Valid Illinois Quitclaim Deed Template

The Illinois Quitclaim Deed form serves as a crucial legal instrument for transferring property ownership between parties. This form allows the current owner, known as the grantor, to convey their interest in a property to another individual or entity, referred to as the grantee, without making any guarantees about the property's title. It is particularly useful in situations such as transferring property between family members, resolving disputes, or clearing up title issues. The quitclaim deed does not provide warranties, meaning the grantee accepts the property "as is," which can be a double-edged sword. While it simplifies the transfer process, it also places the onus on the grantee to conduct thorough due diligence. Additionally, the form must be properly executed, which includes the signature of the grantor, and often requires notarization to ensure its validity. Once completed, the deed must be filed with the appropriate county recorder's office to make the transfer official and provide public notice of the change in ownership. Understanding these key aspects of the Illinois Quitclaim Deed form is essential for anyone considering a property transfer in the state.

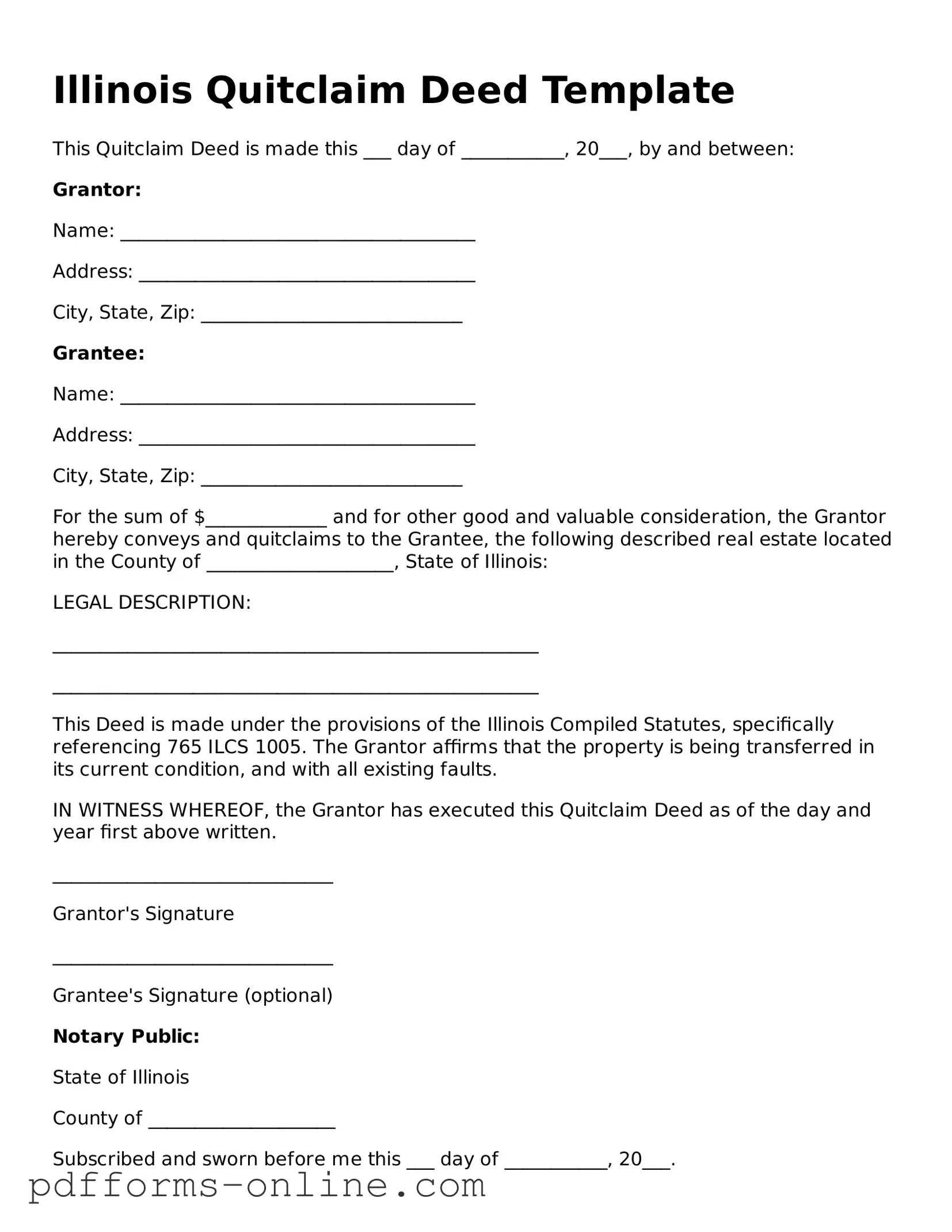

Document Example

Illinois Quitclaim Deed Template

This Quitclaim Deed is made this ___ day of ___________, 20___, by and between:

Grantor:

Name: ______________________________________

Address: ____________________________________

City, State, Zip: ____________________________

Grantee:

Name: ______________________________________

Address: ____________________________________

City, State, Zip: ____________________________

For the sum of $_____________ and for other good and valuable consideration, the Grantor hereby conveys and quitclaims to the Grantee, the following described real estate located in the County of ____________________, State of Illinois:

LEGAL DESCRIPTION:

____________________________________________________

____________________________________________________

This Deed is made under the provisions of the Illinois Compiled Statutes, specifically referencing 765 ILCS 1005. The Grantor affirms that the property is being transferred in its current condition, and with all existing faults.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

______________________________

Grantor's Signature

______________________________

Grantee's Signature (optional)

Notary Public:

State of Illinois

County of ____________________

Subscribed and sworn before me this ___ day of ___________, 20___.

______________________________

Notary Public Signature

My commission expires: ________________

Frequently Asked Questions

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title. Instead, it simply conveys whatever interest the grantor has in the property, if any. This type of deed is often used among family members or in situations where the parties know each other well.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in various scenarios, including:

- Transferring property between family members, such as during a divorce or estate settlement.

- Adding or removing a spouse or partner from the title.

- Clearing up title issues when a property has been inherited.

- Transferring property into or out of a trust.

In each of these cases, the quitclaim deed serves to simplify the transfer process without the need for extensive legal proceedings.

-

Do I need to have the Quitclaim Deed notarized?

Yes, in Illinois, a Quitclaim Deed must be signed in the presence of a notary public. This requirement helps to ensure that the identities of the parties involved are verified and that the document is executed voluntarily. After notarization, the deed should be recorded with the appropriate county recorder's office to make the transfer official and public.

-

Are there any taxes associated with a Quitclaim Deed?

In Illinois, while there is no specific tax for transferring property via a Quitclaim Deed, it is essential to consider potential transfer taxes. Depending on the location and the circumstances of the transfer, local municipalities may impose a transfer tax. It is advisable to check with your local tax authority or consult a tax professional to understand any obligations you may have.

-

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot be revoked unilaterally. If you wish to reverse the transfer, the original grantor would need to execute another deed, such as a new Quitclaim Deed, to transfer the property back. It is important to consult with a legal professional to understand the implications and processes involved in such a reversal.

Misconceptions

When dealing with real estate transactions in Illinois, the Quitclaim Deed form often raises questions and misconceptions. Understanding the truth behind these misconceptions can help individuals navigate property transfers more confidently. Here are four common misconceptions about the Illinois Quitclaim Deed:

- Misconception 1: A Quitclaim Deed guarantees clear title to the property.

- Misconception 2: Quitclaim Deeds are only used between family members.

- Misconception 3: A Quitclaim Deed is the same as a Warranty Deed.

- Misconception 4: You do not need to file a Quitclaim Deed with the county.

This is not true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the title is free of liens or claims. Buyers should conduct a title search to understand the property’s history and any potential issues.

While it is common for family members to use Quitclaim Deeds to transfer property, they are not limited to familial transactions. Anyone can use a Quitclaim Deed to transfer property rights, making it a versatile option for various situations.

This misconception is significant. A Warranty Deed offers protections and guarantees regarding the title, whereas a Quitclaim Deed does not provide such assurances. Understanding the differences is crucial for anyone involved in property transfers.

It is essential to file the Quitclaim Deed with the appropriate county recorder’s office. Failing to do so may lead to complications regarding ownership and can affect the enforceability of the deed in the future.

Common mistakes

-

Incorrect Grantee Information: Failing to provide the correct name or address of the person receiving the property can lead to complications. Double-check spelling and ensure the address is current.

-

Missing Signatures: All necessary parties must sign the document. If a signature is missing, the deed may be considered invalid.

-

Not Notarizing the Document: A quitclaim deed must be notarized to be legally binding. Skipping this step can render the deed ineffective.

-

Incorrect Legal Description: The property’s legal description must be accurate and complete. Errors can create confusion and lead to disputes over ownership.

-

Omitting the Date: The date of signing is crucial. Without it, the deed may be questioned regarding its validity and timing.

-

Not Recording the Deed: After completing the deed, it must be recorded with the appropriate county office. Failing to do so can affect the enforceability of the deed.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for quitclaim deeds. Not adhering to these can lead to legal issues down the line.

Find Some Other Quitclaim Deed Forms for Specific States

How to Gift Land to Family Member - This form has no inherent guarantees about the property's title status.

Familiarizing yourself with the terms of a residential Room Rental Agreement is crucial for both landlords and tenants. This document serves to clarify the obligations and rights of each party, ensuring that the living arrangement is transparent and fair.

Quit Claim Deed Sample - Using a Quitclaim Deed does not absolve the grantor of debts associated with the property.

Quit Claim Deed Pa - This form is not recommended for sales or complex real estate transactions.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | The Illinois Quitclaim Deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Usage | This form is commonly used among family members, to clear up title issues, or when a property is transferred as a gift. |

| Requirements | The deed must be signed by the grantor in the presence of a notary public to be valid. |

| Recording | Once completed, the quitclaim deed should be recorded with the county recorder's office to provide public notice of the ownership change. |

| Limitations | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property, which can pose risks for the grantee. |

Similar forms

The Illinois Quitclaim Deed is similar to a Warranty Deed in that both documents are used to transfer property ownership. However, the key difference lies in the level of protection offered to the buyer. A Warranty Deed guarantees that the seller holds clear title to the property and provides assurances against any claims or liens. In contrast, a Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. This means that if there are issues with the title, the buyer may have no recourse against the seller.

Another document akin to the Quitclaim Deed is the Grant Deed. Like the Quitclaim Deed, a Grant Deed conveys property ownership from one party to another. However, it typically includes certain warranties, such as the assurance that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This makes the Grant Deed somewhat more secure than a Quitclaim Deed, which offers no such protections. Buyers should consider these differences when deciding which document to use for a property transfer.

The Bargain and Sale Deed also shares similarities with the Quitclaim Deed. This type of deed conveys property ownership but does not provide warranties against encumbrances. It implies that the seller has the right to sell the property but does not guarantee that the title is free of issues. While a Quitclaim Deed simply transfers whatever interest the seller has, a Bargain and Sale Deed suggests a level of ownership, albeit without the protections that a Warranty Deed would provide. Buyers should be cautious, as this can lead to potential disputes over title issues.

When entering into property transactions, it's essential to understand the various types of deeds available, including the Warranty Deed and the Quitclaim Deed, as each carries different implications for ownership rights. For comprehensive information on the necessary legal documents for forming an LLC in Arizona, consider consulting All Arizona Forms, which can provide valuable insights into the creation of an Operating Agreement that clearly delineates member responsibilities and protections.

Lastly, the Special Purpose Deed is another document that resembles a Quitclaim Deed. This type of deed is often used in specific situations, such as transferring property into a trust or between family members. Like a Quitclaim Deed, it typically does not provide any warranties regarding the title. The intent behind a Special Purpose Deed is to facilitate a transfer with minimal legal formalities. However, it is crucial for parties involved to understand that, similar to a Quitclaim Deed, they may be assuming risks related to the property's title when using this document.