Valid Illinois Transfer-on-Death Deed Template

In Illinois, the Transfer-on-Death Deed (TODD) offers a unique approach for individuals looking to manage the transfer of real estate upon their passing. This legal instrument allows property owners to designate one or more beneficiaries who will automatically receive the property without the need for probate. By using this deed, individuals can maintain full control over their property during their lifetime, while also ensuring a smooth transition of ownership after death. The form is straightforward, requiring essential information such as the property description, the names of the beneficiaries, and the signatures of the property owners. Importantly, the Transfer-on-Death Deed can be revoked or modified at any time before the owner's death, providing flexibility in estate planning. This tool is particularly appealing to those seeking to simplify the transfer process and minimize potential disputes among heirs, making it a valuable option in the realm of estate planning in Illinois.

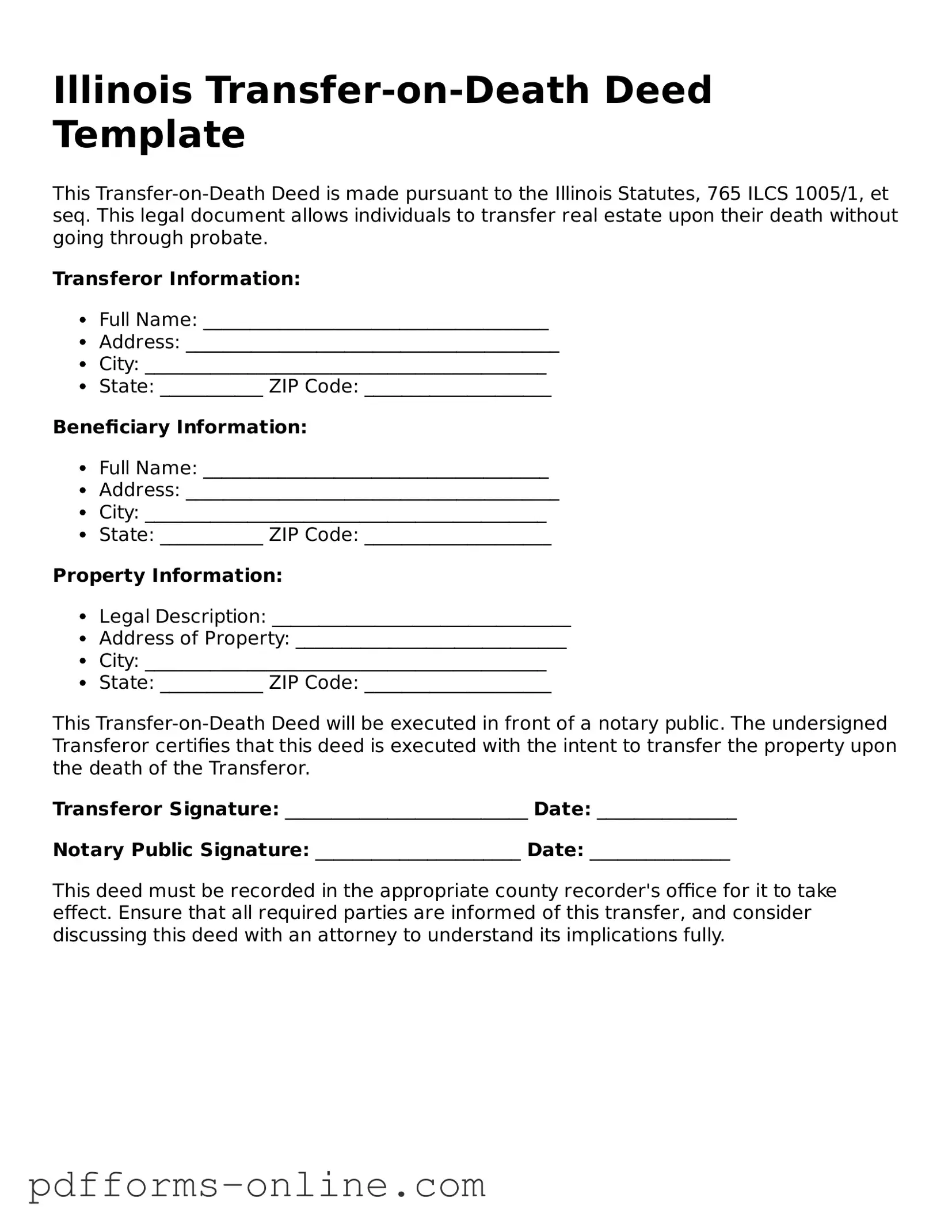

Document Example

Illinois Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the Illinois Statutes, 765 ILCS 1005/1, et seq. This legal document allows individuals to transfer real estate upon their death without going through probate.

Transferor Information:

- Full Name: _____________________________________

- Address: ________________________________________

- City: ___________________________________________

- State: ___________ ZIP Code: ____________________

Beneficiary Information:

- Full Name: _____________________________________

- Address: ________________________________________

- City: ___________________________________________

- State: ___________ ZIP Code: ____________________

Property Information:

- Legal Description: ________________________________

- Address of Property: _____________________________

- City: ___________________________________________

- State: ___________ ZIP Code: ____________________

This Transfer-on-Death Deed will be executed in front of a notary public. The undersigned Transferor certifies that this deed is executed with the intent to transfer the property upon the death of the Transferor.

Transferor Signature: __________________________ Date: _______________

Notary Public Signature: ______________________ Date: _______________

This deed must be recorded in the appropriate county recorder's office for it to take effect. Ensure that all required parties are informed of this transfer, and consider discussing this deed with an attorney to understand its implications fully.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner in Illinois to designate one or more beneficiaries to receive their property upon their death. This deed enables the property to pass directly to the beneficiaries without going through probate, making the transfer process simpler and often quicker.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Illinois can use a TOD Deed. This includes homeowners and property owners. However, it's important to ensure that the property is solely owned or that all owners agree to the transfer, as joint ownership can complicate the process.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must complete the appropriate form, which includes details about the property and the beneficiaries. After filling out the form, it must be signed and notarized. Finally, the deed should be recorded with the local county recorder's office where the property is located. This ensures that the deed is legally recognized and enforceable.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time before your death. To do this, you must create a new deed that explicitly revokes the previous one or file a formal revocation document with the county recorder's office. It's advisable to consult with a legal professional to ensure the changes are made correctly.

-

What happens if a beneficiary dies before me?

If a beneficiary named in your TOD Deed passes away before you do, their share of the property will typically go to their heirs or beneficiaries, depending on their estate plan. If you want to avoid complications, consider naming alternate beneficiaries in your deed.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property via a TOD Deed does not trigger immediate tax consequences. However, the property may be subject to estate taxes upon your death, depending on the total value of your estate. It's wise to consult a tax advisor or an estate planning attorney to understand any potential tax implications fully.

Misconceptions

Understanding the Illinois Transfer-on-Death Deed form is crucial for effective estate planning. However, several misconceptions can lead to confusion and poor decision-making. Below is a list of nine common misconceptions regarding this form.

- It only applies to real estate. Many believe that the Transfer-on-Death Deed is limited to real estate. In reality, it can also apply to certain interests in real property, such as a life estate.

- It avoids probate completely. While the Transfer-on-Death Deed allows assets to pass outside of probate, it does not eliminate the need for probate in all situations. For example, if other assets are involved, probate may still be necessary.

- It can be revoked easily. Some think that revoking a Transfer-on-Death Deed is as simple as tearing it up. In fact, a formal revocation process must be followed to ensure that the deed is no longer valid.

- It is effective immediately upon signing. Many individuals assume that signing the deed makes it effective right away. However, the deed only takes effect upon the death of the property owner.

- It is a substitute for a will. Some believe that using a Transfer-on-Death Deed eliminates the need for a will. This is not true, as a will can address other important matters that a deed cannot.

- Only one beneficiary can be named. A common misconception is that only a single beneficiary can be designated. In fact, multiple beneficiaries can be named, allowing for greater flexibility in estate planning.

- It requires a lawyer to complete. While legal assistance can be beneficial, it is not mandatory to complete the Transfer-on-Death Deed. Individuals can fill out the form themselves, provided they understand the requirements.

- It is only for married couples. Many people think this deed is only applicable to married couples. In reality, anyone can use it to transfer property to any individual or entity.

- It is a permanent decision. Some may believe that once a Transfer-on-Death Deed is executed, it cannot be changed. However, property owners can alter or revoke the deed at any time before their death.

Clarifying these misconceptions is essential for anyone considering a Transfer-on-Death Deed in Illinois. Proper understanding can lead to more effective estate planning and ensure that your wishes are honored.

Common mistakes

-

Failing to provide accurate property descriptions. It's essential to clearly identify the property being transferred to avoid confusion.

-

Not including all required signatures. Both the owner and the witness must sign the deed for it to be valid.

-

Using incorrect legal terminology. Misunderstandings can arise from incorrect wording, which may lead to legal issues.

-

Overlooking the need for notarization. A notary public must witness the signing to ensure authenticity.

-

Neglecting to record the deed. Failure to file the deed with the county recorder can invalidate the transfer.

-

Not specifying alternate beneficiaries. In case the primary beneficiary cannot inherit, having alternates is crucial.

-

Forgetting to check state laws. Each state has specific requirements for Transfer-on-Death Deeds, and Illinois has its own rules.

-

Using outdated forms. Always ensure that the most current version of the form is being used to avoid issues.

-

Not understanding tax implications. It's important to consider potential tax consequences for beneficiaries.

-

Ignoring the impact on existing debts. The deed does not eliminate any liens or mortgages on the property, which can affect the transfer.

Find Some Other Transfer-on-Death Deed Forms for Specific States

Ladybird Deed Texas Form - The form can often be found online or at county offices, making it accessible.

A Straight Bill of Lading form is a key document used in the shipping industry. It serves as a contract between a shipper and carrier for the transportation of goods. This document specifies the particulars of the cargo, ensuring both parties have clear details about the shipment. For more information on this essential document, you can visit OnlineLawDocs.com.

Transfer on Death Deed Nc - The transparency of this deed can make it easier for heirs to understand their rights upon the owner’s passing.

How Much Does It Cost to Do a Transfer on Death Deed - The Transfer-on-Death Deed is typically inexpensive and easy to set up.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Illinois Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Eligibility | Only real property, such as land and buildings, can be transferred using this deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property. |

| Revocation | The deed can be revoked at any time before the owner's death, allowing for changes in beneficiary designations. |

| Filing Requirement | The deed must be recorded with the county recorder’s office where the property is located to be effective. |

| No Immediate Effect | The transfer does not take effect until the death of the property owner; the owner retains full control during their lifetime. |

| Tax Implications | Beneficiaries may face property taxes on the transferred property, but there are no immediate tax consequences for the owner. |

| Legal Assistance | While not required, it is advisable to consult with a legal professional to ensure proper completion and understanding of the deed. |

| Limitations | This deed cannot be used for transferring property that is subject to a mortgage or other liens without addressing those obligations. |

Similar forms

The Illinois Transfer-on-Death Deed (TOD Deed) is similar to a Last Will and Testament. Both documents allow individuals to express their wishes regarding the distribution of their property after death. A will requires probate, which can be a lengthy and costly process. In contrast, the TOD Deed allows property to pass directly to the named beneficiary without going through probate, simplifying the transfer process and potentially saving time and money for the heirs.

The New York Motorcycle Bill of Sale form is an important document used to record the sale and transfer of ownership of a motorcycle. It serves as proof of purchase for both the buyer and the seller. Having this form completed accurately can help prevent disputes and ensure a smooth transaction. For more information and access to the form, you can visit https://documentonline.org/blank-new-york-motorcycle-bill-of-sale/.