Blank Investment Letter of Intent Form

The Investment Letter of Intent (LOI) is a crucial document that outlines the preliminary terms and conditions of a potential investment agreement between parties. This form serves as a roadmap for negotiations, laying out key aspects such as the amount of investment, the intended use of funds, and the timeline for the transaction. It often includes information about the parties involved, the structure of the investment, and any contingencies that must be met before finalizing the deal. While the LOI is not a legally binding contract, it establishes a mutual understanding and demonstrates the seriousness of the parties' intentions. By clarifying expectations and responsibilities, the Investment Letter of Intent helps facilitate smoother discussions and can pave the way for a more formal agreement down the line. Understanding its components is essential for both investors and entrepreneurs looking to secure funding and build successful partnerships.

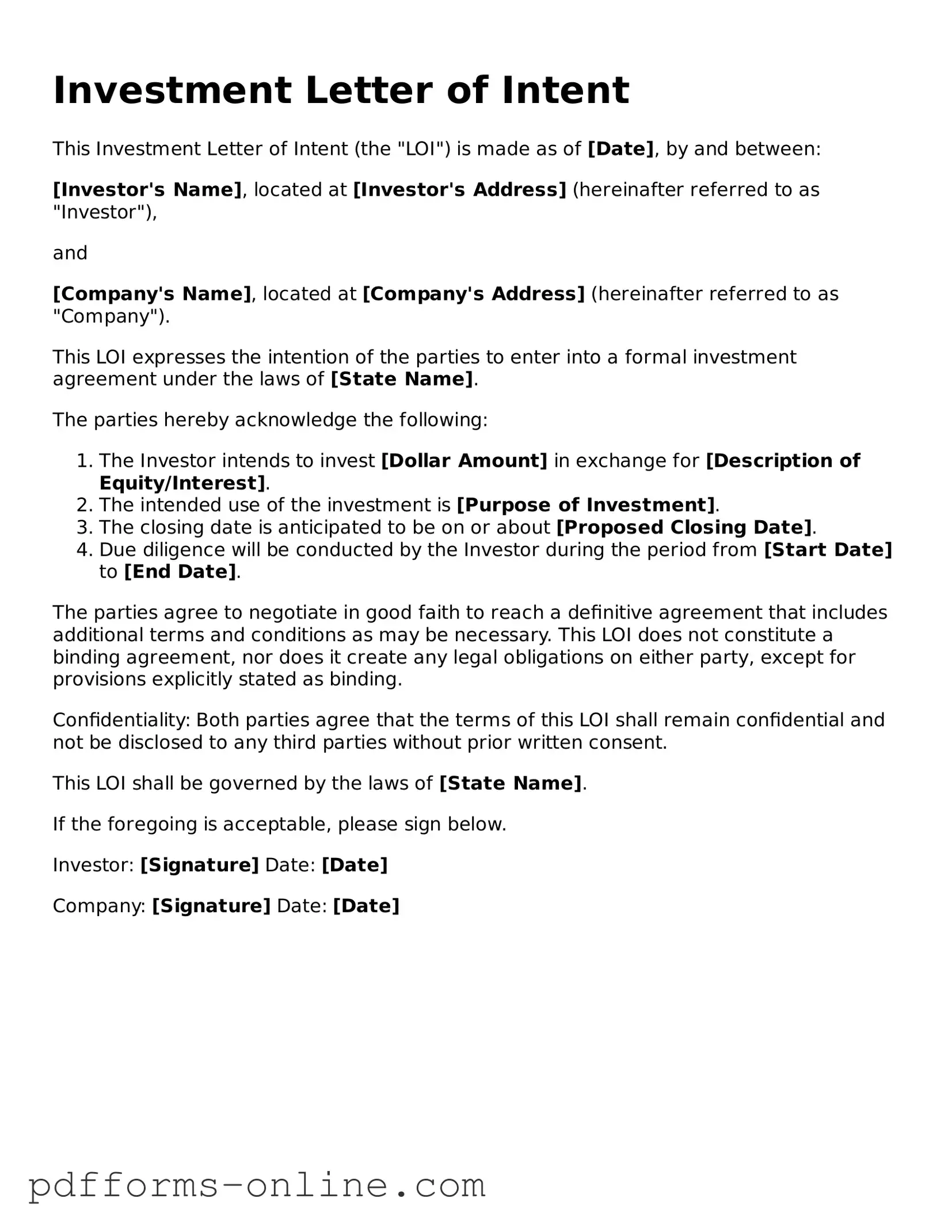

Document Example

Investment Letter of Intent

This Investment Letter of Intent (the "LOI") is made as of [Date], by and between:

[Investor's Name], located at [Investor's Address] (hereinafter referred to as "Investor"),

and

[Company's Name], located at [Company's Address] (hereinafter referred to as "Company").

This LOI expresses the intention of the parties to enter into a formal investment agreement under the laws of [State Name].

The parties hereby acknowledge the following:

- The Investor intends to invest [Dollar Amount] in exchange for [Description of Equity/Interest].

- The intended use of the investment is [Purpose of Investment].

- The closing date is anticipated to be on or about [Proposed Closing Date].

- Due diligence will be conducted by the Investor during the period from [Start Date] to [End Date].

The parties agree to negotiate in good faith to reach a definitive agreement that includes additional terms and conditions as may be necessary. This LOI does not constitute a binding agreement, nor does it create any legal obligations on either party, except for provisions explicitly stated as binding.

Confidentiality: Both parties agree that the terms of this LOI shall remain confidential and not be disclosed to any third parties without prior written consent.

This LOI shall be governed by the laws of [State Name].

If the foregoing is acceptable, please sign below.

Investor: [Signature] Date: [Date]

Company: [Signature] Date: [Date]

Frequently Asked Questions

-

What is an Investment Letter of Intent (LOI)?

An Investment Letter of Intent is a document that outlines the preliminary understanding between parties who intend to engage in an investment transaction. It serves as a non-binding agreement that indicates the intention to negotiate and finalize a deal. The LOI typically includes key terms and conditions, such as the amount of investment, the structure of the deal, and any contingencies that must be met before the transaction can proceed.

-

What are the key components of an Investment LOI?

Key components of an Investment Letter of Intent often include:

- Identification of the parties involved.

- Details regarding the investment amount.

- Proposed timeline for the transaction.

- Terms and conditions that must be met.

- Confidentiality clauses, if applicable.

- Any exclusivity agreements between the parties.

-

Is an Investment LOI legally binding?

Generally, an Investment Letter of Intent is considered a non-binding document. This means that while it expresses the intent of the parties to move forward with negotiations, it does not create enforceable obligations. However, specific sections of the LOI, such as confidentiality or exclusivity clauses, may be binding. It is essential for parties to clearly state which parts of the LOI are intended to be binding.

-

How should one complete an Investment LOI?

To complete an Investment Letter of Intent, the following steps are recommended:

- Clearly identify all parties involved in the transaction.

- Specify the investment amount and any conditions related to it.

- Outline the proposed timeline for due diligence and final agreement.

- Include any specific terms or contingencies that must be addressed.

- Review the document for clarity and completeness before signing.

-

What should be done after signing the Investment LOI?

After signing the Investment Letter of Intent, the parties should begin the due diligence process. This involves verifying the information provided and assessing the risks associated with the investment. Communication between the parties should remain open throughout this process. Once due diligence is complete and both parties are satisfied, they can proceed to draft and finalize a formal investment agreement.

Misconceptions

The Investment Letter of Intent (LOI) is a crucial document in the world of investments, yet many misunderstand its purpose and implications. Here’s a list of common misconceptions that can lead to confusion or missteps in the investment process.

- It is a legally binding contract. Many believe that an LOI is a binding agreement. In reality, it typically serves as a preliminary document outlining intentions, not a final commitment.

- It guarantees funding. Some think that signing an LOI guarantees that the investment will go through. However, it merely indicates interest and sets the stage for further negotiations.

- All terms are set in stone. People often assume that the terms outlined in the LOI cannot be changed. In fact, the LOI is a starting point for discussions, and terms can be adjusted as negotiations progress.

- It’s only for large investments. A common myth is that LOIs are only necessary for significant investments. In truth, they can be useful for any size deal to clarify intentions and expectations.

- It eliminates the need for due diligence. Some investors think that signing an LOI means they can skip the due diligence process. This is a misconception; due diligence remains a critical step before finalizing any investment.

- It is only for the investor’s benefit. Many believe that the LOI is solely for the investor's protection. However, it also serves to protect the interests of the company seeking investment.

- All LOIs look the same. Some assume that LOIs are standardized documents. In reality, they can vary widely based on the specifics of the deal and the parties involved.

- It can be ignored once signed. A misconception exists that once the LOI is signed, it can be disregarded. In fact, it should be treated seriously as it lays the groundwork for future agreements.

- It doesn’t require legal review. Some individuals think that LOIs are simple enough to bypass legal counsel. However, having a lawyer review the document can help avoid potential pitfalls.

- It’s a formal commitment to invest. Finally, many people mistakenly believe that signing an LOI means they are formally committing to invest. Instead, it reflects an intention to negotiate further.

Understanding these misconceptions is essential for anyone involved in the investment process. Being informed can lead to better decision-making and smoother negotiations.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all the necessary details required on the form. This can include missing personal information, financial details, or investment amounts. Incomplete forms can lead to delays in processing or even rejection.

-

Incorrect Financial Figures: Some people mistakenly enter inaccurate financial information. Whether it's the total investment amount or income details, inaccuracies can raise red flags and complicate the review process.

-

Failure to Sign: A common oversight is neglecting to sign the form. Without a signature, the document is not considered valid. This simple mistake can cause significant delays in moving forward with the investment.

-

Not Reviewing the Terms: Many applicants skip the step of thoroughly reading the terms and conditions associated with the investment. Failing to understand these terms can lead to misunderstandings later on, potentially affecting the investment outcome.

-

Missing Supporting Documents: Often, people forget to attach necessary supporting documents. This could include proof of identity or financial statements. Without these documents, the application may be deemed incomplete, resulting in further delays.

Fill out Common Types of Investment Letter of Intent Forms

Letter of Intent Purchase Business - It can summarize the buyer's outlook on market conditions affecting the purchase.

Letter of Intent for a Job - The document is simple yet effective in conveying commitment from the employer to the candidate.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent outlines the preliminary agreement between parties interested in making an investment. |

| Non-Binding | This document is typically non-binding, meaning it expresses intent but does not create legal obligations. |

| Parties Involved | It usually involves at least two parties: the investor and the entity seeking investment. |

| Key Terms | The letter often includes key terms such as investment amount, timeline, and conditions for investment. |

| Confidentiality | Many letters include confidentiality clauses to protect sensitive information shared between parties. |

| Governing Law | The governing law may vary by state; for example, California law often governs such agreements. |

| Expiration | Investment Letters of Intent usually have an expiration date, after which the terms may no longer be valid. |

| Due Diligence | The document may outline a period for due diligence, allowing the investor to evaluate the opportunity. |

| Signature Requirements | While not legally binding, signatures from both parties indicate mutual interest and acknowledgment of terms. |

| Follow-Up | After signing, parties often move towards drafting a formal agreement based on the terms discussed in the letter. |

Similar forms

The Investment Letter of Intent (LOI) shares similarities with a Memorandum of Understanding (MOU). Both documents serve as preliminary agreements outlining the intentions of parties involved in a potential transaction. An MOU typically details the key terms and conditions that the parties agree to discuss further. Like the LOI, it is not legally binding but sets the stage for negotiations and can help clarify expectations, fostering a mutual understanding before formal agreements are drafted.

Another document comparable to the Investment LOI is the Term Sheet. A Term Sheet outlines the basic terms and conditions of an investment deal, including valuation, investment amount, and equity stake. While the LOI expresses intent to invest, the Term Sheet provides a more detailed framework for the investment structure. Both documents guide negotiations and help ensure that all parties are aligned on critical aspects of the deal before moving forward with more formal agreements.

Lastly, the Purchase Agreement bears resemblance to the Investment LOI in that both documents outline specific terms of a transaction. The Purchase Agreement is a legally binding contract that details the sale of an asset or equity, while the LOI is a non-binding expression of interest. However, both documents highlight the essential elements of the deal, such as pricing and conditions, paving the way for a formal contract that will finalize the transaction.