Blank Membership Ledger Template

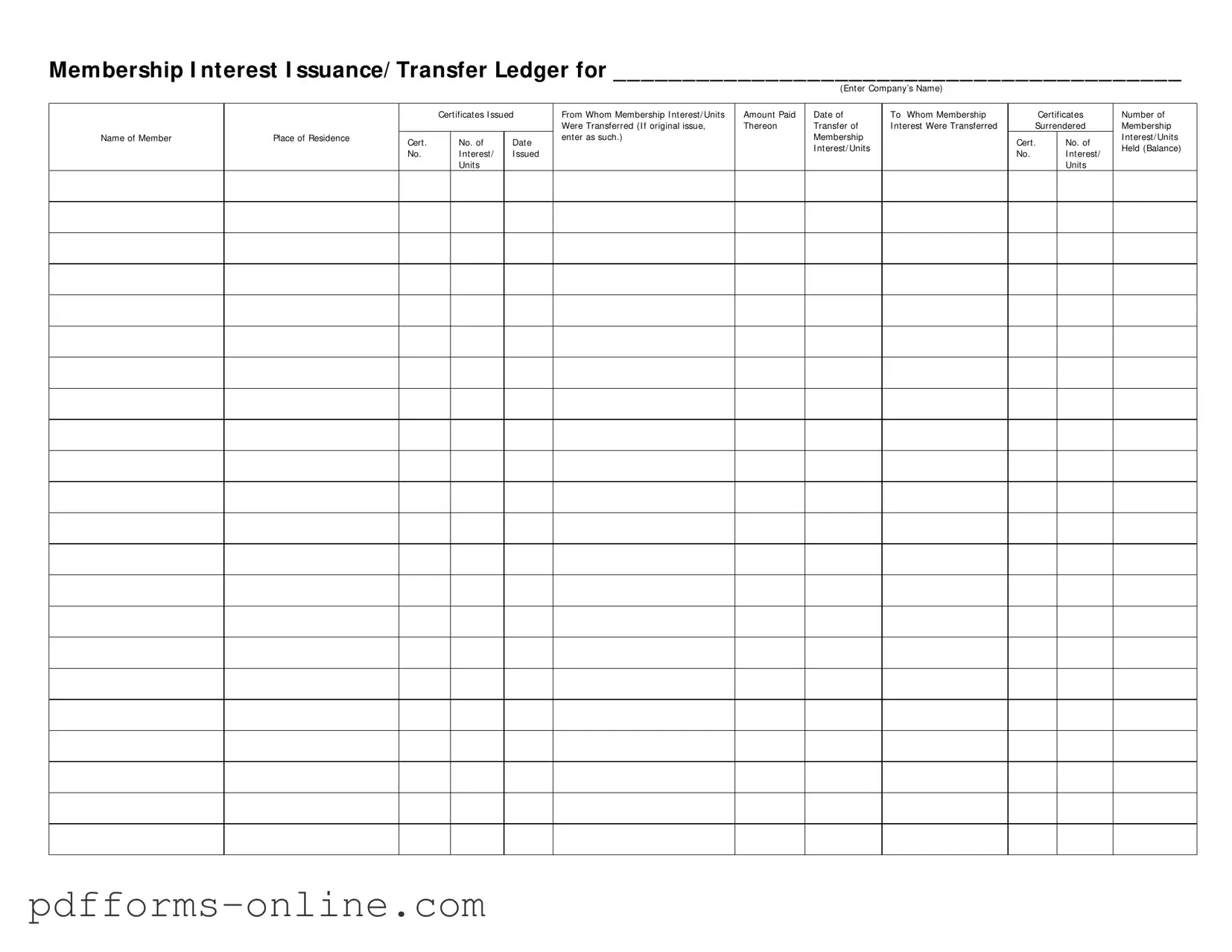

The Membership Ledger form serves as a crucial tool for tracking and managing membership interests within an organization. It provides a structured layout for documenting essential information, including the name of the company and details about the certificates issued. Each entry captures the source of the membership interest, the amount paid, and the dates relevant to the transfer of interests. Members’ names and their places of residence are also recorded, ensuring transparency and accountability. The ledger includes sections for noting the certificate numbers associated with each membership interest, as well as information about any certificates that have been surrendered. This comprehensive documentation aids in maintaining an accurate balance of membership interests held by each member, facilitating smooth transactions and transfers within the organization.

Document Example

Membership I nt erest I ssuance/ Transfer Ledger for _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Enter Company’s Name)

|

|

|

Certificates I ssued |

From Whom Membership I nterest/ Units |

Amount Paid |

Date of |

To Whom Membership |

||

|

|

|

|

|

|

Were Transferred (I f original issue, |

Thereon |

Transfer of |

I nterest Were Transferred |

Name of Member |

Place of Residence |

Cert . |

|

No. of |

Date |

enter as such.) |

|

Membership |

|

|

|

|

|

|

I nterest/ Units |

|

|||

|

|

No. |

|

I nterest/ |

I ssued |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates

Surrendered

Cert . |

No. of |

No. |

I nterest/ |

|

Units |

|

|

Number of Membership

I nterest/ Units Held (Balance)

Frequently Asked Questions

-

What is the Membership Ledger form?

The Membership Ledger form is a document used to track the issuance and transfer of membership interests or units within a company. It records important details such as the names of members, the amount paid for their interests, and any transfers that occur.

-

What information do I need to fill out the form?

You will need to provide the company’s name, details of the certificates issued, the names of members, their places of residence, and information regarding any transfers of membership interests. Additionally, you will need to include the amount paid and the dates of these transactions.

-

How do I record a transfer of membership interest?

To record a transfer, enter the name of the member transferring their interest, the name of the new member, and the amount of membership interest being transferred. Make sure to include the date of the transfer and the certificate number associated with the interest.

-

What should I do if there is an error on the form?

If you notice an error, it is important to correct it as soon as possible. You can cross out the incorrect information and write the correct details next to it. Ensure that any changes are initialed and dated to maintain a clear record.

-

How do I determine the balance of membership interests held?

The balance of membership interests held can be calculated by subtracting the total number of interests transferred from the total number of interests issued. This information should be clearly recorded on the form to provide an accurate account of each member’s holdings.

-

Is there a specific format I need to follow when completing the form?

Yes, the form should be completed in a clear and organized manner. Use the provided fields to enter information accurately. Ensure that all entries are legible and that you follow the sequence outlined in the form to maintain consistency.

-

Who should have access to the Membership Ledger form?

The Membership Ledger form should be accessible to company management, the legal team, and any authorized personnel involved in managing membership interests. This ensures that all relevant parties can track and verify membership transactions effectively.

-

How long should I keep the Membership Ledger form?

It is advisable to keep the Membership Ledger form for a minimum of seven years. This duration allows for compliance with legal and regulatory requirements, as well as providing a historical record of membership transactions for future reference.

Misconceptions

Here are five common misconceptions about the Membership Ledger form:

- It is only for new memberships. Many believe the Membership Ledger form is only necessary for new members. In reality, it is also used to track transfers and changes in existing memberships.

- Only the company can fill it out. Some think that only authorized company personnel can complete the form. However, members can provide necessary information for their own transfers or updates.

- The form is optional. There is a misconception that using the Membership Ledger form is optional. In fact, it is essential for maintaining accurate records of membership interests and transfers.

- It only records financial transactions. While the form does track amounts paid, it also includes important details about membership transfers, such as names and dates, which are crucial for proper record-keeping.

- It is a complicated document. Many people think the Membership Ledger form is difficult to understand. In truth, it is straightforward and designed to capture essential information clearly.

Common mistakes

-

Leaving the Company Name Blank: Always enter the company's name at the top of the form. A blank field can lead to confusion and delays in processing.

-

Incorrect Certificate Numbers: Ensure that the certificate numbers are accurate. Mistakes here can complicate tracking and ownership verification.

-

Not Specifying Membership Interest: Clearly indicate the type and amount of membership interest or units. Omitting this information can result in incorrect records.

-

Failing to Date the Transfers: Always include the date of transfer. Without it, the timeline of ownership may become unclear.

-

Omitting the Recipient's Information: When transferring membership interests, be sure to fill out the recipient's name and place of residence. Missing this can lead to disputes over ownership.

-

Not Indicating Surrendered Certificates: If certificates are surrendered, make sure to note them clearly. This helps maintain accurate records of what is currently held.

-

Ignoring Balance Information: Always provide the number of membership interests or units held after transfers. This balance is crucial for accurate record-keeping.

Additional PDF Templates

Prescription Pad Size - Allows for quick updates to existing prescriptions as needed.

When it comes to legal protections in Michigan, a Michigan Hold Harmless Agreement can be essential for parties engaged in potentially risky activities, ensuring that one party can safeguard against losses or legal actions initiated by another. These agreements become particularly important in situations involving property usage or specific service engagements. For additional insights on these legal documents and to ensure proper execution, you may refer to resources available at onlinelawdocs.com/, where you can find comprehensive guidelines that underscore the necessity of such agreements in mitigating liability risks.

Chicago Title Lien Waiver - Illinois law requires this type of waiver to protect property owners from lien claims.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Membership Ledger form is used to track the issuance and transfer of membership interests or units within a company. This helps maintain accurate records of ownership and transactions. |

| Company Name | Users must enter the company's name at the top of the form, ensuring that all entries are associated with the correct entity. This is crucial for legal and organizational clarity. |

| Transfer Details | The form requires detailed information about each transfer, including the names of the members involved, the amount paid, and the date of the transfer. This information is vital for tracking ownership changes. |

| Certificate Numbers | Each membership interest is linked to a certificate number. This number must be included in the ledger to provide a clear reference for each unit or interest issued or transferred. |

| State-Specific Regulations | The use of the Membership Ledger form may be governed by specific state laws, such as the Uniform Limited Liability Company Act (ULLCA) or similar statutes. Always check local regulations to ensure compliance. |

Similar forms

The Membership Interest Issuance/Transfer Ledger is similar to a Stock Transfer Ledger. Both documents track the transfer of ownership interests in a company. The Stock Transfer Ledger records the details of stock ownership, including the names of shareholders, the number of shares owned, and any transfers that occur. Just like the Membership Ledger, it maintains a clear record of who holds what, ensuring transparency in ownership changes.

Another comparable document is the Partnership Interest Ledger. This ledger serves to document the ownership interests of partners in a partnership. It captures details such as the partner's name, the amount of their investment, and any changes in ownership. Similar to the Membership Ledger, it helps in maintaining accurate records of ownership and transfers, which is crucial for the partnership's financial health.

The Capital Contributions Ledger is also similar in purpose. It tracks the contributions made by members or partners to a business. This document records the amounts contributed, the date of contribution, and the individual or entity making the contribution. Like the Membership Ledger, it provides a clear picture of each member's financial stake in the company.

A Member Registration Form shares similarities with the Membership Ledger as well. This form collects essential information about each member, including their name, address, and membership interest. While the Membership Ledger focuses on transactions, the Member Registration Form serves as a foundational document that establishes who the members are and their initial contributions.

In addition to the previously mentioned documents, understanding the New York Trailer Bill of Sale is essential for those involved in trailer transactions. This form serves a vital purpose in ensuring the legal transfer of ownership and captures key transaction details, thus safeguarding both the buyer and seller. For more information about this document, you can visit documentonline.org/blank-new-york-trailer-bill-of-sale/, which provides further insights into its importance and usage.

The Ownership Transfer Agreement is another document that aligns closely with the Membership Ledger. This agreement outlines the terms and conditions under which ownership interests are transferred between parties. It includes details such as the names of the transferor and transferee, the interests being transferred, and the effective date of the transfer. Both documents aim to ensure that ownership changes are recorded accurately and legally.

The Membership Certificate is also relevant here. This certificate serves as proof of ownership for members in a company. It typically includes the member's name, the number of units owned, and the date of issuance. Like the Membership Ledger, it plays a crucial role in establishing and verifying ownership interests within the organization.

A Shareholder Agreement can be compared to the Membership Ledger as well. This document outlines the rights and responsibilities of shareholders in a corporation. It includes provisions for the transfer of shares, similar to how the Membership Ledger records the transfer of membership interests. Both documents help manage the relationships and obligations among owners.

The Financial Statement of the company is another document that relates to the Membership Ledger. While it provides an overview of the company's financial health, it often reflects the ownership interests recorded in the Membership Ledger. Changes in ownership can impact financial statements, making it essential to keep both documents aligned.

The Minutes of Meetings can also be seen as similar. These minutes document the discussions and decisions made during meetings, including any resolutions related to membership transfers or ownership changes. They serve as a record of the governance of the organization, complementing the Membership Ledger by providing context to ownership changes.

Lastly, the Annual Report is akin to the Membership Ledger. This report summarizes the company’s performance over the year and includes information about membership interests and changes. Both documents are essential for stakeholders to understand ownership structures and the overall health of the organization.