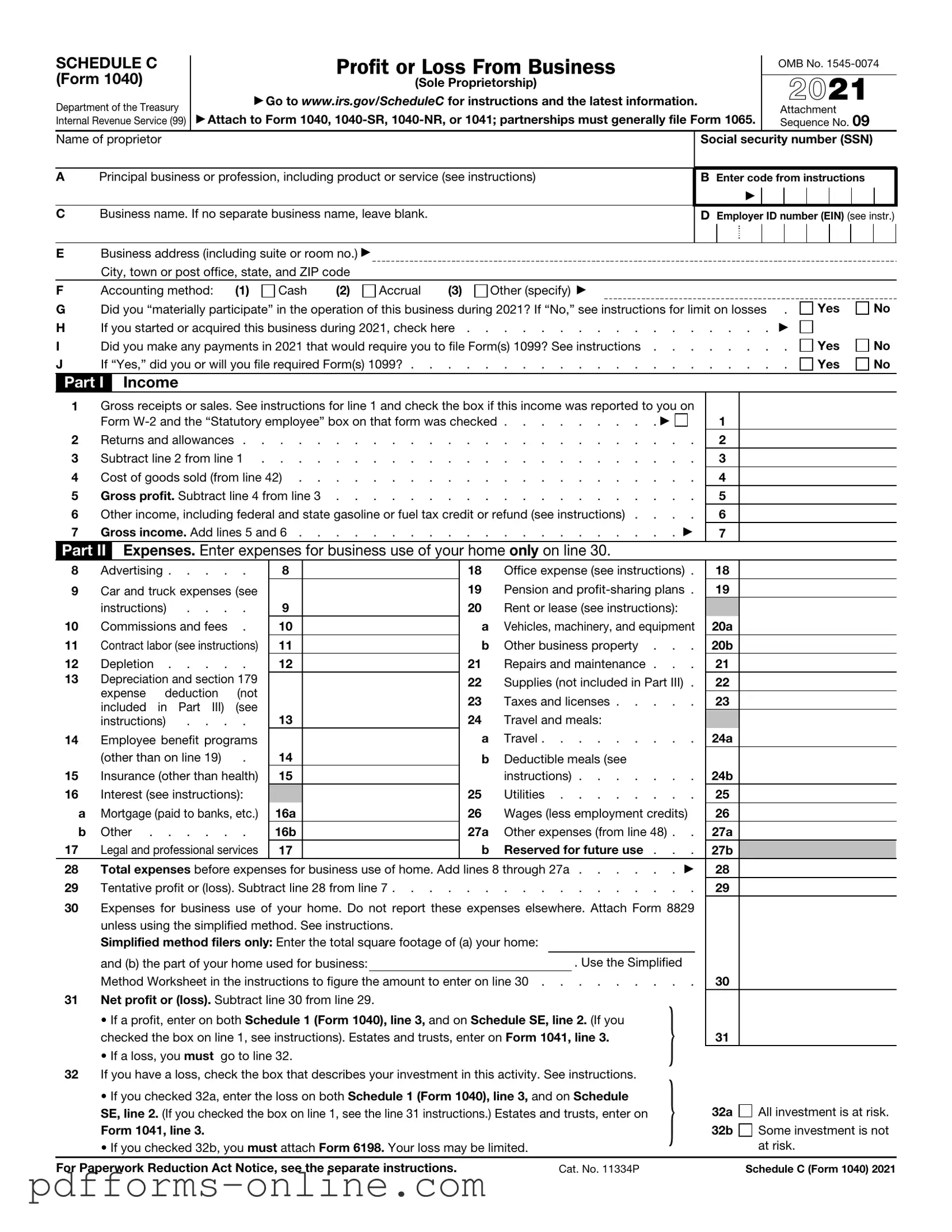

Blank IRS Schedule C 1040 Template

The IRS Schedule C (Form 1040) is a crucial document for individuals operating as sole proprietors or independent contractors in the United States. This form allows taxpayers to report income earned from their business activities, providing a comprehensive overview of both revenue and expenses. By detailing various business-related costs, such as supplies, equipment, and home office deductions, Schedule C helps in calculating the net profit or loss from the business. This information is essential not only for tax purposes but also for understanding the financial health of the business. Additionally, the form requires the classification of the business, which can influence the applicable tax rates and deductions. Understanding how to accurately complete Schedule C is vital for ensuring compliance with IRS regulations and maximizing potential tax benefits. Furthermore, the form serves as a valuable tool for tracking business performance over time, offering insights that can aid in future planning and growth.

Document Example

SCHEDULE C (Form 1040)

Department of the Treasury Internal Revenue Service (99)

Profit or Loss From Business

(Sole Proprietorship)

▶Go to www.irs.gov/ScheduleC for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 09

Name of proprietor

APrincipal business or profession, including product or service (see instructions)

CBusiness name. If no separate business name, leave blank.

Social security number (SSN)

BEnter code from instructions

▶

DEmployer ID number (EIN) (see instr.)

EBusiness address (including suite or room no.) ▶

City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

|

Accrual |

(3) |

Other (specify) ▶ |

|

|

|

|

|

|

|

||||||

G |

Did you “materially participate” in the operation of this business during 2021? If “No,” see instructions for limit on losses |

. |

Yes |

No |

|||||||||||||||||

H |

If you started or acquired this business during 2021, check here |

. . |

. . |

▶ |

|

|

|||||||||||||||

I |

Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions . . . |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

Part I |

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|

|

|

|||||||||||||||

|

Form |

. . . . . . . . . ▶ |

1 |

|

|

|

|

||||||||||||||

2 |

Returns and allowances |

2 |

|

|

|

|

|||||||||||||||

3 |

Subtract line 2 from line 1 |

3 |

|

|

|

|

|||||||||||||||

4 |

Cost of goods sold (from line 42) |

4 |

|

|

|

|

|||||||||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

5 |

|

|

|

|

|||||||||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|

|

|

|||||||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . . |

. ▶ |

7 |

|

|

|

|

|||||||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

|

|

|||||||||||||

8 |

Advertising |

8 |

|

|

|

|

|

|

18 |

Office expense (see instructions) . |

18 |

|

|

|

|

||||||

9 |

Car and truck expenses (see |

|

|

|

|

|

|

|

19 |

Pension and |

19 |

|

|

|

|

||||||

|

instructions) . . . . |

9 |

|

|

|

|

|

|

20 |

Rent or lease (see instructions): |

|

|

|

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

|

|

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

|

|

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

|

|

|

|

b |

Other business property . . . |

20b |

|

|

|

|

||||||

12 |

Depletion |

12 |

|

|

|

|

|

|

21 |

Repairs and maintenance . . . |

21 |

|

|

|

|

||||||

13 |

Depreciation and section 179 |

|

|

|

|

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

|

|

|

||||||

|

expense deduction |

(not |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|

|

|

|||||||

|

included in Part III) (see |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

instructions) . . . . |

13 |

|

|

|

|

|

|

24 |

Travel and meals: |

|

|

|

|

|

|

|

||||

14 |

Employee benefit programs |

|

|

|

|

|

|

|

a |

Travel |

24a |

|

|

|

|

||||||

|

(other than on line 19) |

. |

14 |

|

|

|

|

|

|

b |

Deductible meals (see |

|

|

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

|

|

|

|

instructions) |

24b |

|

|

|

|

||||||

16 |

Interest (see instructions): |

|

|

|

|

|

|

|

25 |

Utilities |

25 |

|

|

|

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

|

|

|

|

26 |

Wages (less employment credits) |

26 |

|

|

|

|

||||||

b |

Other |

16b |

|

|

|

|

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

|

|

|

||||||

17 |

Legal and professional services |

17 |

|

|

|

|

|

|

b |

Reserved for future use . . . |

27b |

|

|

|

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a |

. ▶ |

28 |

|

|

|

|

||||||||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

29 |

|

|

|

|

|||||||||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|

|

|

|||||||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

and (b) the part of your home used for business: |

|

|

|

|

|

|

|

. Use the Simplified |

|

|

|

|

|

|||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|

|

|

|||||||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

|

|

} |

|

|

|

|

|

|

||||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|

|

||||||||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

31 |

|

|

|

|

||||||||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

} |

|

|

|

|

|

|

|||||||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

|

|

|

|

||||||||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on |

|

32a |

All investment is at risk. |

|||||||||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

32b |

Some investment is not |

|||||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

at risk. |

|

|

||||||||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

Schedule C (Form 1040) 2021 |

||||||||||||||

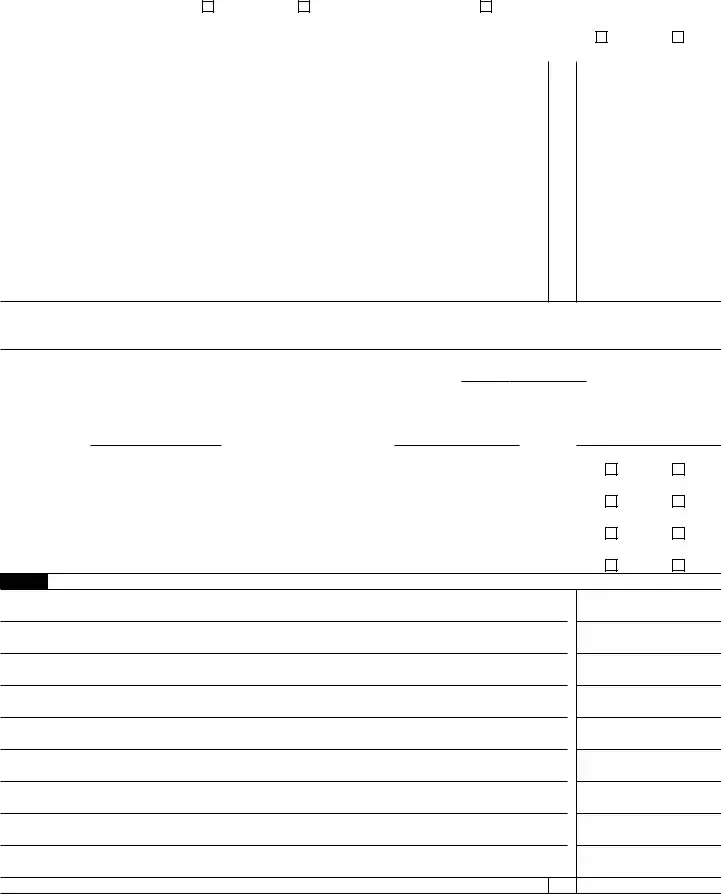

Schedule C (Form 1040) 2021 |

Page 2 |

|

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

36 |

Purchases less cost of items withdrawn for personal use |

36 |

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

38 |

Materials and supplies |

38 |

39 |

Other costs |

39 |

40 |

Add lines 35 through 39 |

40 |

41 |

Inventory at end of year |

41 |

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562.

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

44Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

45 |

Was your vehicle available for personal use during |

||

46 |

Do you (or your spouse) have another vehicle available for personal use? |

||

47a |

Do you have evidence to support your deduction? |

||

b |

If “Yes,” is the evidence written? |

||

Yes

Yes

Yes

Yes

No

No

No

No

Part V Other Expenses. List below business expenses not included on lines

48 |

Total other expenses. Enter here and on line 27a |

48

Schedule C (Form 1040) 2021

Frequently Asked Questions

-

What is IRS Schedule C?

IRS Schedule C is a tax form used by sole proprietors to report income or loss from their business. It is part of the Form 1040, which is the individual income tax return. This form allows business owners to detail their earnings and expenses, ultimately determining their taxable income.

-

Who needs to file Schedule C?

Individuals who operate a business as a sole proprietorship must file Schedule C. This includes freelancers, independent contractors, and anyone else who earns income through self-employment. If you receive a Form 1099-MISC or similar income statement, you likely need to file this form.

-

What types of income should be reported on Schedule C?

All income earned from your business activities should be reported on Schedule C. This includes sales revenue, fees for services, and any other income related to your business operations. Even if you did not receive a Form 1099, all income must be reported.

-

What expenses can I deduct on Schedule C?

Various business expenses can be deducted on Schedule C, including:

- Cost of goods sold

- Advertising

- Car and truck expenses

- Contract labor

- Depreciation

- Office supplies

- Utilities

- Rent or lease payments

It is essential to keep accurate records and receipts for all deductions claimed.

-

How do I calculate my net profit or loss?

To calculate your net profit or loss, subtract your total expenses from your total income. If your income exceeds your expenses, you have a net profit. Conversely, if your expenses are greater than your income, you will report a net loss.

-

Can I file Schedule C electronically?

Yes, Schedule C can be filed electronically using tax preparation software or through a tax professional. Electronic filing often speeds up the process and may reduce errors.

-

What happens if I don’t file Schedule C?

Failing to file Schedule C when required can lead to penalties and interest on any unpaid taxes. The IRS may also audit your return, which can result in further complications and potential fines.

-

Are there any special considerations for home-based businesses?

Yes, if you run a business from home, you may qualify for a home office deduction. This allows you to deduct a portion of your home expenses, such as utilities and mortgage interest, based on the size of your office space. Specific criteria must be met to qualify.

-

What is the deadline for filing Schedule C?

The deadline for filing Schedule C is the same as the deadline for filing your Form 1040, which is typically April 15. If you need additional time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

-

Where can I find more information about Schedule C?

Additional information about Schedule C can be found on the IRS website. The site provides detailed instructions, examples, and resources to help you complete the form accurately. Consulting a tax professional can also provide personalized guidance.

Misconceptions

Understanding the IRS Schedule C form can be challenging for many. Here are nine common misconceptions that often lead to confusion:

-

Only self-employed individuals need to file Schedule C.

While Schedule C is primarily for self-employed individuals, it is also used by sole proprietors who operate a business as a single-member LLC. This means that anyone earning income from a business activity may need to file this form.

-

All income must be reported on Schedule C.

Not all income is reported here. For instance, if you earn passive income, such as from rental properties or investments, you would report that income on different forms.

-

Expenses can only be deducted if you have receipts.

While having receipts is ideal for substantiating expenses, you can still deduct certain expenses without them. However, it is crucial to keep detailed records to support your claims in case of an audit.

-

Schedule C is only for businesses that make a profit.

Even if a business operates at a loss, it still needs to file Schedule C. Reporting losses can be beneficial, as they may offset other income on your tax return.

-

All expenses are deductible.

Not every expense qualifies for deduction. Personal expenses, for example, cannot be deducted. It is essential to distinguish between personal and business-related expenses.

-

You can only claim deductions for expenses incurred in the current year.

Business owners can also deduct certain expenses that were incurred in previous years, such as start-up costs, which may be amortized over several years.

-

Filing Schedule C is the same as filing a personal tax return.

Filing Schedule C is a part of the personal tax return process, but it specifically deals with business income and expenses. It requires a different level of detail and attention to business-related financial activities.

-

Using a tax software guarantees accuracy.

While tax software can help streamline the process, it is not foolproof. Users must still input accurate information and understand their business activities to ensure correct filings.

-

Once filed, Schedule C cannot be amended.

It is possible to amend a Schedule C if errors are discovered after filing. Taxpayers can submit a Form 1040-X to correct any mistakes on their original return.

By dispelling these misconceptions, individuals can better navigate the complexities of the IRS Schedule C form and ensure they comply with tax regulations.

Common mistakes

-

Neglecting to report all income: Many people forget to include all sources of income. Ensure that every dollar earned is accounted for, including cash payments and side jobs.

-

Incorrectly categorizing expenses: Misclassifying expenses can lead to incorrect deductions. Familiarize yourself with the different categories and choose the right one for each expense.

-

Failing to keep adequate records: Without proper documentation, it becomes difficult to support your claims. Maintain receipts, invoices, and bank statements to back up your entries.

-

Not separating personal and business expenses: Mixing these expenses can complicate your tax return. Keep business and personal finances separate to simplify the process.

-

Overlooking deductions: Some deductions may be missed due to lack of knowledge. Research available deductions that apply to your business to maximize your tax benefits.

-

Submitting the form late: Filing after the deadline can result in penalties. Be aware of the due dates and plan ahead to avoid late submissions.

Additional PDF Templates

Share Transfer Form - This ledger helps maintain accurate records of stock ownership over time.

A thorough understanding of a Non-disclosure Agreement form, often abbreviated as NDA, is essential for businesses aiming to protect their confidential information. This legal contract serves to safeguard sensitive material by restricting access to or disclosures by unauthorized third parties. For more on creating an NDA that meets your specific needs, visit OnlineLawDocs.com, where you can find valuable resources and templates to help streamline the process.

Cheaper Insurance Than Progressive - Submitting one claim at a time is a requirement for processing these supplement requests.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income or loss from their business. |

| Who Should File | Individuals who operate a business as a sole proprietorship must file this form. |

| Filing Deadline | The form is typically due on April 15, aligning with the individual income tax return deadline. |

| Income Reporting | All business income, including cash, checks, and credit card payments, must be reported on Schedule C. |

| Deductible Expenses | Business expenses such as supplies, utilities, and travel can be deducted to reduce taxable income. |

| Net Profit or Loss | The net profit or loss calculated on Schedule C is transferred to the main Form 1040. |

| Record Keeping | Maintaining accurate records of income and expenses is essential for completing Schedule C accurately. |

| Self-Employment Tax | Profits reported on Schedule C may be subject to self-employment tax, which funds Social Security and Medicare. |

| State-Specific Forms | Some states require additional forms or schedules for business income; check your state's tax authority for details. |

| Amending Schedule C | If errors are found after filing, you can amend your return using Form 1040-X and correcting Schedule C. |

Similar forms

The IRS Schedule C (Form 1040) is primarily used by sole proprietors to report income or loss from their business. This document is similar to the IRS Form 1065, which is utilized by partnerships. Both forms require detailed reporting of income and expenses, but while Schedule C focuses on individual business owners, Form 1065 reflects the collective income and deductions of multiple partners. Each partner then reports their share of the partnership's income on their personal tax returns, creating a connection between individual and partnership taxation.

Another document that shares similarities with Schedule C is the IRS Form 1120, which is used by corporations. Like Schedule C, Form 1120 requires a comprehensive breakdown of income and expenses. However, the key difference lies in the structure of the business. Schedule C is for sole proprietors, while Form 1120 is for corporations, which are separate legal entities. This distinction affects how income is taxed and reported, but both forms aim to provide a clear picture of financial performance.

IRS Schedule E is another form that resembles Schedule C, particularly for those who earn income from rental real estate or partnerships. Both forms involve reporting income and expenses, but Schedule E is specifically designed for passive income sources, while Schedule C is for active business income. Individuals who own rental properties may need to use both forms if they also run a business, highlighting the diverse ways income can be generated.

The IRS Form 1040 itself is closely related to Schedule C, as it serves as the main tax return for individuals. Schedule C is an attachment to the 1040, allowing sole proprietors to report their business income alongside other personal income sources. This integration helps streamline the filing process and provides a comprehensive overview of an individual’s financial situation.

Form 1099-MISC is another document that aligns with Schedule C. This form is used to report various types of income received by individuals who are not employees, such as freelancers or independent contractors. If someone receives a 1099-MISC, they will likely report that income on Schedule C. Both documents focus on income generation outside of traditional employment, making them essential for self-employed individuals.

IRS Form 4562 is relevant as it pertains to depreciation and amortization. Business owners using Schedule C may need to file Form 4562 to claim depreciation on their assets. While Schedule C captures overall business income and expenses, Form 4562 specifically addresses how to account for the wear and tear of business property over time, which can significantly impact taxable income.

In exploring the intricacies of lease agreements, it is essential to understand the legal frameworks involved, such as those outlined in various templates and resources, including the information available at documentonline.org/blank-new-york-lease-agreement/. These resources help clarify the terms of rental agreements, including the specifics relating to rental prices, lease durations, and obligations of landlords and tenants alike. Ultimately, having a well-defined agreement is key to ensuring a smooth rental experience for all parties involved.

Form 8829, which is used for claiming expenses for business use of a home, is also similar to Schedule C. If a sole proprietor operates their business from home, they can use Form 8829 to detail their home office expenses. This form complements Schedule C by providing a way to deduct specific costs associated with running a business from a residential property, ultimately reducing taxable income.

Another related document is IRS Form 1040-SR, which is designed for seniors. While it serves a similar purpose as the standard 1040, it includes larger print and a simplified layout. If a senior citizen operates a business, they would still use Schedule C to report their business income, but they might prefer the user-friendly features of Form 1040-SR for their overall tax filing.

Finally, IRS Form 941 is relevant for those who have employees. While Schedule C is for sole proprietors, Form 941 is used to report payroll taxes for businesses with employees. If a sole proprietor has employees, they will need to manage both forms to ensure compliance with tax obligations. This highlights the complexity of tax reporting for business owners who navigate both personal and business income.