Blank Loan Agreement Form

A Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions agreed upon by both the lender and the borrower. This form typically includes key details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Clarity is essential; thus, it specifies the rights and responsibilities of each party, ensuring that both understand their obligations. Additionally, the agreement may address potential consequences for late payments or defaults, providing a framework for resolving disputes. By documenting these important aspects, the Loan Agreement form helps to protect both parties and facilitates a smoother transaction. It is not just a formality; it lays the groundwork for a trustworthy financial relationship.

Document Example

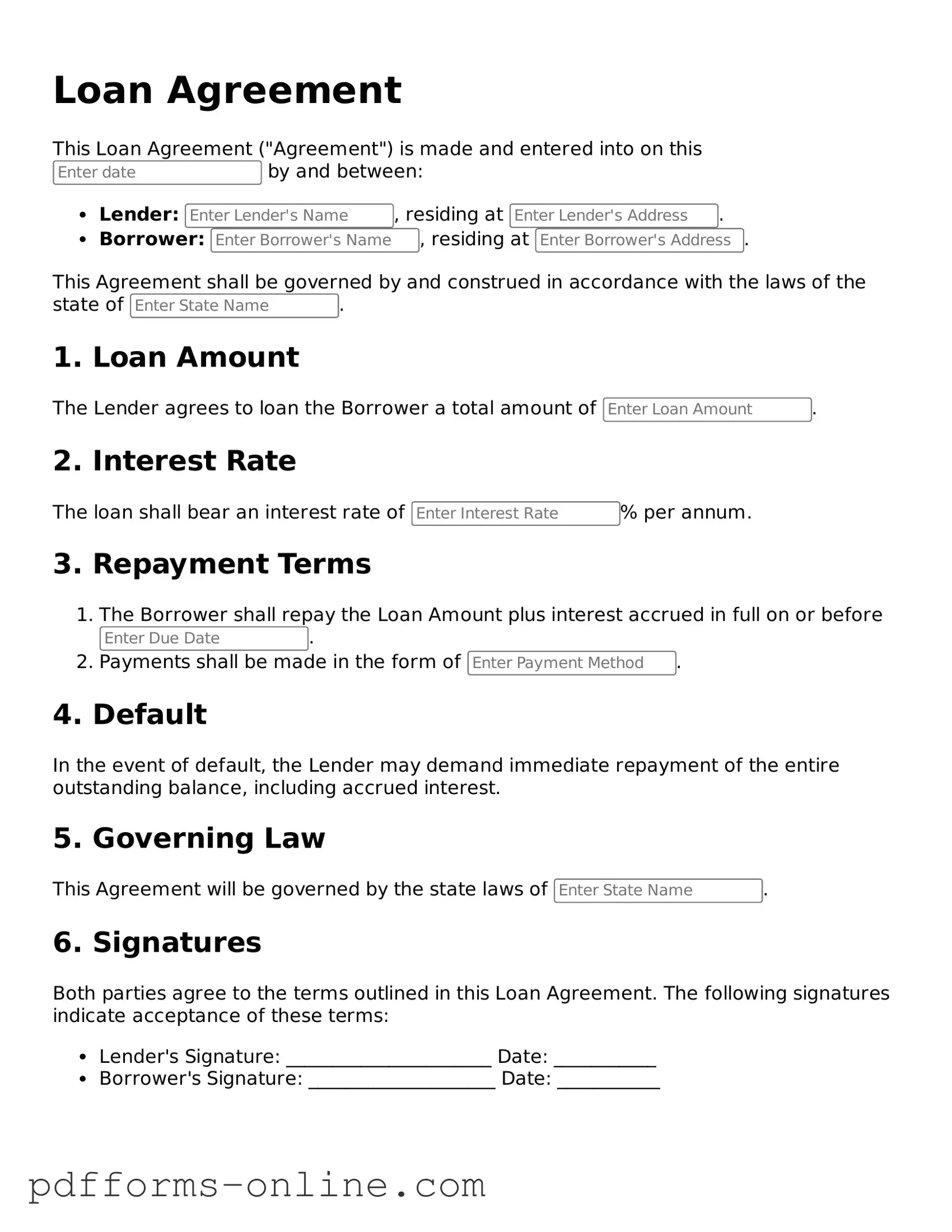

Loan Agreement

This Loan Agreement ("Agreement") is made and entered into on this by and between:

- Lender: , residing at .

- Borrower: , residing at .

This Agreement shall be governed by and construed in accordance with the laws of the state of .

1. Loan Amount

The Lender agrees to loan the Borrower a total amount of .

2. Interest Rate

The loan shall bear an interest rate of % per annum.

3. Repayment Terms

- The Borrower shall repay the Loan Amount plus interest accrued in full on or before .

- Payments shall be made in the form of .

4. Default

In the event of default, the Lender may demand immediate repayment of the entire outstanding balance, including accrued interest.

5. Governing Law

This Agreement will be governed by the state laws of .

6. Signatures

Both parties agree to the terms outlined in this Loan Agreement. The following signatures indicate acceptance of these terms:

- Lender's Signature: ______________________ Date: ___________

- Borrower's Signature: ____________________ Date: ___________

Loan Agreement Form Types

Frequently Asked Questions

-

What is a Loan Agreement?

A Loan Agreement is a formal document that outlines the terms and conditions under which a borrower receives funds from a lender. It specifies the amount borrowed, the interest rate, repayment schedule, and any other obligations of both parties.

-

Who needs a Loan Agreement?

Anyone entering into a lending arrangement should have a Loan Agreement. This includes individuals borrowing from friends or family, businesses seeking loans from financial institutions, and anyone involved in peer-to-peer lending.

-

What information is typically included in a Loan Agreement?

A Loan Agreement generally includes:

- The names and contact information of the borrower and lender

- The loan amount

- The interest rate

- The repayment schedule

- Consequences of default

- Any collateral required

- Governing law

-

How does a Loan Agreement protect both parties?

A Loan Agreement provides clarity and security for both the borrower and lender. It ensures that both parties understand their rights and obligations, reducing the risk of disputes. In case of disagreement, the agreement serves as a legal reference.

-

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified, but it typically requires the consent of both parties. Any changes should be documented in writing and signed to ensure that both parties are aware and agree to the new terms.

-

What happens if the borrower defaults on the Loan Agreement?

If the borrower fails to repay the loan as agreed, the lender may take legal action to recover the owed amount. This could include pursuing collections or, if collateral is involved, seizing the collateral.

-

Is a Loan Agreement legally binding?

Yes, a properly executed Loan Agreement is legally binding. It holds both parties accountable to the terms outlined within it. However, it is essential that all parties fully understand the agreement before signing.

-

Do I need a lawyer to create a Loan Agreement?

While it is not mandatory to involve a lawyer, consulting with one can be beneficial, especially for larger loans or complex agreements. A lawyer can help ensure that the agreement complies with local laws and adequately protects your interests.

-

How can I ensure my Loan Agreement is enforceable?

To ensure enforceability, make sure the Loan Agreement is clear, comprehensive, and signed by both parties. It is also advisable to have a witness or notary present during the signing process, as this adds an extra layer of validity.

Misconceptions

Understanding a Loan Agreement form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

All Loan Agreements are the Same:

Many believe that all loan agreements follow a standard format. In reality, terms can vary significantly based on the lender, type of loan, and individual circumstances.

-

Loan Agreements are Non-Negotiable:

Some think that once a loan agreement is presented, the terms are set in stone. However, many aspects can be negotiated, including interest rates and repayment schedules.

-

Only Banks Provide Loan Agreements:

It's a common misconception that only banks can issue loan agreements. Various financial institutions, credit unions, and private lenders also provide loans and associated agreements.

-

Signing Means Full Understanding:

People often assume that signing a loan agreement indicates complete understanding of its terms. In truth, borrowers should thoroughly read and comprehend all clauses before signing.

-

Loan Agreements are Only for Large Amounts:

Many believe that loan agreements are only necessary for large loans. However, even small loans can benefit from a formal agreement to outline the terms clearly.

-

Once Signed, You Can’t Change Your Mind:

Some borrowers think that once they sign a loan agreement, they cannot back out. There may be options for cancellation or refinancing, depending on the lender and local laws.

Being aware of these misconceptions can help individuals navigate the lending process more effectively.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Leaving sections blank can lead to delays in processing.

-

Incorrect Personal Details: Mistakes in names, addresses, or contact information can create confusion. Double-checking these details is crucial.

-

Wrong Loan Amount: Entering an incorrect loan amount can affect approval. Ensure that the amount requested matches your needs and eligibility.

-

Neglecting to Read Terms: Some people skip the fine print. Understanding the terms and conditions of the loan is essential to avoid future surprises.

-

Missing Signatures: Forgetting to sign the document is a common oversight. Signatures are often required in multiple places, so be thorough.

-

Providing Inaccurate Financial Information: Listing incorrect income or expenses can lead to loan denial. Be honest and accurate when detailing your financial situation.

-

Not Including Supporting Documents: Some lenders require additional documentation. Failing to provide these can slow down the approval process.

-

Ignoring Deadlines: Loan agreements often have specific timelines for submission. Missing these deadlines can jeopardize your loan application.

Popular Templates

Small Business Business Bill of Sale Pdf - Sellers can use it to document the sale for their financial records and tax purposes.

Bdsm Limit List - Enjoyment in teasing or denial practices.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Parties Involved | The form typically includes the names and addresses of the lender and borrower. |

| Loan Amount | The total sum of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applied to the loan, whether fixed or variable. |

| Governing Law | Each state has specific laws governing loan agreements, which must be adhered to, such as California Civil Code § 1916-1921. |

| Repayment Terms | The form outlines how and when the borrower will repay the loan, including any penalties for late payments. |

Similar forms

A promissory note is a document that outlines a borrower's promise to repay a loan under specified terms. Like a Loan Agreement, it details the amount borrowed, the interest rate, and the repayment schedule. However, a promissory note is typically simpler and focuses primarily on the borrower's commitment to repay the debt, rather than the comprehensive terms and conditions found in a Loan Agreement. This document serves as a straightforward acknowledgment of the debt and can be used in various lending situations.

A mortgage agreement is another document similar to a Loan Agreement, particularly in real estate transactions. It secures a loan by using the property as collateral. Both documents outline the loan amount, interest rates, and repayment terms. However, a mortgage agreement specifically includes details about the property being financed and the rights of the lender to take possession if the borrower defaults. This added layer of security for the lender makes it distinct from a standard Loan Agreement.

A lease agreement shares similarities with a Loan Agreement in that it establishes terms for the use of property in exchange for payment. Both documents specify payment amounts and schedules. However, a lease agreement focuses on the rental of property rather than a loan for purchasing. It typically includes terms regarding the duration of the lease, maintenance responsibilities, and conditions for termination. This makes it more about the use of property rather than the borrowing of funds.

An installment agreement is comparable to a Loan Agreement in that it outlines a structured payment plan for repaying a debt. Both documents detail the total amount owed, payment frequency, and interest rates. However, installment agreements are often used in situations where a borrower is repaying a tax debt or other obligations over time. This type of agreement may include specific provisions for penalties or late fees, which can differ from the terms in a typical Loan Agreement.

A credit agreement is another document that resembles a Loan Agreement, particularly in its function of detailing the terms of borrowing. Both documents specify the amount of credit extended, interest rates, and repayment terms. However, a credit agreement often applies to revolving credit accounts, such as credit cards or lines of credit, where the borrower can draw on the funds as needed. This flexibility in borrowing distinguishes it from the more fixed structure of a traditional Loan Agreement.