Valid Illinois Real Estate Purchase Agreement Template

The Illinois Real Estate Purchase Agreement form serves as a vital document in the home buying process, acting as a roadmap for both buyers and sellers in the state. This comprehensive agreement outlines the essential terms of the transaction, including the purchase price, financing details, and the timeline for closing. It also addresses contingencies, such as inspections and appraisals, which protect the interests of both parties. In addition to these key elements, the form includes provisions for earnest money deposits, which demonstrate the buyer's commitment to the purchase. Furthermore, it outlines the responsibilities of both the seller and the buyer, ensuring that all parties are clear about their obligations throughout the transaction. By providing a structured framework, the Illinois Real Estate Purchase Agreement not only facilitates smoother negotiations but also helps to mitigate potential disputes, making it an indispensable tool in the real estate market.

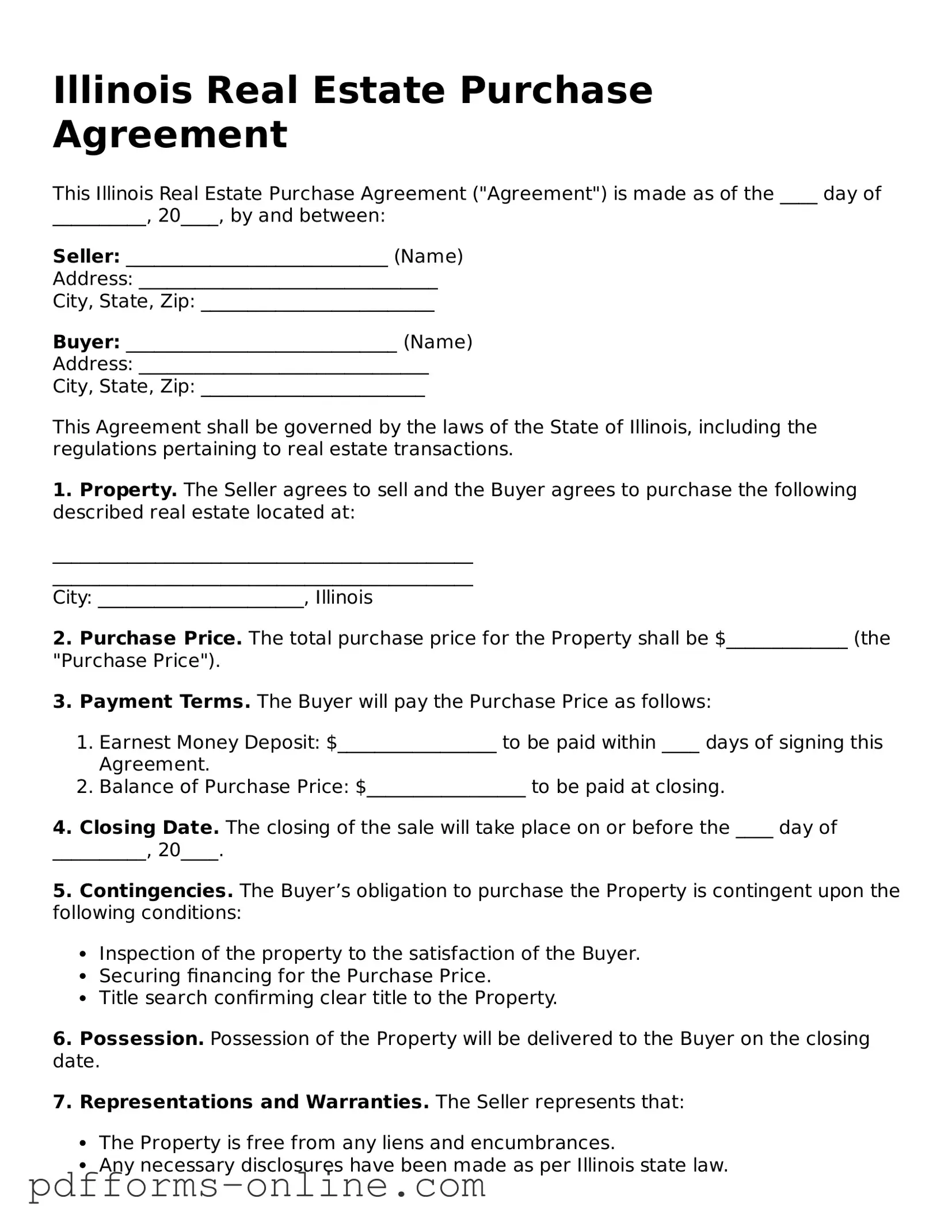

Document Example

Illinois Real Estate Purchase Agreement

This Illinois Real Estate Purchase Agreement ("Agreement") is made as of the ____ day of __________, 20____, by and between:

Seller: ____________________________ (Name)

Address: ________________________________

City, State, Zip: _________________________

Buyer: _____________________________ (Name)

Address: _______________________________

City, State, Zip: ________________________

This Agreement shall be governed by the laws of the State of Illinois, including the regulations pertaining to real estate transactions.

1. Property. The Seller agrees to sell and the Buyer agrees to purchase the following described real estate located at:

_____________________________________________

_____________________________________________

City: ______________________, Illinois

2. Purchase Price. The total purchase price for the Property shall be $_____________ (the "Purchase Price").

3. Payment Terms. The Buyer will pay the Purchase Price as follows:

- Earnest Money Deposit: $_________________ to be paid within ____ days of signing this Agreement.

- Balance of Purchase Price: $_________________ to be paid at closing.

4. Closing Date. The closing of the sale will take place on or before the ____ day of __________, 20____.

5. Contingencies. The Buyer’s obligation to purchase the Property is contingent upon the following conditions:

- Inspection of the property to the satisfaction of the Buyer.

- Securing financing for the Purchase Price.

- Title search confirming clear title to the Property.

6. Possession. Possession of the Property will be delivered to the Buyer on the closing date.

7. Representations and Warranties. The Seller represents that:

- The Property is free from any liens and encumbrances.

- Any necessary disclosures have been made as per Illinois state law.

8. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Illinois.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

Seller's Signature: _____________________________ Date: ___________

Buyer's Signature: _____________________________ Date: ___________

Frequently Asked Questions

-

What is the Illinois Real Estate Purchase Agreement?

The Illinois Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a real estate transaction in Illinois. This agreement serves as a binding contract between the buyer and the seller, detailing the purchase price, property description, contingencies, and other essential elements of the sale.

-

What key components are included in the agreement?

The agreement typically includes several important sections:

- Property Description: A detailed description of the property being sold, including the address and any relevant legal descriptions.

- Purchase Price: The agreed-upon price for the property.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or home inspection requirements.

- Closing Date: The date when the transaction will be finalized and ownership will be transferred.

- Earnest Money: A deposit made by the buyer to show their commitment to the purchase.

-

Who typically prepares the agreement?

The agreement can be prepared by various parties, including real estate agents, attorneys, or the buyers and sellers themselves. However, it is often advisable to have a qualified attorney review the document to ensure that it complies with state laws and protects your interests.

-

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability.

-

What happens if a party breaches the agreement?

If either party fails to fulfill their obligations under the agreement, it may be considered a breach of contract. The non-breaching party may have several options, including seeking damages, enforcing the contract, or terminating the agreement, depending on the circumstances and specific terms outlined in the document.

-

Is an attorney required to sign the agreement?

While it is not legally required to have an attorney sign the agreement, it is highly recommended. An attorney can provide valuable guidance, ensure that the agreement complies with Illinois law, and help protect your rights during the transaction.

-

How long is the agreement valid?

The validity of the agreement typically lasts until the closing date or until the parties mutually agree to terminate it. If contingencies are not met within the specified time frames, the agreement may also become void.

-

What should I do if I have questions about the agreement?

If you have questions or concerns about the Illinois Real Estate Purchase Agreement, it is best to consult with a qualified real estate attorney or a licensed real estate professional. They can provide clarity on specific terms and help you navigate the complexities of the transaction.

Misconceptions

Understanding the Illinois Real Estate Purchase Agreement form can be challenging. Many people have misconceptions about it. Here are ten common misunderstandings:

- It’s a standard form for all real estate transactions. Many believe that the same form applies to every type of property. In reality, the agreement can vary based on the property type and specific circumstances.

- Only real estate agents can fill it out. Some think that only licensed agents can complete the form. However, buyers and sellers can fill it out themselves, provided they understand the terms.

- Once signed, it cannot be changed. Many assume that the agreement is set in stone after signing. Modifications can be made, but both parties must agree to any changes.

- It guarantees the sale of the property. Some people believe that signing the agreement means the sale will definitely happen. The agreement is a step in the process, but it does not guarantee a sale until all conditions are met.

- It only protects the seller. There’s a misconception that the agreement favors the seller. In truth, it outlines the rights and responsibilities of both parties, offering protection to both the buyer and the seller.

- All terms are negotiable. While many terms can be negotiated, some aspects, like legal requirements, must be adhered to. Understanding which terms are flexible is important.

- It is the same as a lease agreement. Some confuse the purchase agreement with a lease. They serve different purposes; the purchase agreement is for buying property, while a lease is for renting.

- It does not require legal review. Many think that a legal review is unnecessary. However, having a lawyer review the agreement can help clarify terms and protect your interests.

- It is only for residential properties. Some believe the form is exclusively for homes. In fact, it can be used for various types of real estate, including commercial properties.

- Signing it means you must go through with the sale. People often think that signing the agreement binds them to the transaction. There are conditions under which a buyer or seller can withdraw.

By clarifying these misconceptions, individuals can approach the Illinois Real Estate Purchase Agreement with greater confidence and understanding.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to confusion. Ensure that the legal description matches the one found in public records.

-

Missing Signatures: All parties involved must sign the agreement. Missing signatures can render the contract unenforceable.

-

Improper Dates: Entering incorrect dates can create issues. Make sure the date of the agreement and any deadlines for contingencies are clearly stated.

-

Neglecting Contingencies: Not including necessary contingencies, such as financing or inspection, can lead to unexpected problems. Clearly outline any conditions that must be met for the sale to proceed.

-

Ignoring Local Laws: Each locality may have specific requirements. Familiarize yourself with local regulations to ensure compliance and avoid potential legal issues.

Find Some Other Real Estate Purchase Agreement Forms for Specific States

Real Estate Contract for Sale by Owner Free Georgia - Specifies if the sale is contingent upon buyer financing.

Pa Real Estate Contract - A Real Estate Purchase Agreement can clarify the closing date.

When considering property transfers in Texas, it's essential to understand the legal implications of using a Texas Quitclaim Deed. This form serves as a straightforward method to convey property rights, especially among family members or in situations requiring title clarification. For detailed guidance on this process, you can visit OnlineLawDocs.com, which offers valuable resources to ensure a smooth transaction without any unexpected complications.

Real Estate Purchase Agreement Michigan - It outlines the responsibilities of each party in the transaction, ensuring clarity and accountability.

Midland Title Toledo - The Real Estate Purchase Agreement details what fixtures and appliances are included in the sale.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Real Estate Purchase Agreement is governed by the Illinois Compiled Statutes, particularly the Real Estate License Act and the Uniform Commercial Code. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Essential Elements | Key components include the purchase price, property description, closing date, and contingencies. |

| Binding Agreement | Once signed by both parties, the agreement becomes legally binding, provided all necessary legal requirements are met. |

| Contingencies | Common contingencies may include financing, inspections, and appraisal conditions that must be satisfied before closing. |

Similar forms

The Illinois Real Estate Purchase Agreement is quite similar to the Residential Purchase Agreement. Both documents serve as a binding contract between a buyer and a seller for the sale of residential property. They outline essential terms such as the purchase price, contingencies, and the closing date. Just like the Illinois form, the Residential Purchase Agreement requires signatures from both parties, ensuring that all terms are mutually agreed upon before proceeding with the transaction.

Another document that shares similarities is the Commercial Purchase Agreement. While the Illinois Real Estate Purchase Agreement typically focuses on residential properties, the Commercial Purchase Agreement is designed for commercial real estate transactions. Both documents outline the key terms of the sale, including price and conditions, but the Commercial Purchase Agreement may also include specific provisions related to zoning, tenant leases, and business operations, reflecting the complexities of commercial real estate.

The Lease Agreement also bears resemblance to the Illinois Real Estate Purchase Agreement, particularly in how it outlines the terms between parties regarding property use. While a Lease Agreement is focused on renting rather than purchasing, both documents detail the responsibilities of the parties involved, such as payment terms and maintenance obligations. This commonality highlights the importance of clear communication and agreement in any real estate transaction.

For those looking to finalize a transaction, having an accurate comprehensive motorcycle bill of sale template is vital. This document not only records the necessary details of the motorcycle but also provides legal assurance that both parties are fulfilling their obligations during the transfer of ownership.

The Option to Purchase Agreement is another related document. This agreement gives a potential buyer the right, but not the obligation, to purchase a property within a specified timeframe. Similar to the Illinois Real Estate Purchase Agreement, it outlines terms such as the purchase price and duration of the option. However, the Option to Purchase Agreement allows for flexibility, enabling buyers to secure a property without committing to an immediate purchase.

The Listing Agreement is also noteworthy. While it serves a different purpose, it is closely tied to the real estate transaction process. This document is signed between a seller and a real estate agent, granting the agent the authority to sell the property. Similar to the Illinois Real Estate Purchase Agreement, it includes details about the property, commission rates, and the duration of the agreement, ensuring that all parties are clear on their roles and expectations.

Lastly, the Seller’s Disclosure Statement is comparable in that it provides crucial information about the property being sold. This document is typically required in real estate transactions and outlines any known issues or defects with the property. Like the Illinois Real Estate Purchase Agreement, it aims to protect both the buyer and seller by ensuring that all relevant information is disclosed before the sale is finalized. Transparency is key in both documents, fostering trust in the transaction process.