Blank Lady Bird Deed Form

The Lady Bird Deed, also known as an enhanced life estate deed, is a valuable tool for property owners looking to simplify the transfer of their real estate while retaining control during their lifetime. This unique form allows the property owner to maintain the right to use, live in, and even sell the property without needing the consent of the beneficiaries. Upon the owner’s passing, the property automatically transfers to the named beneficiaries, avoiding the often lengthy and costly probate process. This deed can provide peace of mind, ensuring that the property is passed on according to the owner’s wishes, while also potentially offering tax benefits. Understanding how the Lady Bird Deed works, its advantages, and any potential drawbacks is essential for anyone considering this option for their estate planning needs.

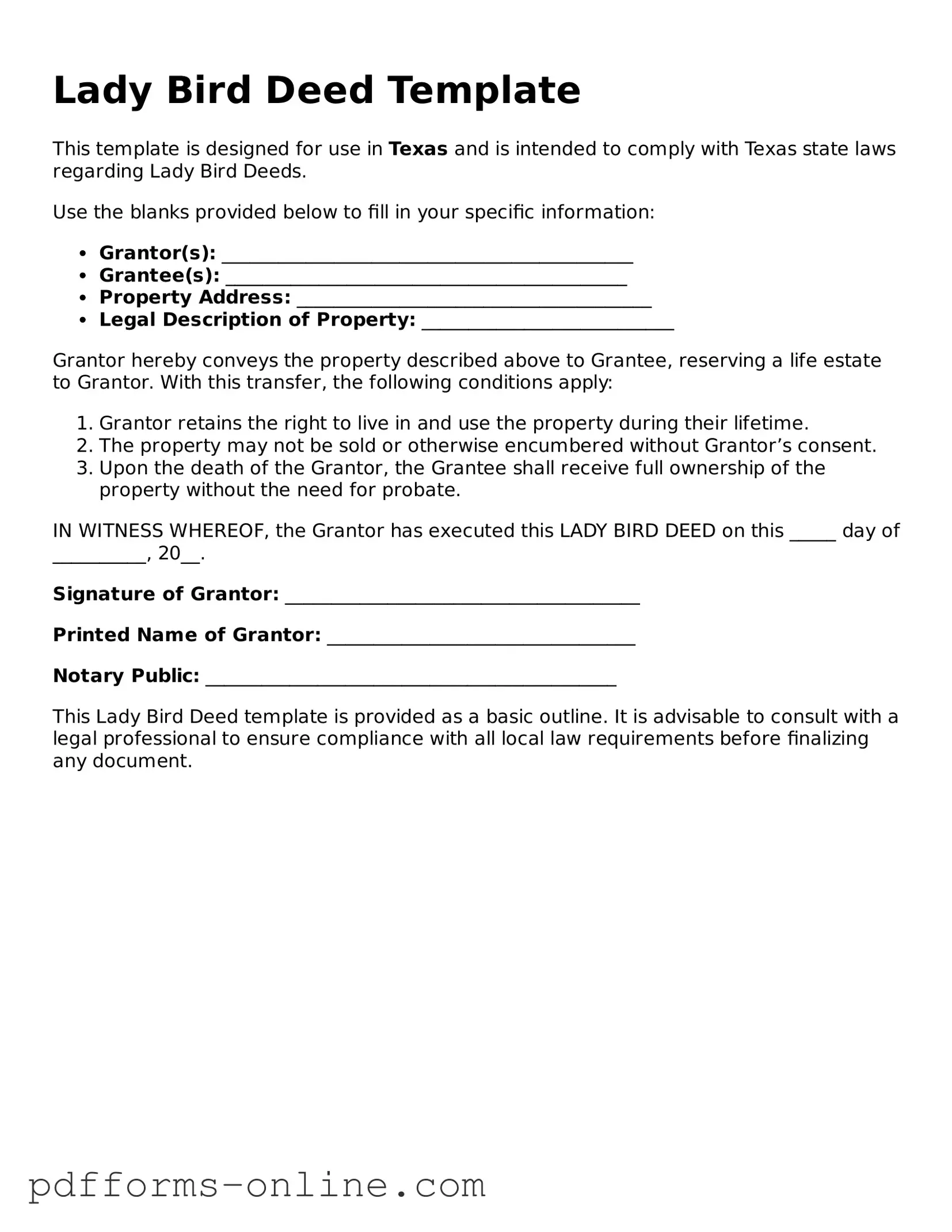

Document Example

Lady Bird Deed Template

This template is designed for use in Texas and is intended to comply with Texas state laws regarding Lady Bird Deeds.

Use the blanks provided below to fill in your specific information:

- Grantor(s): ____________________________________________

- Grantee(s): ___________________________________________

- Property Address: ______________________________________

- Legal Description of Property: ___________________________

Grantor hereby conveys the property described above to Grantee, reserving a life estate to Grantor. With this transfer, the following conditions apply:

- Grantor retains the right to live in and use the property during their lifetime.

- The property may not be sold or otherwise encumbered without Grantor’s consent.

- Upon the death of the Grantor, the Grantee shall receive full ownership of the property without the need for probate.

IN WITNESS WHEREOF, the Grantor has executed this LADY BIRD DEED on this _____ day of __________, 20__.

Signature of Grantor: ______________________________________

Printed Name of Grantor: _________________________________

Notary Public: ____________________________________________

This Lady Bird Deed template is provided as a basic outline. It is advisable to consult with a legal professional to ensure compliance with all local law requirements before finalizing any document.

State-specific Guides for Lady Bird Deed Documents

Frequently Asked Questions

-

What is a Lady Bird Deed?

A Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed is often used to avoid probate and can provide certain tax benefits.

-

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains full control over the property even after the deed is executed. The owner can sell, mortgage, or change the beneficiaries at any time. Upon the owner’s death, the property automatically transfers to the designated beneficiaries without going through probate.

-

What are the benefits of using a Lady Bird Deed?

- Avoids probate, which can be a lengthy and costly process.

- Allows the property owner to retain control over the property during their lifetime.

- May help in qualifying for Medicaid benefits by removing the property from the owner’s estate.

- Can provide tax advantages for beneficiaries, as they may receive a step-up in basis.

-

Are there any downsides to a Lady Bird Deed?

While Lady Bird Deeds have many advantages, there are potential downsides. For instance, the property may still be subject to creditor claims during the owner's lifetime. Additionally, not all states recognize Lady Bird Deeds, so it is important to check local laws.

-

Who can create a Lady Bird Deed?

Any property owner can create a Lady Bird Deed, provided they are of legal age and mentally competent. It is advisable to consult with a legal professional to ensure the deed is executed correctly and complies with state laws.

-

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, you will need to draft the deed, specifying the property, the current owner, and the beneficiaries. It must be signed and notarized. After that, it should be filed with the appropriate county office where the property is located.

-

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked or modified at any time during the property owner's lifetime. This is typically done by executing a new deed that explicitly states the revocation of the previous one.

-

Is a Lady Bird Deed the same as a traditional life estate?

No, a Lady Bird Deed differs from a traditional life estate. In a traditional life estate, the owner loses some control over the property after transferring it to beneficiaries. With a Lady Bird Deed, the owner maintains full control until death, making it a more flexible option.

Misconceptions

-

Misconception 1: A Lady Bird Deed automatically avoids probate.

While a Lady Bird Deed can simplify the transfer of property upon death, it does not entirely eliminate probate. If there are other assets or complications, probate may still be necessary.

-

Misconception 2: The property is no longer considered part of the grantor's estate.

Although the Lady Bird Deed allows for a smooth transfer of property, the grantor retains control and ownership during their lifetime. The property remains part of their estate for tax and other purposes.

-

Misconception 3: A Lady Bird Deed can only be used for residential properties.

This type of deed can apply to various types of real estate, including commercial properties. Its flexibility makes it a viable option for different property types.

-

Misconception 4: Anyone can create a Lady Bird Deed without legal assistance.

While it is possible to draft a Lady Bird Deed independently, seeking legal guidance is advisable. An attorney can ensure that the deed meets all legal requirements and accurately reflects the grantor's intentions.

-

Misconception 5: A Lady Bird Deed eliminates all tax implications.

Although this deed can provide certain tax benefits, it does not completely eliminate tax implications. Property taxes and potential capital gains taxes may still apply upon transfer.

Common mistakes

-

Incomplete Information: One of the most common mistakes is not providing all necessary details. Ensure that names, addresses, and property descriptions are fully filled out.

-

Incorrect Property Description: Failing to accurately describe the property can lead to confusion. Always double-check the legal description of the property to ensure it matches public records.

-

Not Including All Owners: If multiple people own the property, all owners must be included in the deed. Omitting an owner can create legal complications down the road.

-

Improper Signatures: Signatures must be clear and correctly placed. Each owner should sign in the designated area to avoid any disputes later.

-

Missing Witnesses: Some states require witnesses to sign the deed. Check your state’s requirements to ensure compliance.

-

Not Notarizing the Document: A Lady Bird Deed often needs to be notarized. Failing to have it notarized can render the deed invalid.

-

Ignoring State-Specific Laws: Laws regarding Lady Bird Deeds can vary significantly by state. Be aware of your state’s specific requirements to avoid issues.

-

Filing the Deed Incorrectly: After completing the deed, it must be filed with the appropriate county office. Ensure that you follow the proper filing procedures.

-

Not Keeping Copies: Always retain copies of the completed deed for your records. This is essential for future reference and can help resolve any disputes.

Fill out Common Types of Lady Bird Deed Forms

Correction Deed California - The form is useful when correcting the names of grantors or grantees on a deed.

The Access-A-Ride NYC Application form is essential for eligible employees wishing to benefit from the City of New York Commuter Benefits Program, tailored for paratransit services. To streamline the application process and ensure that all necessary documentation is incorporated, applicants are encouraged to download the document in pdf. Completing this form allows employees to make adjustments to their personal information, manage deductions, and fulfill their commuting needs through the MTA New York City Transit Access-A-Ride Program, ensuring they receive the support they require.

Does California Have a Transfer on Death Deed - Gifting property through this deed is different from traditional gifting, as it occurs after death.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This form is governed by state laws, particularly in states like Florida and Texas. |

| Benefits | It helps avoid probate, ensuring a smoother transition of property to heirs. |

| Revocability | The property owner can revoke or change the deed at any time before death. |

| Tax Implications | There are potential tax benefits, as the property may receive a step-up in basis upon the owner's death. |

| Ownership Rights | The owner retains full rights to use, sell, or mortgage the property during their lifetime. |

| Legal Requirements | Some states require specific language and notarization for the deed to be valid. |

Similar forms

The Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their real estate to beneficiaries while retaining the right to live in and control the property during their lifetime. Similar to this deed is the traditional life estate deed. In a life estate deed, the property owner transfers ownership to another party but retains a life estate, meaning they can live on the property until death. Unlike the Lady Bird Deed, the traditional life estate does not allow the original owner to sell or mortgage the property without the consent of the remainderman, the person who will inherit the property after the owner's death.

Another document akin to the Lady Bird Deed is the transfer-on-death deed (TOD). A TOD allows property owners to designate beneficiaries who will receive the property automatically upon the owner's death, bypassing probate. While both the Lady Bird Deed and the TOD facilitate the transfer of property outside of probate, the key difference lies in the rights retained by the owner. The Lady Bird Deed allows for greater control during the owner’s lifetime, including the ability to sell or mortgage the property without needing consent from the beneficiaries.

The quitclaim deed is another document that shares similarities with the Lady Bird Deed. A quitclaim deed transfers whatever interest the grantor has in the property to the grantee without any warranties. While it does not provide the same lifetime rights as the Lady Bird Deed, it can be used to transfer property among family members. However, unlike the Lady Bird Deed, the quitclaim deed does not allow the original owner to retain any rights or control over the property after the transfer.

The warranty deed also resembles the Lady Bird Deed in that it transfers ownership of property. A warranty deed guarantees that the grantor holds clear title to the property and has the right to sell it. While both deeds facilitate property transfers, the warranty deed does not retain any rights for the original owner, unlike the Lady Bird Deed, which allows the owner to live on and manage the property during their lifetime.

A revocable living trust is another estate planning tool similar to the Lady Bird Deed. This legal entity allows individuals to place their assets, including real estate, into a trust while retaining control over those assets during their lifetime. Upon death, the assets can be transferred to beneficiaries without going through probate. While both the Lady Bird Deed and a revocable living trust help avoid probate, the trust does not provide the same immediate control over the property as the Lady Bird Deed does.

The general power of attorney can also be compared to the Lady Bird Deed. This document grants someone the authority to act on behalf of another person in financial or legal matters. While it does not transfer property ownership, it allows the agent to manage real estate assets, including selling or renting them. The Lady Bird Deed, however, specifically pertains to the transfer of property rights while allowing the original owner to retain control over the property during their lifetime.

The special warranty deed is similar to the Lady Bird Deed in that it provides a limited guarantee of title. This type of deed ensures that the grantor is responsible for any claims or issues that arose during their ownership. While both documents facilitate property transfers, the special warranty deed does not allow the original owner to maintain any rights over the property, unlike the Lady Bird Deed, which provides lifetime rights to the original owner.

Understanding the nuances of property transfer methods, including the Lady Bird Deed, is essential for effective estate planning. It's important to analyze how these tools interact with agreements like the onlinelawdocs.com/ that can help manage liability and protect interests during property use. Each document, from revocable living trusts to quitclaim deeds, offers unique advantages and implications, making it crucial to choose the right approach based on individual circumstances.

The living will, while not a property transfer document, can be considered similar in its intent to express the owner’s wishes. A living will outlines an individual’s preferences for medical treatment in case they become incapacitated. While it does not deal with property, it reflects the owner's desire to maintain control over their affairs, akin to the way a Lady Bird Deed allows for control over property during one's lifetime.

Lastly, the joint tenancy deed shares some characteristics with the Lady Bird Deed. In a joint tenancy arrangement, two or more individuals own property together, with rights of survivorship. This means that when one owner passes away, their share automatically transfers to the surviving owner(s). While both documents facilitate the transfer of property upon death, the Lady Bird Deed allows for more control during the owner’s lifetime, whereas joint tenancy involves shared ownership and rights among multiple parties.