Blank Intent To Lien Florida Template

In Florida, the Intent to Lien form plays a crucial role in protecting the rights of contractors and service providers who have not received payment for their work. This form serves as a formal notification to property owners that a lien may be filed against their property if payment is not made. The process begins with the completion of the form, which includes essential details such as the date, the names and addresses of the property owner and general contractor, and a description of the property involved. The form outlines the amount owed for labor, materials, or services rendered, and it clearly states that this notice is being sent in compliance with Florida law, specifically Florida Statutes §713.06. By sending this notice at least 45 days before filing a lien, contractors provide property owners with an opportunity to address the outstanding payment. If the property owner fails to respond within 30 days, they risk having a lien recorded against their property, which could lead to foreclosure and additional costs. The form also includes a section for the sender to certify that the notice was delivered, ensuring transparency in the communication process. Overall, understanding the Intent to Lien form is essential for both contractors seeking payment and property owners wishing to protect their assets.

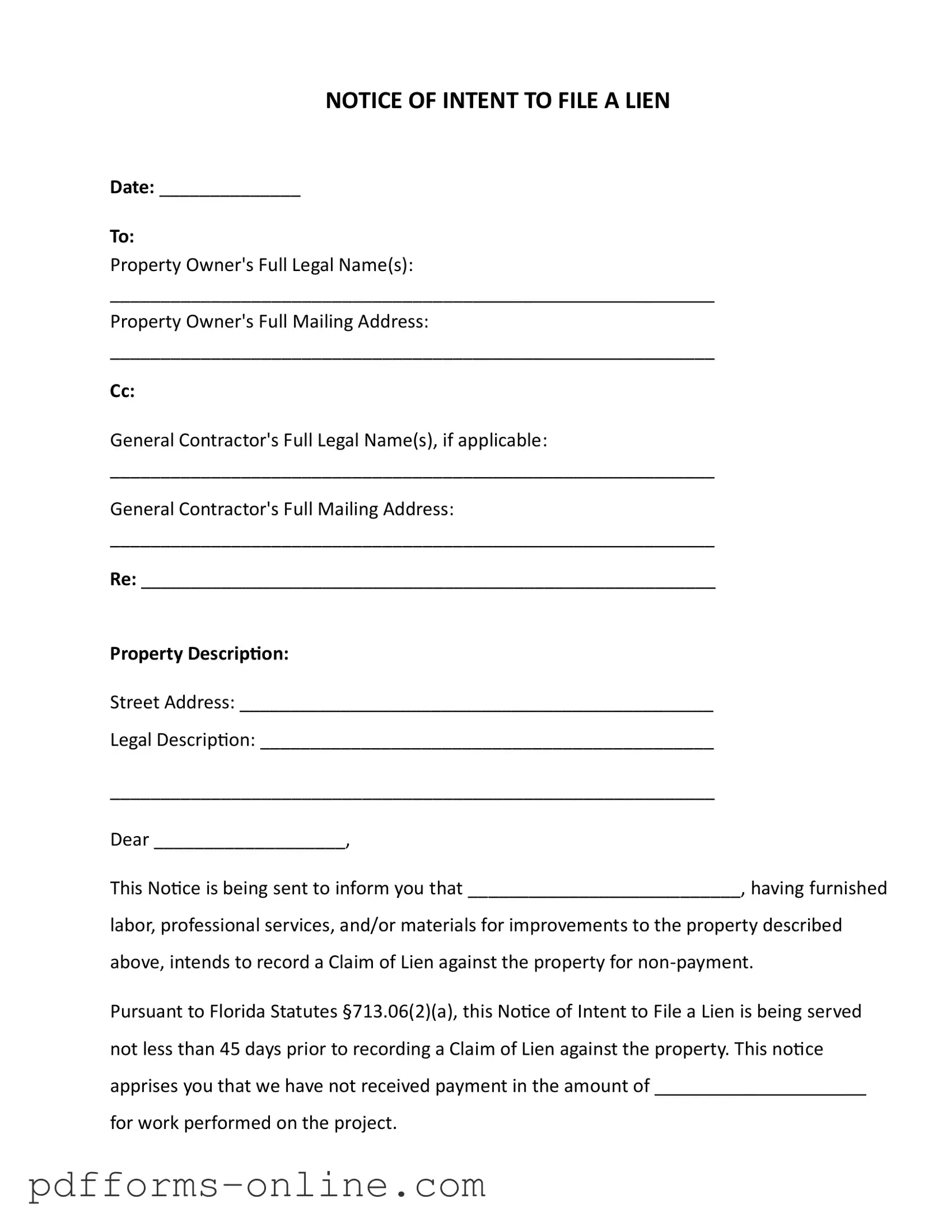

Document Example

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Frequently Asked Questions

-

What is the Intent to Lien Florida form?

The Intent to Lien form is a legal document used in Florida to notify property owners that a lien may be placed on their property due to non-payment for services or materials provided. This form serves as a warning, giving the property owner a chance to settle any outstanding payments before a lien is officially recorded.

-

Who should use the Intent to Lien form?

This form is typically used by contractors, subcontractors, or suppliers who have provided labor, materials, or services for property improvements and have not received payment. It is a way for them to protect their right to file a lien on the property if necessary.

-

What information is required on the form?

The form requires specific information, including:

- The date of the notice

- The full legal names and addresses of the property owners

- The name and address of the general contractor, if applicable

- A description of the property, including the street address and legal description

- The amount owed for the work performed

-

How long before filing a lien must the notice be sent?

According to Florida law, the notice must be sent at least 45 days before filing a Claim of Lien. This timeframe allows the property owner to address the payment issue before any legal action is taken.

-

What happens if the property owner does not respond?

If the property owner fails to respond or make payment within 30 days of receiving the notice, the party who issued the notice may proceed to record a lien against the property. This can lead to foreclosure proceedings and additional costs for the property owner.

-

Can a lien be avoided after the notice is sent?

Yes, a lien can be avoided if the property owner responds to the notice and arranges for payment. Prompt communication and resolution of the payment issue can prevent further legal actions.

-

What are the consequences of having a lien filed?

A recorded lien can have serious consequences for property owners. It can affect their ability to sell or refinance the property. Additionally, if the lien remains unpaid, it may lead to foreclosure, along with potential attorney fees and court costs.

-

How is the Intent to Lien form delivered?

The form can be delivered in several ways, including certified mail, registered mail, hand delivery, delivery by a process server, or publication. The method of delivery should be noted in the Certificate of Service section of the form.

Misconceptions

Here are five common misconceptions about the Intent To Lien Florida form:

- It's only for contractors. Many believe that only contractors can file an Intent To Lien. However, anyone who provides labor, materials, or services for property improvements can use this form, including subcontractors and suppliers.

- Filing the form means a lien is automatically placed. Some think that submitting this notice automatically results in a lien. In reality, it serves as a warning. A lien is only recorded if payment is not received within the specified timeframe.

- The notice can be ignored. Ignoring the Intent To Lien is a mistake. The notice is a formal communication that indicates potential legal action. It's essential to address it promptly to avoid further complications.

- It must be filed in person. There's a misconception that the Intent To Lien must be delivered in person. In fact, it can be sent via certified mail or other methods, as long as proper documentation is maintained.

- It's only relevant for large projects. Many think this form is only necessary for substantial construction projects. However, it applies to any property improvement, regardless of size, as long as labor or materials were provided.

Common mistakes

-

Incorrect Date: Failing to fill in the date accurately can lead to confusion regarding the timeline for lien filing.

-

Missing Property Owner Information: Omitting the full legal name and mailing address of the property owner can delay the process and may invalidate the notice.

-

Incomplete Contractor Details: Not including the general contractor's name and address, if applicable, can lead to miscommunication.

-

Vague Property Description: Providing an unclear or incomplete description of the property can complicate the identification of the lien target.

-

Missing Payment Amount: Failing to specify the amount due for work performed can leave the property owner uncertain about the claim.

-

Improper Notification Timing: Not adhering to the required 45-day notice period before filing a lien can render the claim ineffective.

-

Ignoring Response Time: Not allowing the property owner a full 30 days to respond before proceeding with the lien can lead to legal issues.

-

Missing Signature: Forgetting to sign the notice can invalidate the document and prevent it from being recognized legally.

-

Failure to Certify Service: Not properly certifying that the notice was served can create complications in proving that the property owner was informed.

Additional PDF Templates

Profits or Loss From Business - Use Schedule C to include information on business-related travel expenses.

For those looking to enter into a rental agreement in New York, it’s essential to reference the New York Residential Lease Agreement, which can be found at https://documentonline.org/blank-new-york-residential-lease-agreement/. This legal document serves to clarify the expectations between landlords and tenants, ensuring that both parties are aware of their rights and obligations throughout the rental period.

Joint Tenancy Mortgage Death - Completing the form can provide peace of mind during a difficult time.

Document Data

| Fact Name | Details |

|---|---|

| Date Requirement | The form must include the date on which it is being sent. |

| Property Owner Information | Full legal name and mailing address of the property owner must be provided. |

| General Contractor Details | If applicable, the general contractor's full legal name and mailing address should be included. |

| Property Description | The form requires a street address and legal description of the property in question. |

| Intent to Lien | This notice indicates the sender's intention to file a lien for non-payment. |

| Notice Period | According to Florida Statutes §713.06(2)(a), notice must be served at least 45 days before filing a lien. |

| Payment Notification | The sender must specify the amount due for work performed on the property. |

| Response Timeframe | Florida Statutes §713.06(2)(b) states that a response must be made within 30 days to avoid lien recording. |

| Consequences of Non-Payment | Failure to pay may result in foreclosure proceedings and additional costs, including attorney fees. |

Similar forms

The Notice of Commencement is a crucial document in Florida's construction process. It serves to officially announce that construction work will begin on a property. Like the Intent to Lien, it protects the rights of contractors and suppliers by notifying property owners and other interested parties of the upcoming work. This notice must be filed with the county clerk and is typically required before any lien can be placed on a property. Both documents aim to ensure transparency and communication among all parties involved in a construction project.

The Notice of Non-Payment is another document that serves a similar purpose. It is used by contractors or suppliers to formally notify property owners that payment has not been received for services rendered or materials provided. This notice can act as a precursor to filing a lien, much like the Intent to Lien. By sending this notice, the sender seeks to prompt the property owner to address the payment issue before further legal action is taken. It emphasizes the importance of communication in resolving payment disputes.

A Texas Last Will and Testament form is a legal document that allows individuals to specify how they would like their property and assets distributed after their death. It provides a clear guide to loved ones and legal executors, ensuring that the person’s final wishes are honored. This critical document helps to reduce potential conflicts among survivors by laying out the decedent's intentions clearly. For more information on this topic, visit OnlineLawDocs.com.

The Claim of Lien is directly related to the Intent to Lien and is the actual document that may be filed if payment is not made. Once the 45-day notice period has passed, a contractor or supplier can file this document with the county clerk to secure their right to payment. The Claim of Lien serves as a public record, making it clear that a financial obligation exists against the property. Both documents aim to protect the rights of those who contribute to a construction project, ensuring they have a legal recourse if payment is not forthcoming.

The Release of Lien is a document that follows the Claim of Lien. Once payment is received, the lien must be released to clear the property title. This document confirms that the debt has been satisfied, allowing the property owner to move forward without the burden of a lien. Similar to the Intent to Lien, the Release of Lien is essential for maintaining clear communication and trust between property owners and contractors, as it signifies the resolution of any financial disputes.

The Affidavit of Non-Payment is another relevant document that can be used in conjunction with the Intent to Lien. This affidavit is often submitted by contractors or suppliers to provide a sworn statement that payment has not been received. It serves as a formal declaration of the unpaid status and can be used in legal proceedings if necessary. Like the Intent to Lien, this document underscores the importance of documenting payment issues to protect the rights of those involved in the construction process.

Lastly, the Notice of Termination is a document that can be issued when a contract is terminated before the completion of work. It informs all parties involved that the contract is no longer in effect. While it may not directly relate to payment issues, it can impact the rights of contractors and suppliers if work is halted. Both the Notice of Termination and the Intent to Lien serve to clarify the status of a project, ensuring that all parties are aware of their rights and obligations moving forward.