Blank LLC Share Purchase Agreement Form

When considering the purchase or sale of shares in a Limited Liability Company (LLC), an LLC Share Purchase Agreement becomes an essential document to ensure a smooth transaction. This agreement outlines the terms and conditions under which the shares will be bought or sold, providing clarity and protection for both parties involved. Key aspects typically covered in the form include the purchase price, the number of shares being transferred, and the closing date of the transaction. Additionally, the agreement often specifies representations and warranties made by the seller regarding the shares, ensuring that the buyer is fully informed about what they are acquiring. Important details such as payment methods, conditions precedent, and any contingencies that must be met before the sale can be finalized are also included. By addressing these elements, the LLC Share Purchase Agreement not only facilitates the transfer of ownership but also minimizes potential disputes, making it a vital tool for anyone engaging in the buying or selling of LLC shares.

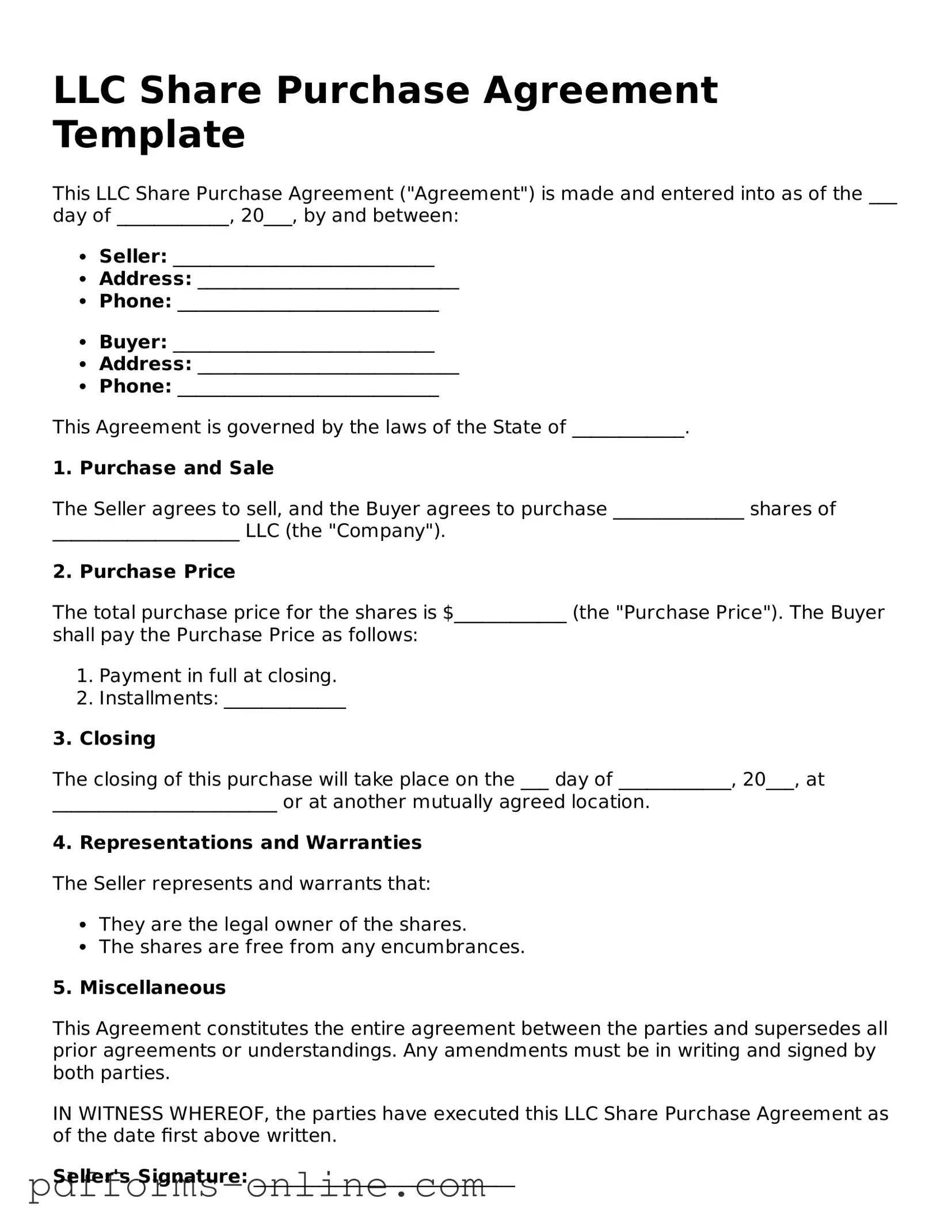

Document Example

LLC Share Purchase Agreement Template

This LLC Share Purchase Agreement ("Agreement") is made and entered into as of the ___ day of ____________, 20___, by and between:

- Seller: ____________________________

- Address: ____________________________

- Phone: ____________________________

- Buyer: ____________________________

- Address: ____________________________

- Phone: ____________________________

This Agreement is governed by the laws of the State of ____________.

1. Purchase and Sale

The Seller agrees to sell, and the Buyer agrees to purchase ______________ shares of ____________________ LLC (the "Company").

2. Purchase Price

The total purchase price for the shares is $____________ (the "Purchase Price"). The Buyer shall pay the Purchase Price as follows:

- Payment in full at closing.

- Installments: _____________

3. Closing

The closing of this purchase will take place on the ___ day of ____________, 20___, at ________________________ or at another mutually agreed location.

4. Representations and Warranties

The Seller represents and warrants that:

- They are the legal owner of the shares.

- The shares are free from any encumbrances.

5. Miscellaneous

This Agreement constitutes the entire agreement between the parties and supersedes all prior agreements or understandings. Any amendments must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this LLC Share Purchase Agreement as of the date first above written.

Seller's Signature: ____________________________

Date: _____________

Buyer's Signature: ____________________________

Date: _____________

Frequently Asked Questions

-

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which one party agrees to purchase shares from another party in a Limited Liability Company (LLC). This agreement serves to protect both the buyer and the seller by clearly defining the rights and obligations of each party involved in the transaction.

-

Why do I need an LLC Share Purchase Agreement?

This agreement is essential for ensuring that both parties have a clear understanding of the sale. It helps prevent misunderstandings and disputes that may arise after the transaction. By detailing the purchase price, payment terms, and any representations or warranties, the agreement provides a solid foundation for the transfer of ownership.

-

What key elements should be included in the agreement?

Essential elements of an LLC Share Purchase Agreement typically include:

- The names and addresses of the buyer and seller

- A description of the shares being sold

- The purchase price and payment terms

- Representations and warranties made by both parties

- Conditions for closing the sale

- Any post-closing obligations

-

How is the purchase price determined?

The purchase price can be established through various methods, including mutual agreement between the buyer and seller, valuation by a third-party appraiser, or based on the company's financial performance. It is crucial that both parties feel comfortable with the price to ensure a smooth transaction.

-

What are representations and warranties?

Representations and warranties are statements made by the seller regarding the condition of the LLC and the shares being sold. These statements assure the buyer that certain facts are true, such as ownership of the shares, the financial status of the LLC, and compliance with applicable laws. They provide the buyer with important information that can influence their decision to proceed with the purchase.

-

What happens if either party breaches the agreement?

If a party breaches the agreement, the other party may have legal recourse. This could include seeking damages or specific performance, which requires the breaching party to fulfill their obligations under the agreement. It is advisable to include a clause in the agreement that outlines the remedies available in the event of a breach.

-

Can an LLC Share Purchase Agreement be modified?

Yes, the agreement can be modified if both parties agree to the changes. It is essential to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

-

Is it necessary to have legal assistance when drafting this agreement?

While it is possible to draft an LLC Share Purchase Agreement without legal assistance, it is highly recommended to consult with a legal professional. An attorney can provide valuable guidance, ensuring that the agreement complies with state laws and adequately protects your interests.

-

Where can I obtain an LLC Share Purchase Agreement form?

LLC Share Purchase Agreement forms can be found through various online legal services, law firms, or legal document providers. Ensure that the form you choose is tailored to your specific needs and complies with the laws of your state.

Misconceptions

Understanding the LLC Share Purchase Agreement is essential for both buyers and sellers. However, several misconceptions can lead to confusion. Below is a list of common misconceptions, along with clarifications to help you navigate this important document.

- Misconception 1: An LLC Share Purchase Agreement is the same as a standard purchase agreement.

- Misconception 2: All LLC Share Purchase Agreements are identical.

- Misconception 3: Once signed, the agreement cannot be changed.

- Misconception 4: The agreement does not require legal review.

- Misconception 5: A verbal agreement is sufficient.

- Misconception 6: The agreement only covers the sale price.

- Misconception 7: Once the agreement is signed, the transaction is complete.

This is not true. An LLC Share Purchase Agreement specifically pertains to the purchase of membership interests in a limited liability company, while a standard purchase agreement may cover various types of transactions.

In reality, these agreements can vary significantly based on the specific terms negotiated between the parties involved. Each agreement should be tailored to meet the unique needs of the transaction.

This is a common misunderstanding. While the agreement is binding once executed, parties can negotiate amendments if both agree to the changes.

It is advisable to have a legal professional review the agreement. This ensures that all terms are clear and legally enforceable, protecting the interests of both parties.

Verbal agreements can lead to misunderstandings. A written LLC Share Purchase Agreement provides clarity and serves as a legal document in case of disputes.

While the sale price is a critical component, the agreement also addresses other important aspects such as payment terms, representations, warranties, and conditions for closing.

This is misleading. The signing of the agreement is just one step in the process. Additional actions, such as transferring ownership and filing necessary documents, must follow to finalize the transaction.

Addressing these misconceptions can help ensure a smoother transaction process. Understanding the nuances of an LLC Share Purchase Agreement is vital for all parties involved.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details in the form. This can include missing names, addresses, or contact information of the parties involved.

-

Incorrect Ownership Percentages: It's crucial to accurately state the percentage of ownership being purchased. Errors in this area can lead to disputes later on.

-

Omitting Purchase Price: Some people forget to include the total purchase price for the shares. This information is essential for clarity and agreement between parties.

-

Neglecting Signatures: Failing to sign the agreement is a common oversight. Without signatures, the document may not be legally binding.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for LLC agreements. Not adhering to these can invalidate the agreement.

-

Not Seeking Legal Advice: Some individuals attempt to fill out the form without consulting a legal professional. This can result in misunderstandings or mistakes that could have been avoided.

Popular Templates

U.S. Corporation Income Tax Return - C corporations must include information about stock ownership and shareholder dividends on this form.

It is essential to use a reliable resource when creating a General Bill of Sale, ensuring that all necessary information is accurately represented; you can download a template from https://documentonline.org/blank-general-bill-of-sale for your convenience, helping to streamline the process of transferring ownership legally.

Availability Form Template - Your input on availability is important for overall work efficiency.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which shares of an LLC are bought and sold. |

| Parties Involved | The agreement typically involves a seller, who owns the shares, and a buyer, who intends to purchase those shares. |

| Governing Law | The governing law can vary by state. For example, in Delaware, the law governing LLCs is Title 6, Chapter 18 of the Delaware Code. |

| Purchase Price | The agreement specifies the purchase price for the shares, which may be a fixed amount or based on a formula. |

| Closing Conditions | It outlines the conditions that must be met before the transaction can be completed, such as regulatory approvals. |

| Representations and Warranties | Both parties make representations and warranties regarding their authority to enter into the agreement and the condition of the LLC. |

| Indemnification | The agreement may include indemnification clauses, protecting one party from losses caused by the other party's breach of the agreement. |

| Confidentiality | Confidentiality provisions may be included to protect sensitive information shared during the negotiation process. |

| Governing Jurisdiction | The agreement often specifies the jurisdiction where disputes will be resolved, which can impact the enforcement of the agreement. |

| Amendments | It typically includes provisions for how the agreement can be amended, requiring written consent from both parties. |

Similar forms

The LLC Operating Agreement is a crucial document that outlines the management structure and operational procedures of a limited liability company. Similar to the Share Purchase Agreement, it details the rights and responsibilities of the members. Both documents serve to protect the interests of the parties involved, ensuring clarity and mutual understanding regarding ownership stakes and decision-making processes. The Operating Agreement is particularly essential for internal governance, while the Share Purchase Agreement focuses on the transfer of ownership interests.

The Stock Purchase Agreement (SPA) is another document that bears similarities to the LLC Share Purchase Agreement. This agreement specifically pertains to the purchase and sale of shares in a corporation. Like the Share Purchase Agreement for an LLC, the SPA outlines the terms of the transaction, including the purchase price and the representations and warranties of the seller. Both documents aim to facilitate a smooth transfer of ownership while ensuring that all parties are aware of their rights and obligations.

The Membership Interest Purchase Agreement is also comparable to the LLC Share Purchase Agreement. This document governs the sale of membership interests in an LLC, detailing the terms under which ownership interests are transferred. It includes provisions related to payment, representations, and warranties, much like the Share Purchase Agreement. Both agreements seek to protect the parties by clearly defining the terms of the transaction and the rights of the members involved.

The Asset Purchase Agreement (APA) is another relevant document that shares similarities with the LLC Share Purchase Agreement. While the Share Purchase Agreement focuses on the transfer of ownership interests, the APA deals with the purchase of specific assets of a business. Both agreements outline the terms of the transaction, including payment and any contingencies. They serve to clarify the expectations of the parties and ensure a legally binding transfer of assets or interests.

In the world of investment, understanding the various agreements is crucial, and one such document is the Investment Letter of Intent, which acts as a preliminary agreement between an investor and a company. This form not only outlines the framework of a potential investment deal but also establishes the essential terms and conditions for capital investment. As such, resources like TopTemplates.info can provide valuable insights and templates to facilitate this vital step in the investment process.

Finally, the Non-Disclosure Agreement (NDA) can be seen as related to the LLC Share Purchase Agreement in terms of confidentiality. While the Share Purchase Agreement may include confidentiality provisions, an NDA specifically protects sensitive information exchanged during negotiations. Both documents are vital for safeguarding the interests of the parties involved, ensuring that proprietary information remains confidential throughout the transaction process.