate the process of property transfer more effectively. Always consider seeking professional advice to ensure compliance with all legal requirements.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. The description should include not just the address, but also the lot number, parcel number, or any other identifiers that clearly define the property boundaries.

-

Missing Signatures: All necessary parties must sign the deed. Forgetting to obtain a signature from one of the sellers or buyers can invalidate the deed.

-

Improper Notarization: The deed must be notarized correctly. If the notary does not sign or stamp the document properly, it may not be accepted by the county register of deeds.

-

Wrong Type of Deed: Using the wrong type of deed can lead to complications. For example, a quitclaim deed may not provide the same protections as a warranty deed. Understanding the differences is crucial.

-

Failure to Record: After filling out the deed, many people forget to record it with the appropriate county office. Failing to do so can lead to issues with ownership recognition in the future.

-

Omitting Grantee Information: The grantee's information must be complete and accurate. Omitting details like the full name or address can cause problems later on.

-

Not Understanding Tax Implications: Some individuals do not consider the tax implications of transferring property. This can lead to unexpected financial responsibilities, such as transfer taxes or reassessments.

Find Some Other Deed Forms for Specific States

New York Warranty Deed Form - Can be tailored to reflect joint ownership interests, like tenants in common.

Ohio Deed - Helps clarify legal rights and responsibilities of property owners.

In addition to the essential details surrounding the transfer of ownership, it is important to have access to the appropriate resources, including the https://documentonline.org/blank-new-york-mobile-home-bill-of-sale, which provides a template for the New York Mobile Home Bill of Sale that can streamline the process for both buyers and sellers.

Who Has the Deed to My House - Confidentiality around property terms is often maintained in Deeds.

PDF Attributes

| Fact Name | Details |

|---|---|

| Governing Law | The Michigan Deed form is governed by Michigan Compiled Laws, specifically MCL 565.1 et seq. |

| Purpose | This form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and grant deeds. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property). |

| Notarization | A notary public must witness the signing of the deed for it to be valid. |

| Recording | The deed should be recorded with the county clerk’s office to provide public notice of the transfer. |

| Legal Description | A precise legal description of the property must be included in the deed. |

| Consideration | The deed should state the consideration (value) exchanged for the property. |

| Tax Implications | Transfer taxes may apply when the property is transferred, depending on the value. |

| Validity | The deed is considered valid once it is signed, notarized, and recorded. |

Similar forms

The Michigan Deed form shares similarities with the Warranty Deed. Both documents serve to transfer property ownership from one party to another. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. This type of deed provides protection to the buyer, as it includes assurances against any future claims to the property. In contrast, a Michigan Deed may not always offer the same level of guarantee regarding the title's condition, depending on the specific type used.

Another document comparable to the Michigan Deed is the Quitclaim Deed. This type of deed transfers whatever interest the grantor has in the property without any warranties. While a Quitclaim Deed is often used between family members or in divorce settlements, it does not provide the same protections as a Warranty Deed. The Michigan Deed may function similarly in that it can transfer property but may include different terms regarding the title's condition.

The Bargain and Sale Deed also resembles the Michigan Deed. This document conveys property ownership but implies that the grantor has title to the property without making explicit guarantees. Like the Michigan Deed, it facilitates the transfer of ownership but does not provide the same assurances that a Warranty Deed does. This can leave the buyer at risk if any issues with the title arise after the transfer.

The Georgia Motor Vehicle Bill of Sale form is essential for documenting the sale and transfer of ownership of a motor vehicle, ensuring clarity and legality in transactions. This form not only captures important details such as the vehicle's price and description but also identifies the buyer and seller involved in the process. It is vital for proper registration and titling in Georgia, and for those seeking more information or a template, onlinelawdocs.com provides valuable resources to guide you through this important legal documentation.

The Special Purpose Deed is another document that aligns with the Michigan Deed. Often used for specific transactions, such as foreclosure sales or transfers by a trustee, it allows for the transfer of property under unique circumstances. While it may share the goal of transferring ownership, the context and conditions under which it is used can differ significantly from the standard Michigan Deed.

The Trustee’s Deed is similar in that it is used to transfer property held in a trust. This document conveys the property from the trustee to a beneficiary or third party. While the Michigan Deed may be used in more general transactions, the Trustee’s Deed focuses specifically on trust-related transfers. Both documents facilitate ownership changes, but the legal implications and contexts vary.

Lastly, the Personal Representative’s Deed is akin to the Michigan Deed, particularly in estate situations. This document is used to transfer property from a deceased person's estate to heirs or beneficiaries. While the Michigan Deed serves a broader purpose in property transactions, the Personal Representative’s Deed is specifically tied to the administration of an estate, highlighting the different contexts in which property ownership is transferred.