Blank Letter of Intent to Purchase Business Form

The Letter of Intent to Purchase Business form serves as a crucial preliminary document in the process of acquiring a business. This form outlines the intentions of the buyer and seller, establishing a foundation for negotiations and future agreements. Key components typically include the purchase price, terms of payment, and a timeline for the transaction. Additionally, it may address contingencies such as financing and due diligence requirements, ensuring that both parties have a clear understanding of their obligations and expectations. By delineating the framework of the proposed sale, this document fosters transparency and facilitates smoother discussions, ultimately guiding the parties toward a formal purchase agreement. The inclusion of confidentiality clauses is also common, protecting sensitive information during the negotiation phase. Overall, the Letter of Intent serves as a strategic tool, signaling the seriousness of the buyer while providing the seller with a structured outline of the proposed terms.

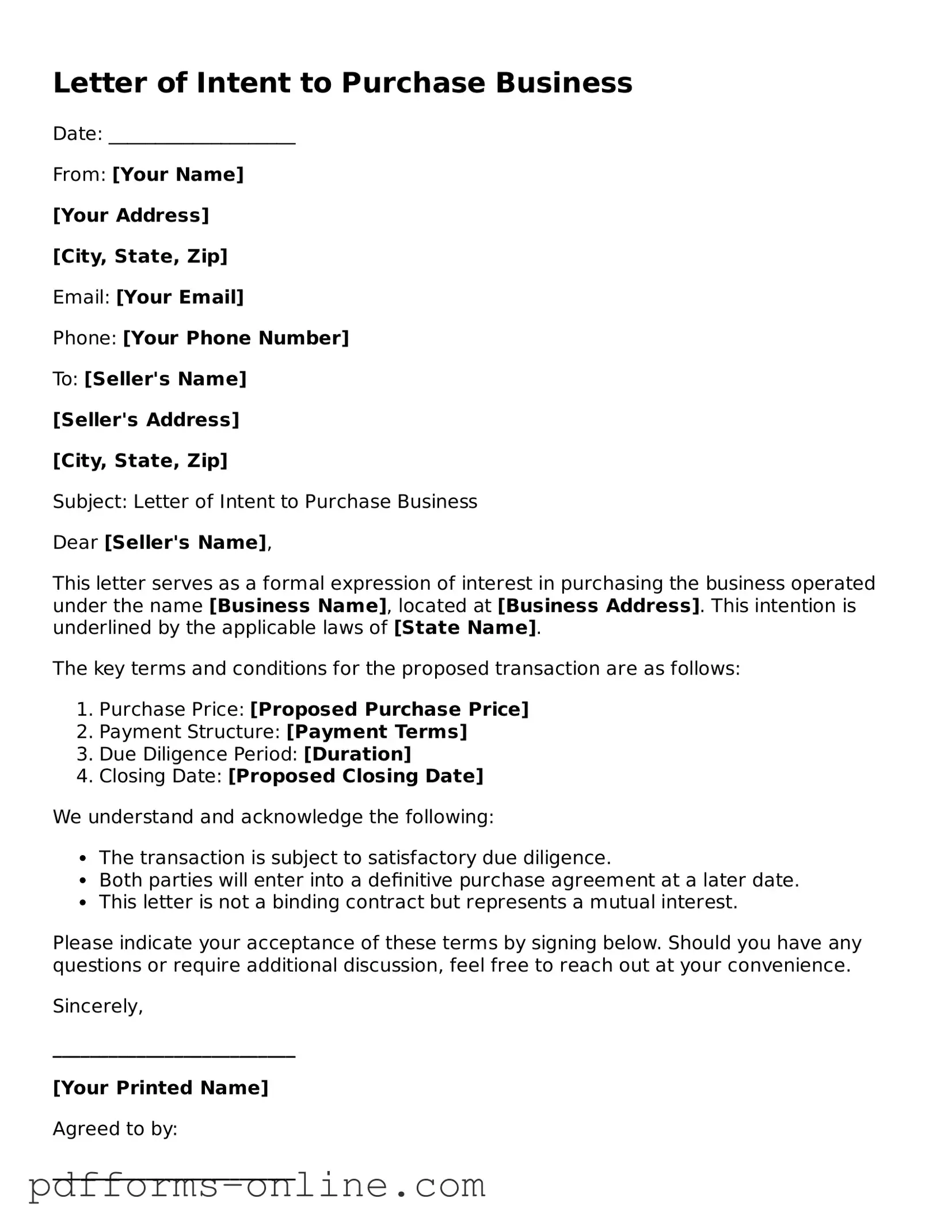

Document Example

Letter of Intent to Purchase Business

Date: ____________________

From: [Your Name]

[Your Address]

[City, State, Zip]

Email: [Your Email]

Phone: [Your Phone Number]

To: [Seller's Name]

[Seller's Address]

[City, State, Zip]

Subject: Letter of Intent to Purchase Business

Dear [Seller's Name],

This letter serves as a formal expression of interest in purchasing the business operated under the name [Business Name], located at [Business Address]. This intention is underlined by the applicable laws of [State Name].

The key terms and conditions for the proposed transaction are as follows:

- Purchase Price: [Proposed Purchase Price]

- Payment Structure: [Payment Terms]

- Due Diligence Period: [Duration]

- Closing Date: [Proposed Closing Date]

We understand and acknowledge the following:

- The transaction is subject to satisfactory due diligence.

- Both parties will enter into a definitive purchase agreement at a later date.

- This letter is not a binding contract but represents a mutual interest.

Please indicate your acceptance of these terms by signing below. Should you have any questions or require additional discussion, feel free to reach out at your convenience.

Sincerely,

__________________________

[Your Printed Name]

Agreed to by:

__________________________

[Seller’s Printed Name]

Date: ____________________

Frequently Asked Questions

-

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to Purchase Business is a document that outlines the preliminary understanding between a buyer and a seller regarding the sale of a business. This letter serves as a starting point for negotiations and typically includes key terms such as the purchase price, payment structure, and any conditions that must be met before the sale is finalized.

-

Why is a Letter of Intent important?

The LOI is crucial because it helps clarify the intentions of both parties before entering into a formal agreement. It can prevent misunderstandings and set the groundwork for further negotiations. Additionally, an LOI can signal to both parties that they are serious about the transaction, which can help secure financing or other necessary approvals.

-

What should be included in a Letter of Intent?

A comprehensive LOI should include:

- The names and contact information of both the buyer and the seller

- A description of the business being sold

- The proposed purchase price and payment terms

- Any contingencies, such as financing or due diligence

- Confidentiality agreements, if applicable

- A timeline for the transaction

-

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding. It is meant to express the intent to negotiate in good faith. However, certain sections of the LOI, such as confidentiality clauses or exclusivity agreements, may be binding. It is important to clearly indicate which parts of the LOI are intended to be enforceable.

-

How does a Letter of Intent affect negotiations?

The LOI can significantly streamline negotiations by providing a clear framework for discussions. It allows both parties to identify their priorities and concerns early in the process. This clarity can lead to more productive conversations and help avoid potential conflicts down the line.

-

Can a Letter of Intent be revised?

Yes, a Letter of Intent can be revised as negotiations progress. Both parties should feel comfortable discussing changes to the terms outlined in the LOI. It is common for the document to evolve as new information is gathered or as circumstances change.

-

What happens after a Letter of Intent is signed?

Once the LOI is signed, the next steps typically involve due diligence, where the buyer investigates the business further. This process may include reviewing financial records, legal documents, and operational practices. If everything checks out, both parties can move towards drafting a formal purchase agreement.

-

Should I seek legal advice before signing a Letter of Intent?

It is highly advisable to consult with a legal professional before signing an LOI. An attorney can help ensure that your interests are protected and that you fully understand the implications of the terms outlined in the document. They can also assist in negotiating specific clauses to better suit your needs.

Misconceptions

Understanding the Letter of Intent (LOI) to Purchase a Business is crucial for both buyers and sellers. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- An LOI is a legally binding contract. Many people believe that once an LOI is signed, it is a binding agreement. In reality, an LOI typically outlines the terms of negotiation but is not legally binding unless specified.

- All LOIs are the same. There is a misconception that all LOIs follow a standard format. In fact, each LOI can be tailored to fit the specific circumstances of the transaction and the parties involved.

- Signing an LOI guarantees the sale will happen. Some think that signing an LOI ensures that the sale will go through. However, an LOI is just the beginning of the negotiation process, and many factors can lead to a deal falling apart.

- LOIs are only for large transactions. People often assume that LOIs are only necessary for high-value business transactions. In truth, any business sale, regardless of size, can benefit from an LOI to clarify intentions and terms.

- LOIs do not require legal review. There is a belief that LOIs are simple documents that don’t need legal scrutiny. It is always wise to have a legal professional review an LOI to ensure that it accurately reflects the intentions of the parties involved.

By addressing these misconceptions, buyers and sellers can navigate the process more effectively and make informed decisions.

Common mistakes

-

Neglecting to Include Key Details: One common mistake is failing to provide essential information such as the purchase price, payment terms, and specific assets being acquired. These details are crucial for clarity and future negotiations.

-

Using Ambiguous Language: Clarity is vital. Many people use vague terms that can lead to misunderstandings. Phrases like “reasonable efforts” or “as soon as possible” can create confusion about expectations.

-

Ignoring Contingencies: Not addressing contingencies can be a significant oversight. Buyers should consider including conditions that must be met for the deal to proceed, such as financing approval or satisfactory due diligence results.

-

Overlooking Confidentiality: Some individuals forget to include confidentiality clauses. Protecting sensitive information is essential, especially when discussing business operations and financials.

-

Failing to Specify the Timeline: A lack of timelines for key milestones can hinder the process. Buyers should outline when they expect to complete due diligence, finalize the purchase, and transition ownership.

-

Not Seeking Professional Guidance: Many people attempt to fill out the form without consulting legal or financial advisors. This can lead to costly mistakes. Professional input can ensure that the letter meets legal standards and protects the buyer's interests.

Fill out Common Types of Letter of Intent to Purchase Business Forms

Letter of Intent Real Estate Example - A good first step for buyers interested in potential purchases.

Sample Letter of Intent for Grant Funding Pdf - Allows for preliminary assessment of project feasibility.

The Investment Letter of Intent (LOI) is crucial in establishing a clear understanding between the parties involved, especially when they seek to avoid any ambiguities in their negotiations. For those interested in creating such a document, resources like OnlineLawDocs.com can provide valuable guidance and templates to ensure all necessary terms are properly detailed and understood.

Letter of Intent for Homeschool - Ensures that educational rights are clearly established with local authorities.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent (LOI) outlines the preliminary agreement between parties interested in a business transaction. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that it expresses intent but does not create a legal obligation to complete the transaction. |

| Key Components | Common elements include purchase price, payment terms, and timelines for due diligence and closing. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information shared during negotiations. |

| State-Specific Laws | The governing laws for LOIs can vary by state; for example, California law may apply for transactions in California. |

| Due Diligence | LOIs often outline a period for due diligence, allowing the buyer to investigate the business before finalizing the purchase. |

| Negotiation Tool | It serves as a negotiation tool, helping both parties clarify their intentions and expectations. |

| Expiration Date | LOIs usually include an expiration date, after which the terms may no longer be valid. |

| Legal Advice | It is advisable for parties to seek legal counsel before signing an LOI to ensure their interests are protected. |

Similar forms

The Letter of Intent (LOI) to Purchase Business is similar to a Memorandum of Understanding (MOU). Both documents outline the intentions of the parties involved and serve as a preliminary agreement. An MOU typically details the roles and responsibilities of each party, while an LOI focuses more on the terms of a potential purchase. Both documents are often non-binding and help set the stage for more formal agreements down the line.

An Offer to Purchase is another document that shares similarities with the LOI. This offer is a formal proposal made by a buyer to a seller, indicating a willingness to buy a business at a specified price. Like an LOI, it outlines key terms and conditions but is often more detailed and binding upon acceptance. The Offer to Purchase is usually a step that follows the LOI in the transaction process.

Understanding the intricacies of various documents in business transactions, such as the Letter of Intent (LOI), is crucial for smooth negotiations. For parents looking to navigate the homeschooling landscape in Colorado, there's a similar process for notifying school districts. The Colorado Homeschool Letter of Intent form is essential, as it ensures compliance with state regulations and marks a significant step toward personalized education. For more details, you can refer to https://homeschoolintent.com/editable-colorado-homeschool-letter-of-intent.

Another similar document is the Term Sheet. This document summarizes the key terms and conditions of a proposed deal, much like an LOI. A Term Sheet often provides more detailed information on the structure of the transaction, including financial terms and conditions. While an LOI may express general intent, a Term Sheet lays out specific details that guide further negotiations.

A Purchase Agreement is a more formal document that follows the LOI in the transaction process. This agreement solidifies the terms of the sale and is legally binding once signed. While the LOI indicates interest and outlines preliminary terms, the Purchase Agreement finalizes the sale, detailing obligations, warranties, and other important elements of the transaction.

Similar to the LOI, a Partnership Agreement outlines the terms of a partnership between two or more parties. This document details each partner's roles, contributions, and profit-sharing arrangements. While the LOI focuses on a business purchase, a Partnership Agreement is about collaboration and shared ownership, but both serve as foundational documents for future agreements.

A Business Plan can also resemble an LOI in that it outlines the vision and strategy for a business. While an LOI is focused on the intent to purchase, a Business Plan is a broader document that can be used to attract investors or guide operations. Both documents require clarity and a clear understanding of goals, making them essential for successful business ventures.

Finally, a Letter of Interest (LOI) is closely related to the Letter of Intent. It expresses a party's desire to engage in negotiations for a business transaction. While the LOI to Purchase Business is specific to buying a business, a Letter of Interest can apply to various opportunities, including partnerships or investments. Both documents serve as a starting point for discussions and indicate serious intent.