Valid Illinois Promissory Note Template

In Illinois, a Promissory Note serves as a vital financial document that outlines the terms of a loan agreement between a borrower and a lender. This straightforward yet essential form details the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties understand their obligations. It typically includes key elements such as the names and addresses of the involved parties, the due date for repayment, and any applicable penalties for late payments. Additionally, the Promissory Note may specify whether the loan is secured or unsecured, which can significantly impact the lender's rights in case of default. Clarity and precision in this document are crucial, as they help prevent disputes and provide a clear course of action should issues arise. Understanding the nuances of the Illinois Promissory Note is essential for anyone looking to engage in lending or borrowing, as it lays the groundwork for a legally binding agreement that protects both parties' interests.

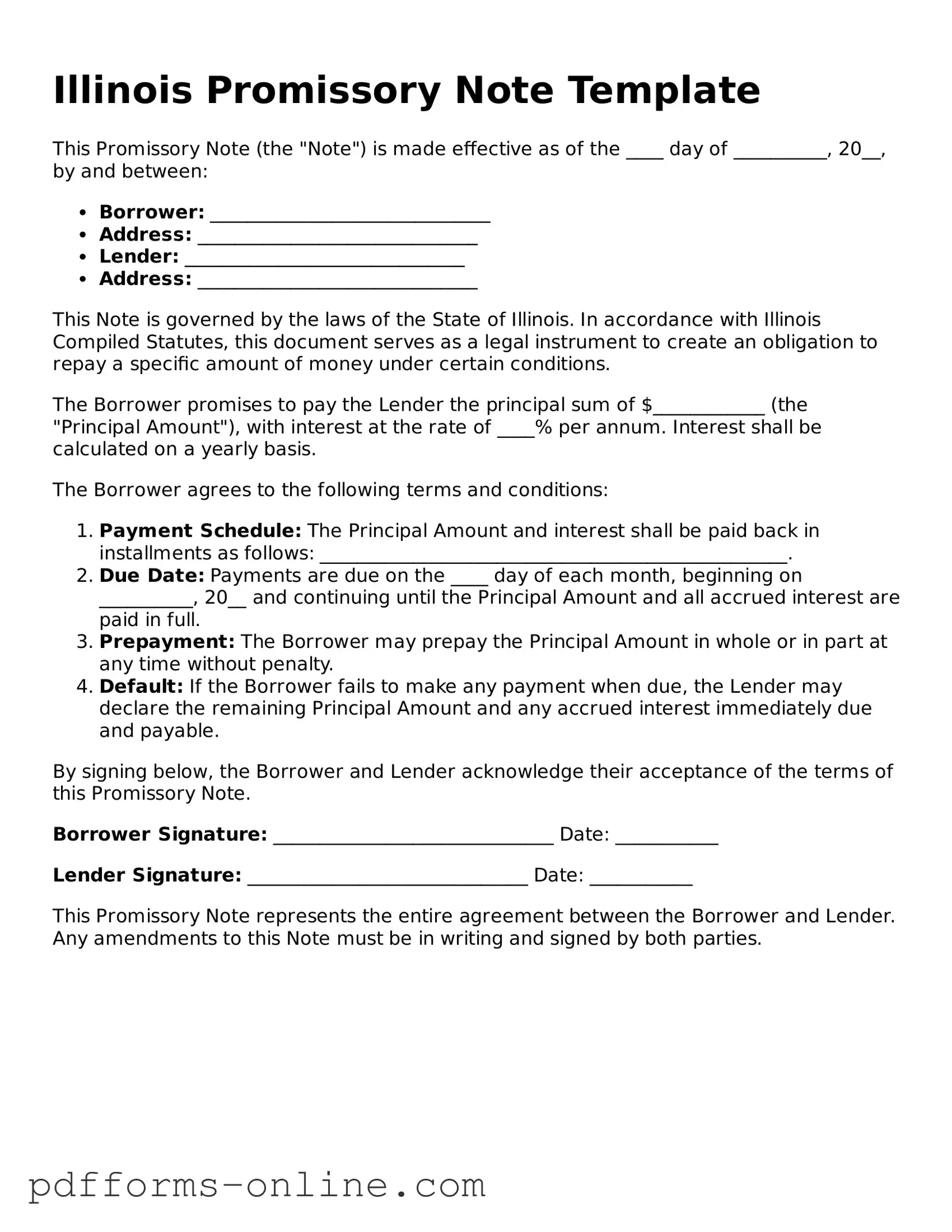

Document Example

Illinois Promissory Note Template

This Promissory Note (the "Note") is made effective as of the ____ day of __________, 20__, by and between:

- Borrower: ______________________________

- Address: ______________________________

- Lender: ______________________________

- Address: ______________________________

This Note is governed by the laws of the State of Illinois. In accordance with Illinois Compiled Statutes, this document serves as a legal instrument to create an obligation to repay a specific amount of money under certain conditions.

The Borrower promises to pay the Lender the principal sum of $____________ (the "Principal Amount"), with interest at the rate of ____% per annum. Interest shall be calculated on a yearly basis.

The Borrower agrees to the following terms and conditions:

- Payment Schedule: The Principal Amount and interest shall be paid back in installments as follows: __________________________________________________.

- Due Date: Payments are due on the ____ day of each month, beginning on __________, 20__ and continuing until the Principal Amount and all accrued interest are paid in full.

- Prepayment: The Borrower may prepay the Principal Amount in whole or in part at any time without penalty.

- Default: If the Borrower fails to make any payment when due, the Lender may declare the remaining Principal Amount and any accrued interest immediately due and payable.

By signing below, the Borrower and Lender acknowledge their acceptance of the terms of this Promissory Note.

Borrower Signature: ______________________________ Date: ___________

Lender Signature: ______________________________ Date: ___________

This Promissory Note represents the entire agreement between the Borrower and Lender. Any amendments to this Note must be in writing and signed by both parties.

Frequently Asked Questions

-

What is a Promissory Note?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined future date or on demand. It serves as a legal document that outlines the terms of the loan or debt agreement between the borrower and the lender.

-

What are the key components of an Illinois Promissory Note?

Key components typically include:

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any collateral securing the loan.

- Signatures of both parties.

-

Do I need to have the Promissory Note notarized?

While notarization is not required for a promissory note to be legally binding in Illinois, having it notarized can provide an additional layer of protection. It verifies the identities of the parties involved and can help prevent disputes over authenticity.

-

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note to ensure clarity and enforceability.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender may pursue various remedies. These can include demanding immediate payment of the remaining balance, initiating legal action, or seizing any collateral specified in the note. The specific course of action will depend on the terms outlined in the promissory note.

-

Is there a statute of limitations for enforcing a Promissory Note in Illinois?

Yes, in Illinois, the statute of limitations for enforcing a written promissory note is typically 10 years. This means that the lender has 10 years from the date of default to take legal action to collect the debt.

-

Can a Promissory Note be transferred or sold?

A promissory note can be transferred or sold to another party, provided the original terms of the note allow for such actions. The new holder of the note will assume the rights to collect the debt under the same terms.

-

What should I do if I lose my Promissory Note?

If a promissory note is lost, the borrower should notify the lender as soon as possible. The lender may require the borrower to sign an affidavit stating that the note has been lost. Depending on the situation, the lender may issue a replacement note.

-

Are there any specific laws governing Promissory Notes in Illinois?

Yes, promissory notes in Illinois are governed by the Uniform Commercial Code (UCC), which outlines the rules and regulations for commercial transactions, including notes. It is important for both parties to be aware of these laws to ensure compliance.

-

Where can I find a template for an Illinois Promissory Note?

Templates for Illinois promissory notes can often be found online. Many legal websites offer free or paid templates that can be customized to fit individual needs. However, it is advisable to consult with a legal professional to ensure that the template meets all necessary legal requirements.

Misconceptions

Understanding the Illinois Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here is a list of common misunderstandings about this important financial document:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, they can vary significantly in terms of terms, conditions, and legal requirements.

- A Promissory Note Must Be Notarized: Some individuals think that notarization is mandatory for a promissory note to be valid. While notarization can provide additional legal protection, it is not always required.

- Only Written Promissory Notes Are Valid: There is a misconception that verbal agreements cannot be considered promissory notes. However, a verbal promise to pay can be legally binding, though proving its terms may be more challenging.

- Interest Rates Are Fixed: Many assume that interest rates on promissory notes must remain constant. In fact, the terms can specify whether the rate is fixed or variable, depending on the agreement between the parties.

- Promissory Notes Are Only for Large Loans: Some believe that promissory notes are only necessary for substantial loans. However, they can be used for any amount, regardless of size, to formalize an agreement.

- Once Signed, a Promissory Note Cannot Be Changed: There is a notion that a signed promissory note is set in stone. In truth, both parties can agree to modify the terms, but this should be documented properly.

- Defaulting on a Promissory Note Has No Consequences: Many think that failing to repay a promissory note will not lead to serious repercussions. However, defaulting can result in legal action, damage to credit scores, and other financial consequences.

Being aware of these misconceptions can help individuals navigate the complexities of promissory notes more effectively. Understanding the true nature of these documents is crucial for both lenders and borrowers.

Common mistakes

-

Incorrect Names: One common mistake is failing to accurately enter the names of the borrower and lender. It is essential to use the full legal names as they appear on official documents to avoid any confusion or disputes later.

-

Missing Signatures: Both parties must sign the document for it to be valid. Neglecting to include a signature can render the note unenforceable.

-

Improper Date: The date of signing is crucial. If the date is missing or incorrect, it may lead to complications regarding the terms of repayment.

-

Unclear Terms: Vague or ambiguous terms regarding the loan amount, interest rate, or repayment schedule can lead to misunderstandings. Clearly stating these details is vital for both parties' protection.

-

Failure to Include Consequences: Not specifying what happens in case of default can be a significant oversight. Outlining the consequences can help both parties understand their rights and responsibilities.

Find Some Other Promissory Note Forms for Specific States

California Promissory Note Requirements - It typically includes the amount borrowed, interest rate, and repayment schedule.

The New York Motorcycle Bill of Sale form is an important document used to record the sale and transfer of ownership of a motorcycle. It serves as proof of purchase for both the buyer and the seller. Having this form completed accurately can help prevent disputes and ensure a smooth transaction. For more details, you can visit https://documentonline.org/blank-new-york-motorcycle-bill-of-sale.

Online Promissory Note - Promissory notes can be simple or complex, depending on the situation.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specific amount of money to a designated person or entity. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in Illinois. |

| Parties Involved | Typically, there are two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The note can specify an interest rate, which must comply with Illinois usury laws. |

| Payment Terms | It outlines when and how payments should be made, including due dates and payment methods. |

| Default Conditions | The document should specify what constitutes a default and the remedies available to the lender. |

| Signatures Required | Both parties must sign the note for it to be legally binding. |

Similar forms

The Illinois Promissory Note is similar to a Loan Agreement, which outlines the terms of a loan between a borrower and a lender. Both documents specify the amount borrowed, the interest rate, and the repayment schedule. While a promissory note is generally a simpler document focusing on the promise to repay, a loan agreement often includes additional details such as collateral, default conditions, and specific legal obligations for both parties. This makes the loan agreement more comprehensive but also more complex.

Another document that shares similarities with the Illinois Promissory Note is the Mortgage. A mortgage is a specific type of promissory note that is secured by real property. In both cases, the borrower promises to repay the loan amount. However, the mortgage also involves a lien on the property, which means the lender can claim the property if the borrower fails to repay. This added layer of security distinguishes the mortgage from a standard promissory note.

The Illinois Promissory Note also resembles an IOU. An IOU is a simple acknowledgment of a debt, much like a promissory note. However, an IOU typically lacks the formal structure and detailed terms that a promissory note provides. While both documents serve as evidence of a debt, the promissory note includes specific repayment terms, interest rates, and consequences for default, making it a more formal commitment.

Another similar document is a Personal Loan Agreement. Like a promissory note, this agreement outlines the terms of a loan between individuals. Both documents specify the loan amount and repayment terms. However, a personal loan agreement may include more detailed clauses regarding the responsibilities of each party, such as payment methods, late fees, and dispute resolution procedures. This makes it more comprehensive than a basic promissory note.

The Illinois Promissory Note can also be compared to a Business Loan Agreement. This document is specifically tailored for business transactions, detailing the terms under which a business borrows money. Similar to a promissory note, it includes the loan amount and repayment terms. However, a business loan agreement may also address issues like business performance metrics, collateral requirements, and conditions for default, reflecting the complexities of business financing.

Understanding the nuances of various financial documents can greatly enhance one’s ability to navigate agreements effectively; for instance, when dealing with a Residential Lease Agreement, the importance of consulting resources such as OnlineLawDocs.com cannot be overstated, as they provide valuable insights into the rights and responsibilities of both landlords and tenants.

Finally, a Secured Promissory Note is another document that shares characteristics with the Illinois Promissory Note. This type of note is backed by collateral, providing the lender with additional security. Both documents involve a promise to repay, but the secured promissory note includes details about the collateral, which can be seized if the borrower defaults. This added protection for the lender distinguishes it from a standard promissory note.