Valid Michigan Articles of Incorporation Template

In the state of Michigan, the Articles of Incorporation form serves as a crucial document for anyone looking to establish a corporation. This form outlines essential information about the business, including its name, purpose, and the address of its registered office. It also requires details about the corporation’s duration, which can be set for a specific period or indefinitely. Additionally, the form mandates the identification of the initial board of directors, providing transparency and accountability right from the start. Filing this document is not just a formality; it is a legal requirement that officially creates your corporation in the eyes of the state. Understanding the nuances of this form can significantly impact the future of your business, making it imperative to pay attention to every detail. Whether you are a seasoned entrepreneur or a first-time business owner, getting the Articles of Incorporation right is a vital step in your journey toward establishing a successful corporation in Michigan.

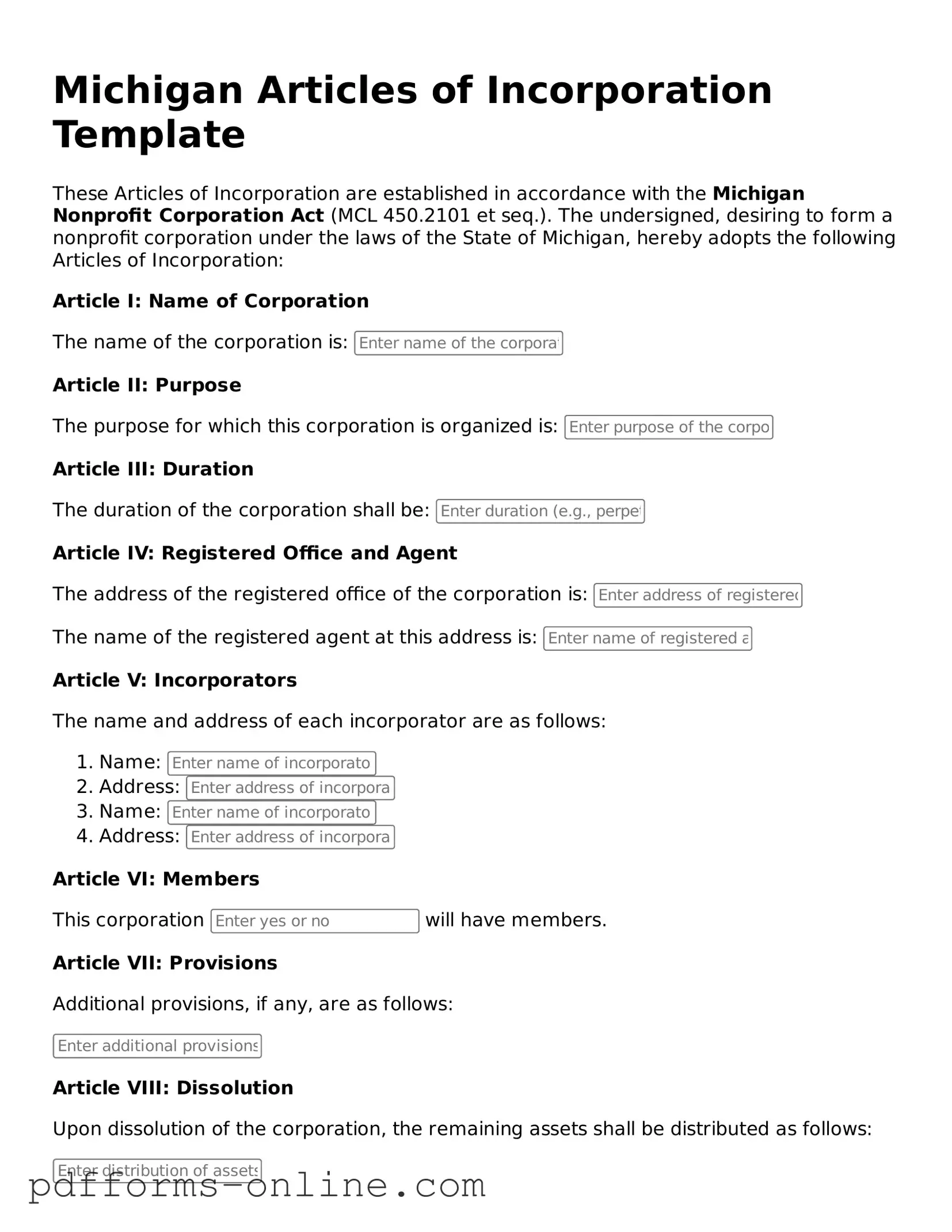

Document Example

Michigan Articles of Incorporation Template

These Articles of Incorporation are established in accordance with the Michigan Nonprofit Corporation Act (MCL 450.2101 et seq.). The undersigned, desiring to form a nonprofit corporation under the laws of the State of Michigan, hereby adopts the following Articles of Incorporation:

Article I: Name of Corporation

The name of the corporation is:

Article II: Purpose

The purpose for which this corporation is organized is:

Article III: Duration

The duration of the corporation shall be:

Article IV: Registered Office and Agent

The address of the registered office of the corporation is:

The name of the registered agent at this address is:

Article V: Incorporators

The name and address of each incorporator are as follows:

- Name:

- Address:

- Name:

- Address:

Article VI: Members

This corporation will have members.

Article VII: Provisions

Additional provisions, if any, are as follows:

Article VIII: Dissolution

Upon dissolution of the corporation, the remaining assets shall be distributed as follows:

IN WITNESS WHEREOF, the undersigned incorporators have executed these Articles of Incorporation this .

Signature of Incorporator:

Printed Name:

All information provided in this document is a true representation of the incorporators' intentions as of the date above.

Frequently Asked Questions

-

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in Michigan. They outline the basic information about your business, such as its name, purpose, and structure. Filing these articles with the state is a crucial step in forming a corporation.

-

What information do I need to include in the Articles of Incorporation?

Your Articles of Incorporation must include several key details:

- The name of the corporation

- The purpose of the corporation

- The duration of the corporation, if not perpetual

- The address of the corporation's registered office

- The names and addresses of the initial directors

- The number of shares the corporation is authorized to issue

-

How do I file the Articles of Incorporation in Michigan?

To file the Articles of Incorporation in Michigan, you need to complete the form provided by the Michigan Department of Licensing and Regulatory Affairs (LARA). After filling it out, submit it along with the required filing fee. You can file online or send a paper form by mail. Make sure to keep a copy for your records.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Michigan varies based on the type of corporation you are forming. Typically, the fee ranges from $50 to $100. Check the Michigan LARA website for the most current fee schedule and payment options.

-

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation in Michigan can vary. Generally, it takes about 5 to 10 business days for the state to process your filing. If you need faster service, you may request expedited processing for an additional fee.

Misconceptions

Understanding the Michigan Articles of Incorporation form can be challenging, and several misconceptions often arise. Here are ten common misunderstandings, along with clarifications for each.

-

Misconception 1: The Articles of Incorporation must be filed with a lawyer.

This is not true. While legal assistance can be helpful, individuals can file the Articles of Incorporation themselves without the need for a lawyer.

-

Misconception 2: The form is the same for all types of corporations.

Different types of corporations, such as for-profit and non-profit, have distinct requirements. It is essential to use the correct form for the specific type of corporation being established.

-

Misconception 3: Filing the Articles of Incorporation guarantees the corporation will be approved.

While filing is a necessary step, approval is not guaranteed. The state reviews the application, and any errors or omissions can lead to denial.

-

Misconception 4: There is no need to include the purpose of the corporation.

Every Articles of Incorporation must include a statement of the corporation's purpose. This is a crucial part of the filing process.

-

Misconception 5: The Articles of Incorporation can be filed at any time without consequences.

There are specific filing deadlines and requirements. Delays in filing can lead to penalties or complications in operating the corporation.

-

Misconception 6: Once filed, the Articles of Incorporation cannot be changed.

Changes can be made, but they require filing additional documents. It is possible to amend the Articles of Incorporation if necessary.

-

Misconception 7: Incorporation protects personal assets automatically.

While incorporation generally provides liability protection, it does not shield personal assets in all situations. Proper management and compliance are essential to maintain that protection.

-

Misconception 8: The Articles of Incorporation can be filed online only.

Although online filing is an option, paper submissions are still accepted. Individuals can choose the method that best suits their needs.

-

Misconception 9: There is no fee to file the Articles of Incorporation.

A filing fee is required when submitting the Articles of Incorporation. The amount can vary depending on the type of corporation.

-

Misconception 10: Once incorporated, there are no further obligations.

Incorporation comes with ongoing responsibilities, such as filing annual reports and maintaining compliance with state laws. These obligations are vital for the corporation's good standing.

Clarifying these misconceptions can help individuals navigate the incorporation process more effectively. Understanding the requirements and responsibilities associated with the Articles of Incorporation is crucial for successful business formation in Michigan.

Common mistakes

-

Incorrect Business Name: Many individuals fail to ensure that their chosen business name is unique and not already in use. This can lead to delays or rejections.

-

Missing Registered Agent Information: It's crucial to provide accurate details about the registered agent. Omitting this information can result in the form being incomplete.

-

Inaccurate Purpose Statement: Some people write vague or overly broad purpose statements. Clearly defining the business purpose is essential for compliance.

-

Improperly Stated Duration: Applicants sometimes forget to specify the duration of the corporation. If not indicated, the default is perpetual, which may not be the intended choice.

-

Failure to Include Initial Directors: Not listing the initial directors can lead to confusion. This information is necessary for the formation of the corporation.

-

Signature Issues: Some individuals neglect to sign the form or have the wrong person sign it. Ensure that the authorized person’s signature is present to avoid processing delays.

Find Some Other Articles of Incorporation Forms for Specific States

Texas Department of Corporations - It ensures clarity on ownership distribution among stakeholders.

Pa Division of Corporations - Filing fees may apply when submitting the Articles of Incorporation.

Incorporate Nc - They outline how profits will be distributed to shareholders.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Michigan Articles of Incorporation are governed by the Michigan Business Corporation Act (Public Act 284 of 1972). |

| Purpose | This form is used to officially create a corporation in the state of Michigan. |

| Filing Requirement | The Articles of Incorporation must be filed with the Michigan Department of Licensing and Regulatory Affairs (LARA). |

| Information Required | The form requires details such as the corporation's name, purpose, registered agent, and duration. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Processing Time | Processing times for the Articles of Incorporation can vary, typically ranging from a few days to several weeks. |

Similar forms

The Articles of Incorporation is a foundational document for establishing a corporation. It is similar to the Certificate of Incorporation, which serves a similar purpose in many states. Both documents are filed with the state government and outline basic information about the corporation, such as its name, purpose, and structure. The Certificate of Incorporation, however, may vary in name and specific requirements depending on the jurisdiction, but its core function remains the same: to officially recognize a corporation as a legal entity.

Another document that shares similarities is the Bylaws. While the Articles of Incorporation set forth the basic framework of the corporation, the Bylaws provide detailed rules for its internal management. They cover topics such as the roles of officers and directors, meeting procedures, and voting rights. Together, these documents establish both the external recognition and internal governance of a corporation.

The Operating Agreement is akin to the Bylaws but is specific to Limited Liability Companies (LLCs). It outlines the management structure and operational procedures of the LLC, detailing member roles and responsibilities. Like the Articles of Incorporation, it is essential for establishing the legal framework of the business, but it focuses on the unique aspects of LLCs rather than corporations.

Incorporation by Reference documents also bear similarities. These documents allow a corporation to incorporate certain information from other documents by reference. This can streamline the incorporation process by avoiding redundancy. However, unlike the Articles of Incorporation, which must be filed with specific information, Incorporation by Reference documents typically serve to clarify or expand upon existing documents.

The Statement of Information is another relevant document. Required in some states, this form provides updated information about a corporation after its formation. It often includes details about the corporation’s address, officers, and agent for service of process. While the Articles of Incorporation establish the corporation, the Statement of Information helps maintain transparency and compliance with state requirements.

Similar to the Articles of Incorporation is the Partnership Agreement, which governs the relationship between partners in a partnership. This document outlines the terms of the partnership, including profit-sharing and decision-making processes. While it serves a different type of business structure, both documents are essential for defining the roles and responsibilities of the entities involved.

The Franchise Disclosure Document (FDD) is also noteworthy. While primarily used in franchising, it shares the goal of providing essential information about a business entity. The FDD outlines the rights and obligations of both the franchisor and franchisee, similar to how the Articles of Incorporation define the corporation’s structure and purpose. Both documents aim to ensure transparency and informed decision-making.

The Business License Application bears some resemblance as well. This document is often required by local governments to permit businesses to operate legally within their jurisdiction. Like the Articles of Incorporation, it is a necessary step in the formation of a business entity. However, it focuses more on compliance with local regulations than on the internal structure of the business.

The Tax Identification Number (TIN) application is another document that is crucial for businesses. While not a formation document, obtaining a TIN is essential for tax purposes and is often required for various business activities. It complements the Articles of Incorporation by ensuring that the corporation is recognized for tax obligations and compliance with federal regulations.

Lastly, the Certificate of Good Standing is relevant. This document verifies that a corporation is legally registered and compliant with state requirements. It is often requested by lenders or partners. While the Articles of Incorporation initiate the corporation's existence, the Certificate of Good Standing confirms that it remains in good standing with the state.