Blank IRS 1099-MISC Template

The IRS 1099-MISC form serves as a crucial document for reporting various types of income received by individuals and businesses outside of traditional employment. This form is typically utilized by independent contractors, freelancers, and other self-employed individuals who earn $600 or more in a calendar year from a single payer. It is important to note that the 1099-MISC is also used to report other payments, such as rents, royalties, and certain legal settlements. The payer is responsible for providing a copy of the form to the recipient and submitting it to the IRS, ensuring that all reported income is accurately documented for tax purposes. Understanding the key elements of the 1099-MISC, including its deadlines and filing requirements, is essential for both payers and recipients to maintain compliance with tax regulations. Failure to properly report income on this form may lead to penalties or additional scrutiny from the IRS. As such, familiarity with the 1099-MISC is vital for anyone who receives income that falls under its purview.

Document Example

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at IRS.gov/Form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

If you have 10 or more information returns to file, you may be required to file

If you have fewer than 10 information returns to file, we strongly encourage you to

See Publications 1141, 1167, and 1179 for more information about printing these forms.

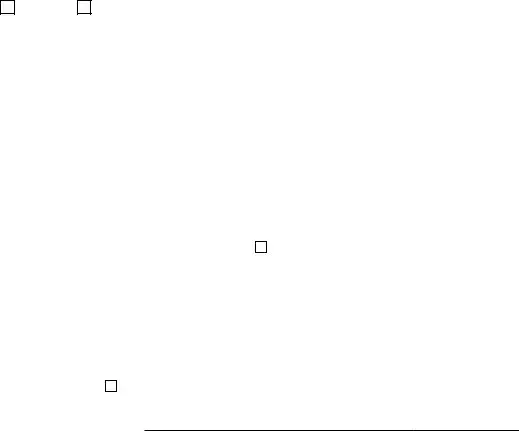

9595 |

|

VOID |

CORRECTED |

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1 |

Rents |

OMB No. |

|

|

|||||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

$ |

|

Form |

|

Miscellaneous |

||||

|

|

|

|

2 |

Royalties |

(Rev. January 2024) |

|

Information |

||||

|

|

|

|

|

|

For calendar year |

|

|

||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Other income |

4 |

Federal income tax withheld |

Copy A |

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

For |

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

5 |

Fishing boat proceeds |

6 |

Medical and health care |

Internal Revenue |

|||||

|

|

|

|

|

|

|

payments |

Service Center |

||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

File with Form 1096. |

|

RECIPIENT’S name |

|

|

7 |

Payer made direct sales |

8 |

Substitute payments in lieu |

For Privacy Act |

|||||

|

|

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

and Paperwork |

||||

|

|

|

|

|

consumer products to |

$ |

|

|

|

|

||

|

|

|

|

|

recipient for resale |

|

|

|

|

Reduction Act |

||

Street address (including apt. no.) |

|

|

9 |

Crop insurance proceeds |

10 |

Gross proceeds paid to an |

Notice, see the |

|||||

|

|

|

|

|

|

|

attorney |

current General |

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

Instructions for |

|

|

|

|

|

|

|

|

|

|

Certain |

|||

City or town, state or province, country, and ZIP or foreign postal code |

11 |

Fish purchased for resale |

12 |

Section 409A deferrals |

||||||||

Information |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

$ |

|

$ |

|

|

|

|

Returns. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

13 FATCA filing |

14 |

Excess golden parachute |

15 |

Nonqualified deferred |

|

||||

|

|

|

requirement |

|

payments |

|

compensation |

|

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

2nd TIN not. |

16 |

State tax withheld |

17 |

State/Payer’s state no. |

18 State income |

||||

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

Form |

Cat. No. 14425J |

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

||||||||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1 |

Rents |

OMB No. |

|

|

|

|||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Form |

|

Miscellaneous |

||||

|

|

|

2 |

Royalties |

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

|

For calendar year |

|

|

|

|||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Other income |

4 |

Federal income tax withheld |

|

Copy 1 |

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

For State Tax |

PAYER’S TIN |

RECIPIENT’S TIN |

|

5 |

Fishing boat proceeds |

6 |

Medical and health care |

|

Department |

|||

|

|

|

|

|

|

payments |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 |

Payer made direct sales |

8 |

Substitute payments in lieu |

|

|

|||

|

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

|

|

|||

|

|

|

|

consumer products to |

$ |

|

|

|

|

|

|

|

|

|

|

recipient for resale |

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

9 |

Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

|

|||

|

|

|

|

|

|

attorney |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

11 |

Fish purchased for resale |

12 |

Section 409A deferrals |

|

|

|||||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

13 FATCA filing |

14 |

Excess golden parachute |

15 |

Nonqualified deferred |

|

|

|||

|

|

requirement |

|

payments |

|

compensation |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

16 |

State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

|||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

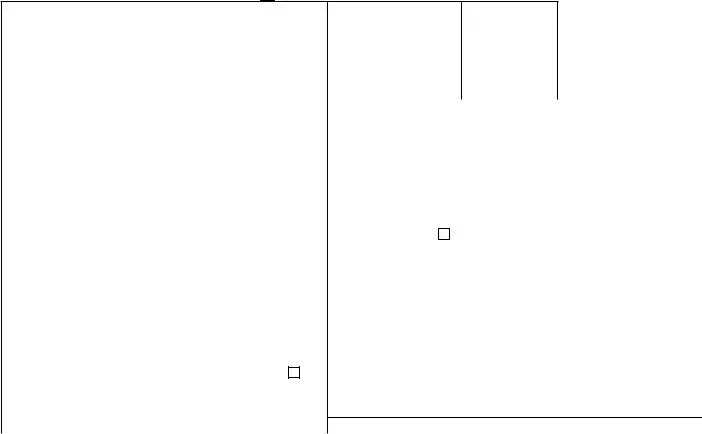

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents |

OMB No. |

or foreign postal code, and telephone no. |

|

|

|

|

$ |

Form |

Miscellaneous |

|||||

|

|

|

2 Royalties |

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

For calendar year |

|

|

||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

3 Other income |

4 Federal income tax withheld |

Copy B |

|||||

|

|

|

$ |

$ |

|

|

|

|

|

For Recipient |

PAYER’S TIN |

RECIPIENT’S TIN |

5 Fishing boat proceeds |

6 |

Medical and health care |

|

|

||||

|

|

|

|

|

payments |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 Payer made direct sales |

8 |

Substitute payments in lieu |

|

This is important tax |

|||

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

|

||||

|

|

|

consumer products to |

$ |

|

|

|

|

|

information and is |

|

|

|

recipient for resale |

|

|

|

|

|

being furnished to |

|

Street address (including apt. no.) |

|

|

9 Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

the IRS. If you are |

|||

|

|

|

|

|

attorney |

|

required to file a |

|||

|

|

|

$ |

$ |

|

|

|

|

|

return, a negligence |

|

|

|

|

|

|

|

|

penalty or other |

||

City or town, state or province, country, and ZIP or foreign postal code |

11 Fish purchased for resale |

12 |

Section 409A deferrals |

|

sanction may be |

|||||

|

|

|

|

|

|

|

|

|

|

imposed on you if |

|

|

|

$ |

$ |

|

|

|

|

|

this income is |

|

|

|

|

|

|

|

|

taxable and the IRS |

||

|

|

13 FATCA filing 14 Excess golden parachute |

15 |

Nonqualified deferred |

|

determines that it |

||||

|

|

requirement |

payments |

|

compensation |

|

has not been |

|||

|

|

|

$ |

$ |

|

|

|

|

|

reported. |

|

|

|

|

|

|

|

|

|

||

Account number (see instructions) |

|

|

16 State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

|||

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

$ |

Form |

(keep for your records) |

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

||||||

Instructions for Recipient

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN). However, the payer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to distinguish your account.

Amounts shown may be subject to

Form

Box 1. Report rents from real estate on Schedule E (Form 1040). However, report rents on Schedule C (Form 1040) if you provided significant services to the tenant, sold real estate as a business, or rented personal property as a business. See Pub. 527.

Box 2. Report royalties from oil, gas, or mineral properties; copyrights; and patents on Schedule E (Form 1040). However, report payments for a working interest as explained in the Schedule E (Form 1040) instructions. For royalties on timber, coal, and iron ore, see Pub. 544.

Box 3. Generally, report this amount on the “Other income” line of Schedule 1 (Form 1040) and identify the payment. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other taxable income. See Pub. 525. If it is trade or business income, report this amount on Schedule C or F (Form 1040).

Box 4. Shows backup withholding or withholding on Indian gaming profits. Generally, a payer must backup withhold if you did not furnish your TIN. See Form

Box 5. Shows the amount paid to you as a fishing boat crew member by the operator, who considers you to be

Box 6. For individuals, report on Schedule C (Form 1040).

Box 7. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a

Box 8. Shows substitute payments in lieu of dividends or

Box 9. Report this amount on Schedule F (Form 1040).

Box 10. Shows gross proceeds paid to an attorney in connection with legal services. Report only the taxable part as income on your return.

Box 11. Shows the amount of cash you received for the sale of fish if you are in the trade or business of catching fish.

Box 12. May show current year deferrals as a nonemployee under a nonqualified deferred compensation (NQDC) plan that is subject to the requirements of section 409A plus any earnings on current and prior year deferrals.

Box 13. If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. You may also have a filing requirement. See the Instructions for Form 8938.

Box 14. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See your tax return instructions for where to report.

Box 15. Shows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. Any amount included in box 12 that is currently taxable is also included in this box. Report this amount as income on your tax return. This income is also subject to a substantial additional tax to be reported on Form 1040,

Boxes

Future developments. For the latest information about developments related to Form

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents |

OMB No. |

or foreign postal code, and telephone no. |

|

|

|

|

$ |

|

Form |

Miscellaneous |

|||||

|

|

|

2 Royalties |

|

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

|

For calendar year |

|

|

||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

3 Other income |

4 |

Federal income tax withheld |

|

Copy 2 |

||||

|

|

|

$ |

$ |

|

|

|

|

|

To be filed with |

|

PAYER’S TIN |

RECIPIENT’S TIN |

5 Fishing boat proceeds |

6 |

Medical and health care |

|

recipient’s state |

|||||

|

|

|

|

|

|

payments |

|

income tax return, |

|||

|

|

|

|

|

|

|

|

|

|

|

when required. |

|

|

|

$ |

$ |

|

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 Payer made direct sales |

8 |

Substitute payments in lieu |

|

|

||||

|

|

|

totaling $5,000 or more of |

|

|

of dividends or interest |

|

|

|||

|

|

|

consumer products to |

$ |

|

|

|

|

|

|

|

|

|

|

recipient for resale |

|

|

|

|

|

|

||

Street address (including apt. no.) |

|

|

9 Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

|

||||

|

|

|

|

|

|

attorney |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

11 Fish purchased for resale |

12 |

Section 409A deferrals |

|

|

||||||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

13 FATCA filing 14 Excess golden parachute |

15 |

Nonqualified deferred |

|

|

|||||

|

|

requirement |

payments |

|

|

compensation |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

Account number (see instructions) |

|

|

16 State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

www.irs.gov/Form1099MISC |

|

|

Department of the Treasury - Internal Revenue Service |

|||||||

Frequently Asked Questions

-

What is the IRS 1099-MISC form?

The IRS 1099-MISC form is used to report various types of income that are not considered wages. This includes payments made to independent contractors, rent payments, prizes, awards, and other forms of income. If you’ve paid someone $600 or more in a calendar year for services provided, you’ll likely need to issue a 1099-MISC to that individual.

-

Who needs to file a 1099-MISC?

Any business, including sole proprietorships, partnerships, and corporations, may need to file a 1099-MISC if they have made qualifying payments. This could be to freelancers, contractors, or vendors. If you’re a self-employed individual and you receive payments from clients, they may need to send you a 1099-MISC as well.

-

When is the 1099-MISC form due?

The 1099-MISC form must be filed with the IRS by January 31 of the year following the tax year in which the payments were made. For recipients, the form must also be provided to them by this same date. It’s essential to keep track of these deadlines to avoid potential penalties.

-

What happens if I don’t file a 1099-MISC?

Failing to file a 1099-MISC can lead to penalties from the IRS. These penalties can vary based on how late the form is filed, with fees escalating the longer you wait. Additionally, if you don’t provide the form to the recipient, they may face challenges when filing their own taxes. It’s best to stay compliant to avoid these issues.

Misconceptions

Understanding the IRS 1099-MISC form is crucial for anyone who receives income that isn't reported on a W-2. However, several misconceptions can lead to confusion. Here are five common misunderstandings about the 1099-MISC form:

- Only Businesses Receive 1099-MISC Forms: Many people think that only businesses need to worry about this form. In reality, anyone who earns income from freelance work, rental properties, or other non-employee sources may receive a 1099-MISC.

- All Payments Are Reported on 1099-MISC: Some assume that every payment they receive will be reported on this form. However, not all payments qualify. For example, personal payments or amounts under $600 typically do not require a 1099-MISC.

- Receiving a 1099-MISC Means You Owe Taxes: There is a belief that receiving this form automatically means you owe taxes. While it does indicate income, your overall tax liability depends on various factors, including deductions and credits.

- 1099-MISC Forms Are Only for Independent Contractors: This form is often associated with independent contractors, but it is also used for various other payments, such as rent, prizes, and awards. Understanding the full scope of the form is essential.

- You Can Ignore a 1099-MISC: Some individuals think they can disregard a 1099-MISC if they believe it’s incorrect. Ignoring this form can lead to complications. It’s important to address any discrepancies with the issuer and report accurate income on your tax return.

Being informed about these misconceptions can help ensure that you handle your tax responsibilities correctly. If you receive a 1099-MISC, review it carefully and consult with a tax professional if you have questions.

Common mistakes

-

Incorrect Recipient Information: Many individuals fail to provide accurate names and addresses for the recipients. This can lead to delays and complications in processing. Always double-check that the name matches the recipient's tax identification documents.

-

Wrong Tax Identification Number (TIN): Entering an incorrect TIN is a common error. This number must match the IRS records. If it doesn’t, the IRS may impose penalties or the recipient may face issues with their tax return.

-

Improper Amount Reporting: Some people miscalculate the amounts paid to recipients. Ensure that the total reported reflects the actual payments made during the year. Double-check your calculations to avoid underreporting or overreporting.

-

Missing Signature: Failing to sign the form can render it invalid. Always remember to sign and date the form before submission. This simple step is crucial for compliance.

-

Not Filing on Time: Timeliness is key. Many individuals overlook the filing deadlines. Late submissions can lead to penalties. Mark your calendar and plan ahead to avoid last-minute rushes.

Additional PDF Templates

Where to Find Old Immunization Records - Proper documentation helps schools and childcare providers monitor immunization status.

A New York Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a residential or commercial property. This form serves as a binding contract, detailing essential elements such as rental price, lease duration, and the responsibilities of both parties. Understanding this document is crucial for protecting rights and ensuring a smooth rental experience. For more information, you can refer to documentonline.org/blank-new-york-lease-agreement.

Best Lease Purchase Trucking Companies 2023 - Insurance coverage must at least meet the minimum requirements outlined by federal law and UIIA guidelines.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS 1099-MISC form is used to report miscellaneous income paid to non-employees, such as independent contractors. |

| Threshold | Businesses must issue a 1099-MISC if they paid $600 or more to a non-employee during the tax year. |

| Filing Deadline | The deadline to file the 1099-MISC form with the IRS is typically January 31 of the year following the payment. |

| Recipient Copy | Recipients must receive their copy of the 1099-MISC by January 31 as well. |

| State Requirements | Some states have their own versions of the 1099-MISC, which may require separate filing. |

| Common Uses | Common uses include reporting payments to freelancers, rent payments, and legal settlements. |

| Penalties | Failure to file or provide a 1099-MISC can result in penalties, which vary based on how late the form is submitted. |

| Electronic Filing | Businesses can file the 1099-MISC electronically through the IRS e-file system. |

| Changes in 2020 | Starting in 2020, the IRS introduced a new form, the 1099-NEC, specifically for reporting non-employee compensation. |

| Record Keeping | It’s important for businesses to keep accurate records of payments made, as they will need this information to complete the 1099-MISC. |

Similar forms

The IRS 1099-NEC form is similar to the 1099-MISC in that both are used to report payments made to non-employees. The 1099-NEC specifically focuses on reporting non-employee compensation, such as payments to independent contractors or freelancers. This form was reintroduced in 2020 to separate non-employee compensation from other types of payments reported on the 1099-MISC, making it clearer for both the payers and the IRS. As a result, if you have paid someone for services rendered and the total exceeds $600 in a year, you would use the 1099-NEC instead of the 1099-MISC for those specific payments.

The IRS 1099-DIV form is another document that shares similarities with the 1099-MISC. While the 1099-MISC is used for reporting miscellaneous income, the 1099-DIV is specifically for reporting dividends and distributions received by shareholders. If you own stocks or mutual funds and receive dividends exceeding $10, the financial institution will issue a 1099-DIV. Both forms serve the purpose of informing the IRS about income that may not be reflected on a W-2, ensuring that all income is accurately reported for tax purposes.

The 1099-INT form is also comparable to the 1099-MISC, as it is used to report interest income. If you earn interest from a bank account, a loan, or other sources and the total interest exceeds $10, the institution will provide you with a 1099-INT. Similar to the 1099-MISC, this form helps the IRS track income that individuals may receive outside of traditional employment, ensuring that all earnings are reported and taxed appropriately.

Understanding various financial forms is essential for accurate income reporting. Among these, the Profit And Loss form plays a critical role by summarizing a company's revenues, costs, and expenses, providing a snapshot of financial performance. Moreover, for those needing guidance in managing legal aspects of financial documentation, resources like OnlineLawDocs.com can be invaluable in ensuring compliance and clarity.

Lastly, the IRS 1099-B form is related to the 1099-MISC in that it reports proceeds from broker and barter exchange transactions. If you sell stocks or other securities, the brokerage firm will issue a 1099-B to report the gains or losses from those transactions. Like the 1099-MISC, the 1099-B is essential for providing the IRS with a complete picture of your income sources. It helps ensure that taxpayers accurately report capital gains and losses when filing their tax returns, thereby fulfilling their tax obligations.