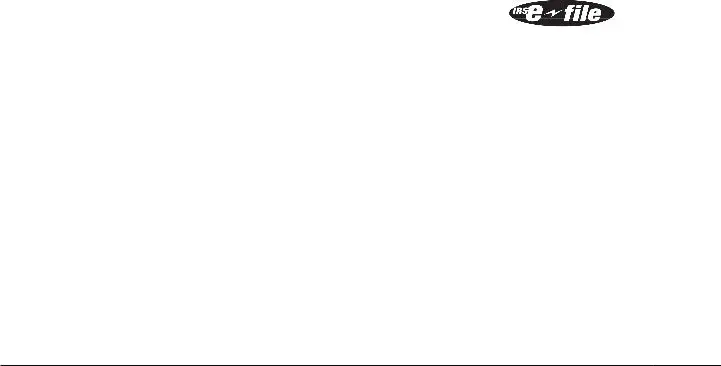

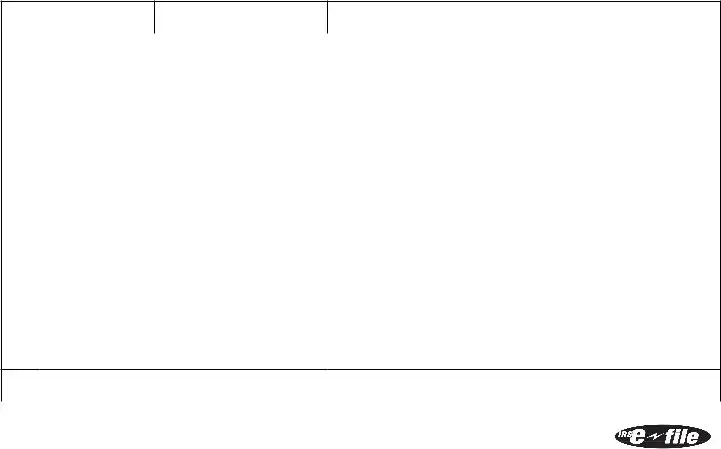

Blank IRS W-2 Template

The IRS W-2 form is a crucial document for anyone who earns a wage in the United States. Each year, employers are required to provide this form to their employees, detailing the total earnings and the taxes withheld throughout the year. This information is essential for accurately filing your income tax return. The W-2 includes important details such as your Social Security number, the employer’s identification number, and various boxes that indicate your wages, tips, and other compensation. It also shows the amounts withheld for federal, state, and local taxes, as well as contributions to Social Security and Medicare. Understanding the W-2 is vital, as it not only helps you track your income but also ensures compliance with tax regulations. Additionally, if you receive multiple W-2 forms from different employers, you will need to combine this information when filing your taxes. Overall, the W-2 serves as a key piece of the puzzle in managing your finances and fulfilling your tax obligations.

Document Example

Attention:

You may file Forms

The maximum amount of dependent care assistance benefits excludable from income may be increased for 2021. The American Rescue Plan Act of 2021 permits employers to increase the amount of dependent care benefits under their plans that can be excluded from an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). See section C of Notice

Internal Revenue Bulletin:

Note: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file Copy A downloaded from this website with the SSA; a penalty may be imposed for filing forms that can’t be scanned. See the penalties section in the current General Instructions for Forms

Please note that Copy B and other copies of this form, which appear in black, may be downloaded, filled in, and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns such as Forms

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22222 |

VOID |

|

|

a |

Employee’s social security number |

For Official Use Only ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b Employer identification number (EIN) |

|

|

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

d Control number |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

|

Last name |

|

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

15 State Employer’s state ID number |

|

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

|

20 Locality name |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

||||||||||||||||||||||

|

|

|

|

|

For Privacy Act and Paperwork Reduction |

||||||||||||||||||||||

|

Copy |

|

|

|

|

|

Act Notice, see the separate instructions. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Form |

|

|

|

|

|

|

|

|

|

|

Cat. No. 10134D |

|||||||||||||||

Do Not Cut, Fold, or Staple Forms on This Page

22222 |

a Employee’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

|

|

a |

Employee’s social security number |

|

|

|

Safe, accurate, |

|

|

|

|

|

Visit the IRS website at |

|

|||||

|

|

|

|

|

OMB No. |

FAST! Use |

|

|

|

|

|

www.irs.gov/efile |

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

This information is being furnished to the Internal Revenue Service.

Notice to Employee

Do you have to file? Refer to the Form 1040 instructions to determine if you are required to file a tax return. Even if you don’t have to file a tax return, you may be eligible for a refund if box 2 shows an amount or if you are eligible for any credit.

Earned income credit (EIC). You may be able to take the EIC for 2022 if your adjusted gross income (AGI) is less than a certain amount. The amount of the credit is based on income and family size. Workers without children could qualify for a smaller credit. You and any qualifying children must have valid social security numbers (SSNs). You can’t take the EIC if your investment income is more than the specified amount for 2022 or if income is earned for services provided while you were an inmate at a penal institution. For 2022 income limits and more information, visit www.irs.gov/EITC. See also Pub. 596, Earned Income Credit. Any EIC that is more than your tax liability is refunded to you, but only if you file a tax return.

Employee’s social security number (SSN). For your protection, this form may show only the last four digits of your SSN. However, your employer has reported your complete SSN to the IRS and the Social Security Administration (SSA).

Clergy and religious workers. If you aren’t subject to social security and Medicare taxes, see Pub. 517, Social Security and Other Information for Members of the Clergy and Religious Workers.

Corrections. If your name, SSN, or address is incorrect, correct Copies B, C, and 2 and ask your employer to correct your employment record. Be sure to ask the employer to file Form

Cost of

Credit for excess taxes. If you had more than one employer in 2022 and more than $9,114 in social security and/or Tier 1 railroad retirement (RRTA) taxes were withheld, you may be able to claim a credit for the excess against your federal income tax. See the Form 1040 instructions. If you had more than one railroad employer and more than $5,350.80 in Tier 2 RRTA tax was withheld, you may be able to claim a refund on Form 843. See the Instructions for Form 843.

(See also Instructions for Employee on the back of Copy C.)

aEmployee’s social security number

|

This information is being furnished to the Internal Revenue Service. If you |

|

OMB No. |

are required to file a tax return, a negligence penalty or other sanction |

|

may be imposed on you if this income is taxable and you fail to report it. |

||

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

||||||||||||

|

|

|

|

Safe, accurate, |

|

|||||||||||

Copy |

|

|

|

|

|

|

|

FAST! Use |

|

|||||||

(See Notice to Employee on the back of Copy B.)

Instructions for Employee

(See also Notice to Employee on the back of Copy B.)

Box 1. Enter this amount on the wages line of your tax return.

Box 2. Enter this amount on the federal income tax withheld line of your tax return.

Box 5. You may be required to report this amount on Form 8959, Additional Medicare Tax. See the Form 1040 instructions to determine if you are required to complete Form 8959.

Box 6. This amount includes the 1.45% Medicare Tax withheld on all Medicare wages and tips shown in box 5, as well as the 0.9% Additional Medicare Tax on any of those Medicare wages and tips above $200,000.

Box 8. This amount is not included in box 1, 3, 5, or 7. For information on how to report tips on your tax return, see the Form 1040 instructions.

You must file Form 4137, Social Security and Medicare Tax on Unreported Tip Income, with your income tax return to report at least the allocated tip amount unless you can prove with adequate records that you received a smaller amount. If you have records that show the actual amount of tips you received, report that amount even if it is more or less than the allocated tips. Use Form 4137 to figure the social security and Medicare tax owed on tips you didn’t report to your employer. Enter this amount on the wages line of your tax return. By filing Form 4137, your social security tips will be credited to your social security record (used to figure your benefits).

Box 10. This amount includes the total dependent care benefits that your employer paid to you or incurred on your behalf (including amounts from a section 125 (cafeteria) plan). Any amount over your employer’s plan limit is also included in box 1. See Form 2441.

Box 11. This amount is (a) reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or nongovernmental section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior year deferral under a nonqualified or section 457(b) plan that became taxable for social security and Medicare taxes this year because there is no longer a substantial risk of forfeiture of your right to the deferred amount. This box shouldn’t be used if you had a deferral and a distribution in the same calendar year. If you made a deferral and

received a distribution in the same calendar year, and you are or will be age 62 by the end of the calendar year, your employer should file Form

Box 12. The following list explains the codes shown in box 12. You may need this information to complete your tax return. Elective deferrals (codes D, E, F, and S) and designated Roth contributions (codes AA, BB, and EE) under all plans are generally limited to a total of $20,500 ($14,000 if you only have SIMPLE plans; $23,500 for section 403(b) plans if you qualify for the

However, if you were at least age 50 in 2022, your employer may have allowed an additional deferral of up to $6,500 ($3,000 for section 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount is not subject to the overall limit on elective deferrals. For code G, the limit on elective deferrals may be higher for the last 3 years before you reach retirement age. Contact your plan administrator for more information. Amounts in excess of the overall elective deferral limit must be included in income. See the Form 1040 instructions.

Note: If a year follows code D through H, S, Y, AA, BB, or EE, you made a

(continued on back of Copy 2)

|

|

a Employee’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

Income Tax Return

Instructions for Employee (continued from back of

Copy C)

Box 12 (continued)

Box 13. If the “Retirement plan” box is checked, special limits may apply to the amount of traditional IRA contributions you may deduct. See Pub.

Box 14. Employers may use this box to report information such as state disability insurance taxes withheld, union dues, uniform payments, health insurance premiums deducted, nontaxable income, educational assistance payments, or a member of the clergy’s parsonage allowance and utilities. Railroad employers use this box to report railroad retirement (RRTA) compensation, Tier 1 tax, Tier 2 tax, Medicare tax, and Additional Medicare Tax. Include tips reported by the employee to the employer in railroad retirement (RRTA) compensation.

Note: Keep Copy C of Form

|

VOID |

|

|

a Employee’s social security number |

OMB No. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||||

|

|

|

|

For Privacy Act and Paperwork Reduction |

|||||||||||||||

Copy |

|

|

|

|

|

|

|

|

|

|

Act Notice, see separate instructions. |

||||||||

Frequently Asked Questions

-

What is the IRS W-2 form?

The IRS W-2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees. It details the employee's annual wages and the taxes withheld from their paychecks. This form is essential for employees when filing their income tax returns, as it provides the necessary information to report earnings and tax payments.

-

Who receives a W-2 form?

Any employee who has received wages, salaries, or other forms of compensation from an employer during the tax year will receive a W-2 form. This includes full-time, part-time, and temporary employees. Employers are required to send out W-2 forms to all eligible employees by January 31 of the following year.

-

What information is included on the W-2 form?

The W-2 form contains several key pieces of information, including:

- The employee's total earnings for the year

- The amount of federal, state, and local taxes withheld

- Social Security and Medicare contributions

- The employer's identification information

- The employee's Social Security number

This information is crucial for accurately reporting income and calculating tax liabilities.

-

What should I do if I don't receive my W-2 form?

If you do not receive your W-2 form by mid-February, it is important to take action. First, contact your employer to inquire about the status of your W-2. If you still do not receive it, you can reach out to the IRS for assistance. You may need to file your tax return using Form 4852, which serves as a substitute for your W-2.

-

Can I access my W-2 form online?

Many employers now provide electronic access to W-2 forms. If your employer offers this option, you can log into their payroll or HR system to download your W-2. Alternatively, some third-party services also allow employees to access their W-2 forms online, provided your employer participates in such a program.

-

What should I do if there is an error on my W-2 form?

If you notice any errors on your W-2 form, such as incorrect wages or tax withholdings, contact your employer immediately. They are responsible for issuing a corrected form, known as a W-2c. It is essential to address these errors before filing your tax return to avoid potential issues with the IRS.

Misconceptions

The IRS W-2 form is an essential document for employees and employers alike. However, several misconceptions surround its purpose and use. Here are ten common misunderstandings:

- The W-2 is only for employees. Many believe that only traditional employees receive a W-2. However, some independent contractors may also receive a W-2 if they are classified as employees for tax purposes.

- All income is reported on the W-2. Some think that every dollar earned is reported on the W-2. In reality, certain income types, like freelance work or investment income, are reported on different forms.

- The W-2 is the same as the 1099 form. The W-2 and the 1099 serve different purposes. The W-2 reports wages for employees, while the 1099 reports income for independent contractors and other non-employees.

- Employers must send W-2s only at year-end. Many assume W-2s can only be issued at the end of the year. Employers must provide these forms to employees by January 31 of the following year.

- W-2 forms are only for federal taxes. Some people think W-2s are only relevant for federal tax purposes. In fact, they are also used for state and local tax reporting.

- Receiving a W-2 guarantees a tax refund. Just because someone receives a W-2 does not mean they will get a tax refund. The amount of tax owed or refunded depends on various factors, including income and deductions.

- W-2 forms are not necessary for filing taxes. Some believe they can file taxes without a W-2. However, this form is crucial for accurately reporting income and withholding amounts.

- Only one W-2 is issued per year. Many think that employees receive just one W-2. However, if someone has multiple jobs, they will receive a separate W-2 from each employer.

- W-2 forms are only for full-time workers. Some assume that only full-time employees receive W-2s. Part-time workers and seasonal employees also receive this form if they meet the criteria.

- W-2s can be ignored if income is low. Many believe that if their income is low, they do not need to worry about their W-2. However, all income must be reported, regardless of the amount.

Understanding these misconceptions can help individuals navigate their tax responsibilities more effectively.

Common mistakes

-

Incorrect Social Security Number: One of the most common mistakes is entering the wrong Social Security Number (SSN). A simple typo can lead to significant delays in processing and potential issues with tax returns.

-

Wrong Employee Information: Failing to accurately fill in the employee's name, address, or other identifying details can cause confusion. It is crucial to ensure that all personal information matches what is on file with the Social Security Administration.

-

Misreporting Income: Some individuals mistakenly report their income incorrectly. This can occur due to miscalculating wages or failing to include bonuses and other compensation. It’s important to double-check all figures.

-

Errors in Tax Withholding: Incorrectly reporting federal income tax withheld can lead to underpayment or overpayment. Employees should verify that the amounts withheld match their pay stubs and the employer's records.

-

Missing Signature: Forgetting to sign the form can result in it being considered incomplete. Always ensure that all necessary signatures are provided before submission to avoid processing delays.

Additional PDF Templates

How Many Pages in a Passport - This application is essential for identity verification for U.S. citizens.

To ensure the protection of sensitive information, it is advisable to utilize a Non-disclosure Agreement form, which is critical in various scenarios including business partnerships and employee hiring processes. For more resources on creating and understanding NDAs, you can visit OnlineLawDocs.com.

Cg 2010 Form 07/04 - By utilizing this endorsement, businesses can address liability issues before they emerge.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-2 form is used by employers to report wages paid to employees and the taxes withheld from them. It provides essential information for employees when filing their income tax returns. |

| Filing Deadline | Employers must provide W-2 forms to their employees by January 31st of each year. This ensures that employees have the necessary documentation to file their taxes on time. |

| State-Specific Requirements | Some states require additional forms or have specific laws governing the distribution of W-2 forms. For example, California law mandates that employers provide W-2 forms to employees by January 31st as well. |

| Electronic Filing | Employers can choose to file W-2 forms electronically with the IRS, which is encouraged for those filing 250 or more forms. Electronic filing can streamline the process and reduce errors. |

Similar forms

The IRS W-2 form is similar to the 1099-MISC form, which is used to report income received by independent contractors and freelancers. While the W-2 reports wages paid to employees, the 1099-MISC details payments made to non-employees. Both forms serve to inform the Internal Revenue Service about income earned, ensuring that individuals report their earnings accurately on their tax returns.

Another document comparable to the W-2 is the 1099-NEC form. This form specifically reports non-employee compensation, which includes payments made to independent contractors. Like the W-2, the 1099-NEC is essential for tax reporting purposes, but it focuses solely on payments made outside of traditional employment relationships.

When drafting a Lease Agreement, it's important to understand the various terms involved, which can significantly influence the rental experience. For those unfamiliar with the specifics of such contracts, resources like https://documentonline.org/blank-new-york-lease-agreement/ provide templates and guidance that can help ensure clarity and legal compliance between landlords and tenants.

The 1040 form, known as the U.S. Individual Income Tax Return, is also related to the W-2. Taxpayers use the 1040 to report their annual income, including wages from a W-2. The information provided on the W-2 is crucial for accurately completing the 1040, as it reflects the taxpayer's earnings for the year.

The 1098 form, which reports mortgage interest paid, shares similarities with the W-2 in that both documents provide necessary information for tax reporting. Homeowners receive the 1098 to claim deductions on their tax returns, just as employees use the W-2 to report their income. Both forms help taxpayers understand their financial obligations and potential deductions.

The 1095-A form, used for reporting health insurance coverage through the Health Insurance Marketplace, is another document akin to the W-2. While the W-2 reports wages, the 1095-A provides information about health insurance premiums and subsidies. Both forms are integral to the tax filing process, ensuring that taxpayers comply with health coverage requirements.

The 1099-DIV form, which reports dividends and distributions from investments, is similar to the W-2 in that it helps taxpayers report income. While the W-2 focuses on employment income, the 1099-DIV is essential for individuals who earn income through investments. Accurate reporting of both types of income is crucial for tax compliance.

The 1099-INT form, which reports interest income earned from banks or other financial institutions, is another document that parallels the W-2. Just as the W-2 provides information on earned income, the 1099-INT ensures that taxpayers report any interest income received. Both forms play a vital role in the overall income reporting process.

Lastly, the Schedule C form, used by sole proprietors to report income and expenses from their business, can be compared to the W-2. While the W-2 reflects wages from employment, the Schedule C details income generated from self-employment. Both documents are essential for accurately reporting income to the IRS and determining tax obligations.