Blank Independent Contractor Pay Stub Template

When it comes to managing finances and ensuring transparency in business transactions, the Independent Contractor Pay Stub form plays a crucial role. This document serves as a detailed record of payments made to independent contractors, outlining essential information such as the contractor’s name, payment period, and the total amount earned. Not only does it provide clarity on the services rendered, but it also includes deductions for taxes and other withholdings, ensuring that both parties have a clear understanding of the financial exchange. Additionally, the form can help contractors keep track of their earnings for tax purposes, making it an invaluable tool for freelancers and businesses alike. By fostering a transparent relationship between contractors and clients, the pay stub form helps streamline the payment process and promotes accountability in financial dealings.

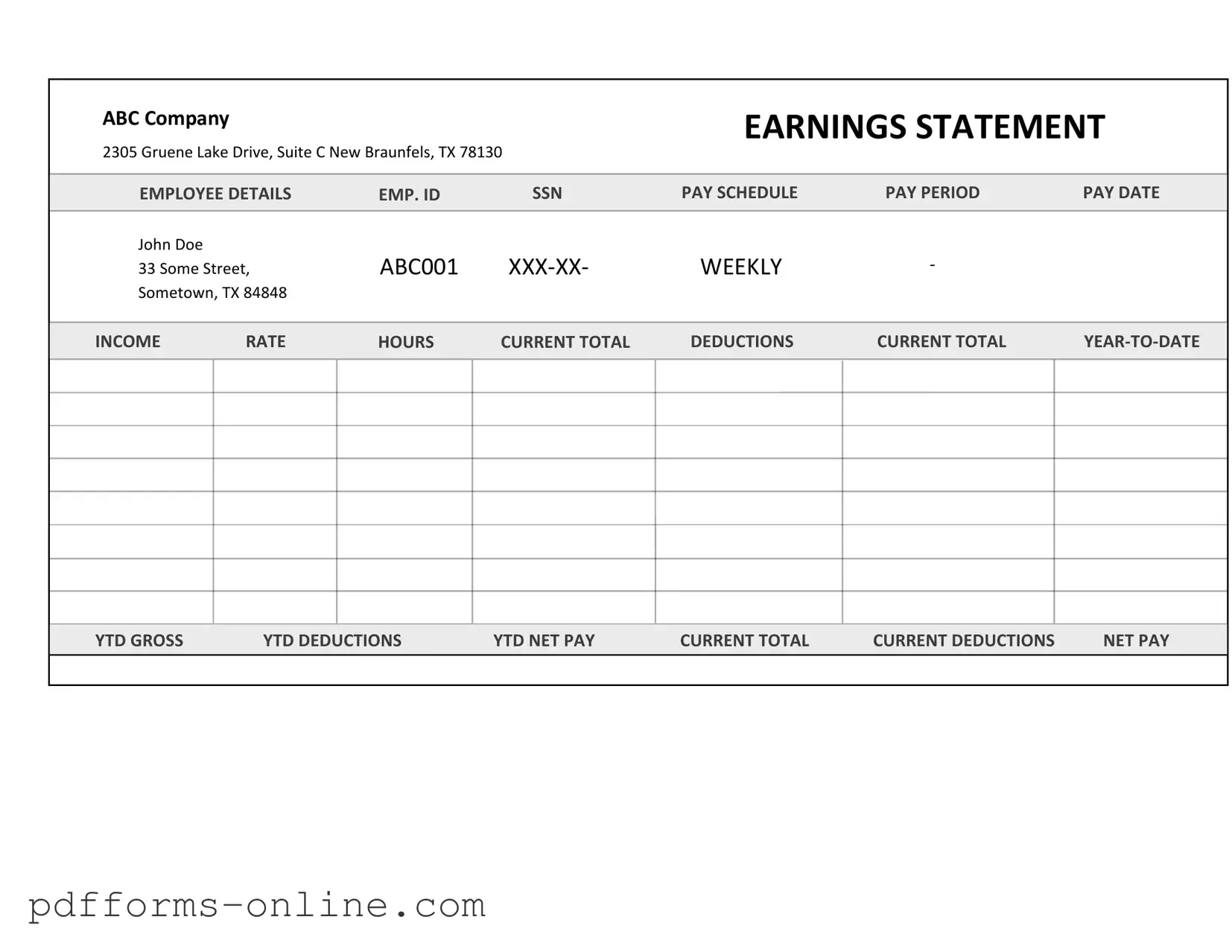

Document Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Frequently Asked Questions

-

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the payment details for a contractor who is not classified as an employee. This pay stub typically includes information such as the contractor's name, the payment period, the amount earned, any deductions, and the net payment amount. It serves as a record for both the contractor and the hiring entity, helping to maintain transparency in financial transactions.

-

Why do I need an Independent Contractor Pay Stub?

Having an Independent Contractor Pay Stub is essential for several reasons. First, it provides a clear record of earnings, which can be useful for tax purposes. Contractors may need to report their income to the IRS, and a pay stub serves as proof of the income received. Additionally, it helps in tracking payments over time and can be beneficial if any disputes arise regarding compensation.

-

What information should be included in the pay stub?

The Independent Contractor Pay Stub should include the following key details:

- The contractor's name and contact information

- The name and contact information of the hiring entity

- The payment period covered by the stub

- The total amount earned during that period

- Any deductions made, such as taxes or fees

- The net amount paid to the contractor

Including this information ensures that both parties have a clear understanding of the payment arrangement.

-

How do I create an Independent Contractor Pay Stub?

Creating an Independent Contractor Pay Stub can be done easily using templates available online or through accounting software. Start by entering the contractor's and hiring entity's details, followed by the payment period and the total amount earned. If there are any deductions, list those next, and finally calculate the net payment. Ensure that the document is clear and easy to read, as it will serve as an important record for both parties.

-

Is an Independent Contractor Pay Stub required by law?

While there is no federal law specifically requiring the issuance of pay stubs to independent contractors, it is considered good practice to provide them. Some states may have specific regulations regarding pay stubs, so it is advisable to check local laws. Issuing a pay stub can help prevent misunderstandings and disputes, making it a beneficial practice for both contractors and hiring entities.

Misconceptions

Understanding the Independent Contractor Pay Stub form is crucial for both contractors and businesses. However, misconceptions often cloud the reality of its purpose and use. Below is a list of ten common misunderstandings, along with clarifications to help demystify this important document.

- Independent contractors do not need a pay stub. Many believe that pay stubs are only necessary for employees. However, independent contractors can benefit from pay stubs for their own records and tax purposes.

- All independent contractors receive pay stubs. Not every contractor will receive a pay stub. It often depends on the agreement with the client or company. Some may opt for invoices instead.

- A pay stub guarantees employment status. A pay stub does not imply that a contractor is an employee. It merely serves as a record of payment for services rendered.

- Independent contractors can only use one pay stub format. There is no single format for pay stubs. Contractors and companies can create customized versions that meet their needs.

- Pay stubs are only for financial records. While they serve as a financial record, pay stubs can also provide important information about the nature of the work performed and payment terms.

- Pay stubs are unnecessary for tax purposes. This is misleading. Pay stubs can help independent contractors track their income and expenses, which is vital for accurate tax reporting.

- Independent contractors do not have to report income from pay stubs. All income must be reported to the IRS, regardless of whether it is documented with a pay stub or not.

- Pay stubs can only be issued by larger companies. Small businesses and individual clients can also issue pay stubs. The size of the company does not limit the ability to provide this documentation.

- Pay stubs must include tax deductions. Unlike employees, independent contractors typically do not have taxes withheld from their payments. Therefore, pay stubs may not reflect tax deductions.

- Independent contractors can ignore pay stubs if they are paid in cash. Regardless of the payment method, maintaining a record through a pay stub is advisable for financial tracking and legal purposes.

By addressing these misconceptions, independent contractors and businesses can better navigate their financial and legal responsibilities. Understanding the role of pay stubs helps ensure compliance and promotes transparency in contractor-client relationships.

Common mistakes

-

Incorrect Personal Information: Many people forget to double-check their name, address, and Social Security number. Errors in this section can lead to delays in payments and tax issues.

-

Miscalculating Hours Worked: It’s common to miscount the number of hours worked. Always ensure that you accurately track your time to avoid underpayment or overpayment disputes.

-

Neglecting to Include Deductions: Some contractors fail to account for necessary deductions, such as taxes or benefits. This can result in unexpected tax liabilities later on.

-

Using the Wrong Pay Rate: Contractors sometimes forget to verify their pay rate. Ensure that the rate matches what was agreed upon in your contract to avoid confusion.

-

Not Keeping Copies: Failing to keep copies of pay stubs can create issues if disputes arise. Always maintain a record for your personal files.

-

Ignoring Payment Terms: Many overlook the payment terms outlined in their contract. Make sure to follow these terms closely to ensure timely payments.

-

Forgetting to Sign: It may seem trivial, but forgetting to sign the pay stub can delay processing. Always include your signature to confirm the information is accurate.

-

Failing to Update Changes: If your personal information or pay rate changes, you must update the pay stub accordingly. Outdated information can lead to complications.

-

Not Reviewing for Accuracy: Lastly, many people rush through the process without reviewing their pay stub for errors. Take the time to ensure everything is correct before submission.

Additional PDF Templates

T47 Paralympics - The T-47 form supports the legal integrity of real estate transactions.

Broker Price Opinion Form - The form assesses current supply levels of similar properties in the area.

The Arizona Employee Handbook form not only serves as a crucial document outlining the policies, procedures, and expectations of a company for its employees but also provides an essential resource for various administrative needs. For comprehensive support in ensuring alignment and smooth operations within Arizona-based businesses, exploring All Arizona Forms can be incredibly beneficial. Filling out the Employee Handbook form is a critical step in this process.

Scrivener's Affidavit California - A formal statement attesting to the scrivener's qualifications and reliability.

Document Data

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub form is a document that outlines the earnings of an independent contractor for a specific pay period. |

| Purpose | This form serves to provide a clear record of payment details, including gross earnings, deductions, and net pay. |

| Components | Typical components include the contractor's name, payment date, hours worked, hourly rate, and any applicable deductions. |

| Legal Requirement | While not universally mandated, many states recommend or require pay stubs for independent contractors to ensure transparency. |

| State-Specific Forms | Some states have specific requirements for independent contractor pay stubs. For example, California requires detailed reporting of hours worked and payment information. |

| Tax Implications | Independent contractors are responsible for reporting their income, and pay stubs can assist in tracking earnings for tax purposes. |

| Format | The form can be presented in paper or digital format, depending on the preferences of the contractor and the hiring entity. |

| Record Keeping | Both contractors and hiring entities should keep copies of pay stubs for their records, as they can be important for financial planning and audits. |

| Dispute Resolution | In cases of payment disputes, having a pay stub can provide evidence of the agreed-upon terms and payments made. |

Similar forms

The Independent Contractor Pay Stub form shares similarities with the Employee Pay Stub. Both documents serve as proof of payment for services rendered, detailing the amounts earned during a specific pay period. They typically include information such as the pay period dates, total earnings, and any deductions. However, while employee pay stubs often reflect withholdings for taxes and benefits, independent contractor pay stubs may not include such deductions, as contractors are responsible for managing their own taxes.

Another document akin to the Independent Contractor Pay Stub is the Invoice. An invoice is a request for payment that outlines the services provided, the amount owed, and the payment terms. Like the pay stub, it provides clarity on the financial transaction between the contractor and the client. However, an invoice is usually issued before payment is received, while a pay stub is provided after the payment has been processed, confirming that the contractor has been compensated for their work.

The 1099 form is also similar to the Independent Contractor Pay Stub. This tax document is used to report income paid to independent contractors. It summarizes the total earnings for the year and is essential for tax filing. While the pay stub focuses on a specific pay period, the 1099 form provides a broader view of the contractor's annual earnings. Both documents are crucial for financial record-keeping, yet they serve different purposes in the payment process.

For those entering into rental agreements, having a solid understanding of the Room Rental Agreement process is imperative. You can find a valuable resource that outlines the necessary details by visiting the comprehensive Room Rental Agreement form guide.

Additionally, the Work Order can be compared to the Independent Contractor Pay Stub. A work order outlines the specific tasks or services requested by a client and may include details such as timelines and costs. It serves as a contract between the contractor and the client. While the pay stub confirms payment for completed work, the work order sets the stage for the work to be done, demonstrating the initial agreement before the payment is processed.

The Receipt is another document that bears resemblance to the Independent Contractor Pay Stub. A receipt serves as proof of payment for goods or services provided. It typically includes the date, amount paid, and a description of the services rendered. Similar to a pay stub, a receipt confirms that a transaction has occurred. However, receipts are often issued for one-time purchases, whereas pay stubs are issued periodically for ongoing services rendered by independent contractors.

Finally, the Contract for Services shares some similarities with the Independent Contractor Pay Stub. This document outlines the terms and conditions under which the contractor will provide services, including payment details. While the pay stub reflects the actual payment made, the contract establishes the framework for that payment, including the agreed-upon rates and deliverables. Both documents are essential in ensuring clarity and transparency in the contractor-client relationship.