Blank Louisiana act of donation Template

The Louisiana Act of Donation form serves as a crucial legal instrument for individuals wishing to transfer ownership of property without the exchange of monetary compensation. This form outlines the donor's intent to give a specific asset, such as real estate, personal belongings, or financial accounts, to a designated recipient, known as the donee. Essential elements of the form include the identification of both parties, a detailed description of the property being donated, and any conditions or limitations the donor wishes to impose on the transfer. Additionally, the form requires the signatures of both the donor and the donee, often necessitating the presence of a notary public to validate the transaction. Understanding the nuances of this form is vital for ensuring that the donation process adheres to Louisiana law, safeguarding the interests of both parties involved. Whether for estate planning, charitable contributions, or family gifting, the Act of Donation form plays a significant role in facilitating these transactions while providing legal clarity and protection.

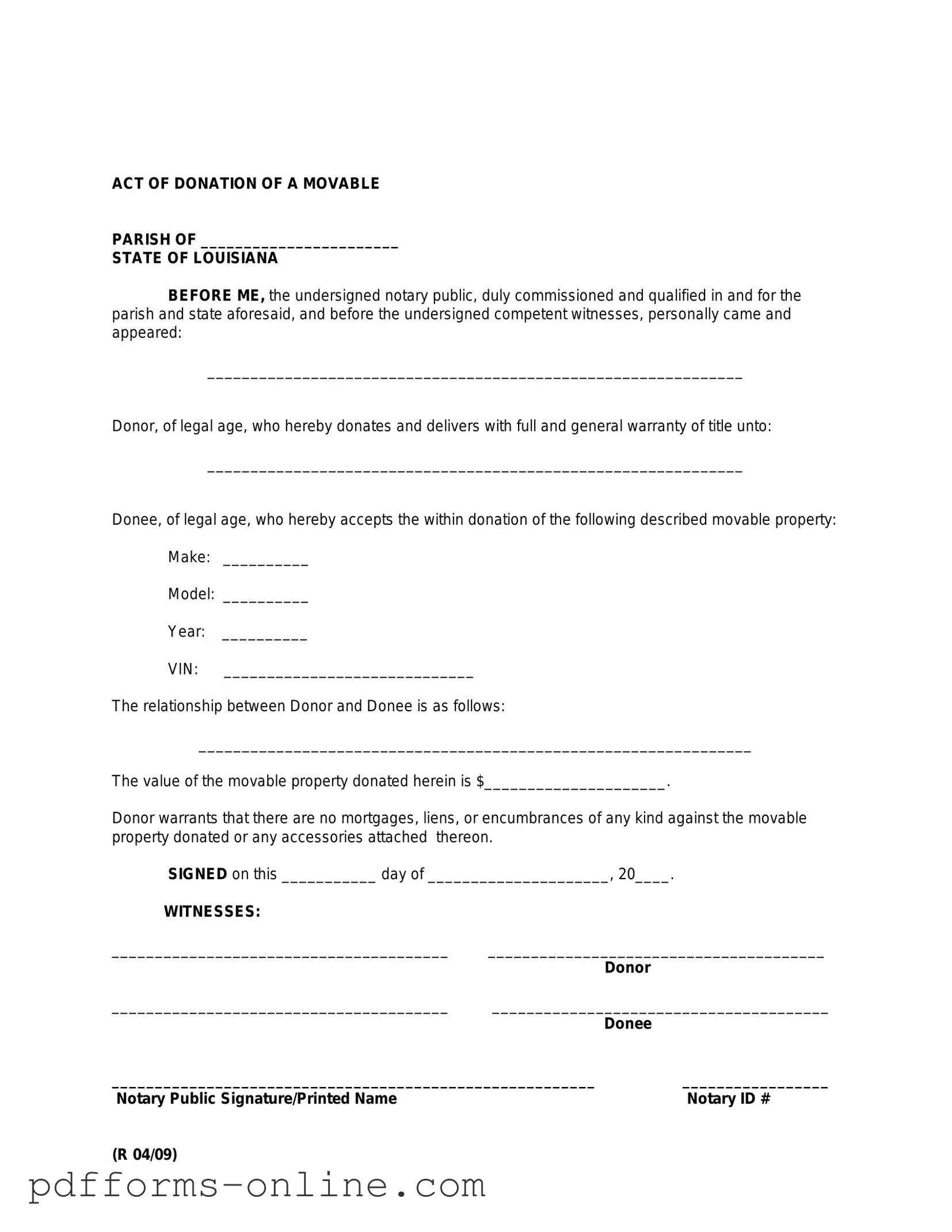

Document Example

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Frequently Asked Questions

-

What is the Louisiana Act of Donation form?

The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another without any exchange of money. This form is often used for gifts of real estate, personal property, or other assets. It serves to formally record the intention of the donor to give the property to the recipient, known as the donee.

-

Who can use the Louisiana Act of Donation form?

Any individual or entity that wishes to donate property can use this form. This includes parents giving property to their children, friends making gifts to one another, or even organizations donating assets. However, it is important that the donor has legal ownership of the property and the capacity to make the donation.

-

Are there any requirements for completing the form?

Yes, there are specific requirements for the Louisiana Act of Donation form. The document must clearly identify the donor and the donee, describe the property being donated, and state the donor's intention to make the gift. Additionally, the form typically needs to be signed by the donor in the presence of a notary public. In some cases, witnesses may also be required.

-

Do I need to file the Act of Donation with the state?

While it is not mandatory to file the Act of Donation with the state, doing so can provide additional legal protection and public notice of the transfer. Filing the document with the appropriate parish clerk's office is advisable, especially for real estate donations. This step ensures that the donation is officially recognized and can help avoid disputes in the future.

-

Can the Louisiana Act of Donation be revoked?

Generally, once the Act of Donation is executed and the property has been transferred, it cannot be revoked. However, if the donation was made under certain conditions, such as fraud or undue influence, there may be grounds for challenging the donation. It is essential to consult with a legal professional if there are concerns about the validity of the donation.

Misconceptions

The Louisiana act of donation form is often misunderstood. Here are eight common misconceptions about this important legal document:

-

It only applies to real estate.

Many believe the act of donation is limited to transferring ownership of real property. In reality, it can also apply to personal property, such as vehicles, jewelry, and other assets.

-

It requires a notary public.

While having a notary public can provide additional validity, it is not a strict requirement for the act of donation to be legally binding in Louisiana.

-

All donations are irrevocable.

Some assume that once a donation is made, it cannot be undone. However, certain conditions allow for revocation, particularly if the donor retains specific rights over the donated property.

-

Only family members can receive donations.

This is a common belief, but the act of donation can be made to any individual or entity, not just relatives.

-

Tax implications are minimal.

Many people overlook the potential tax consequences of making a donation. Depending on the value of the donation, both the donor and recipient may face significant tax obligations.

-

It is the same as a will.

While both documents deal with the transfer of property, an act of donation is a gift made during the donor's lifetime, whereas a will comes into effect after death.

-

There are no formal requirements.

Some may think that any informal agreement suffices. In fact, the act of donation must meet specific criteria to be enforceable, including clear intent and description of the property.

-

It cannot be contested.

Contrary to popular belief, an act of donation can be contested in court. Disputes may arise over the donor's capacity, the validity of the document, or other factors.

Understanding these misconceptions can help individuals navigate the complexities of the Louisiana act of donation form more effectively.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. Missing names, addresses, or signatures can render the form invalid.

-

Incorrect Property Description: Some people do not accurately describe the property being donated. This can lead to confusion and potential disputes later.

-

Not Following Witness Requirements: The form often requires witnesses to sign. Neglecting this step can invalidate the donation.

-

Failure to Notarize: In Louisiana, notarization is typically necessary for the act of donation to be legally binding. Skipping this step can create issues.

-

Not Understanding Tax Implications: Some donors overlook the potential tax consequences of their donation. This can lead to unexpected financial burdens.

Additional PDF Templates

Cheaper Insurance Than Progressive - The GEICO Supplement Request Form plays a key role in the claims adjustment process.

Additionally, understanding the importance of having a Living Will form can significantly impact your healthcare experience, ensuring that you receive medical care aligned with your desires. For those who wish to explore this further or need to access the necessary documentation, please refer to All Arizona Forms to begin the process of securing your wishes today.

What Is Required on a Prescription Label - It is a crucial part of the medication dispensing process.

Document Data

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation is a legal document used to transfer ownership of property as a gift. |

| Governing Law | This act is governed by the Louisiana Civil Code, specifically Articles 1469 to 1491. |

| Types of Donations | Donations can be inter vivos (between living persons) or mortis causa (through a will). |

| Requirements | The act must be in writing and signed by the donor to be valid. |

| Witnesses | In some cases, the presence of witnesses may be required for the act to be legally binding. |

| Revocation | Donations can be revoked under specific circumstances, such as if the donor becomes incapacitated. |

| Tax Implications | Gifts may have tax implications for both the donor and the recipient, including potential gift taxes. |

| Property Types | Real estate, personal property, and financial assets can all be included in a donation. |

| Notarization | While notarization is not always required, it is highly recommended to ensure the document's validity. |

| Legal Advice | Consulting with a legal expert is advisable to navigate the complexities of property donation. |

Similar forms

The Louisiana Act of Donation form is similar to a gift deed. A gift deed is a legal document that transfers ownership of property from one person to another without any exchange of money. Like the Act of Donation, a gift deed must be executed voluntarily and with the intent to make a gift. Both documents require the signature of the donor and may need to be notarized to be legally binding. This ensures that the transfer is recognized by the state and protects the rights of both parties involved.

An additional document that shares similarities is the Last Will and Testament. A will outlines how a person's assets will be distributed after their death. Like the Act of Donation, a will can include specific gifts of property to individuals. Both documents must be executed with clear intent and follow legal requirements to ensure that the wishes of the donor or testator are honored. However, while the Act of Donation is effective during the donor's lifetime, a will takes effect only after death.

The Quitclaim Deed is another document that resembles the Louisiana Act of Donation. A quitclaim deed transfers whatever interest a person has in a property without guaranteeing that the title is clear. Similar to the Act of Donation, it is often used to transfer property between family members or friends. Both documents do not require a sale price, emphasizing the nature of the transfer as a gift rather than a transaction.

The Bill of Sale is comparable in that it serves as a document to transfer ownership of personal property. While it is typically used for tangible items like vehicles or furniture, it shares the same fundamental principle of transferring ownership without a sale price. Both the Bill of Sale and the Act of Donation must be executed properly to ensure that the transfer is legally recognized, although the Act of Donation is more focused on real estate or significant gifts.

The Release of Liability form also bears some resemblance to the Louisiana Act of Donation. This document is used to relinquish any claims against another party, often in exchange for a gift or favor. In both cases, the parties involved must understand the implications of their agreement. While the Act of Donation focuses on transferring ownership, a Release of Liability is more about protecting the donor from future claims related to the gift.

The Trust Agreement is another similar document. A trust allows a person to place assets under the control of a trustee for the benefit of another person. Like the Act of Donation, it can facilitate the transfer of property without the immediate need for a sale. Both documents require careful consideration of the intentions of the donor and the needs of the recipient, ensuring that the assets are managed according to the donor's wishes.

Understanding the intricacies of legal documents is vital, particularly when it comes to property transactions and transfers. For instance, the Georgia Motor Vehicle Bill of Sale form is an essential document that facilitates the sale and ownership transfer of a vehicle in Georgia. This form details the particulars of the transaction, ensuring that both buyer and seller have a clear record. For further information, you can visit https://onlinelawdocs.com/.

Finally, the Deed of Gift is closely related to the Louisiana Act of Donation. This document explicitly states that property is being given as a gift, and it outlines the details of the transfer. Both documents serve the same purpose of transferring ownership without compensation. They require the donor’s intent to make a gift and typically must be signed and notarized to be valid. The Deed of Gift may be used in various states, while the Louisiana Act of Donation is specific to Louisiana law.